Electrical Steel Market Size (2025 – 2030)

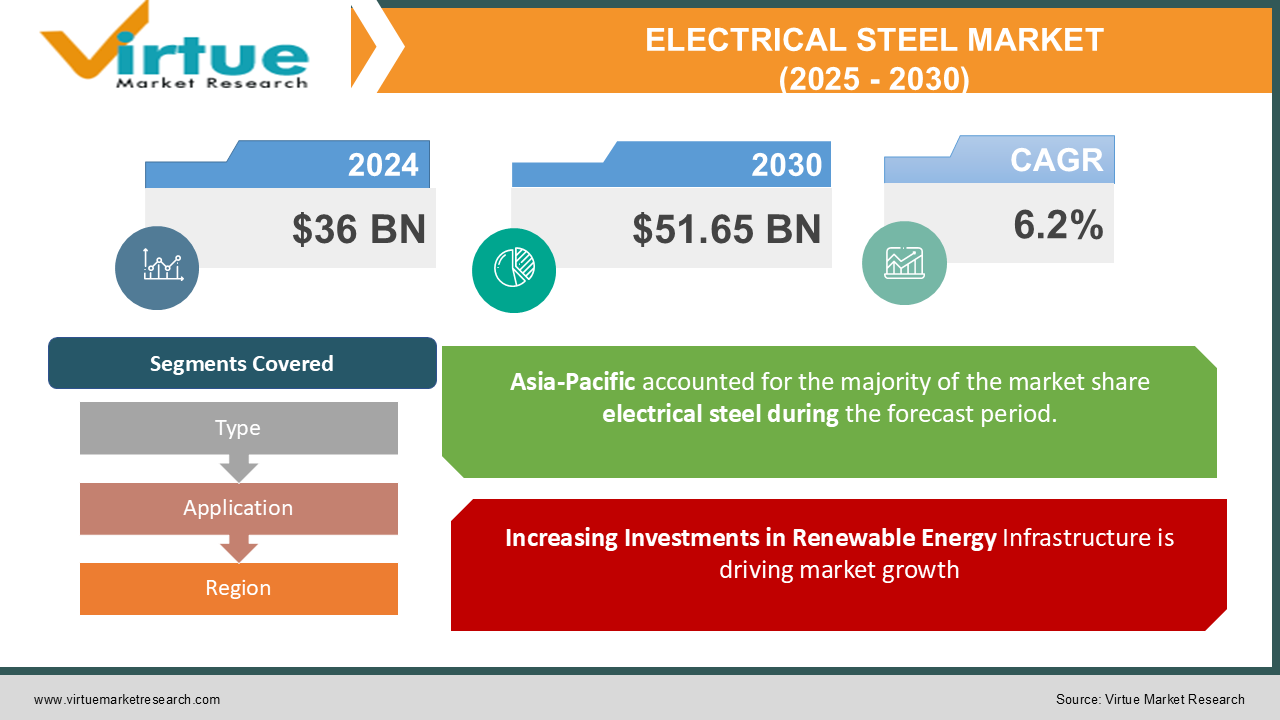

The Global Electrical Steel Market was valued at USD 36 billion in 2024 and is projected to grow at a CAGR of 6.2% from 2025 to 2030, reaching a market size of USD 51.65 billion by 2030.

Electrical steel, also known as lamination steel or silicon steel, is a specialty steel used in the production of magnetic components, including transformers, motors, and generators. This material exhibits high permeability, reduced core losses, and excellent efficiency in energy conversion processes. The growth of the electrical steel market is driven by rising energy consumption, increasing demand for electric vehicles (EVs), and expanding investments in renewable energy infrastructure. The market is also influenced by advancements in grid infrastructure and electrification trends worldwide.

Key Market Insights

-

The non-grain-oriented electrical steel segment accounted for the largest share in 2024, driven by its extensive use in motor manufacturing for EVs and industrial equipment.

-

The demand for grain-oriented electrical steel is growing significantly, particularly in the transformer industry, as countries upgrade aging grid infrastructure to meet renewable energy goals. Additionally, technological innovations, including high-frequency electrical steel for advanced EV motors, are expected to drive market expansion in the coming years. Rising emphasis on energy efficiency and reduced power losses is boosting the adoption of electrical steel across various industries.

-

Asia-Pacific dominates the electrical steel market, with over 50% market share in 2024, due to rapid industrialization, urbanization, and energy demand in countries like China and India.

-

The electric vehicle segment is witnessing a surge in demand for electrical steel, with a projected CAGR of 9% during the forecast period, as automakers focus on efficiency and lightweight solutions.

