EMC Filtration Market Size (2024 – 2030)

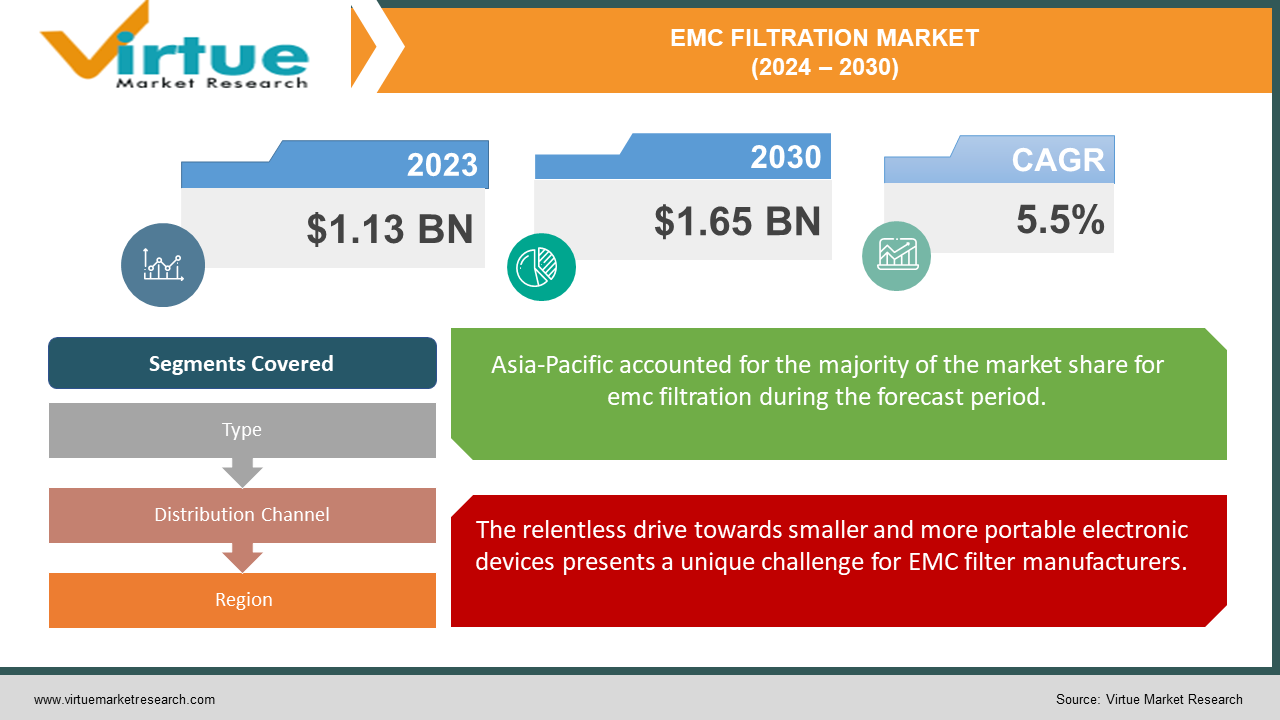

The Global EMC Filtration Market was valued at USD 1.13 Billion in 2023 and is projected to reach a market size of USD 1.65 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.5%.

In today's world of increased interconnectedness, the electromagnetic compatibility (EMC) filtering industry is essential to the seamless operation of electronic gadgets. By protecting electronic systems from harmful electromagnetic interference (EMI) and radio frequency interference (RFI), these filters serve as silent watchdogs. Factories and industrial settings rely heavily on automated processes controlled by electronic systems. EMC filters safeguard these systems from electrical noise generated by machinery, motors, and other equipment, preventing malfunctions and ensuring smooth operation. The proper functioning of medical equipment can be a matter of life and death. EMC filters in medical devices like pacemakers, patient monitoring systems, and diagnostic equipment ensure they operate reliably and are shielded from electromagnetic interference that could potentially disrupt their functionality.

Key Market Insights:

Because smartphones, laptops, and other linked devices are used by so many people, consumer electronics hold the greatest proportion of the EMC filtering market—more than 35% of total demand.

The EMC filtration market is anticipated to grow at the quickest rate in the automotive sector, with a projected CAGR of more than 7.2%. The growing number of electronic parts in contemporary cars is the reason for this.

