Electrofuel Market Size (2024-2030)

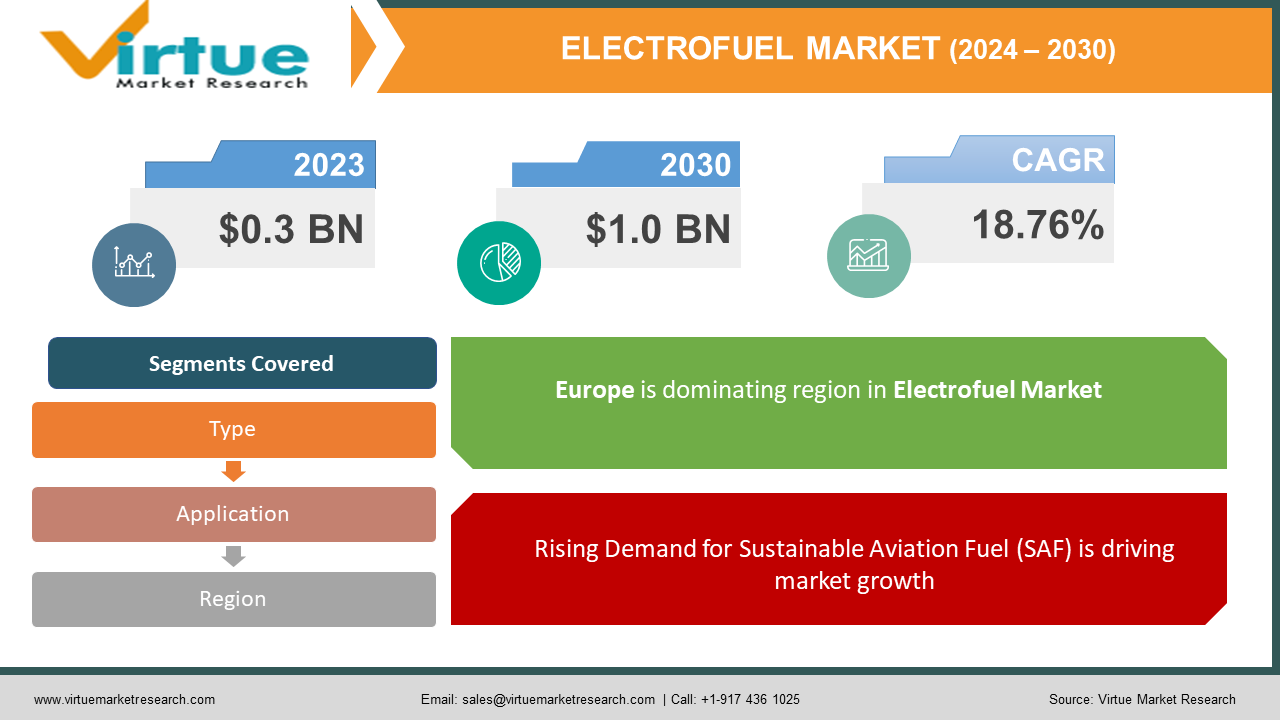

The Global Electrofuel Market was valued at USD 0.3 billion in 2023 and is projected to grow at a remarkable CAGR of 18.76% from 2024 to 2030, reaching an estimated USD 1.0 billion by 2030.

Electrofuel, also known as e-fuel, is synthesized by combining carbon dioxide with hydrogen produced through renewable energy sources, making it a promising alternative to traditional fossil fuels. Electrofuel has a wide range of applications, including use in transportation, aviation, and shipping industries. Driven by the increasing demand for sustainable energy solutions and global commitments to reduce carbon emissions, the electro fuel market is positioned for substantial growth as industries and governments seek cleaner fuel alternatives.

Key Market Insights:

Electrofuel demand is driven largely by the transportation sector, which represents approximately 60% of the market share. The shift toward sustainable mobility solutions is expected to continue as emission reduction targets become stricter.

Europe is a significant player in the electrofuel market, with nearly 40% market share, owing to extensive government support, green initiatives, and ambitious climate goals.