Global Electrical Steel Market Drivers

Increasing Investments in Renewable Energy Infrastructure is driving market growth:

The global transition toward renewable energy sources, such as solar and wind, is a significant driver of the electrical steel market. Grain-oriented electrical steel is an essential material for transformers and generators used in renewable energy systems. As governments worldwide invest heavily in renewable energy projects to meet sustainability goals, the demand for electrical steel is expected to rise. For instance, countries in Europe and North America are upgrading their grid infrastructure to integrate renewable energy sources, requiring efficient and high-performance transformers. Additionally, developing regions like Asia-Pacific are expanding their renewable energy capacities, creating a substantial market for electrical steel in wind turbines and other energy applications.

Rising Adoption of Electric Vehicles (EVs is driving market growth:

EVs require highly efficient motors with reduced energy losses, and non-grain-oriented electrical steel is a critical material in their production. As automakers worldwide ramp up EV production to meet government regulations on emissions and cater to increasing consumer demand, the need for electrical steel is accelerating. For example, Tesla, BYD, and other leading EV manufacturers are investing in high-performance motors made from electrical steel to improve energy efficiency and driving range. The electrification of public transport systems, including electric buses and trains, further amplifies this demand.

Expansion of Smart Grids and Electrification Projects is driving market growth:

The global shift toward smart grids and electrification projects is significantly boosting the demand for electrical steel. Grain-oriented electrical steel is integral to the construction of transformers and distribution systems required for smart grids, which enable efficient energy management and reduce power losses. As urbanization continues and electricity access expands in developing regions, the need for reliable and efficient grid infrastructure increases. For instance, countries in Asia and Africa are heavily investing in grid expansion and modernization projects, driving the growth of the electrical steel market. Furthermore, government incentives and policies promoting energy efficiency add momentum to these initiatives.

Global Electrical Steel Market Challenges and Restraints

Volatility in Raw Material Prices is restricting market growth:

The production of electrical steel relies heavily on raw materials like iron ore, silicon, and alloying elements, the prices of which are often volatile. Market fluctuations in the cost of these inputs can significantly affect production costs and profit margins for manufacturers. For instance, silicon, a critical component in electrical steel, has experienced price surges due to supply chain disruptions and increasing global demand. Such volatility creates uncertainty for manufacturers, making it challenging to plan long-term strategies. Additionally, the competition among manufacturers to offer cost-effective solutions puts further pressure on the industry to maintain profitability while managing raw material cost fluctuations.

Environmental and Regulatory Challenges is restricting market growth:

The electrical steel manufacturing process involves energy-intensive steps, such as smelting and rolling, which contribute to carbon emissions. As global environmental concerns grow, governments are imposing stricter regulations on industrial emissions and energy efficiency standards. Compliance with these regulations requires manufacturers to invest in cleaner production technologies, which can be capital-intensive. For example, the European Union’s carbon neutrality goals place significant pressure on steelmakers to reduce their carbon footprints, increasing production costs. Furthermore, competition from alternative materials, such as advanced composites, poses a challenge to the adoption of electrical steel in certain applications, especially in energy-efficient systems.

Market Opportunities

The electrical steel market presents vast opportunities, primarily driven by global electrification trends, the EV boom, and renewable energy expansion. One of the most promising areas is the integration of high-performance electrical steel in electric vehicles and renewable energy systems. As automakers develop next-generation EVs with higher energy efficiency and reduced power losses, advanced grades of electrical steel will become indispensable. Additionally, the development of high-frequency electrical steel, which offers superior magnetic properties for advanced motors, is opening new avenues for innovation. This technology is particularly relevant for EVs, robotics, and industrial automation, where precision and efficiency are critical. Emerging markets in Asia-Pacific, Africa, and Latin America offer significant growth potential due to increasing investments in infrastructure development and electrification projects. Governments in these regions are prioritizing energy access and grid modernization, creating a robust demand for electrical steel in transformers and distribution networks. Furthermore, the focus on reducing greenhouse gas emissions is driving the adoption of energy-efficient solutions, such as smart grids and renewable energy systems. These trends create opportunities for manufacturers to develop sustainable production processes and cater to the rising demand for eco-friendly electrical steel solutions. Collaborations between steel manufacturers and technology providers are also fostering innovation, enhancing product offerings, and strengthening market competitiveness.

ELECTRICAL STEEL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nippon Steel Corporation, ArcelorMittal, Baosteel Group, JFE Steel Corporation, Voestalpine AG, AK Steel Holding Corporation, Tata Steel, POSCO, Thyssenkrupp AG, NLMK Group |

Electrical Steel Market Segmentation - By Type

-

Grain-Oriented Electrical Steel

-

Non-Grain-Oriented Electrical Steel

Non-grain-oriented electrical steel is the dominant segment, accounting for a significant share due to its widespread use in EV motors and industrial applications. Its versatility and cost-effectiveness make it the preferred choice for rotating machinery and automotive components.

