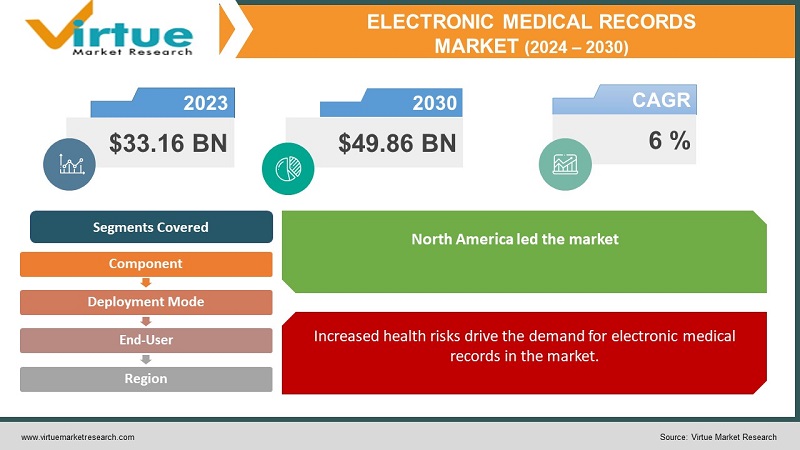

Electronic Medical Records Market Size (2024-2030)

The Electronic Medical Records Market was valued at USD 33.16 billion and is projected to reach a market size of USD 49.86 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6%.

Past methods of storing, managing, and analyzing medical data were tedious, as the process involved manual entry and analysis of data on paper, which was prone to tampering. This also led to human error and inaccuracy in analyzing patient’s illness. However, with the advent of technology, the first EMR system was developed in the United States in the year 1972, by the Regenstrief Institute. This enhanced the management of clinical and medical data, however, proved too costly in the initial time. However, with further technological advancements, EMR took the form of cloud-based and web-based software, which increased efficiency, reduced human error, reduced manual work, and offered cost-effective remote solutions to medical professionals. In addition, the incorporation of data analytics in present times provided automatic and AI-driven insights to doctors and medical professionals, which considerably reduced delays in treatment decisions and improved patient care.

The future holds positive for the EMR market, as with the emergence of AI and machine learning algorithms doctors and researchers can perform diagnosis and prediction regarding potential disease outbreaks of certain chronic diseases. Furthermore, increasing demand for enhanced security networks for managing electronic medical records has induced companies to incorporate blockchain technology for securing EMR data safely on their devices.

Key Market Insights:

According to a survey conducted by HIMSS, nearly 58% of medical professionals use mobile-optimized patient portals to connect with their patients.

As per the Centers for Disease Control & Prevention (CDC), 88.2% of office-based physicians use EMR systems,

As per the HHS Cybersecurity Program report on EMR in healthcare, Epic Systems, an EMR software vendor, occupies a 34.1% share in the market (2021), followed by Cerner with a market share of 23.7%. These software are widely used by hospitals.

As per Economic Forum Report, AI expenditure in India is anticipated to reach a value of USD 11.78 billion by the year 2025 and USD 1 trillion to India’s economy by the year 2035.

Electronic Medical Records Market Drivers:

Increased health risks drive the demand for electronic medical records in the market.

Rising health problems among people, especially among the aged are increasing the need to store, segregate, and analyze health data at a centralized platform, which surged the demand for EMR software & hardware in the market. With the help of EMRs, healthcare centers can analyze & manage patient data related to chronic health illness and drug response of the body that further enable them to make better informed decisions regarding treatment procedures. Moreover, EMR offers enhanced communication and collaboration with healthcare facility centers, leading to immediate treatment and offered increased patient safety. Apart from this, EMR software provides worldwide medical data and trends related to chronic diseases via integration with online health databases, which help in further analyzing the potential risk factors, outbreaks, and effects on the people of a particular area.

The rising demand for health analytics has boosted the demand for electronic medical records in the market.

The emerging trends and technological adoptions in the healthcare sector are increasing efficiency and productivity in treatment. Moreover, the incorporation of data analytics into the healthcare sector is improving patient care by providing accurate data-driven insights and immediate treatment recommendations to medical professionals. Further, some EMR software comes with population health analytics tools that enable doctors and medical professionals to analyze and identify potential health risks based on previous virus outbreaks in a country or region. Moreover, the predictive analytics features in EMR helps doctors and researchers to predict potential outbreak and their effect on the health of the people by making predictions based on historical medical data. In addition, EMR software offers a robust and secure network for managing and tracking patients’ data cost-effectively. Apart from this, the growing demand for specialized EMR software is further inducing health tech firms to incorporate featured analytics tools for the enhancement of the healthcare sector.

Electronic Medical Records Market Restraints and Challenges:

Data leaks and security issues can decrease the demand for electronic medical records in the market. EMRs are managed on online and cloud-based platforms, which are hosted on third-party servers. These servers are often exposed to online threats such as data breaches and privacy, which can affect the usage of EMR software in the market.

