Electronics Performance Elastomers Market Size (2024-2030)

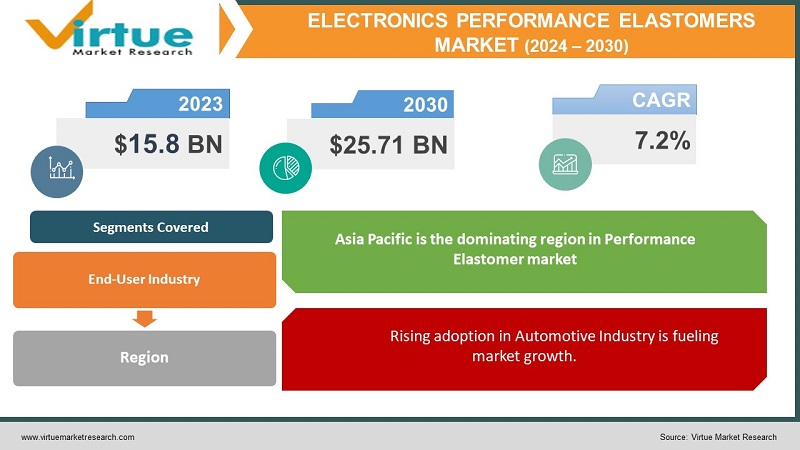

The Performance Elastomers Market was valued at USD 15.8 billion in 2023 and is projected to reach a market size of USD 25.71 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 7.2%.

Performance elastomers are advanced polymers composed of long chains of atom. They are made of repeated units of a single monomer or of two or multiple monomers. They are often characterized by high level of viscosity and elasticity, having the capacity to considerably deform and then back to the original shape, after removal of the force causing the deformation. Performance elastomers are complex materials that represent unique combinations of useful properties, the most important being resistance and flexibility. These products have very strong molecular bonds, resisting extreme temperature, highly reactive chemicals and hazardous gases like ozone. The growth of the market can be attributed to the rising demand for Performance Elastomers owning to the Automotive and Transportation, Industrial Machinery, Building and Construction, Healthcare, Electrical and Electronics Applications across the world.

Key Market Insights:

- China is a dominating leader in the Global Electric Car market. According to the China Association of Automobile Manufacturing, the manufacturing of new energy vehicles in the country witnessed a year-on-year increase of 96.9 percent in December 2022. Thus, the expanding electric vehicle market is expected to rise the demand for Elastomers.

- About approximately 40% of all Thermoplastic Elastomers products consumed worldwide are utilised in vehicle manufacturing. Therefore, the advancement of the Automotive and Transport industries and their parts, components, and OEM suppliers is a significant indicator for future TPE demand.

- Also, the automotive industry in India is developing. The country witnessed a major increase in the production of passenger vehicles. For example, the production of passenger vehicles hit 3,650,698 for the FY 2021-2022, representing an increase of 19% compared to previous year.

Electronics Performance Elastomers Market Drivers:

- Rising adoption in Automotive Industry is fueling market growth.

Performance elastomer is widely utilised in the manufacturing of automotive parts. The growing manufacture of vehicles both in emerging as well as developed economies is one of the crucial factors which is recognised to the growth of the performance elastomer market globally. Elastomers are employed in belts and hoses, bellows, gaskets, sound management inside the car, floors and instrument panel skins. Furthermore, outside the car, it can be used to make tires (base tires, sidewalls, and treads), wire, cables, and coatings.

The global manufacturing of automobiles reached over 80 million units in 2021 which represents a 3% rise when compared to its previous year. Hence, this is positively impacting the market growth of Electronics Performance Elastomers. The development of electric vehicles is also expected to help in the growth of the market. In countries like China and Europe due to various government programs which are promoting to refrain the use of fossil fuels owing to various environmental concerns the designers of the automotive segments will discover new possibilities.

- Awareness regarding benefits of Performance Elastomers propelling market growth.

Better awareness about several benefits of Performance Elastomers such as flexibility, durability, aging resistance, huge variety such as heat resistance, weathering and ozone resistance, chemical resistance and oil & gas resistance. Various beneficial properties of Performance Elastomers over the standard elastomers are expected to push their demand and drive the market growth rate. Furthermore, growing application from Automotive, Electronics and Transportation industry, is increasing the demand of product, because of their superior and amazing properties, rising disposable income and purchasing power of consumers are some of the other reasons which is expected to boost the growth of the Performance Elastomer market during the estimated period.

- Superior Properties than Standard Elastomers

Standard elastomers are being alternated by Performance Elastomers because of their unique set of properties such as superior durability, flexibility, heat resistance, chemical resistance, aging resistance, high variety of oil & gas resistance, enhanced performance and long-life cycle. Performance elastomers like silicone elastomers are boosting heat resistance over 300°C by using polysiloxane additives. As a result, the demand for Performance Elastomers is surging in construction projects. Across the world, there has been an increase in the construction of residential buildings, commercial buildings and industrial buildings. The superior properties of Performance Elastomers over standard Elastomers are expected to drive the global Performance Elastomers market during the forecast period.

