Electrolyte Mixes Market Size (2024-2030)

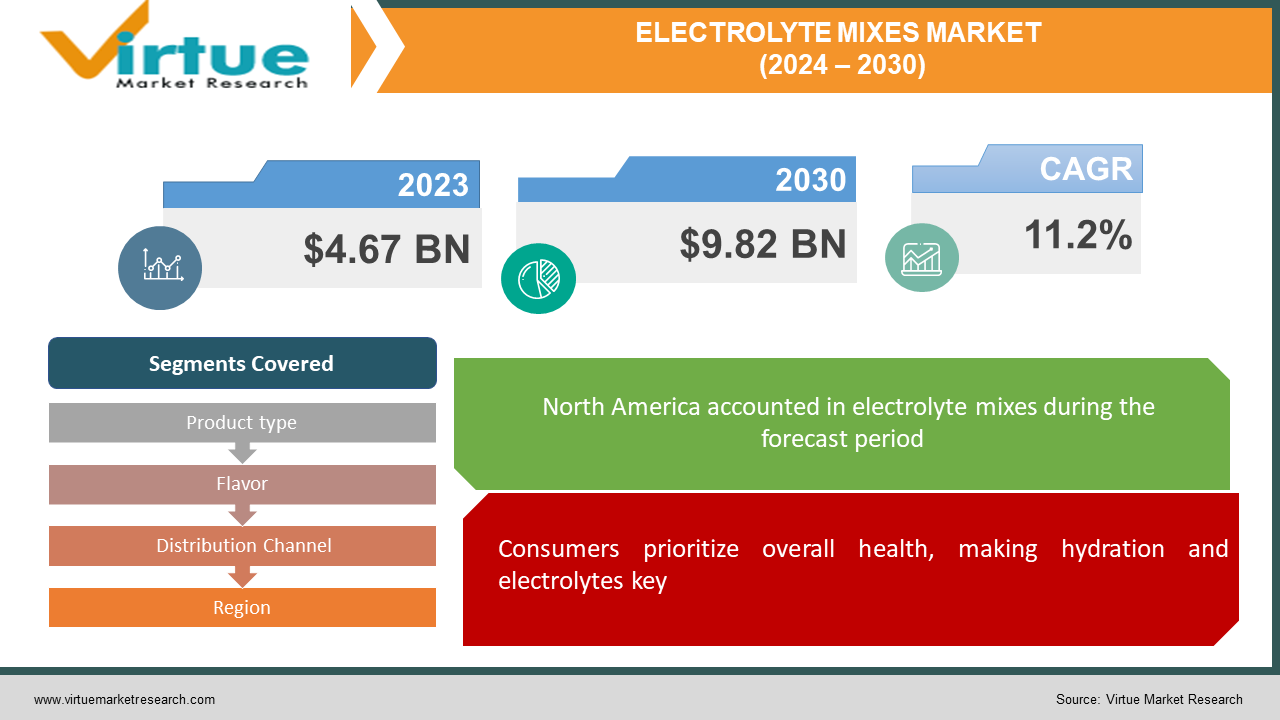

The Electrolyte Mixes Market was valued at USD 4.67 billion in 2023 and is projected to reach a market size of USD 9.82 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 11.2%.

The Electrolyte Mixes Market is brimming with opportunity, driven by a surge in health consciousness. Consumers are prioritizing hydration and electrolyte balance for overall well-being. Fitness enthusiasts, from runners to weightlifters, are creating a growing demand for convenient ways to replenish electrolytes lost through sweat. As disposable incomes increase, people are more willing to invest in health and wellness products, and electrolyte mixes are a perfect fit.

Key Market Insights:

According to a report published by the National Library of Medicine in 2022, a 3-weel trial was conducted with a group of 50 sugarcane harvest workers. They received electrolytes during the 2nd and the 3rd weeks of the trials. Their blood and urine samples were collected at the end of each week. There could be incidences drawn to increased hydration associated with less muscle damage and the ability to carry on intense physical activities under extremely hot conditions.

