Electroplating Market Size (2024 – 2030)

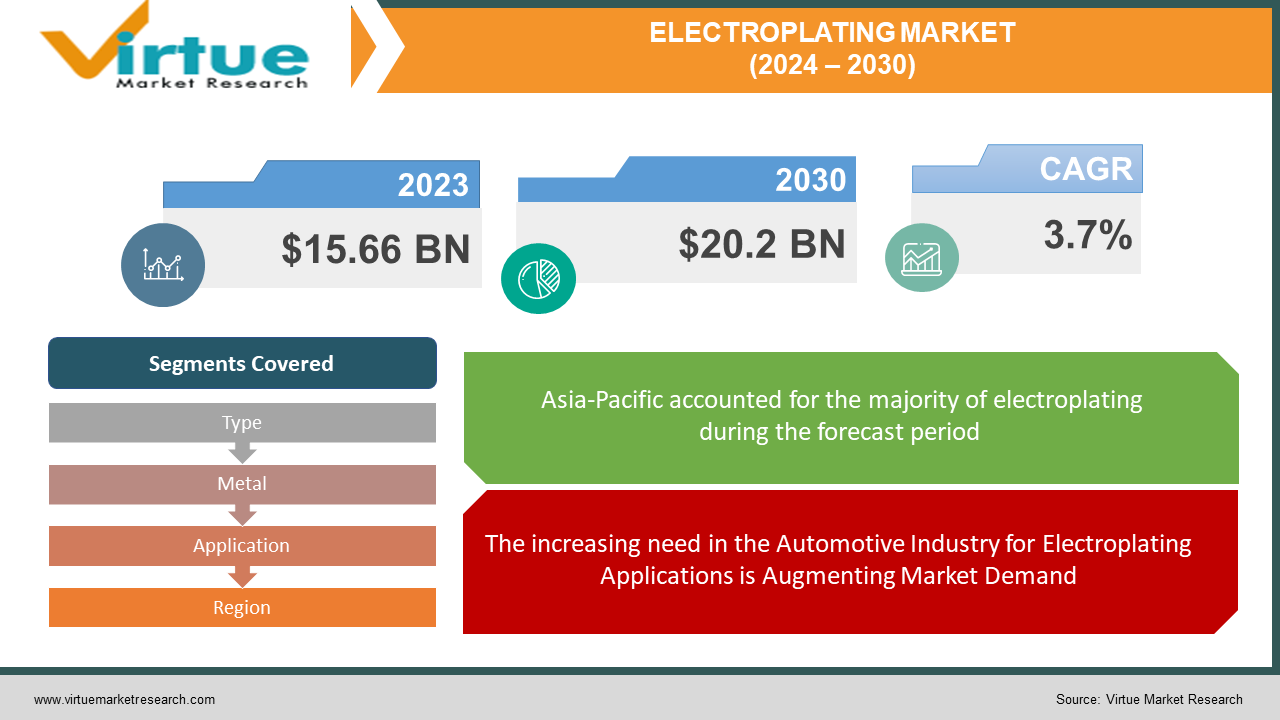

In 2023, the Electroplating Market was valued at $15.66 Billion and is projected to reach a market size of $ 20.2 Billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.7%.

Electroplating refers to the process of applying a layer of metal onto another metal typically done through hydrolysis. Its main purposes are to prevent corrosion and add elements. This technique is closely related, to electroforming as they both involve an electro-deposition process and fall under the category of manufacturing. To carry out metal plating, an anode and cathode are placed in a bath containing a salt solution, which also includes the metal that needs to be coated. Electroplating creates a barrier that minimizes friction and safeguards against corrosion. It also applies a thin but durable metal coating that shields against wear and tear.

When nonmetallic surfaces are coated with metal through electroplating it alters their surface qualities. Furthermore, it provides benefits such as increased wear resistance, protection against corrosion, and improved abrasion resistance. Metal coatings are often utilized to enhance the appearance of components. The global classification of electroplating includes plating, gold plating, brass plating, and copper plating. In silver plating, it is crucial to immerse the object in a bath containing ions. Through electron transfer, within the solution, these ions deposit onto the component surface effectively covering it with the desired metal.

Gold plating involves the process of applying a layer of gold onto the surface of another metal through chemical or electrochemical plating while electricity is present. Electroplating is widely utilized across industries to increase thickness enhance durability provide surface properties safeguard the base material from corrosive surroundings and adverse conditions and improve its overall aesthetics. This results in the creation of a barrier, electrical conductivity, heat resistance enhanced hardness, and an improved visual appeal.

Key Market Insights:

Various alternatives, such, as PVD, plasma nitriding, high-velocity oxyfuel (HVOF), and laser cladding are being adopted by OEMs to rebuild components. These alternatives have been funded through the US Defense Department's Advanced Research Projects Agency.

Various vertical industries, including automotive, aerospace, defense, and others are experiencing a rise, in the adoption of electroplating. This trend is playing a role, in stimulating market growth.