Electronics Performance Elastomers Market Restraints and Challenges:

The high cost of product manufacturing is one of the primary factors limiting the growth of the Electro performance elastomer market globally. Synthetic rubber is made from the raw material crude oil. When the price of crude oil increases, the price of synthetic rubber climbs with it. For oil, gas, and chemical businesses, the result of COVID-19 and the oil price war is proving to be a two-pronged problem. Oil prices are reducing because of failed production-cut agreements, and demand for chemicals and refined goods is falling due to industrial slowdowns and travel limitations in the aftermath of the global pandemic. Hence, changes in crude oil are a major problem for the elastomers industry's growth, as petrochemicals (crude oil derivatives) are a crucial raw ingredient for synthetic rubber. These materials typically are priced more than regular commodity elastomers because the processing gives them the needed hardness, heat resistance, and chemical resistance. These products have specialized and pivotal application areas that make their use necessary and hence rise the cost of the product. In the future years, this aspect will have a negative impact on the market for Electro Performance Elastomer.

The disposal of elastomers gives rise to environmental problems since hazardous waste is released. The discarding of elastomers is a major source of worry for environmental organizations, as it releases a large number of harmful substances into the environment. Elastomer recycling alternatives are limited, and it is only doable with uncured elastomers, while the majority of them are cured. These materials can be thrown away in two ways: incineration or landfills, both of which pose a risk to the environment. When elastomers are burned, carbon monoxide and hydrogen cyanide are released, both of which are detrimental to the environment.

Electronics Performance Elastomers Market Opportunities:

The growing awareness regarding the usage of Performance Elastomer and strict government rules and regulations associated with the use of rubber will increase the demand for Performance Elastomer in several end user industries, creating immense chances for the Performance Elastomer market players during the estimated period. In addition, the widespread adoption of elastomers in the automotive sector and the ongoing research and development activities and technological advancements in the field of Performance Elastomers will further provide lucrative opportunities for the growth of the Performance Elastomer market in future years.

ELECTRONICS PERFORMANCE ELASTOMERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By End User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Arkema (France), Asahi Kasei Corporation (Japan), BASF SE (Germany), Dow (U.S) , Covestro AG (Germany), Huntsman International LLC. (U.S.), Tosh Corporation (Japan), Kraton Corporation (U.S.), Mitsubishi Chemical Company (Japan), DuPont (U.S.) |

Electronics Performance Elastomers Market Segmentation:

Electronics Performance Elastomers Market By End-User Industry

- Automotive & Transportation

- Healthcare, Industrial Machinery

- Building & Construction

- Electrical & Electronics

- Others

The Automotive and Transportation segment held the largest Performance Elastomers Market share and is estimated to grow at the highest CAGR of 5.9% during the forecast period. Performance elastomers such as nitrile butadiene rubber (NBR), hydrogenated nitrile-based rubber (HNBR) and more have highlighted properties, including improved heat and chemical resistance, low intermolecular strength and low modulus elasticity. These properties enhance the strength and longevity of the automotive parts, which is the reason it is utilized in the automotive industry. The factors such as the rising adoption of passenger cars, the booming transport production and other factors are escalating the growth of the automotive industry. Resultantly, there has been an increase in the demand for performance elastomers. This would give rise to the growth of the Performance Elastomers market in the projected period.

Electronics Performance Elastomers Market By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Asia Pacific is the dominating region in Performance Elastomer market in terms of market share and revenue growth. This is due to the rising number of applications from Automotive and Transportation industry in this region. As there is a growing demand for automatic production across the nations the market is expected to grow. Increased manufacturing of Automotives in Thailand, China, India and Indonesia are driving the market development period rapid industrialization and rapid urbanization in these developing nations is driving the manufacturing industries as well as the Construction industries in these countries. The developing Construction and Manufacturing industries are creating a demand for elastomers. Several Original Equipment Manufacturers are shifting their basis to the markets that have low operational cost. By decreasing the cost of manufacturing they're also escalating the demand for various other passenger cars. This creates more demand for elastomers.

Europe and North America are expected to be the fastest growing regions during the estimated period of due to the increasing disposable income of the people along with prevalence of large consumer and rising usages in several applications in this region.

COVID-19 Impact Analysis on the Electronics Performance Elastomers Market:

The outbreak of COVID-19 pandemic has continued to affect the growth of the automotive and many other sectors across the globe. This pandemic has hampered a majority of businesses overall the world due to imposed lockdown, which caused the people to stay at home. The imposed lockdown led to a decrease in the sales of vehicle, and various other products where Electronic Performance Elastomers are used, consequently, contracting the global Performance Elastomer market. The market for Performance Elastomers was heavily affected by the decline in vehicle production, which also decreased demand for silicone, fluoroelastomers, and silicone-based elastomers. However, the market is recovering rapidly and reaching pre-COVID levels over the forecast period.