These health influences have been considered as the potential risk factors for acute kidney damage that may ultimately result in chronic kidney disease that is affecting agricultural workers globally. Findings from the same research report suggested that the provision of water and rest was protective, with almost (81%) fewer chances of acute kidney injury (AKI) among the workers.

The Electrolyte Mixes Market Drivers:

Consumers prioritize overall health, making hydration and electrolytes key.

Consumers are increasingly prioritizing their well-being, recognizing the importance of hydration and electrolyte balance for overall health. This trend creates a prime opportunity for electrolyte mixes to address these concerns.

Fitness enthusiasts demand solutions to replenish electrolytes lost through sweat.

The growing popularity of activities like running, cycling, and weight training is a major driver. These activities lead to sweat loss, and depleting electrolytes. Electrolyte mixes offer a convenient and effective way to replenish them, potentially enhancing performance.

Clean labels with natural ingredients and exciting flavors win over consumers.

The market is responsive to changing tastes. There's a growing demand for products with clean labels, featuring natural and organic ingredients. Additionally, exciting new flavors and convenient packaging are captivating a wider range of consumers, catering to various lifestyles.

The plant-based trend extends to electrolyte mixes, catering to vegan and plant-based diets.

The trend towards vegan and plant-based products extends to the Electrolyte Mixes Market. This caters to the growing population following vegan or plant-based diets and those with specific dietary restrictions.

A fragmented market with global players and local competitors drives innovation.

The market is fragmented, with established global players competing alongside regional and local companies. This fosters innovation as companies strive to differentiate themselves through unique product offerings, strategic expansion, and even mergers and acquisitions.

The Electrolyte Mixes Market Restraints and Challenges:

The Electrolyte Mixes Market is booming, fuelled by a surge in health consciousness. Consumers are prioritizing their overall well-being and seeking ways to improve hydration and electrolyte balance. However, despite this growth, there are hurdles to overcome.

One key challenge is limited consumer awareness. While the market is expanding, some consumers might not fully grasp the benefits of electrolyte mixes or when they're truly needed. This limits the market's potential reach. Additionally, the presence of substitutes like coconut water and sports drinks creates competition and can influence purchasing decisions.

Regulatory hurdles also play a role. The regulations surrounding health claims and ingredients can be complex and vary by region. This presents challenges for manufacturers, potentially hindering the development of new products and limiting market expansion. Striking the right price point is another challenge. Some consumers might perceive electrolyte mixes as expensive compared to traditional beverages, impacting their purchasing decisions.

Finally, there might be some misconceptions about electrolyte needs, potentially leading to overuse. This could raise safety concerns and negatively impact the market's perception. To ensure continued growth, the industry needs to address these challenges through consumer education, innovation, and navigating the regulatory landscape effectively.

The Electrolyte Mixes Market Opportunities:

The Electrolyte Mixes Market isn't just quenching a current thirst; it's overflowing with opportunities for further growth and innovation. Manufacturers can expand their reach by developing targeted products for specific demographics like athletes, women, or millennials. These products would have tailored formulations and marketing that resonate with each group. Innovation can extend beyond just hydration by incorporating functional ingredients like vitamins, minerals, or even cognitive enhancers. This would cater to a wider range of health and wellness goals. The future might even hold personalized electrolyte mixes! Imagine consumers tailoring their mix based on individual sweat profiles or activity levels. This level of personalization would create a more engaging and effective product experience. Strategic partnerships with fitness centers, sports teams, or health influencers can leverage established communities and amplify brand awareness. Imagine a world where reaching for an electrolyte mix becomes as natural as grabbing a water bottle, thanks to the influence of these partnerships. Finally, exploring new distribution channels beyond stores is key. Online subscriptions, partnerships with fitness apps, or vending machines in gyms can offer convenient access to quench the thirst of on-the-go consumers. By embracing these opportunities, the Electrolyte Mixes Market can ensure it remains a thriving force in the ever-evolving health and wellness landscape.