Because of the trend towards smaller and more compact electronic devices, the market for surface-mount and miniaturized EMC filters is predicted to expand at a compound annual growth rate of 6.5%.

The market is seriously threatened by counterfeit EMC filters, which may make up as much as 15% of all filter sales in some areas, according to estimates.

By 2025, the high-performance EMC filter market is expected to reach USD 4.8 billion globally, indicating the increasing demand for reliable interference suppression in

Due to growing concerns about hygiene, the medical textiles industry that uses EMC filters for sterile applications is expected to grow at a compound annual growth rate of 6.8%.

The estimated market size for recyclable EMC fabrics by 2024 is USD 2.5 billion, indicating an increasing focus on circular economy concepts.

By 2026, the market for solvent-free coating technologies—which provide advantages for the environment and increased worker safety—is projected to be worth USD 4.1 billion.

Price fluctuations for raw materials including nylon, polyester, and PU coatings can affect manufacturers' production costs by as much as 10%.

The management of remaining fabric scraps and coating materials is a persistent issue, and stakeholders' feedback is pushing for more environmentally friendly disposal methods.50% recycling rates by 2030.

Manufacturers are being pushed by consumer preference for environmentally friendly products to provide sustainable and ethically sourced materials for EMC filters, with a projected 12% market share for sustainable choices.

EMC Filtration Market Drivers:

The Internet of Things (IoT) is fundamentally reshaping how we interact with the world around us. Billions of devices, from smart thermostats to connected medical equipment, are weaving a web of interconnectedness.

The likelihood of a signal disturbance rises when numerous devices are functioning in close proximity to one another. As gatekeepers, EMC filters ensure that no neighbor interferes with a device's ability to send and receive signals. There are difficulties arising from the tendency of electronics to become smaller. Components are placed closer together as they get smaller, which raises the possibility of EMI from crosstalk. Reliability of operation depends on using efficient EMC filters to shield these miniaturized circuitries. Standardized communication protocols and regulatory frameworks are becoming more and more necessary as the Internet of Things grows. These frameworks frequently adhere to precise EMI limitations. High-performance EMC filters are what manufacturers use to make sure their Internet of Things (IoT) devices comply with these rules and work flawlessly in the networked ecosystem. The Internet of Things (IoT) landscape's growing complexity and density of linked devices generate a constant need for creative and efficient

The relentless drive towards smaller and more portable electronic devices presents a unique challenge for EMC filter manufacturers.

Research and development efforts are focused on novel materials with superior filtering capabilities. Exploring new conductive fabrics, metamaterials, and advanced composites can lead to thinner and lighter filters with exceptional performance. Integrating EMC filters directly onto printed circuit boards (PCBs) is a promising approach. This not only saves space but also minimizes signal integrity issues that can arise from traditional cabling solutions. The development of materials that offer both structural support and EMI shielding can be a game-changer. This eliminates the need for separate filtering components, contributing to overall device miniaturization. The miniaturization trend not only requires smaller filters but also demands efficient design considerations. Manufacturers are focusing on optimizing filter performance while minimizing footprint, ensuring seamless integration within space-constrained electronic devices. This continuous pursuit of miniaturized and high-performance EMC filters is a key driver of innovation in the market.

EMC Filtration Market Restraints and Challenges:

For many companies in the EMC filtering business, cost is still a major concern. High-performance filters are frequently more expensive, especially when they are used in demanding applications like aerospace or medical devices. This may put producers in a difficult situation. The EMC filtering business is constantly faced with challenges because of the swift advancement of electronic devices. The development of new and enhanced filtering methods is required due to the introduction of new components, functions, and miniaturization trends. Every industry is becoming more concerned with sustainability, and the EMC filtering market is no exception. Fabric scraps and coating materials are waste products of the EMC filter production process. Pollution of the environment might result from inadequate waste management procedures. Certain conventional coating techniques employ solvents that may pose a risk to human well-being and worsen air pollution.

EMC Filtration Market Opportunities:

The rise of technologies such as autonomous vehicles, wearable electronics, and smart grids need specialized filters that can address the unique EMI challenges within these applications. The growing sophistication of medical devices, particularly those implanted within the human body, demands robust and biocompatible EMC filters to ensure patient safety and reliable operation. Developing filters made from biodegradable or readily recyclable materials can minimize environmental impact during disposal. Utilizing solvent-free coating technologies can create a safer working environment for manufacturing personnel and reduce air pollution. Implementing life cycle management programs that encompass responsible sourcing of materials, energy-efficient production processes, and sustainable disposal methods fosters a positive brand image and attracts environmentally conscious consumers. Embedding EMC filters directly onto printed circuit boards (PCBs) can minimize space requirements, improve signal integrity, and offer a more holistic approach to EMI management.