The aviation industry shows considerable potential for electrofuel adoption, as sustainable aviation fuels (SAF) are expected to constitute around 10% of the total jet fuel demand by 2030.

The production cost of electrofuel is currently higher than conventional fuels, but ongoing R&D efforts and scaling of production facilities are expected to reduce costs by around 30% over the next decade.

Global Electrofuel Market Drivers:

Rising Demand for Sustainable Aviation Fuel (SAF) is driving market growth:

The aviation industry is one of the biggest emitters of greenhouse gases and is increasingly being forced to consider sustainable alternatives to conventional jet fuel. Electrofuel can be blended with or used to replace traditional fuels with relatively minor modifications to existing engines and infrastructure. Governments and regulatory bodies worldwide are setting stringent emission reduction targets, which creates significant demand for SAF. For instance, in its dedication to achieving net zero carbon emissions by 2050, IATA commits to electrofuels since they are crucial for the accomplishment. Electrofuels have also been proven to ensure a circular carbon economy from renewable sources as they require CO₂ from the air during their production. By doing this, it means a significant reduction in carbon footprint compared to the total aviation system. These advances in production technology, together with a growing emphasis on sustainability, have made electrofuel a critical component of greener aviation.

Government Policies and Incentives for Decarbonization is driving market growth:

Global governments have, therefore, been implementing policies, subsidies, and incentives to facilitate this transition in the industries to low-carbon alternatives. For example, the Green Deal of the European Union and the Inflation Reduction Act of the United States are major regulatory frameworks. These encourage the use of renewable energy sources, like electrofuels. Such schemes provide subsidies, tax credits, and grants to companies investing in carbon-neutral technologies, and electrofuel production is hence economically viable. Carbon taxation and emission trading schemes are increasingly being applied to more industries. This will encourage high carbon-emitting industries to switch to clean energy sources such as electrofuel. Providing financial cushioning and regulatory certainty has spurred R&D and led to increased investment in electrofuel technology. This way, the government policies encourage infrastructure for electrofuel production while at the same time giving out long-term commitment signals; such policies encourage private investment, promote partnerships between the firms and governments, and drive the growth trajectory of the electrofuel market faster.

Technological Advancements in Carbon Capture and Hydrogen Production are driving market growth:

The efficiency and scalability of carbon capture and hydrogen production determine the economic viability and environmental impact of the final product in the production of electrofuel. Major developments have taken place in carbon capture technologies, allowing for effective extraction of CO₂ either from industrial emissions or directly from the air, which forms a closed-loop production cycle for electrofuels. Second, processes leading to hydrogen production through electrolyzers, most predominantly by renewable energy, are fast becoming more efficient with steadily decreasing costs. A crucial unit of conversion from water into hydrogen, electrolyzers have declined by 40% in the past five years, and there will be a further decrease over the next few years that will lead to an overall economy of scale. It makes electrofuels that have been priced much above competition with fossil fuels in a significant way competitive in price terms over traditional fossil fuels. This is because carbon capture and hydrogen production technologies synergize together to allow the creation of electrofuels that have a lower carbon footprint. This also helps position electrofuel as a sustainable alternative in hard-to-electrify sectors, driving demand and expansion in the market.

Global Electrofuel Market Challenges and Restraints:

High Production Costs and Infrastructure Requirements are restricting market growth:

Although electrofuels can reduce carbon emissions, the production of electrofuels is still extremely expensive. The synthesis of electrofuels involves energy-intensive steps, such as the electrolysis of water to produce hydrogen and the capture of carbon dioxide, which require significant financial investment. Electrofuel production costs are currently two to four times higher than those of conventional fossil fuels. The primary constraint to entry for most firms is high upfront investments. Economies of scale and technological improvements are, however, expected to reduce the cost. Moreover, developing an integrated infrastructure for the production, storage, and distribution of electrofuels requires high levels of capital and resources. It is very difficult for regions with low renewable energy capacity since reliance on traditional energy sources would jeopardize the carbon neutrality of electrofuels. As such, the high cost of production and infrastructure development is a major restraint that would limit the market growth unless more cost reductions are achieved through technological innovation and policy support.