Latest Trends:

The Automotive industry has gotten better in part because more cars are being produced and each car uses more polypropylene. Compounds of thermoplastic olefin (TPO) are used in place of flexible PVC to cover instrument panels and for other interior uses.

The Automotive and Transportation industries apply Thermoplastic Elastomers (TPEs) a lot because they are lightweight, easy to process, give designers more freedom, are versatile, and can be recycled. And thermoset rubber is a type of elastomer that is mainly applied in making automotive tyres. About approximately 40% of all TPE products consumed worldwide are used in vehicle manufacturing. Therefore, the growth of the Automotive and Transport industries and their parts, components, and OEM suppliers is a crucial indicator for future TPE demand.

Key Players:

- Arkema (France)

- Asahi Kasei Corporation (Japan)

- BASF SE (Germany)

- Dow (U.S)

- Covestro AG (Germany)

- Huntsman International LLC. (U.S.)

- Tosh Corporation (Japan)

- Kraton Corporation (U.S.)

- Mitsubishi Chemical Company (Japan)

- DuPont (U.S.)

Chapter 1. GLOBAL ELECTRONICS PERFORMANCE ELASTOMERS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL ELECTRONICS PERFORMANCE ELASTOMERS MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL ELECTRONICS PERFORMANCE ELASTOMERS MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL ELECTRONICS PERFORMANCE ELASTOMERS MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL ELECTRONICS PERFORMANCE ELASTOMERS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL ELECTRONICS PERFORMANCE ELASTOMERS MARKET – By End-User Industry

6.1. Introduction/Key Findings

6.2. Automotive & Transportation

6.3. Healthcare, Industrial Machinery

6.4. Building & Construction

6.5. Electrical & Electronics

6.6. Others

6.7. Y-O-Y Growth trend Analysis By End-User Industry

6.8. Absolute $ Opportunity Analysis By End-User Industry , 2023-2030

Chapter 7. GLOBAL ELECTRONICS PERFORMANCE ELASTOMERS MARKET - By Geography – Market Size, Forecast, Trends & Insights

7.1. North America

7.1.1. By Country

7.1.1.1. U.S.A.

7.1.1.2. Canada

7.1.1.3. Mexico

7.1.2. By End-User Industry

7.1.3. Countries & Segments - Market Attractiveness Analysis

7.2. Europe

7.2.1. By Country

7.2.1.1. U.K.

7.2.1.2. Germany

7.2.1.3. France

7.2.1.4. Italy

7.2.1.5. Spain

7.2.1.6. Rest of Europe

7.2.2. By End-User Industry

7.2.3. Countries & Segments - Market Attractiveness Analysis

7.3. Asia Pacific

7.3.1. By Country

7.3.1.1. China

7.3.1.2. Japan

7.3.1.3. South Korea

7.3.1.4. India

7.3.1.5. Australia & New Zealand

7.3.1.6. Rest of Asia-Pacific

7.3.2. By End-User Industry

7.3.3. Countries & Segments - Market Attractiveness Analysis

7.4. South America

7.4.1. By Country

7.4.1.1. Brazil

7.4.1.2. Argentina

7.4.1.3. Colombia

7.4.1.4. Chile

7.4.1.5. Rest of South America

7.4.2.By End-User Industry

7.4.3. Countries & Segments - Market Attractiveness Analysis

7.5. Middle East & Africa

7.5.1. By Country

7.5.1.1. United Arab Emirates (UAE)

7.5.1.2. Saudi Arabia

7.5.1.3. Qatar

7.5.1.4. Israel

7.5.1.5. South Africa

7.5.1.6. Nigeria

7.5.1.7. Kenya

7.5.1.7. Egypt

7.5.1.7. Rest of MEA

7.5.2. By End-User Industry

7.5.3. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL ELECTRONICS PERFORMANCE ELASTOMERS MARKET – Company Profiles – (Overview, End-User Industry Portfolio, Financials, Strategies & Developments)

9.1 Arkema (France)

9.2. Asahi Kasei Corporation (Japan)

9.3. BASF SE (Germany)

9.4. Dow (U.S)

9.5. Covestro AG (Germany)

9.6. Huntsman International LLC. (U.S.)

9.7. Tosh Corporation (Japan)

9.8. Kraton Corporation (U.S.)

9.9. Mitsubishi Chemical Company (Japan)

9.10. DuPont (U.S.)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Performance Elastomers Market was valued at USD 15.8 billion in 2023 and is projected to reach a market size of USD 25.71 billion by the end of 2030. Over the forecast period of 2023-2030, the market is estimated to grow at a CAGR of 7.2%.

The heightened health awareness and ethical consumption among consumers is propelling the Global Organic Spices industry

Electronics Performance Elastomers Market is segmented based on End User Distribution and Region

Asia-Pacific is the most dominant region for the Electronics Performance Elastomers Market.

Arkema (France), Asahi Kasei Corporation (Japan), BASF SE (Germany), Dow (U.S), Covestro AG (Germany) and Huntsman International LLC. (U.S.) are a few of the key players operating in the Electronics Performance Elastomers Market.