Electrolyte and Vitamin Water Market Size (2024 – 2030)

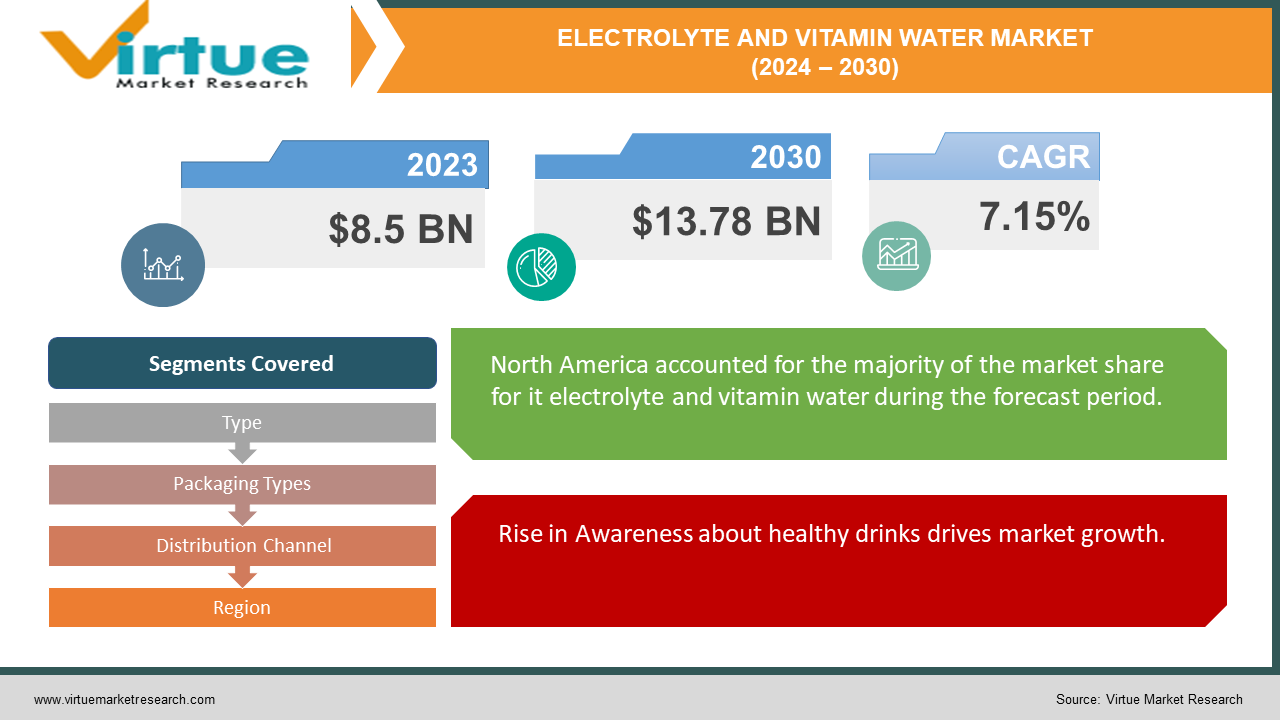

The Electrolyte and Vitamin Water Market was valued at USD 8.5 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 13.78 billion by 2030, growing at a CAGR of 7.15%.

Electrolyte water is enriched with calcium, sodium, potassium, magnesium, and other electrically charged minerals essential for the proper functioning of the brain, heart, muscles, and nervous system. It maintains hydration by balancing the body's internal pH levels. Additionally, it assists in transporting nutrients into body cells and repairing damaged tissues. Conversely, vitamin water is enriched with various water-soluble vitamins and essential nutrients. It plays a role in removing harmful free radicals from cells, ensuring hydration, and regulating body temperature. Furthermore, moderate intake helps maintain the necessary pH balance and supports the optimal functioning of muscles and nerves. Consequently, the popularity of electrolytes and vitamin water is increasing worldwide, particularly among millennials.

Key Market Insights:

The increasing incidence of obesity and other lifestyle-related diseases is a significant factor positively impacting the market. Additionally, market growth is bolstered by a growing population, rapid urbanization, and a rising demand for nutrient-rich beverages.

Electrolyte and Vitamin Water Market Drivers:

Rise in Awareness about healthy drinks drives market growth.

Recent studies highlight the adverse effects of excessive sugar consumption are driving the growth of the global electrolyte and vitamin water market. Policies aimed at reducing added sugar and promoting healthier diets are further encouraging the adoption of these enhanced waters and functional beverages. In response, various global merchants are introducing their brands of fortified water to appeal to consumers seeking natural and healthy functional drink options. Manufacturers are increasingly utilizing natural sweeteners like Stevia, along with other organic and natural ingredients, to attract new consumers and expand their market share in the electrolyte and vitamin water sector.

Increase in the Need for Functional Beverages Boosts Market Growth.

Due to their purported health benefits, there is growing interest in functional beverages, including electrolyte and vitamin-enhanced waters. Consumers are seeking drinks that not only quench their thirst but also provide additional nutrients, such as vitamins and minerals.

