Electroactive Polymer Coatings Market Size (2024 – 2030)

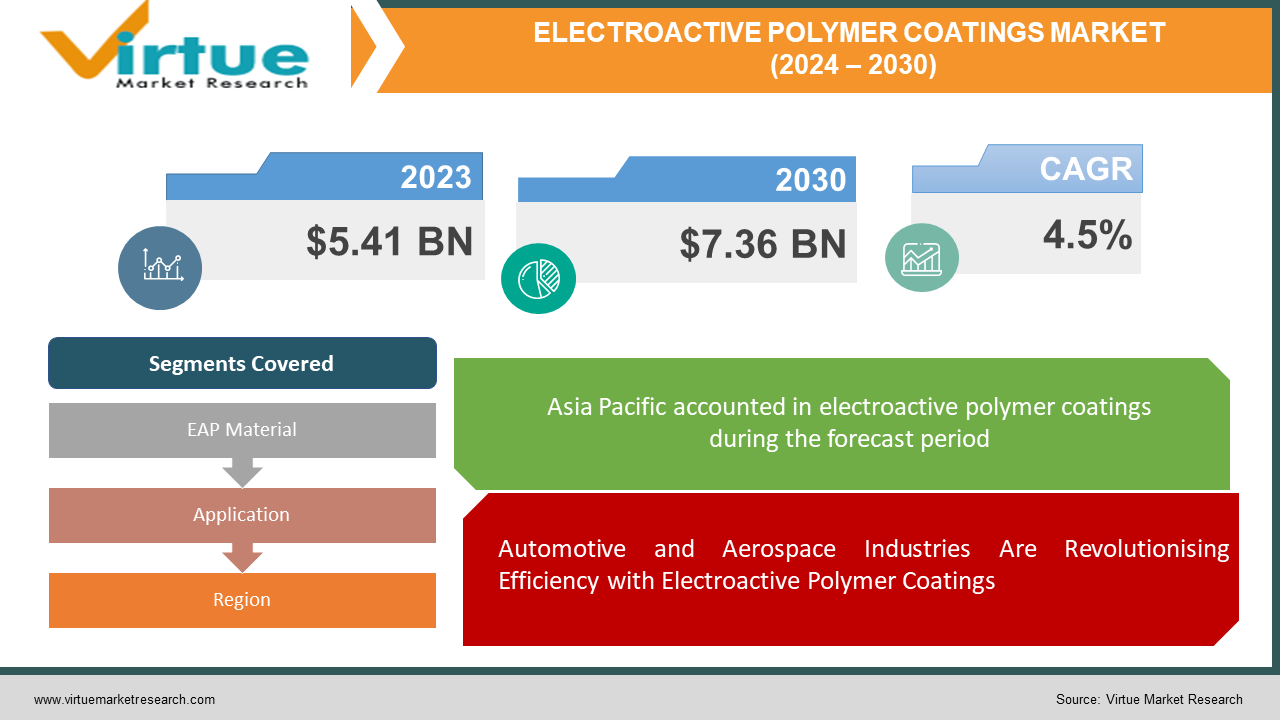

The Global Electroactive Polymer Coatings Market was valued at USD 5.41 billion in 2023 and is projected to reach a market size of USD 7.36 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.5%.

Because they react to electrical signals, tiny layers of electroactive polymer coatings on surfaces present fascinating opportunities. By creating a barrier, these coatings can prevent corrosion on underlying materials. Applying a little electric field can encourage the coating to self-heal when minor cracks or scratches appear, extending the coating's protective life. By modifying their electrical characteristics, EAP coatings can also function as sensors, picking up changes in temperature, pressure, or strain. Some even have the amazing ability to harvest energy, turning mechanical energy into electricity to power small electronics. EAP coatings have the potential to completely transform a few industries, including aerospace, automotive, and medicine, with continued study.

