Electrical Insulation Systems Testing and Certification Services Market Size (2024 – 2030)

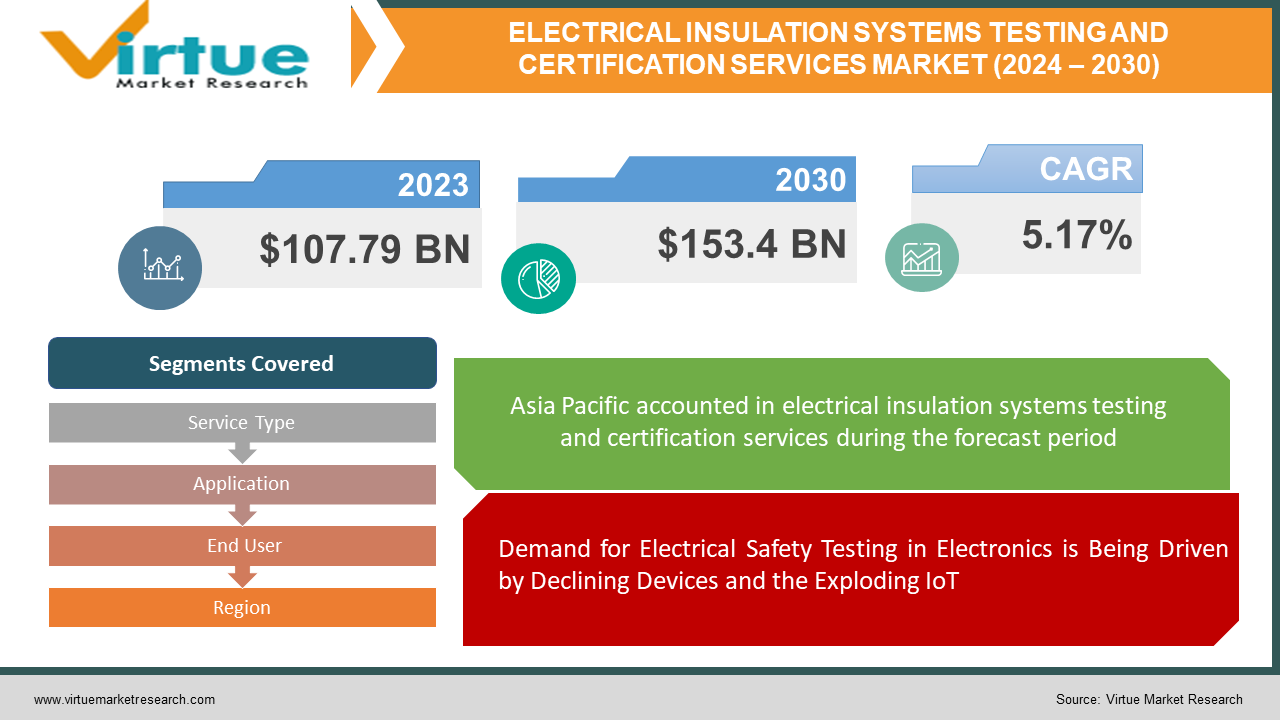

The Global Electrical Insulation Systems Testing and Certification Services Market was valued at USD 107.79 billion and is projected to reach a market size of USD 153.4 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.17%.

Services for testing and certifying electrical insulation systems serve as a safety net for the electrical industry. These services guarantee that the components and designs think ceramics, tapes, and varnishes used to stop current from running away inside electrical devices are up to par. They assess these insulation systems' ability to withstand voltage, prevent current leakage, and function in various temperatures using a battery of tests. Certification is granted if all requirements are met, providing producers and consumers with the assurance that their electrical equipment is designed to operate safely and dependably.

Key Market Insights:

Stricter rules are being enforced globally by regulatory authorities concerning the performance and safety of electrical products. Examples are the UL 1446 standard from the American National Standards Institute (ANSI) and the Low Voltage Directive (LVD) from the European Union. Manufacturers must obtain testing and certification to assure conformity with these rules.

There is a 120% increase in demand for certification services. The doubling of demand indicates a growing awareness among manufacturers and consumers regarding the importance of ensuring that electrical products meet established standards.

98% of products passed stringent insulation testing implies that the vast majority of products subjected to rigorous insulation testing successfully met or exceeded the established standards for safety and performance.