Competition from Alternative Green Fuels and Technologies is restricting market growth:

For this reason, carbon-emission reduction will still come into competition with electrofuels from other low-carbon sources, such as hydrogen fuel cells, battery-electric systems, and biofuels. Hydropower, too, is being utilized as a fast and clean source for heavy industry and transport, while battery-electric solutions have become more or less adopted, at least for the automotive segment due to advancements in the use of batteries and building the charging infrastructure. Another alternative fuel, more specifically through biomass, is biofuels renewable source of energy and this is also viewed as more of a mature technology when compared with electrofuels. Again, the choice is made on bases such as the energy intensity, storage considerations, and infrastructure fit among other strengths of each respective alternative solution. Electric battery technologies provide excellent energy returns for local travel but aren't the best options for transcontinental aircraft or ships. In these cases, electrofuel is the best candidate, but entering the market is limited to competing green technologies. Growth in this market could thereby be influenced by the rate at which innovations are introduced relative to relative success in applications of other renewable energy sources.

Market Opportunities:

This is particularly true for those sectors of the economy that prove hard to electrify, like aviation, maritime shipping, and heavy-duty transportation. Those require high-density-energy fuels, where power delivery over long distances does not match the technology offered by batteries. A possibility that electrofuel shares advantageously with current combustion engines and fuel infrastructure may simplify such a transition towards greener options. Countries with considerable renewable energy resources, either in the form of adequate sunlight or wind, are best placed to become world producers of electrofuels. Synthetic fuels are also on the rise due to investment in renewable energy infrastructure and carbon capture technology, which will transition to carbon-neutral economies. Moreover, with the rise of 5G technology and developments in smart grids, these will support energy management systems, which may further lead to efficient production and distribution of electrofuels. For companies that are already into R&D or those looking forward to diversifying in their respective renewable business units, electro fuels will be long-term growth avenues for serving an evolving market with a focus on sustainability.

ELECTROFUEL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

18.76% |

|

Segments Covered |

By Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Audi AG, ExxonMobil, Siemens AG, TotalEnergies SE, Shell, Carbon Engineering, Nordic Electrofuel, Ineratec GmbH, Sunfire GmbH, and Climeworks. |

Electrofuel Market Segmentation:

Electrofuel Market Segmentation By Type:

- Synthetic Gasoline

- Synthetic Diesel

- Synthetic Jet Fuel

- Synthetic Methane

Synthetic Jet Fuel currently dominates the market, driven by the aviation industry’s demand for sustainable fuel options. With airlines seeking to reduce emissions while maintaining performance standards, synthetic jet fuel presents a viable alternative that aligns with carbon reduction goals.

Electrofuel Market Segmentation By Application:

- Transportation

- Aviation

- Maritime

- Industrial

The transportation sector, particularly aviation, is the leading application for electrofuels. Due to the sector’s stringent emission requirements and the limitations of current electric battery technology, electrofuels provide a suitable alternative, making aviation the primary application for electrofuel adoption.

Electrofuel Market Regional Segmentation:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

Europe is the most potent region in the electrofuel market, given its strong policies and commitment towards the greenhouse gas reduction pledge of the European Green Deal. Investments are going up as well within the European Union given that the 2050 goal for being carbon-neutral will have the potential impact to boost investment in synthetic fuel technologies and renewable energy within this region. Germany, France, and the Netherlands have progressed considerably in electrofuel production capability and infrastructure. The European regulatory framework, including carbon taxation and emission trading schemes, has also been economically viable for companies to invest in electrofuels. The region has a well-established renewable energy sector, positioning it to produce electrofuels at cost-effective levels, which further cements its leading position. The region of focus for Europe on clean transportation, sustainable aviation, and maritime decarbonization means that electrofuels support the region's goals perfectly, thus making it a market at the forefront of electrofuel adoption.