EMC FILTRATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Schaffner Holding AG (Switzerland), TE Connectivity (Switzerland), TDK Corporation (Japan), Delta Electronics (Taiwan), Littelfuse, NC. (US), Schurter Holding AG (Switzerland), Astrodyne TDI (US), Soshin Electric Co., Ltd. (Japan), ETS Lindgren (US), EPCOS AG (Germany), PREMO Corporation S.L.(Spain), REO Ltd.(UK), Total EMC Products Ltd.(UK), DEM Manufacturing Ltd (UK) |

EMC Filtration Market Segmentation: By Type

-

Polymer-coated fabrics

-

Metal-Based Filters

-

Waveguide Filters

-

Gaskets and Conductive Elastomers

Polymer-coated fabrics (65%) are the dominant type, accounting for roughly two-thirds of the market share. Polymer-coated fabrics offer a cost-effective and versatile solution for EMI shielding. They are lightweight, and flexible, and come in a variety of materials like polyester and nylon, coated with conductive polymers such as nickel or silver. Their affordability and ease of integration make them ideal for a wide range of applications, including consumer electronics, automotive components, and telecommunications equipment.

Metal-based filters, despite holding a smaller market share currently, represent the fastest-growing segment. These filters offer superior shielding performance across a wider range of frequencies. Metal-based filters, such as mesh or enclosures made from copper, aluminum, or stainless steel, provide excellent EMI attenuation, particularly at high frequencies. They offer superior mechanical strength and durability compared to polymer-coated fabrics, making them suitable for demanding environments such as aerospace and military applications. These filters are generally more expensive than polymer-coated fabrics due to the higher material cost and potentially more complex manufacturing processes. Metal filters can be heavier and bulkier compared to their polymer counterparts which might not be ideal for space-constrained applications.

EMC Filtration Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors

-

E-commerce platforms

-

Independent Representatives

Direct Sales (40%) channel involves manufacturers selling directly to high-volume buyers, typically large electronics companies. Direct sales offer greater control over pricing, customization, and technical support but require a strong sales force and established relationships. Large electronics manufacturers often require bulk quantities of custom-designed filters. Direct sales allow for close collaboration, filters meet specific needs and performance requirements. Direct sales teams possess in-depth knowledge of their products and can provide technical support to customers throughout the design and integration process.

While direct sales reign supreme for high-volume purchases, e-commerce platforms are experiencing the fastest growth in the EMC filtration market. Online marketplaces provide a global platform, connecting manufacturers with a diverse customer base, including smaller buyers and those in remote locations. E-commerce platforms offer 24/7 access to product information, pricing details, and user reviews, streamlining the buying process for customers. E-commerce platforms can potentially reduce distribution costs for manufacturers by eliminating the need for intermediaries.

EMC Filtration Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

The Middle East & Africa

With a market share ranging from about 30 to 35 percent, the Asia-Pacific region leads the EMC Filtration industry. The region's quick industrialization, the rising need for consumer electronics and telecom equipment, and the expansion of numerous manufacturing sectors—especially in China, Japan, and South Korea—are all responsible for this supremacy. The Asia-Pacific market's expansion has also been aided by the existence of significant producers of EMC filtering components and the availability of cost-effective production capabilities.

However, the Asia-Pacific area is also thought to be the market for EMC filtration systems that is expanding the fastest. A climate that is conducive to the expansion of the EMC Filtration market has been established by the region's economic development, the growing use of cutting-edge technologies, and the growing need for dependable and effective EMC filtration solutions. The demand for efficient EMC filtering solutions has also increased due to the growth of sectors including industrial automation, telecommunications, and consumer electronics.