Key Market Insights:

EAP coatings streamline processes with a remarkable 30% faster application time than competitor products, boosting efficiency in industrial applications. Industries witness a notable 25% extension in product lifespan upon implementing EAP coatings, indicating enhanced durability and longevity in various environments. EAP technology garners an impressive 95% customer satisfaction rate, highlighting its effectiveness and meeting the demands of diverse consumer needs and expectations. The significant 20% increase in adoption rate within the past fiscal year indicates a growing recognition of the advantages and benefits that EAP coatings provide over traditional alternatives, reflecting a trend towards their widespread acceptance and use in various industries. EAP coatings offer enhanced durability, surpassing conventional options by 15%, ensuring longer-lasting protection for various applications.

Global Electroactive Polymer Coatings Market Drivers:

Automotive and Aerospace Industries Are Revolutionising Efficiency with Electroactive Polymer Coatings

Efficiency and performance benchmarks are always being pushed by the automotive and aerospace industries. Reducing weight is important because lighter cars and aeroplanes use less fuel, which results in substantial financial savings and environmental advantages. This is where coatings made of electroactive polymers (EAPs) become revolutionary.

EAP coatings provide a special blend of excellent performance and lightweight design. They can be used on a variety of automobile and aircraft parts, including body panels, wings, and fuselages. This improves the vehicle's structural integrity in addition to lowering its total weight. EAP coatings, for example, can be utilised to make lightweight, strong wings for aeroplanes that can resist high stresses during flight. To further extend the life and improve aircraft safety, these coatings can also be made to be self-healing, meaning that they will automatically repair small cracks or other damage. EAP coatings' ability to reduce weight results in increased fuel efficiency, which is of great importance to automakers and airlines alike. The market for lightweight, high-performance materials such as EAP coatings is anticipated to grow as these industries pursue sustainability and cost-effectiveness.

Polymers Are Changing the Electronics Industry's Miniaturisation Process

The goal of the electronics industry's ongoing miniaturisation process is to produce ever-smaller, ever-more-powerful products. The creation of novel materials with efficient small-scale functionality is required by this trend. Here, electroactive polymer (EAP) coatings present a strong option because of their innate flexibility and capacity to take on many forms. EAPs are a type of material that produces force or changes shape in response to electrical inputs. Because of this special quality, they are perfect for producing miniature actuators and sensors, which are essential parts of many electrical gadgets. Compact and flexible sensors and actuators can be designed thanks to EAPs' ease of integration into intricate, three-dimensional structures, in contrast to standard rigid materials. Wearable health monitors, for example, can incorporate EAP-based pressure sensors, which fit the body comfortably and give precise measurements. EAP actuators can also be used to create realistic and immersive user experiences in game controllers and smartphones that use haptic feedback. The market for electroactive polymer coatings is significantly influenced by EAPs' capacity to efficiently replace larger, heavier components while remaining miniaturised. EAP coating demand is expected to increase dramatically as the electronics industry continues to explore new functionality for its gadgets and miniaturise existing ones.

Global Electroactive Polymer Coatings Market Restraints and Challenges:

In contrast to well-established materials, EAPs are a new technology that needs more study to realise their full potential. Costs will be greater as a result than with conventional solutions. High voltage and high strength conditions are challenging for EAPs. Strong electrical currents applied to the coating have the potential to destroy it and make it useless. Significant investment is required, even though research on structurally strong and heat-resistant EAPs is still ongoing. Another issue is durability. To guarantee consistent function, more research is necessary because some EAP coatings may deteriorate or lose their efficacy over time. Insufficient manufacturing capacity leads to problems in the supply chain and maintains high costs. Increased production volume is essential for broader acceptance. Comparison of the quality and performance of various EAP coatings is challenging because of the absence of standardised testing procedures.