ELECTROLYTE MIXES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.2% |

|

Segments Covered |

By Product type, Flavor, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

PepsiCo Inc., Nestle SA, Abbott Laboratories, Otsuka Pharmaceutical Co. Ltd, Tailwind Nutrition, Nuun, Ultima Health Products Inc., LyteLine LLC, Vega |

Electrolyte Mixes Market Segmentation: By Product Type

-

Ready-to-drink (RTD) Beverages

-

Electrolyte Powders

-

Tablets

-

Emerging Options

The dominant segment in the Electrolyte Mixes Market by product type is Ready-to-Drink (RTD) Beverages, offering convenient, single-serve options ideal for on-the-go consumption. Electrolyte Powders are another major contender, popular for their versatility and portability. The fastest-growing segment, however, is Emerging Options like chews, gels, and sprays, indicating a trend toward more diverse and portable electrolyte delivery methods.

Electrolyte Mixes Market Segmentation: By Flavor

-

Flavoured

-

Unflavoured

The dominant segment in the Electrolyte Mixes Market is flavored, capitalizing on consumer preferences for a variety of taste options. However, the unflavoured segment is anticipated to be the fastest-growing segment. This is likely driven by a growing health consciousness and a desire for natural ingredients, along with catering to those with specific dietary restrictions.

Electrolyte Mixes Market Segmentation: By Distribution Channel

-

Store-Based

-

Non-Store Based

By distribution channel, the Electrolyte Mixes Market is divided into store-based and non-store-based segments. The dominant segment is currently store-based, with convenient access offered through supermarkets, hypermarkets, convenience stores, and pharmacies. However, the fastest-growing segment is non-store-based, leveraging online retail platforms, fitness app partnerships, and subscription services. This segment caters to the growing tech-savvy and health-conscious audience who value the convenience of online shopping and personalized fitness app integration.

Electrolyte Mixes Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America region reigns supreme, boasting a strong emphasis on health and a high concentration of fitness enthusiasts. This translates to a significant demand for electrolyte mixes. From runners to gym-goers, a large portion of the population actively seeks solutions to replenish electrolytes lost through sweat, making North America a lucrative market for electrolyte mix manufacturers.

Mirroring North America, Europe reflects a similar trend of health-conscious consumers and a growing fitness culture. This fuels significant market growth as Europeans prioritize maintaining a healthy lifestyle. Manufacturers can cater to this health-focused audience by highlighting the functional benefits of electrolyte mixes.

Asia-Pacific region is poised for explosive growth. A burgeoning middle class with rising disposable incomes is increasingly prioritizing health and wellness. This, coupled with a growing awareness of the benefits of electrolyte mixes, creates a highly promising market. Manufacturers can tap into this potential by offering innovative and affordable electrolyte mix solutions.

COVID-19 Impact Analysis on the Electrolyte Mixes Market:

The COVID-19 pandemic undoubtedly caused ripples in the Electrolyte Mixes Market. While initial lockdowns led to temporary drops in sales, particularly for store-based products due to limited access, the overall impact proved to be a mixed bag. Supply chain disruptions caused by lockdowns and travel restrictions may have also caused temporary inventory issues for some manufacturers.

However, the long-term effects seem positive. The pandemic heightened awareness of overall health and well-being, potentially leading to a sustained rise in demand for electrolyte mixes as a convenient way to manage hydration and electrolyte balance. This focus on health might also lead to an increase in electrolyte mixes fortified with immunity-boosting ingredients, further expanding the market. Another positive trend is the accelerated shift towards e-commerce. This benefits the non-store-based segment, with consumers opting for online delivery or subscriptions for convenient access to electrolyte mixes.