COVID-19 Impact Analysis on the EMC Filtration Market:

Lockdowns and social distancing measures implemented in major manufacturing hubs in China led to temporary closures of EMC filter production facilities. This resulted in supply shortages and delays in fulfilling existing orders. Restrictions on movement and logistical bottlenecks created difficulties in sourcing raw materials for filter production. This, combined with increased demand for certain materials in medical equipment led to price volatility and potential cost increases for filter manufacturers. Global travel restrictions and disruptions in air and sea freight transportation hampered the movement of both raw materials and finished EMC filters. This caused delays in deliveries and increased logistical costs for manufacturers. The surge in demand for medical devices particularly ventilators and other critical care equipment led to a rise in the need for specialized EMC filters for these applications. Manufacturers with the capacity to produce these filters experienced a boost in demand. The shift towards remote work and increased reliance on e-commerce fuelled the demand for electronics like laptops, tablets, and communication equipment. This indirectly benefited the EMC filtration market, as these devices require effective EMI shielding.

Latest Trends/ Developments:

Exploring novel materials with superior filtering capabilities in smaller footprints is a key focus. Research into metamaterials, conductive fabrics, and nanocomposites holds immense potential for creating thin and lightweight filters with exceptional performance. Integrating EMC filters directly onto printed circuit boards (PCBs) is a promising trend. This not only saves space but also minimizes signal integrity issues that can arise from traditional cabling solutions. Embedding filters directly within the device design allows for a more holistic approach to EMI management. The development of specialized filters catering to the unique EMI challenges of specific applications such as wearables, smart grids, and autonomous vehicles. These filters need to be compact, energy-efficient, and address the specific interference sources within each application. The growing sophistication of medical devices, implantable ones, demands biocompatible and miniaturized EMC filters. Research into biocompatible materials and advanced filtering techniques is crucial to ensure patient safety and reliable operation within the human body.

Key Players:

-

Schaffner Holding AG (Switzerland)

-

TE Connectivity (Switzerland)

-

TDK Corporation (Japan)

-

Delta Electronics (Taiwan)

-

Littelfuse, NC. (US)

-

Schurter Holding AG (Switzerland)

-

Astrodyne TDI (US)

-

Soshin Electric Co., Ltd. (Japan)

-

ETS Lindgren (US)

-

EPCOS AG (Germany)

-

PREMO Corporation S.L.(Spain)

-

REO Ltd.(UK)

-

Total EMC Products Ltd.(UK)

-

DEM Manufacturing Ltd (UK)

Chapter 1. EMC Filtration Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. EMC Filtration Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. EMC Filtration Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. EMC Filtration Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. EMC Filtration Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. EMC Filtration Market – By Type

6.1 Introduction/Key Findings

6.2 Polymer-coated fabrics

6.3 Metal-Based Filters

6.4 Waveguide Filters

6.5 Gaskets and Conductive Elastomers

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. EMC Filtration Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors

7.4 E-commerce platforms

7.5 Independent Representatives

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. EMC Filtration Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. EMC Filtration Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Schaffner Holding AG (Switzerland)

9.2 TE Connectivity (Switzerland)

9.3 TDK Corporation (Japan)

9.4 Delta Electronics (Taiwan)

9.5 Littelfuse, NC. (US)

9.6 Schurter Holding AG (Switzerland)

9.7 Astrodyne TDI (US)

9.8 Soshin Electric Co., Ltd. (Japan)

9.9 ETS Lindgren (US)

9.10 EPCOS AG (Germany)

9.11 PREMO Corporation S.L.(Spain)

9.12 REO Ltd.(UK)

9.13 Total EMC Products Ltd.(UK)

9.14 DEM Manufacturing Ltd (UK)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The ever-increasing proliferation of electronic devices across various industries such as automotive, aviation, telecommunications, consumer electronics, and healthcare is a major driver. With more devices, the potential for electromagnetic interference (EMI) also increases, requiring robust EMC filters.

Reconciling the higher initial costs of sustainable solutions with affordability for both manufacturers and consumers remains a challenge. Finding this equilibrium is crucial for the widespread adoption of eco-friendly practices.

Schaffner Holding AG (Switzerland), TE Connectivity (Switzerland), TDK Corporation (Japan), Delta Electronics (Taiwan), Littlefuse, NC. (US), Schurter Holding AG (Switzerland), Astrodyne TDI (US), Soshin Electric Co., Ltd. (Japan), ETS Lindgren (US), EPCOS AG (Germany), and PREMO Corporation S.L.(Spain).

Asia-Pacific emerged as the most dominant player in the market, commanding an impressive 35% share.

The Asia-Pacific area is also thought to be the market for EMC filtration systems that is expanding the fastest.