Global Electrical Insulation Systems Testing and Certification Services Market Drivers:

Demand for Electrical Safety Testing in Electronics is Being Driven by Declining Devices and the Exploding IoT

Fuelled by numerous major developments, the electronics industry is undergoing a period of unprecedented expansion. Devices are becoming smaller and more powerful thanks to miniaturization, and sophisticated features are packing ever-increasing amounts of processing power into these tiny packaging. This development is further fuelled by the spread of internet-of-things (IoT) gadgets, which connect common objects and necessitate dependable electrical components for operation. Nonetheless, the risks associated with electrical safety are also increased by this miniaturization and increasing complexity. Intricate functions need strong insulation to avoid problems, while smaller components may be more prone to overheating. Because of the overwhelming number of IoT devices, electrical safety issues are further amplified by the huge number of commonplace items. The need for electrical insulation testing and certification services is increasing because of these circumstances coming together. Robust testing aids manufacturers in guaranteeing the dependability and safety of their ever-more-complex components. These services are essential to maintaining the safety and effectiveness of the electronics sector since they confirm that electrical insulation satisfies the required standards.

The market for electrical insulation testing and certification is being driven by increased public awareness and stricter regulations.

The general public's increasing awareness of electrical hazards has made electrical safety a key issue. Public anxiety is heightened by reports of mishaps and fires brought on by malfunctioning electrical equipment. In response, governments are enacting stronger laws that require electrical insulating systems in sectors including building, power generating, and electronics manufacturing to be tested and certified. These laws lower the possibility of mishaps and injuries by ensuring that products fulfill safety requirements before being sold to consumers. The need for electrical insulation testing and certification services is rising significantly because of the increased emphasis on electrical safety.

Global Electrical Insulation Systems Testing and Certification Services Market Restraints and Challenges:

The market for electrical insulation testing and certification is growing, but there are still certain obstacles to overcome. Cost is still a barrier, especially for small and medium-sized enterprises (SMEs). Their capacity to compete and grow their product lines may be hampered by the costly nature of the testing and certification procedure. Additionally, the drawn-out processes can seriously impede a company's time-to-market strategy, which is especially important in the quick-paced technological environment of today, by delaying product launches.

Global Electrical Insulation Systems Testing and Certification Services Market Opportunities:

A few factors are combined to drive the market for electrical insulation testing and certification. The importance of electrical safety is increased. Governments everywhere are passing more stringent laws, requiring electrical insulation systems (EIS) in a variety of industries, including building, power generation, and electronics manufacturing, to be tested and certified. This focus on safety is a result of people becoming more conscious of the possible risks connected to malfunctioning electrical systems. The electronics sector is booming. Dependable and secure electrical components are in high demand as gadgets get smaller, smarter, and more networked (think the Internet of Things!). This means that a stronger EIS is required, and as a result, testing and certification services are required to guarantee their efficacy. Here, regulations are also quite important. Electrical components must meet strict safety requirements specified by regulations such as the EU's Low Voltage Directive. Manufacturers use testing and certification services to make sure their products conform with regulations and to navigate this regulatory environment. In addition to laws, manufacturers are placing a higher priority on dependability and quality. Having electrical components that are reliable and safe gives you a competitive advantage. Manufacturers show the performance and safety of their products by using these testing and certification services, which build customer confidence and enhance brand recognition.

ELECTRICAL INSULATION SYSTEMS TESTING AND CERTIFICATION SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.17% |

|

Segments Covered |

By Service Type, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Applus+, Bureau Veritas SA, DEKRA SE Element Materials Technology, Eurofins Scientific, Intertek Group PLC, SGS Group , TUV SUD, UL Solutions |

Global Electrical Insulation Systems Testing and Certification Services Market Segmentation: By Service Type

-

Testing

-

Inspection

-

Certification

Three strategies are used in the field of electrical insulation services to ensure electrical safety. Testing puts the insulation system to the test, assessing its robustness, ability to withstand leaks, and functionality in various temperature conditions. Inspections are like a visual investigator scanning the area for any signs of physical harm or incorrect installation. The gold medal, which is granted once everything passes muster, is certification. Because of tighter rules, manufacturers' efforts to demonstrate their dedication to safety, and the possible competitive advantage it offers, this market is expanding at the quickest rate. To guarantee the reliable and safe operation of electrical components, all three services collaborate.

