Electroactive Polymer Market Size (2024 – 2030)

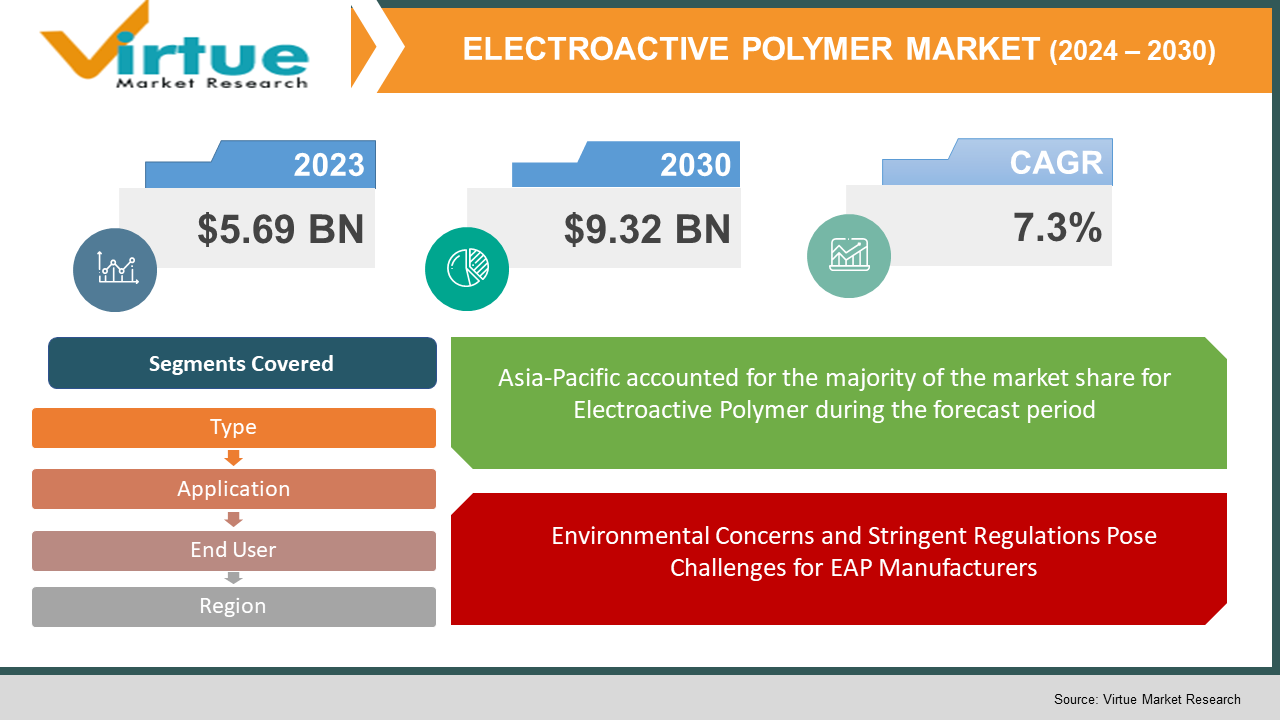

The Global Electroactive Polymer Market is valued at USD 5.69 Billion in 2023 and is projected to reach a market size of USD 9.32 Billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.3%.

The term EAP also refers to electroactive polymers. They belong to a group of polymers that, in response to an external electrical field, alter in size and shape. Electroactive polymers provide a number of benefits, including being lightweight, simple to manufacture, and inexpensive. Many applications, including actuators, sensors, ESD & EMI protection, medication delivery systems, robotics, and electrostatic plastics, use electroactive polymers widely. Throughout the upcoming years, it is anticipated that the industrialization and urbanization of developing regions would accelerate. In addition, it is projected that rising demand from industries like the electronics and automotive sectors will help the market expand. Inherently conductive polymers were the market leader among the various product types in the electroactive polymers market in 2022, and they are predicted to expand significantly over the coming years.

The market is expanding significantly as a result of the expanding applications in fields including robotics, coatings, energy harvesting, smart fabrics, and medicines, among others. Excellent qualities inherent in conductive polymers include increased transparency, environmental stability, and high processibility. Also, the segment is expanding as a result of the low cost of production. The market for inherently conductive polymers is predicted to grow the fastest within the forecasted time frame.

Global Electroactive Polymer Market Drivers:

Growing Demand for EAPs in the Smart Fabrics market due to rapid Development in Multifunctional Interactive Textiles is boosting market growth:

- EAPs are perfect for usage as smart fabrics due to their superior adaptability and affordability feature. Due to increased R&D and swift economic development in nations like the US, Japan, and China, the need for EAPs in smart fabrics is anticipated to rise in the near future. The biggest market for smart fabrics is the US. Throughout the forecast period, it is also anticipated that Europe and APAC would have substantial growth. Smart fabrics serve as multipurpose interactive materials and offer a wide range of applications in telemedicine, ergonomics, sports, health monitoring, and rehabilitation.