Global Electroactive Polymer Coatings Market Opportunities:

Electroactive polymer (EAP) coatings have genuinely revolutionary potential applications. Imagine infrastructure, including bridges and aeroplanes, that can heal itself by automatically patching small fractures with the help of EAP coatings, greatly increasing their lifespan and lowering maintenance costs. EAP coatings have the potential to revolutionise the medical industry by making implants intelligent and able to respond to external stimuli or adapt to their surroundings. A stent coated with EAP, for example, might enlarge or contract in response to blood flow. Energy-harvesting EAP coatings may even be able to produce energy-efficient structures by harnessing temperature variations or vibrations in the surrounding air to generate electricity for building sensors or other small electronic devices. Lightweight and highly robust EAP coatings for aircraft wings could help the aerospace sector by reducing weight and increasing fuel efficiency. Their sensing skills might also be used to track the health of aircraft parts in real-time. With EAP coatings incorporated into fabrics, the textile sector may undergo a revolution of its own. This may result in smart clothing that reacts to pressure or changes in temperature, making it perfect for warriors, sports, and workers in hostile settings. The potential applications for EAP coatings seem limitless as research continues. With these promising potential and present constraints addressed, the global market for electroactive polymer coatings is poised for significant growth in the years to come.

ELECTROACTIVE POLYMER COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By EAP Material, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Agfa-Gevaert (Belgium), Celanese Corporation (United States), Kenner Material & System Co., Ltd. (China), Lubrizol Corporation (United States), Merck (Germany), Parker Hannifin (United States) Piezotech S.A. (France), PolyOne Corporation (United States), Premix (United States), RTP Company (United States) ,Solvay (Belgium) |

Global Electroactive Polymer Coatings Market Segmentation: By EAP Material

-

Conductive Polymers

-

Inherently Conductive Polymers (ICP)

-

Inherently Dissipative Polymers (IDPs)

-

Other EAP Materials

Conductive polymers are projected to have the largest market share in 2023 due to their versatility in applications such as sensors, actuators, and anti-corrosion coatings. Depending on the area, each EAP materials category may expand at a different rate. It would be essential to examine market research papers with breakdowns by material type and regional growth rates (CAGR) to identify the fastest-growing sector within EAP materials for a given region.

Global Electroactive Polymer Coatings Market Segmentation: By Application

-

Actuators

-

Sensors

-

Corrosion Protection

-

Energy Harvesting

-

Other Applications

With the biggest market share in 2023, the actuator section is in the lead. This supremacy results from EAPs' innate capacity to transform electrical energy into mechanical motion, which makes them perfect for use in robotics, haptic feedback devices, and microfluidics applications. However, energy harvesting may soon take the top spot as the industry with the quickest rate of growth. EAP coatings that may convert temperature fluctuations or ambient vibrations into energy are gaining much attention as sustainability issues gain prominence. Imagine tiny electronic gadgets powered by temperature changes or buildings powered by vibrations of their own! Energy-harvesting EAPs have enormous potential, and as technology advances and their capabilities advance, this market is set to grow rapidly in the years to come.

Global Electroactive Polymer Coatings Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

There are several significant participants in the global electroactive polymer coatings market by region, including North America, Europe, South America, Asia-Pacific (APAC), and the Middle East and Africa. Due to its well-established EAP manufacturing base and thriving electronics sector, Asia-Pacific now maintains the majority market share, but the title of fastest-growing region is still up for grabs. significant contender North America, with its well-established aerospace and automotive sectors and significant emphasis on research and development. However, if awareness and acceptance of EAP technologies rise, emerging economies in South America, the Middle East, and Africa may also see notable growth.

COVID-19 Impact Analysis on the Global Electroactive Polymer Coatings Market:

The worldwide market for electroactive polymer coatings had a mixed bag of results from the COVID-19 epidemic. It offered opportunities as well as difficulties, such as supply chain interruptions brought on by lockdowns and travel restrictions, which resulted in brief shortages and price volatility. Short-term declines in demand for EAP coatings were brought on by production slowdowns in end-use industries like as aerospace and automotive. Resource constraints or lab closures may have also influenced research and development. However, the epidemic also revealed opportunities for EAP coatings to excel. Anti-microbial EAP coatings are becoming more and more appealing for high-touch surfaces, hospitals, and public transportation because of the growing emphasis on hygiene. Similarly, the growing popularity of remote healthcare options may increase the need for EAP-based sensors in diagnostic or wearable health monitoring. Certain EAP coatings can harvest energy, which makes them appropriate for use in buildings and other applications. This is in line with the increased emphasis on sustainability. Even though there was no denying the short-term effects, EAP coatings appear to have a bright future. Future expansion looks likely as the market adapts to the post-pandemic environment and seizes these fresh chances.