Global Electrical Insulation Systems Testing and Certification Services Market Segmentation: By Application

-

Power Generation & Transmission

-

Electronics Manufacturing

-

Building & Construction

-

Transportation

Electrical safety is closely monitored by electrical insulation services in a variety of industries. These services are essential to the Power Generation & Transmission market because they guard against catastrophic failures in high-voltage power plants and transmission lines. Comparably, as electronics get smaller, stronger insulation is needed to prevent fires, which is why the electronics manufacturing industry is growing in terms of testing and certification. These services are also necessary for buildings and construction projects to guarantee occupant safety. The Transportation segment is growing at the fastest rate. The need for electrical insulation testing and certification in this industry is being driven by stricter laws governing electric vehicles and autonomous driving technologies, as well as the growing complexity of electrical systems in automobiles, aircraft, and ships. Together, these sections guarantee the appropriate operation of electrical insulation systems, which keeps us safe.

Global Electrical Insulation Systems Testing and Certification Services Market Segmentation: By End User

-

Manufacturers

-

Contractors & Installers

-

Government & Regulatory Bodies

A wide spectrum of customers that require electrical safety assurance are served by the market for electrical insulation services. Manufacturers rely on certification and testing to ensure that their goods adhere to rules. The fastest-growing market for these services is government and regulatory agencies; contractors and installers use them to confirm correct installation. New technologies and international standardization initiatives have led to a greater emphasis on public safety, which calls for additional funding for testing and the implementation of stronger electrical safety laws.

Global Electrical Insulation Systems Testing and Certification Services Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The market for electrical insulation services serves a variety of geographical areas with various safety requirements. Asia Pacific is the region with the quickest growth, while North America and Europe have well-established markets with stringent regulations. The need for these services is fuelled by its rapidly expanding electronics sector and economic development. All areas will probably witness sustained expansion in this market as laws become more stringent globally and the significance of electrical safety becomes apparent.

COVID-19 Impact Analysis on the Global Electrical Insulation Systems Testing and Certification Services Market:

The COVID-19 epidemic has had a complicated interplay of positive and negative effects on the market for electrical insulation testing and certification. Production of electrical components and equipment was severely hindered by disruptions to the worldwide supply chain brought on by travel restrictions and lockdowns. caused a decline in the number of items requiring testing and certification services, which in turn caused a decrease in their demand. Pandemic restrictions forced the cancellation of numerous infrastructure and construction projects, which further reduced the necessity for testing in these industries. The COVID-19-related economic crisis also had an impact, as businesses had to trim spending and possibly postpone or abandon electrical safety precautions. There have also been a few unforeseen benefits. The need for electrical safety testing may rise over time because of increased awareness of cleanliness and safety precautions during pandemics. The importance of maintaining safe working environments for organizations and institutions makes it even more crucial to make sure electrical systems are operating correctly. The epidemic hastened the deployment of technologies for certification and remote testing. This idea has promise for improving accessibility and streamlining processes, especially for geographically scattered businesses. It's also possible that industries like medical device production, which saw tremendous growth during the epidemic, contributed to the increased demand for testing electrical insulation systems in these crucial items. Although the pandemic's initial shock probably resulted in a brief setback, the long-term effects on the market are anticipated to be neutral or even beneficial. In the post-pandemic era, an increasing emphasis on safety combined with technological developments in remote testing could drive market growth.

Recent Trends and Developments in the Global Electrical Insulation Systems Testing and Certification Services Market:

The market for testing and certification services for electrical insulation systems is booming in terms of innovation and adaptability. The increased emphasis on sustainability is a major motivator. Testing and certification services are changing to evaluate these new materials considering the development of environmentally friendly electrical insulation materials. This minimizes their impact on the environment while ensuring they fulfill safety and performance criteria. Innovations in technology are also having a big impact. Testing techniques are becoming more rapid, cost-effective, and efficient. At the forefront are digitization, automation, and data analysis using artificial intelligence (AI). These developments benefit manufacturers and service providers alike by streamlining the testing process, cutting expenses, and increasing accuracy. The COVID-19 pandemic sped up the use of remote certification and testing tools. This makes it easier for geographically scattered places to obtain these services, which may allow new market entrants and make the process more approachable for smaller businesses. It is anticipated that this tendency will continue and change the way testing services are provided. market is growing in developing nations like China and India thanks to their developing electronics sectors. Because of this, there is a noticeable need for electrical insulation testing and certification services, and as these economies expand and become more industrialized, this trend is probably going to continue. Security concerns are another area of emphasis. Cybersecurity is critical given the growing interconnectivity of electrical systems and the emergence of the Internet of Things (IoT).