Furthermore, the complexity of handling and lack of proper knowledge regarding the use of EMR software among medical professionals can decline the market growth of electronic medical records.

Electronic Medical Records Market Opportunities:

The Electronic Medical Records Market is anticipated to deliver lucrative opportunities for businesses, which include acquisitions, partnerships, collaborations, product launches, and agreements during the forecasted period. Furthermore, increasing demand for efficient medical data management and analysis tools and rising trends in telehealth, especially in developing nations are predicted to develop the market for electronic medical records and enhance its future growth opportunities.

ELECTRONIC MEDICAL RECORDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Component, deployment, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Care360, Sevocity, Cerner, Optum Physician, EpicCare, Kareo Clincial, CampDoc, Greenway Health, QD Clinical, Advanced MD, Cerner PowerChart |

Electronic Medical Records Market Segmentation

Electronic Medical Records Market Segmentation: By Component

- Hardware

- Software

- Services

In 2022, based on market segmentation by component, software occupies the highest share of about 33% in the market. Software is the major component of EMR (Electronic Medical Records), as it aids in collecting, analyzing, managing, and accessing the medical data of patients easily on one platform. Moreover, EMR software offers flexibility and increased scalability to healthcare professionals, as it helps in storing and analyzing large data sets of patient’s medical history, genetic data, and others in one place compared to traditional paper-based records, which were prone to tampering leading to loss of data.

The hardware is the fastest-growing segment during the forecast period. Hardware systems assist in the functioning of EMR software. These systems include cloud-based servers for data storage, terminals, workstations, EMR-connected devices such as computers, laptops, IoT-based medical devices, scanners, and others that aid in transferring, storing, and analyzing medical data of patients, leading to increased efficiency in the workforce.

Electronic Medical Records Market Segmentation: By Deployment Mode

- Cloud

- On-Premise

- Web-Based

In 2022, based on market segmentation by deployment mode, the cloud segment occupies the highest share of about 28.5% in the market. Cloud-based EMR servers are easy to use, as they allow remote monitoring and maintenance of medical data at third-party servers. Moreover, it offers easy accessibility of medical data to healthcare professionals, allowing them to remotely work and analyze medical data for further treatment procedures. Additionally, specialized cloud-based servers offer high scalability with robust encryption that is capable of handling large amounts of data. In addition to this, the cost-effectiveness of cloud-based EMR servers is further boosting their applicability in the healthcare sector.

The web-based segment is the fastest-growing during the forecast period. Web-based EMRs are usually online software solutions that allow healthcare professionals to log in and remotely manage medical data on the online platform, particularly on a cloud-based platform. Moreover, it offers easy accessibility and usage, as it requires minimal installation and configuration requirements, and runs smoothly on EMR-connected devices. In addition, the segment is witnessing momentum in the healthcare sector, due to its strict and robust security network and real-time data access on one platform.

Electronic Medical Records Market Segmentation: By End-User

- Hospitals & Clinics

- Pharmacies

- Ambulatory & Surgical Centers

- Diagnostic Centers

- Others

In 2022, based on market segmentation by end-users, hospitals & and clinics occupy the highest share of about 35% in the market. Hospitals & clinics are the major consumers of EMR, as they require it for storing patients’ data, and integrating it with other medical devices for quick analysis of treatment, these medical devices include radiology systems, imaging systems, and others. Furthermore, remote EMR software enables healthcare professionals to make better treatment decisions based on data gathered. Additionally, many EMR software come with additional alert mechanisms that provide drug delivery procedure information in the patient’s body to doctors and other medical professionals that enable them to perform immediate preventive treatments. Apart from this, EMR software offers additional features such as patient appointment management, telehealth services, documentation and prescription of medicines, and other services.

The diagnostic centers are the fastest-growing segment during the forecast period. These centers are the prime users of both EMR software and hardware solutions, as they require EMR for storage of medical data gathered from laboratory testing and imaging, for managing patients’ records such as number of tests, genetic data, medical history, for collaborating with hospitals & clinics, and for disease analysis purposes. These features of EMR enable diagnostic centers to make informed treatment decisions effectively.

Electronic Medical Records Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle-East & Africa

In 2022, based on market segmentation by region, North America occupies the highest share about 34% of the market. Increased health risks, the presence of robust & technologically advanced medical infrastructure, and rising trends in health tech are contributing to the demand for EMR in the region. As per NYCHBL estimation, life sciences and health tech accounted for US 13.8 billion dollars across 412 deals in 2022, across the country.

Asia-Pacific is the fastest-growing region during the forecast period. Rapid digitization and growing trends in telemedicine post-pandemic, and emerging health-tech startups are contributing to the demand for EMR in the region. For instance, as per the EY-IPA study published by IBEF (Indian Brand Equity Foundation), the telemedicine market will grow at an annual CAGR of 31% during the period from 2020-2025.