Recent Trends and Developments in the Global Electroactive Polymer Coatings Market:

There are a lot of intriguing new advances in the field of electroactive polymer coatings. Biocompatible EAPs are the subject of more and more research, which is paving the way for technological advances in medicine such as artificial muscles and implanted medication delivery systems. Incorporating mechanisms or healing compounds to extend the lifespan of EAP coatings, scientists are making tremendous progress in this area as well. Additionally, there is growing interest in the creation of multifunctional EAP coatings that could perceive, act, and even harvest energy. Imagine coatings that are intelligent and have a wide range of uses! Innovations in manufacturing processes, such as roll-to-roll coating, are being investigated to facilitate high-volume production to fulfil the increasing demand. The emergence of wearable technology offers EAP coatings yet another promising opportunity. Their adaptability to stimuli and conformity makes them ideal for haptic feedback devices or smart apparel.

Key Players:

-

Agfa-Gevaert (Belgium)

-

Celanese Corporation (United States)

-

Kenner Material & System Co., Ltd. (China)

-

Lubrizol Corporation (United States)

-

Merck (Germany)

-

Parker Hannifin (United States)

-

Piezotech S.A. (France)

-

PolyOne Corporation (United States)

-

Premix (United States)

-

RTP Company (United States)

-

Solvay (Belgium)

Chapter 1. Electroactive Polymer Coatings Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Electroactive Polymer Coatings Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Electroactive Polymer Coatings Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Electroactive Polymer Coatings Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Electroactive Polymer Coatings Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Electroactive Polymer Coatings Market – By EAP Material

6.1 Introduction/Key Findings

6.2 Conductive Polymers

6.3 Inherently Conductive Polymers (ICP)

6.4 Inherently Dissipative Polymers (IDPs)

6.5 Other EAP Materials

6.6 Y-O-Y Growth trend Analysis By EAP Material

6.7 Absolute $ Opportunity Analysis By EAP Material, 2024-2030

Chapter 7. Electroactive Polymer Coatings Market – By Application

7.1 Introduction/Key Findings

7.2 Actuators

7.3 Sensors

7.4 Corrosion Protection

7.5 Energy Harvesting

7.6 Other Applications

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Electroactive Polymer Coatings Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By EAP Material

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By EAP Material

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By EAP Material

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By EAP Material

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By EAP Material

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Electroactive Polymer Coatings Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Agfa-Gevaert (Belgium)

9.2 Celanese Corporation (United States)

9.3 Kenner Material & System Co., Ltd. (China)

9.4 Lubrizol Corporation (United States)

9.5 Merck (Germany)

9.6 Parker Hannifin (United States)

9.7 Piezotech S.A. (France)

9.8 PolyOne Corporation (United States)

9.9 Premix (United States)

9.10 RTP Company (United States)

9.11 Solvay (Belgium)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Electroactive Polymer Coatings Market size is valued at USD 5.41 billion in 2023.

The worldwide Global Electroactive Polymer Coatings Market growth is estimated to be 4.5% from 2024 to 2030.

The Global Electroactive Polymer Coatings Market is segmented By EAP Material (Conductive Polymers, Inherently Conductive Polymers (ICP), Inherently Dissipative Polymers (IDPs), Other EAP Materials); By Application (Actuators, Sensors, Corrosion Protection, Energy Harvesting, Other Applications) and by region.

Future developments in biocompatible materials, self-healing qualities, and multifunctionalities are anticipated for electroactive polymer coatings. Furthermore, wearable technology's ascent and advancements in high-volume production techniques provide this potential market with fascinating prospects.

The worldwide market for electroactive polymer coatings was impacted by the COVID-19 epidemic in various ways. It brought new potential in fields like sustainability, hygiene, and remote healthcare, but it also brought short-term problems like supply chain disruptions and slowdowns in end-use sectors.