Key Players:

-

Applus+

-

Bureau Veritas SA

-

DEKRA SE

-

Element Materials Technology

-

Eurofins Scientific

-

Intertek Group PLC

-

SGS Group

-

TUV SUD

-

UL Solutions

Chapter 1. ELECTRICAL INSULATION SYSTEMS TESTING AND CERTIFICATION SERVICES MARKET DIESEL GENERATOR MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. ELECTRICAL INSULATION SYSTEMS TESTING AND CERTIFICATION SERVICES MARKET DIESEL GENERATOR MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. ELECTRICAL INSULATION SYSTEMS TESTING AND CERTIFICATION SERVICES MARKET DIESEL GENERATOR MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. ELECTRICAL INSULATION SYSTEMS TESTING AND CERTIFICATION SERVICES MARKET DIESEL GENERATOR MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. ELECTRICAL INSULATION SYSTEMS TESTING AND CERTIFICATION SERVICES MARKET DIESEL GENERATOR MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. ELECTRICAL INSULATION SYSTEMS TESTING AND CERTIFICATION SERVICES MARKET DIESEL GENERATOR MARKET – By Service Type

6.1 Introduction/Key Findings

6.2 Testing

6.3 Inspection

6.4 Certification

6.5 Y-O-Y Growth trend Analysis By Service Type

6.6 Absolute $ Opportunity Analysis By Service Type, 2024-2030

Chapter 7. ELECTRICAL INSULATION SYSTEMS TESTING AND CERTIFICATION SERVICES MARKET DIESEL GENERATOR MARKET – By End User

7.1 Introduction/Key Findings

7.2 Manufacturers

7.3 Contractors & Installers

7.4 Government & Regulatory Bodies

7.5 Y-O-Y Growth trend Analysis By End User

7.6 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. ELECTRICAL INSULATION SYSTEMS TESTING AND CERTIFICATION SERVICES MARKET DIESEL GENERATOR MARKET – By Application

8.1 Introduction/Key Findings

8.2 Power Generation & Transmission

8.3 Electronics Manufacturing

8.4 Building & Construction

8.5 Transportation

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. ELECTRICAL INSULATION SYSTEMS TESTING AND CERTIFICATION SERVICES MARKET DIESEL GENERATOR MARKET , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Service Type

9.1.3 By End User

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Service Type

9.2.3 By End User

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Service Type

9.3.3 By End User

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Service Type

9.4.3 By End User

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Service Type

9.5.3 By End User

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. ELECTRICAL INSULATION SYSTEMS TESTING AND CERTIFICATION SERVICES MARKET DIESEL GENERATOR MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Applus+

10.2 Bureau Veritas SA

10.3 DEKRA SE

10.4 Element Materials Technology

10.5 Eurofins Scientific

10.6 Intertek Group PLC

10.7 SGS Group

10.8 TUV SUD

10.9 UL Solutions

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Electrical Insulation Systems Testing and Certification Services Market size is valued at USD 107.79 billion in 2023.

The worldwide Global Electrical Insulation Systems Testing and Certification Services Market growth is estimated to be 5.17% from 2024 to 2030.

The Global Electrical Insulation Systems Testing and Certification Services Market is segmented By Service Type (Testing, Inspection, Certification); By Application (Power Generation & Transmission, Electronics Manufacturing, Building & Construction, Transportation); By End User (Manufacturers, Contractors & Installers, Government & Regulatory Bodies) and by region.

The market for electrical insulation testing has a promising future. Prospective patterns encompass sustained expansion in developing nations, an emphasis on eco-friendly materials, and the advancement of quicker and more effective testing technologies.

The COVID-19 epidemic affected the market for electrical insulation testing in a variety of ways. Demand is negatively impacted by initial disruptions, but long-term elements like safety awareness and remote testing may spur growth.