COVID-19 Impact Analysis on the Electronic Medical Records Market:

The pandemic had a positive impact on the electronic medical records market. Due to increased demand for healthcare services on account of virus infection, hospitals & and clinics increasingly use EMR software for managing patients’ medical data related to virus infection, symptoms, response to potential drug interventions, and others. Furthermore, increasing trends in telemedicine during the pandemic boosted the demand for EMR software with telehealth features that enhanced communication between individuals and doctors during the pandemic. This specialized telehealth EMR software enabled doctors to manage patient remote monitoring appointments, bills, and documentation, and a virtual platform for consulting patients remotely. In addition, diagnostic and clinical centers utilized EMR software to track, analyze, and transfer infected patients’ data to hospitals and clinics, which led to faster treatment procedures during the pandemic.

Latest Developments:

The electronic medical records market has seen numerous transformations since ages and is further witnessing increased market opportunities due to rising applications of AI, machine learning, and data analytics in the healthcare sector. Furthermore, rising demand for smart telehealth and telemedicine solutions is another factor driving the market growth of EMR software, particularly cloud-based software. In addition, the versatility and easy integration of EMR systems with other devices and software such as imaging & radiology devices, genomic data analyzing software, and others have boosted the market demand for electronic medical records.

Key Players:

- Care360

- Sevocity

- Cerner

- Optum Physician

- EpicCare

- Kareo Clincial

- CampDoc

- Greenway Health

- QD Clinical

- Advanced MD

- Cerner PowerChart

- In April 2023, Wemex launched an integrated EMR system – Medicom-HRF, in Japan. The system is based on a hybrid cloud that can allow healthcare professionals to easily switch between cloud operation and on-premise operation. Furthermore, the new product offers medical record viewing and is equipped with image capture functions that can be accessed through tablets and other devices. In addition, it is a high-end healthcare solution, and it comes with additional features such as online insurance eligibility verification and e-prescriptions.

- In July 2022, MyHealthcare launched a single-screen EMR in India that enabled doctors, clinicians, and other medical professionals to enter the medical records of a patient on a single screen. Moreover, it has an in-built CDSS (clinical decision support system) that enables doctors to view patients’ history with the help of EMR. Additionally, it offers a CDSS-based care protocol library to doctors with various structured templates for improved patient care. Furthermore, it is equipped with AI-based analytics that enables easy recording and management of medical data.

Chapter 1. Global Electronic Medical Records Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Electronic Medical Records Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Electronic Medical Records Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Electronic Medical Records Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Electronic Medical Records Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Electronic Medical Records Market– By Component

6.1. Introduction/Key Findings

6.2. Hardware

6.3. Software

6.4. Services

6.5. Y-O-Y Growth trend Analysis By Component

6.6. Absolute $ Opportunity Analysis By Component , 2023-2030

Chapter 7. Global Electronic Medical Records Market– By Deployment Mode

7.1. Introduction/Key Findings

7.2. Cloud

7.3. On-Premise

7.4. Web-Based

7.5. Y-O-Y Growth trend Analysis By Deployment Mode

7.6. Absolute $ Opportunity Analysis By Deployment Mode , 2024-2030

Chapter 8. Global Electronic Medical Records Market– By End-User

8.1. Introduction/Key Findings

8.2. Hospitals & Clinics

8.3. Pharmacies

8.4. Ambulatory & Surgical Centers

8.5. Diagnostic Centers

8.6. Others

8.7. Y-O-Y Growth trend Analysis End-User

8.8. Absolute $ Opportunity Analysis End-User , 2024-2030

Chapter 9. Global Electronic Medical Records Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Component

9.1.3. By Deployment Mode

9.1.4. By End-User

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Component

9.2.3. By Deployment Mode

9.2.4. By End-User

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Component

9.3.3. By Deployment Mode

9.3.4. By End-User

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By Component

9.4.3. By Deployment Mode

9.4.4. By End-User

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Component

9.5.3. By Deployment Mode

9.5.4. By End-User

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Global Electronic Medical Records Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Care360

10.2. Sevocity

10.3. Cerner

10.4. Optum Physician

10.5. EpicCare

10.6. Kareo Clincial

10.7. CampDoc

10.8. Greenway Health

10.9. QD Clinical

10.10. Advanced MD

10.11. Cerner PowerChart

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Electronic Medical Records Market was valued at USD 33.16 billion and is projected to reach a market size of USD 49.86 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6%.

Increased health risks and Rising demand for health analytics are the market drivers of the Electronic Medical Records Market

Cloud, On-Premise, and Web-Based are the segments under the Electronic Medical Records Market by deployment mode

North America is the most dominant country in the Electronic Medical Records Market.

Asia-Pacific is the fastest-growing country in the Electronic Medical Records Market