Environmental Concerns and Stringent Regulations Pose Challenges for EAP Manufacturers:

- EAPs are made from difficult-to-obtain and frequently risky environmentally raw elements. The removal of garbage produced by EAPs is one of the main issues. EAP goods should never be disposed of improperly as this could have negative effects on the environment and the food chain. The expense of disposing of some EAPs, which cannot be disposed of by biodegradation, may grow for EAP manufacturers. As a result, the government has implemented strict regulations regarding the use of these polymers. The expansion of the EAPs market is constrained by environmental restrictions on the use of petroleum products.

Global Electroactive Polymer Market Challenges:

Rapid R&D has been taking place in the area of EAPs in order to fully utilize their advantages for high voltage and high strength applications. Applications involving high voltage carry a danger of polymer breakdown and subsequent loss of functionality. Because of the rise in demand for EAPs with superior physical and mechanical qualities and high heat resistance, costly R&D is now necessary. Moreover, research is also being conducted on EAP materials with long-term operations. Leading EAP producers have not yet taken advantage of EAPs' full potential in biometrics, superior actuation mechanisms, and mass production methods. For applications like artificial muscle and biomimetics, it is necessary to refine procedures like synthesizing, manufacturing, electrode, and shape in order to increase the actuation capabilities and durability of EAPs.

Global Electroactive Polymer Market Opportunities:

The most notable use of EAPs is in biomimetics. Polymers are created to resemble muscles in biomimetics. Many devices that replicate birds, fish, insects, and even plants have been built, albeit this technology is still in the development stage. Eamex Corporation created a commercially produced EAP-actuated fish called flojet that is found in Japan (Japan). Research and development are currently being done to create artificial intelligence, artificial vision, and artificial muscle. EAPs that resemble biological muscles in their flexibility, resilience, massive actuation, and damage tolerance have great development potential in these upcoming applications. Due to its high strains and energy densities, EAP technology based on electric field-induced deformation of polymer dielectrics offers tremendous potential.

COVID-19 Impact on the Global Electroactive Polymer Market:

The COVID-19 pandemic has had a conflicting effect on the world market for electroactive polymers. The pandemic has caused demand in some market categories to decrease, while it has increased in other segments. Global supply chains have been hampered by the pandemic. Industries that are significant users of electroactive polymers, such as automotive and aerospace, have seen a decrease in demand as a result of the pandemic. Some manufacturers' sales have been impacted by this. which has caused a shortage of raw materials and delays in production and shipment. For some manufacturers, this has resulted in a drop in production and sales. The pandemic has raised the demand for medical devices that utilise electroactive polymers, like ventilators and medical sensors.

Global Electroactive Polymer Market Recent Developments:

- In March 2022, the Chemical business Celanese Corporation, with headquarters in the US, announced the launch of the VECTRA® E-series, a new product that broadens its selection of electroactive polymers. The item is intended for use in applications in the automotive, aerospace, and electronics industries.

- In January 2022, the US-based motion and control technology company Parker Hannifin Company announced the introduction of its Electromechanical Systems Division (EMD) E-Actuators, a new range of electroactive polymer actuators. The items are intended for use in the automotive, medical, and aerospace industries.

- In August 2021, A new electroactive polymer substance dubbed PRE-ELEC® EAP 50 has been developed by the Finnish business Premix Oy, which specializes in materials technology. The substance is made to be used in sensors and actuators in a number of sectors, including the automotive, aerospace, and medical fields.

ELECTROACTIVE POLYMERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.3 % |

|

Segments Covered |

By Type, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Solvay (Belgium), Parker-Hannifin Corporation (U.S.), Agfa-Gevaert Group (Belgium), 3M (U.S.), Merck Sharp & Dohme Corporation (Germany), The Lubrizol Corporation (U.S.), NOVASENTIS, INC (U.S.), Premix (Finland), PolyOne Corporation (U.S.), Kenner Material & System Co., Ltd (China) |

Global Electroactive Polymer Market Segmentation:

Global Electroactive Polymer Market Segmentation: By Type

- Conductive Polymers

- Inherently Dissipative Polymers (IDPs)

- Others

High electrical conductivity conductive polymers are employed in applications like sensors, actuators, EMI shielding, and antistatic packaging. The conductive polymers that are frequently utilized include polyaniline, polythiophene, and polypyrrole. The Inherently Dissipative Polymers (IDPs) category contains polymers with static dissipation characteristics that are employed in antistatic packaging, coatings, and films, among other uses. Polyphenylene sulfide (PPS), polyetherketoneketone (PEKK), and polyaryletherketone are a few of the often employed IDPs (PAEK). Other varieties of electroactive polymers that are not categorized as conductive or IDP polymers are included in the other segment. Piezoelectric polymers, electrostrictive polymers, and dielectric elastomers are a few examples.