Chrome helps minimize the risk of rust and enhances the durability of the underlying material. By reducing friction it extends the lifespan of machinery. Provides lubrication. Chrome does not prevent wear and tear on the machine. Also enhances its overall performance. With chances of overheating less friction leads to operation.

Electroplating offers manufacturers the advantage of utilizing cost metals, like steel or zinc for the bulk of machine parts and components. They can then apply metals to the layer considering factors such as appearance, protection, and other desired properties specific, to the product. Electroplating effectively reinforces machinery parts and components without compromising torque tolerance.

Electroplating Market Drivers:

The increasing need in the Automotive Industry for Electroplating Applications is Augmenting Market Demand.

The automotive industry is a user of electroplating technology which includes the process of zinc to gold electroplating. In cars, plastic electroplating is employed to chrome plate parts. Palladium plating is utilized in the production of converters due, to its hydrogen absorption capabilities. To combat corrosion automotive manufacturers continuously seek ways to protect their products. Galvanizing techniques are extensively employed in components, driven by the industry's rapid growth. Many automotive companies invest in vehicle body electroplating units with layers of materials that resist corrosion and rust. Furthermore, numerous companies offer electroplating techniques. For example, Techmetals provides solutions like Electroless Nickel (EN) known for its resistance to corrosion and wear as it passes over 1,000 hours of salt spray testing. They also offer anodizing services, for brake calipers and body frames.

Growing Consumer Electronics Product Demand is fueling market growth.

The growing demand, for products, is fueling the expansion of the Electroplating Market. This growth is driven by innovation, technology adoption, and the increasing need for devices. Electroplating is essential in coating metal surfaces during the production of devices, components, and other electronic products. The electrical and electronics industry utilizes both precious plated components to enhance various characteristics like corrosion resistance wear resistance, solder ability, and electrical conductivity of the final product. Additionally, numerous companies are making investments in the production of goods. India has set a target to manufacture phones of $24 billion by 2020 and aims for a total value of $190 billion, by 2025.

Electroplating Market Restraints and Challenges:

Despite the growth of the Electroplating Market environmental concerns associated with this technique is impeding its progress during the projected timeframe. The process of electroplating which involves the use of metals and cyanide can result in the release of air pollutants. Additionally, degreasing and cleaning solutions also release compounds (VOCs) that are harmful, to both humans and the environment. Cyanide, a component in plating solutions has effects on our nervous system, heart, and lungs. To address these issues several countries have implemented regulations to control the emission of chemicals and gases released into the atmosphere during electroplating processes. This regulatory landscape is expected to pose a challenge, for the Electroplating Market.

Electroplating Market Opportunities:

Manufacturers are making changes, to the electroplating process including switching from processes to ones. This shift has benefits such, as reducing worker exposure and minimizing waste production. As a result, the electroplating market is expected to experience growth. Additionally, manufacturers are increasingly favoring water-based cleaning agents over alternatives, which is also anticipated to drive the growth of the electroplating market in the future.

ELECTROPLATING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

3.70% |

|

Segments Covered |

By Type, Metal, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Atotech Deutschland, GMBH Interplex Holdings Pte., Ltd Kuntz Electroplating Inc., Pioneer Metal Finishing Inc. , Roy Metal Finishing Inc., Bajaj Electroplaters , J & N Metal Products, LLC Peninsula Metal Finishing Inc. |

Electroplating Market Segmentation: By Type

-

Barrel Plating

-

Rack Plating

-

Continuous Plating

-

Line Plating

In 2022, based on the type, the Rack Plating segment accounted for the largest revenue share by almost 40% and has led the market. Rack plating has become the used form of electroplating due, to its versatility and efficiency. It can effectively plate an array of products, including components, large assemblies, and even unconventional shapes. Additionally, rack plating is known for its cost-effectiveness, which appeals to a customer base.

On the other hand, continuous plating is experiencing the fastest growth rate as it caters to high-volume demands. This particular electroplating method focuses on plating wire, strip, and sheet metal products. The continuous plating market is expanding significantly due to the rising needs of industries, like manufacturing, electronics production, and construction sectors.

Electroplating Market Segmentation: By Metal

-

Standard Metals

-

Precious Metals

-

Alloys

In 2022, based on the metal, the standard segment accounted for the largest revenue share by almost 30% and has led the market. Nickel is a favored metal, for electroplating due to its affordability, durability, and resistance to corrosion. It is commonly employed in the production of finishes like chrome and satin.

Among the expanding range of metals used in electroplating, precious metals like gold and silver are gaining rapid traction. These precious metals serve purposes in electroplating; enhancing the appeal of products and bolstering their electrical conductivity. Market experts anticipate a compound growth rate (CAGR) of over 6% for the precious metals market, throughout the projected period.