An increase in Athletics and Fitness helps in market growth.

With the increasing emphasis on physical activity and fitness, there is a growing demand for electrolyte-rich drinks to replenish fluids and minerals lost during exercise. Electrolyte water is often marketed as a healthier alternative to sugary sports drinks.

Electrolyte and Vitamin Water Market Restraints and Challenges:

Environmental Concerns hinder market growth.

The widespread use of single-use plastic bottles for bottled water products raises concerns about environmental sustainability and packaging waste, potentially influencing consumer preferences. Increasing awareness of environmental impacts may drive a shift towards more eco-friendly packaging options or solutions, thereby affecting market dynamics.

Limited Target Audience decreases market growth.

The primary target market for electrolyte and vitamin water products likely consists of health-conscious consumers, athletes, and individuals seeking functional hydration solutions. However, the limited appeal beyond this group may constrain opportunities for broader market expansion.

Price Sensitivity hinders market growth.

Consumer price sensitivity can hinder market growth, especially in regions with low disposable incomes. Premium pricing strategies for enriched water products may deter adoption among cost-conscious consumers. Additionally, the market is constrained by rising raw material costs. The production of electrolytes and vitamin water demands substantial investment in high-quality fruits, vitamins, and other ingredients. As the prices of these raw materials surge, production costs increase, which are often passed on to consumers, thereby limiting market expansion.

Electrolyte and Vitamin Water Market Opportunities:

The increasing demand for natural and organic products is driving the growth of the global electrolyte and vitamin water market. This significant shift in consumer preferences is leading vendors to introduce zero-calorie enhanced waters to attract these health-conscious consumers. Innovations in formulation processes aimed at creating all-natural energy drinks are further propelling market development. Functional beverages made with natural sweeteners like stevia are expected to boost the adoption of these products and increase the revenues of the electrolyte and vitamin water market.

ELECTROLYTE AND VITAMIN WATER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.15% |

|

Segments Covered |

By Type, Packaging Types, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

PepsiCo, Glaceau, Danone, Big Red Inc, Mountain Valley Spring Water, Vitamin Well, Beltek Canadian Water, Karma Culture LLC, New York Spring Water, Talking Rain |

Electrolyte and Vitamin Water Market Segmentation: By Type

-

Only Electrolytes

-

Only Vitamin

-

Vitamin and Electrolytes

The "only electrolytes" segment held a significant share of the market in 2023, driven by increasing consumer awareness of the importance of hydration and electrolyte balance for maintaining physical health. Electrolyte water, which effectively replenishes essential minerals lost through sweat, has become a preferred choice among athletes and fitness enthusiasts, thus boosting this segment.

The "vitamin & electrolytes" segment is anticipated to grow at a substantial rate in the coming years, fueled by rising demand for functional beverages that offer multiple health benefits. Vitamin and electrolyte water, which hydrates while providing essential nutrients, appeals to health-conscious consumers. Additionally, the ongoing global health and wellness trend is expected to further drive the growth of this segment in the future.

Electrolyte and Vitamin Water Market Segmentation: By Packaging Types

-

Bottles

-

Tetra Packs

The market for electrolyte and vitamin water offers a variety of packaging options, including plastic bottles, glass bottles, and aluminum cans, each available in different sizes to meet diverse consumer preferences. Among these options, bottles are the dominant segment due to their widespread availability and convenience. Additionally, carton packaging, commonly in Tetra Pak containers, is gaining popularity for its convenience and portability in the market.

Electrolyte and Vitamin Water Market Segmentation: By Distribution Channel

-

Supermarkets

-

Convenient Stores

-

Online Stores

-

Specialty Stores

-

Others

In 2023, the Supermarkets segment held the largest market share in the electrolyte and vitamin water market. This was primarily driven by the high footfall in malls, which serve as comprehensive shopping destinations for various consumer needs, including food and beverages. The availability of a wide assortment of brands and products in malls, coupled with the convenience of shopping in a controlled environment, contributed to the segment's growth. Additionally, the increasing preference among health-conscious consumers for beverages offering added nutritional benefits further bolstered this segment.

Looking ahead, the Store segment is projected to grow at a significant compound annual growth rate (CAGR) during the forecast period. This growth is attributed to the expanding number of convenience stores and supermarkets, particularly in urban and semi-urban areas. These retail outlets provide convenient access to a diverse array of products, including health-oriented beverages like electrolytes and vitamin water. Moreover, the rising trend of health and wellness awareness, coupled with increasing awareness about the importance of hydration and nutrition, is expected to drive demand within stores. The ongoing focus on health and immunity due to the pandemic is also anticipated to contribute to the segment's growth in the coming years.

Electrolyte and Vitamin Water Market Segmentation- by Region

-

North America

-

Europe

-

Asia Pacific

-

Middle East & Africa

-

Latin America

In 2023, North America dominated the electrolyte and vitamin water market, driven by a robust health and wellness sector, heightened consumer awareness of the benefits of such beverages, and a strong demand for healthy hydration choices. The United States, in particular, played a significant role in this leadership position due to its proactive approach towards health and wellness, coupled with the presence of numerous leading beverage manufacturers.