Global Electroactive Polymer Market Segmentation: By Application

- Actuators

- Sensors

- Electromagnetic Interference (EMI) Shielding

- Antistatic Packaging

- Others

Due to their capacity to transform electrical energy into mechanical motion, electroactive polymers are frequently used in the production of actuators and held the highest market shrae in 2022. These actuators are employed in a variety of fields, including robotics, aerospace, the automobile industry, and medical equipment. Sensors that can sense changes in temperature, pressure, humidity, and other environmental conditions are made using electroactive polymers. These sensors are employed in a number of sectors, including aerospace, automotive, and healthcare. Electronic gadgets are shielded from electromagnetic interference using materials made of electroactive polymers which stop the accumulation of static electricity and safeguard electronic gadgets during travel and storage, are made using electroactive polymers.

Europe Global Electroactive Polymer Market Segmentation: By End-User

- Automotive

- Aerospace

- Healthcare

- Electronics

- Others

Electroactive polymers are widely employed in the automotive sector for applications like sensors, actuators, and EMI shielding. In 2022, the automotive sector held the highest market share and is anticipated to continue dominance during the forecast period as well. Electroactive polymers can boost a vehicle's performance, efficiency, and safety. Electroactive polymers are used in the aerospace sector for morphing wings, vibration damping, and smart materials for structural health monitoring, among other things. Aeroplanes can benefit from the weight- and fuel-saving effects of electroactive polymers. Electroactive polymers are used in the healthcare sector for a variety of purposes, including drug delivery, tissue engineering, and biosensors. Drug delivery efficiency can be increased by electroactive polymers, which can also lessen the necessity for invasive surgery. Electroactive polymers are used in the electronics sector for energy harvesting, touch screens, and flexible displays. The electronic device functionality and durability can both be enhanced by electroactive polymers. In 2022, the electronics segment is estimated to expand at the fastest CAGR owing to the above factors.

Global Electroactive Polymer Market Segmentation: By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Asia-Pacific is predicted to develop the fastest among these regions over the study period and is forecast to display a blossoming rise. In the growing nations of Asia and the Pacific, the increase in industries and urbanization is accelerating the development of electroactive polymers. Furthermore, the growth of the market is anticipated to be fueled by the area's rise as a beneficial manufacturing centre. The region's need for the electroactive polymer is also being boosted by the expanding electrical, electronics, and automotive industries. The biggest users of electroactive polymers in this region are China, India, and Japan.

The greatest market is estimated to be in North America, followed by Europe. The market is being heavily driven by the developed end-user industries, including, among others, the transportation and electronics sectors. The developed automotive and electrical & electronics industries are the key drivers of the second-largest market in Europe. The region's market is anticipated to rise as a result of the expanding need for actuators and sensors in the well-established vehicle sector. Germany, Italy, and France are the main contributors to this rise.

Global Electroactive Polymer Market Key Players:

- Solvay (Belgium)

- Parker-Hannifin Corporation (U.S.)

- Agfa-Gevaert Group (Belgium)

- 3M (U.S.)

- Merck Sharp & Dohme Corporation (Germany)

- The Lubrizol Corporation (U.S.)

- NOVASENTIS, INC (U.S.)

- Premix (Finland)

- PolyOne Corporation (U.S.)

- Kenner Material & System Co., Ltd (China)

Chapter 1. Electroactive Polymer Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Electroactive Polymer Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Electroactive Polymer Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Electroactive Polymer Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Electroactive Polymer Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Electroactive Polymer Market - By Type

6.1 Conductive Polymers

6.2. Inherently Dissipative Polymers (IDPs)

6.3. Others

Chapter 7. Electroactive Polymer Market - By End-User

7.1. Automotive

7.2. Aerospace

7.3. Healthcare

7.4. Electronics

7.5. Others

Chapter 8. Electroactive Polymer Market - By Application

8.1. Actuators

8.2. Sensors

8.3. Electromagnetic Interference (EMI) Shielding

8.4. Antistatic Packaging

8.5. Others

Chapter 9. Electroactive Polymer Market – By Region

9.1. North America

9.2. Europe

9.3.The Asia Pacific

9.4.Latin America

9.5. Middle-East and Africa

Chapter 10. Electroactive Polymer Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. Solvay (Belgium)

10.2. Parker-Hannifin Corporation (U.S.)

10.3. Agfa-Gevaert Group (Belgium)

10.4. 3M (U.S.)

10.5. Merck Sharp & Dohme Corporation (Germany)

10.6. The Lubrizol Corporation (U.S.)

10.7. NOVASENTIS, INC (U.S.)

10.8. Premix (Finland)

10.9. PolyOne Corporation (U.S.)

10.10. Kenner Material & System Co., Ltd (China)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Electroactive Polymer Market is valued at USD 5.69 Billion in 2023 and is projected to reach a market size of USD 9.32 Billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.3%.

The Global Electroactive Polymer Market drivers are the growing demand for smart materials, Advancements in technology, and increasing use in the automotive industry

The Segments under the Global Bluetooth 5.0 Market by the application are Actuators, Sensors, Electromagnetic Interference (EMI) Shielding, Antistatic Packaging, and others

China, Japan, South Korea, Singapore, and India are the most dominating countries in the Asia Pacific region for the Global Electroactive Polymer Market

Solvay (Belgium), Parker-Hannifin Corporation (U.S.), Agfa-Gevaert Group (Belgium) are the three major leading players in the Global Electroactive Polymer Market