Electroplating Market Segmentation: By Application

-

Automotive

-

Electrical & Electronics

-

Aerospace & Defense

-

Industrial Machinery

-

Jewelry

-

Medical

In 2022, based on the application type, the Automotive segment accounted for the largest revenue share by almost 30.1% and has led the market. Electroplating finds its application, in the sector for safeguarding components against corrosion and wear while also enhancing their appeal. The electronics industry on the other hand is experiencing the fastest growth in electroplating utilization. It is projected to witness a compound growth rate (CAGR) of, more than 6% during the forecast period. In this industry, electroplating serves the purpose of coating components to shield them from corrosion and enhance their conductivity.

Electroplating Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, the Asia Pacific region dominated the global electroplating market with a revenue of 50%. The region is home to a large number of automotive and electronics manufacturers, which are driving the demand for electroplated products. The rising middle class, in the area is also fueling the need for items as they are purchasing cars and other consumer goods. South America the Middle East and Africa have markets for electroplating. They are projected to grow faster than the developed markets in the upcoming years. This expansion will be propelled by the growing demand for products from sectors, like automotive, electronics, and construction.

COVID-19 Impact Analysis on the Global Electroplating Market:

As a result, the COVID-19 pandemic has greatly affected people's lives and employment in a way. To contain the spread of the virus and protect healthcare systems from being overwhelmed governments, across countries have implemented border closures, quarantines for travelers, and other preventive measures. Prioritizing the safety and well-being of workers should have been paramount; however, organizations are currently focused on addressing the consequences of devising strategies to overcome its limitations. Since the outbreak of COVID-19 19, several industries like metals and hardware have experienced a decline, in their percentages leading individual companies to suffer significant losses in their market value. This downturn has particularly impacted the electroplating sector with decreasing interest observed in applications.

Latest Trends/ Developments:

Prominent companies, from across the globe have implemented business strategies to thrive, expand, and advance in the field of electroplating. They have applied solutions in sectors like automotive, aerospace & defense electrical & electronics, and more. Renowned corporations such as Atotech Deutschland GmbH, Allied Finishing Inc., Peninsula Metal Finishing Inc., and others have pursued business approaches like partnerships, acquisitions, mergers, and similar agreements to offer sustainable solutions, across multiple industries worldwide. As a result of these efforts and inventive practices, the American region has witnessed significant growth in the overall market.

Key Players:

-

Atotech Deutschland

-

GMBH Interplex Holdings Pte.

-

Ltd Kuntz Electroplating Inc.

-

Pioneer Metal Finishing Inc.

-

Roy Metal Finishing Inc.

-

Bajaj Electroplaters

-

J & N Metal Products

-

LLC Peninsula Metal Finishing Inc.

In January 2020 Pioneer Metal Finishing, with the support of Aterian Investment Partners broadened its presence by acquiring Pilkington Metal Finishing.

Atotech introduced the DynaSmart plating line in December 2020 offering corrosion coatings. The unique design of DynaSmart allows for the relocation of product carriers, across various plating tanks. It is compact and available, as a system.

Chapter 1. Electroplating Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Electroplating Market – Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Electroplating Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Electroplating Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Electroplating Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Electroplating Market – By Type

6.1 Introduction/Key Findings

6.2 Barrel Plating

6.3 Rack Plating

6.4 Continuous Plating

6.5 Line Plating

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. Electroplating Market – By Metal

7.1 Introduction/Key Findings

7.2 Standard Metals

7.3 Precious Metals

7.4 Alloys

7.5 Y-O-Y Growth trend Analysis By Metal

7.6 Absolute $ Opportunity Analysis By Metal, 2023-2030

Chapter 8. Electroplating Market – By Application

8.1 Introduction/Key Findings

8.2 Automotive

8.3 Electrical & Electronics

8.4 Aerospace & Defense

8.5 Industrial Machinery

8.6 Jewelry

8.7 Medical

8.8 Y-O-Y Growth trend Analysis By Application

8.9 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 9. Electroplating Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Metal

9.1.3 By Application

9.1.4 By Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Metal

9.2.3 By Application

9.2.4 By Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Metal

9.3.3 By Application

9.3.4 By Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Metal

9.4.3 By Application

9.4.4 By Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Metal

9.5.3 By Application

9.5.4 By Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Electroplating Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Atotech Deutschland

10.2 GMBH Interplex Holdings Pte.

10.3 Ltd Kuntz Electroplating Inc.

10.4 Pioneer Metal Finishing Inc.

10.5 Roy Metal Finishing Inc.

10.6 Bajaj Electroplaters

10.7 J & N Metal Products

10.8 LLC Peninsula Metal Finishing Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Electroplating Market was valued at USD 15.11 billion and is projected to reach a market size of USD 20.2 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 3.70%.

Increasing Need in Automotive Industry for Electroplating Applications, Growing Consumer Electronics Product Demand.

Based on Metal, the Global Electroplating Market is segmented by Standard Metals, Precious Metals, Alloys

Asia Pacific is the most dominant region for the Global Electroplating Market.

Atotech Deutschland, GMBH Interplex Holdings Pte., Ltd Kuntz Electroplating Inc., Pioneer Metal Finishing Inc. Roy Metal Finishing Inc. are the key players operating in the Global Electroplating Market.