Looking forward, the Asia Pacific region is poised for significant market growth in the coming years. This growth can be attributed to the expanding health and wellness sector, increasing health consciousness among consumers, and governmental initiatives promoting healthier lifestyles. China, with its ambitious health promotion plans and rising demand for nutritious hydration options, is expected to be a key driver of market expansion in the region. Additionally, the substantial presence of beverage manufacturers in Asia Pacific is anticipated to further stimulate market growth during the forecast period.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic had a significant impact on the Global Electrolyte and Vitamin Water Market. Disruptions in supply chains and distribution networks severely affected the production and availability of electrolyte and vitamin water beverages, leading to a negative impact on market growth. However, heightened health awareness among individuals seeking protection from COVID-19 contributed to increased demand for electrolyte and vitamin water beverages, presenting a positive opportunity for market growth. As a result, the global market for electrolyte and vitamin water encountered both challenges and opportunities amidst the challenging period of the COVID-19 pandemic.

Latest Trends/ Developments:

In March 2023, Vitaminwater expanded its product line with the introduction of two new flavors, 'With Love' and 'Forever You,' to complement its existing range of zero-sugar options. Alongside these additions, they implemented an innovative reformulation across all six zero-sugar flavors. The reformulated versions now feature a new sweetener blend incorporating monk fruit and stevia, along with enhanced levels of vitamins and nutrients.

In January 2023, Flow Beverage Corp. launched Flow Vitamin-Infused Water in Canada, securing placement in 22 retailers spanning over 800 locations and partnering with 8 national distributors. Positioned as a healthier choice within the functional water segment, it provides 120% of the recommended daily value of Vitamin C and is enriched with zinc.

In May 2020, General Beverage Co., Ltd., based in Thailand and renowned for its Vitaday functional drink, introduced two new functional water products. These vitamin water beverages are fortified with additional vitamin C and a vitamin B complex, delivering twice the daily requirement of vitamin C and meeting the entire daily requirement of vitamin B. The goal is to enhance the body's resilience, particularly in response to the ongoing pandemic.

Key Players:

These are the top 10 players in the Electrolyte and Vitamin Water Market: -

-

PepsiCo

-

Glaceau

-

Danone

-

Big Red Inc

-

Mountain Valley Spring Water

-

Vitamin Well

-

Beltek Canadian Water

-

Karma Culture LLC

-

New York Spring Water

-

Talking Rain

Chapter 1. Electrolyte and Vitamin Water Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Electrolyte and Vitamin Water Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Electrolyte and Vitamin Water Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Electrolyte and Vitamin Water Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Electrolyte and Vitamin Water Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Electrolyte and Vitamin Water Market – By Type

6.1 Introduction/Key Findings

6.2 Only Electrolytes

6.3 Only Vitamin

6.4 Vitamin and Electrolytes

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Electrolyte and Vitamin Water Market – By Packaging Types

7.1 Introduction/Key Findings

7.2 Bottles

7.3 Tetra Packs

7.4 Y-O-Y Growth trend Analysis By Packaging Types

7.5 Absolute $ Opportunity Analysis By Packaging Types, 2024-2030

Chapter 8. Electrolyte and Vitamin Water Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Supermarkets

8.3 Convenient Stores

8.4 Online Stores

8.5 Specialty Stores

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Distribution Channel

8.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Electrolyte and Vitamin Water Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Packaging Types

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Packaging Types

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Packaging Types

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Packaging Types

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Packaging Types

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Electrolyte and Vitamin Water Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 PepsiCo

10.2 Glaceau

10.3 Danone

10.4 Big Red Inc

10.5 Mountain Valley Spring Water

10.6 Vitamin Well

10.7 Beltek Canadian Water

10.8 Karma Culture LLC

10.9 New York Spring Water

10.10 Talking Rain

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The increasing incidence of obesity and other lifestyle-related diseases is a significant factor positively impacting the market. Additionally, market growth is bolstered by a growing population, rapid urbanization, and a rising demand for nutrient-rich beverages.

The top players operating in the Electrolyte and Vitamin Water Market are - PepsiCo, Glaceau, Danone, Big Red Inc, Mountain Valley Spring Water, Vitamin Well, Beltek Canadian Water, Karma Culture LLC, New York Spring Water, and Talking Rain.

The COVID-19 pandemic had a significant impact on the Global Electrolyte and Vitamin Water Market. Disruptions in supply chains and distribution networks severely affected the production and availability of electrolyte and vitamin water beverages, leading to a negative impact on market growth.

The increasing demand for natural and organic products is driving the growth of the global electrolyte and vitamin water market. This significant shift in consumer preferences is leading vendors to introduce zero-calorie enhanced waters to attract these health-conscious consumers.

The Asia Pacific region is poised for significant market growth in the coming years.