COVID-19 Impact Analysis on the Electrofuel Market:

The growth in the electrofuel market during the initial phases of the pandemic was slowed due to disruptions in supply chains, delays in projects, and a decrease in investment in new technologies because industries concentrated more on short-term survival rather than long-term sustainability initiatives. The pandemic resulted in a short-term decline in global fuel demand, impacting the general energy sector. While governments of the world are shifting from recession to recovery, this has led to a thrust on sustainable energy solutions again. Green recovery plans of governments are in the fray. The pandemic has really hastened commitments to carbon neutrality as countries integrate the concept of sustainability into the very post-COVID recovery plan. Government stimulus packages, incentives, and policies in turn have re-energized the electrofuel market, especially in regions that find clean energy investment as one of the means of economic recovery. The shift toward digitalization and remote work indirectly helps in the renewable energy market also, as demand for electricity continues to grow. The overall effect is that despite the initial setbacks by COVID-19, this has actually repositioned the sustainable energy industry toward long-term growth in the electrofuel market, with industry and governments working together on rebuilding with sustainability as the objective.

Latest Trends/Developments:

Some notable trends are going on in the electrofuel market, shaping its evolution. For one, the number of partnerships between renewable energy companies and traditional oil and gas companies is increasing. These partnerships are aimed at utilizing existing infrastructure in the distribution and storage of electrofuels in order to connect the conventional and synthetic fuel industries. The scalability of modular units for electrofuel production makes decentralized production possible, making production closer to demand centers, thereby lowering transportation costs and emissions. Carbon capture technologies are in rapid advancement for the betterment of efficient fuel production from atmospheric CO₂. In addition, electrofuel companies are exploring blockchain technology for carbon accounting and transparency in supply chains that provide end-to-end traceability and compliance with carbon-reduction regulations. The other big trend is the development of green hydrogen infrastructure, as massive hydrogen production projects are underway globally to support electrofuel synthesis. Lastly, industry partnerships drive standardization; when standardized, the regulatory approval processes will be simplified, and electrofuels will gain a larger market share.

Key Players:

- Audi AG

- ExxonMobil

- Siemens AG

- TotalEnergies SE

- Shell

- Carbon Engineering

- Nordic Electrofuel

- Ineratec GmbH

- Sunfire GmbH

- Climeworks

Chapter 1. GLOBAL ELECTROFUEL MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL ELECTROFUEL MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL ELECTROFUEL MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL ELECTROFUEL MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL ELECTROFUEL MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL ELECTROFUEL MARKET– BY Type

6.1. Introduction/Key Findings

6.2. Synthetic Gasoline

6.3. Synthetic Diesel

6.4. Synthetic Jet Fuel

6.5. Synthetic Methane

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. GLOBAL ELECTROFUEL MARKET– BY APPLICATION

7.1. Introduction/Key Findings

7.2. Transportation

7.3. Aviation

7.4. Maritime

7.5. Industrial

7.6. Y-O-Y Growth trend Analysis By APPLICATION

7.7. Absolute $ Opportunity Analysis By APPLICATION , 2024-2030

Chapter 8. GLOBAL ELECTROFUEL MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL ELECTROFUEL MARKET – Company Profiles – (Overview, Product Type s Portfolio, Financials, Strategies & Development

9.1. Audi AG

9.2. ExxonMobil

9.3. Siemens AG

9.4. TotalEnergies SE

9.5. Shell

9.6. Carbon Engineering

9.7. Nordic Electrofuel

9.8. Ineratec GmbH

9.9. Sunfire GmbH

9.10. Climeworks

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Electrofuel Market was valued at USD 0.3 billion in 2023 and is expected to reach USD 1.0 billion by 2030, growing at a CAGR of 18.76% from 2024 to 2030.

Key drivers include rising demand for sustainable aviation fuel, supportive government policies and incentives for decarbonization, and advancements in carbon capture and hydrogen production technology.

The market segments are by type (synthetic gasoline, synthetic diesel, synthetic jet fuel, and synthetic methane) and by application (transportation, aviation, maritime, industrial).

Europe is the dominant region, supported by strong government policies, investments in renewable energy, and stringent carbon reduction targets.

Leading players include Audi AG, ExxonMobil, Siemens AG, TotalEnergies SE, Shell, Carbon Engineering, Nordic Electrofuel, Ineratec GmbH, Sunfire GmbH, and Climeworks.