In conclusion, despite the initial challenges posed by COVID-19, the Electrolyte Mixes Market appears well-positioned for continued growth. The growing focus on health and the rise of e-commerce creates exciting opportunities for manufacturers. By addressing potential supply chain vulnerabilities and highlighting the role of electrolyte mixes in overall well-being, the market can thrive in the post-pandemic era.

Latest Trends/ Developments:

The Electrolyte Mixes Market is gulping down innovation alongside hydration. Sure, these mixes have always been about quenching thirst and replenishing electrolytes, but exciting new trends are emerging. One key trend is the inclusion of functional ingredients. Electrolyte mixes are going beyond the basics by incorporating vitamins, minerals, and even cognitive enhancers. This caters to a wider range of health and wellness goals, from boosting immunity to enhancing focus during workouts. The future might even hold personalized electrolyte mixes! Imagine a product tailored to your individual sweat profile or activity level. This level of personalization would create a more effective and engaging product experience. The plant-based boom is also having an impact, with manufacturers developing new electrolyte mixes using plant-based ingredients. Sustainability is another growing concern for consumers, and the market is responding with eco-friendly packaging options like recycled materials or biodegradable containers. Strategic partnerships with fitness institutions, sports teams, or health influencers are a powerful tool to leverage established communities and amplify brand awareness. Imagine reaching for an electrolyte mix becoming as natural as grabbing a water bottle, thanks to these strategic partnerships. Finally, exploring new distribution channels beyond stores is key. Online subscriptions, partnerships with fitness apps, and vending machines in gyms can offer convenient access to on-the-go consumers. By embracing these trends, the Electrolyte Mixes Market is positioned for continued growth in a landscape that prioritizes innovation, personalization, and environmental consciousness.

Key Players:

-

PepsiCo Inc.

-

Nestle SA

-

Abbott Laboratories

-

Otsuka Pharmaceutical Co. Ltd

-

Tailwind Nutrition

-

Nuun

-

Ultima Health Products Inc.

-

LyteLine LLC

-

Vega

Chapter 1. Electrolyte Mixes Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Electrolyte Mixes Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Electrolyte Mixes Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Electrolyte Mixes Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Electrolyte Mixes Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Electrolyte Mixes Market – By Product

6.1 Introduction/Key Findings

6.2 Ready-to-drink (RTD) Beverages

6.3 Electrolyte Powders

6.4 Tablets

6.5 Emerging Options

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Electrolyte Mixes Market – By Flavor

7.1 Introduction/Key Findings

7.2 Flavoured

7.3 Unflavoured

7.4 Y-O-Y Growth trend Analysis By Flavor

7.5 Absolute $ Opportunity Analysis By Flavor, 2024-2030

Chapter 8. Electrolyte Mixes Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Store-Based

8.3 Non-Store Based

8.4 Y-O-Y Growth trend Analysis By Distribution Channel

8.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Electrolyte Mixes Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Flavor

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Flavor

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Flavor

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Flavor

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Flavor

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Electrolyte Mixes Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 PepsiCo Inc.

10.2 Nestle SA

10.3 Abbott Laboratories

10.4 Otsuka Pharmaceutical Co. Ltd

10.5 Tailwind Nutrition

10.6 Nuun

10.7 Ultima Health Products Inc.

10.8 LyteLine LLC

10.9 Vega

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Electrolyte Mixes Market was valued at USD 4.67 billion in 2023 and is projected to reach a market size of USD 9.82 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 11.2%.

Rising Health Consciousness, Fitness Enthusiasts, Evolving Consumer Preferences, Plant-Based Boom, Dynamic Market Landscape.

Ready-to-drink (RTD) Beverages, Electrolyte Powders, Tablets, Emerging Options.

North America holds the dominant position in the Electrolyte Mixes Market, boasting a strong health consciousness and a high prevalence of fitness enthusiasts.

PepsiCo Inc., Nestle SA, Abbott Laboratories, Otsuka Pharmaceutical Co. Ltd, Tailwind Nutrition, Nuun, Ultima Health Products Inc., LyteLine LLC, Vega.