Electrical Steel Market Segmentation - By Application

-

Transformers

-

Motors

-

Generators

-

Others

Transformers lead the application segment, driven by the increasing demand for efficient power distribution systems and renewable energy integration. Grain-oriented electrical steel is particularly critical for high-performance transformers used in energy infrastructure.

Electrical Steel Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest market for electrical steel, holding over 50% market share in 2024. This dominance is fueled by rapid industrialization, urbanization, and expanding energy needs in countries like China, India, and South Korea. China, the largest producer and consumer of electrical steel, drives regional growth through investments in EV production, grid modernization, and renewable energy projects. India's focus on electrification and infrastructure development further contributes to the region's prominence. Moreover, the presence of leading electrical steel manufacturers in Asia-Pacific strengthens the market's position.

COVID-19 Impact Analysis on the Electrical Steel Market

The COVID-19 pandemic had mixed impacts on the electrical steel market. Initially, lockdowns and supply chain disruptions slowed production and reduced demand, particularly in automotive and industrial applications. Delayed construction projects and halted renewable energy installations further dampened market growth. However, the pandemic underscored the importance of resilient energy infrastructure, accelerating investments in grid modernization and renewable energy projects in the post-pandemic era. As economies recover, the demand for electrical steel in transformers, generators, and EV motors is witnessing a resurgence. The automotive industry's shift toward electrification, fueled by government incentives and environmental goals, has emerged as a major growth driver. Additionally, the need for uninterrupted energy supply during the pandemic highlighted the importance of efficient and durable materials like electrical steel in power distribution systems. Overall, while the pandemic posed short-term challenges, it also created opportunities for the market to adapt and thrive in a rapidly evolving landscape.

Latest Trends/Developments

Several trends are shaping the future of the electrical steel market. One notable development is the increasing adoption of high-frequency electrical steel, designed for advanced EV motors and industrial applications. This material offers superior magnetic properties, enabling higher efficiency and performance in energy conversion systems. Another significant trend is the growing focus on sustainable manufacturing processes. Electrical steel producers are adopting energy-efficient technologies and exploring low-carbon alternatives to reduce their environmental footprint. For instance, the use of hydrogen-based steelmaking is gaining traction as part of the industry's decarbonization efforts. The integration of artificial intelligence and data analytics in electrical steel production is also revolutionizing the market. These technologies enhance process efficiency, optimize product quality, and reduce waste, ensuring better outcomes for manufacturers and end-users. Furthermore, partnerships between electrical steel manufacturers and EV producers are driving innovation in motor design, aiming to maximize efficiency and range. The push for renewable energy systems, including wind and solar power, is also driving demand for advanced electrical steel grades that can withstand extreme operating conditions. These trends underscore the dynamic and innovation-driven nature of the electrical steel market.

Key Players

-

Nippon Steel Corporation

-

ArcelorMittal

-

Baosteel Group

-

JFE Steel Corporation

-

Voestalpine AG

-

AK Steel Holding Corporation

-

Tata Steel

-

POSCO

-

Thyssenkrupp AG

-

NLMK Group

Chapter 1. Electrical Steel Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Electrical Steel Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Electrical Steel Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Electrical Steel Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Electrical Steel Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Electrical Steel Market – By Type

6.1 Introduction/Key Findings

6.2 Grain-Oriented Electrical Steel

6.3 Non-Grain-Oriented Electrical Steel

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Electrical Steel Market – By Application

7.1 Introduction/Key Findings

7.2 Transformers

7.3 Motors

7.4 Generators

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Electrical Steel Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Electrical Steel Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Nippon Steel Corporation

9.2 ArcelorMittal

9.3 Baosteel Group

9.4 JFE Steel Corporation

9.5 Voestalpine AG

9.6 AK Steel Holding Corporation

9.7 Tata Steel

9.8 POSCO

9.9 Thyssenkrupp AG

9.10 NLMK Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Electrical Steel Market was valued at USD 36 billion in 2024 and is projected to reach USD 51.65 billion by 2030, growing at a CAGR of 6.2%.

Key drivers include increasing investments in renewable energy infrastructure, rising adoption of electric vehicles, and the expansion of smart grids and electrification projects.

The market is segmented by type (grain-oriented and non-grain-oriented electrical steel) and by application (transformers, motors, generators, and others).

Asia-Pacific is the dominant region, accounting for over 50% market share, driven by industrialization, urbanization, and growing energy demands.

Leading players include Nippon Steel Corporation, ArcelorMittal, Baosteel Group, JFE Steel Corporation, and Voestalpine AG.