EV Charging Station Market Size (2024 – 2030)

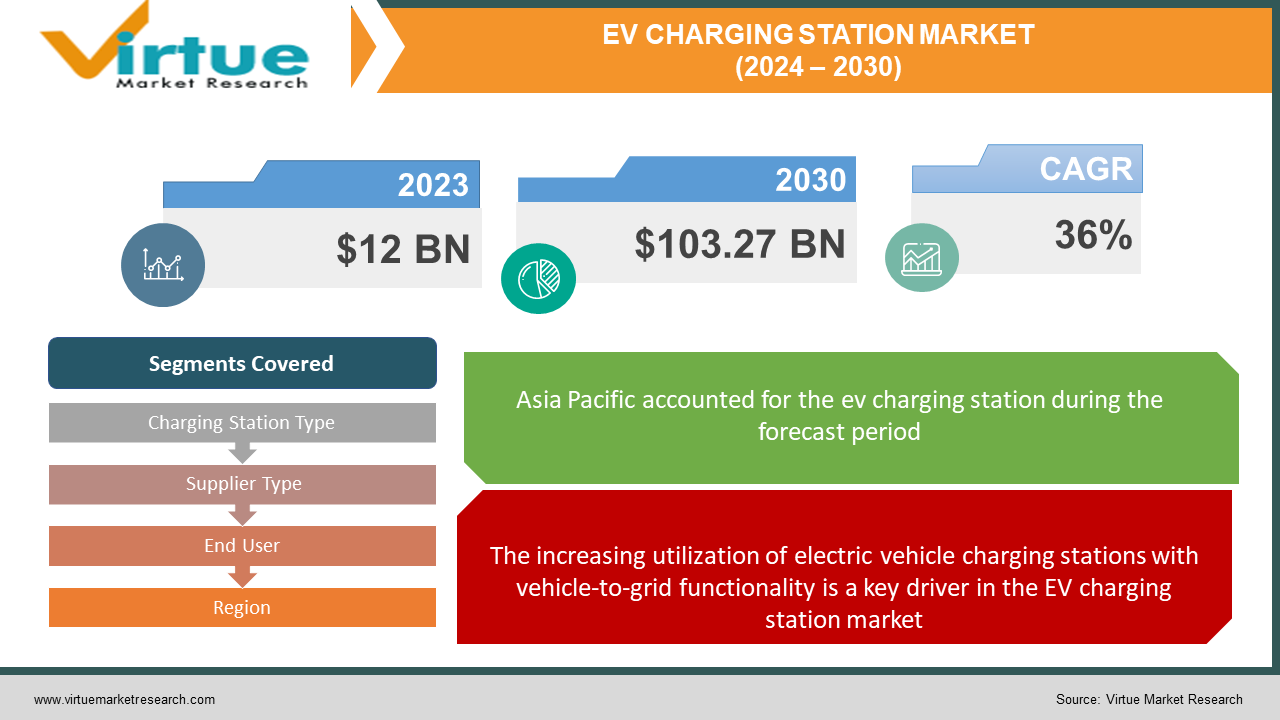

The Global EV Charging Station Market was valued at USD 12 Billion and is projected to reach a market size of USD 103.27 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 36%.

The infrastructure and services associated with charging electric vehicles are the focus of the EV (Electric Vehicle) charging station market. This market entails the creation, setup, and administration of charging stations where owners of electric vehicles can replenish the batteries in their cars. The main objective is to facilitate the increasing uptake of electric vehicles by offering easy-to-access charging options.

Key Market Insights:

The vast majority of EV charging providers are growing their networks throughout different regions, which facilitates customers' ability to locate a charging station that meets their needs. This directly contributes to the market expansion for electric vehicle charging stations. A seamless network of charging stations across the continent is being created by some through partnerships with other businesses. For example, with its energy brand Eli, Volkswagen AG became one of the biggest EV charging network providers in Europe in December 2022. The businesses successfully installed about 400000 charging stations in Germany, the Netherlands, Norway, and Sweden, among other nations. The region is expected to see further growth in the EV charging infrastructure sector over the projected timeline. A combination of factors, including government support, growing demand, corporate social responsibility, and technological advancements as electric vehicles become more mainstream, has led to an increase in the number of EV charging stations throughout developed regions, including North America and Europe. Additionally, several European nations have put in place laws and policies to encourage the use of electric vehicles, such as tax breaks, subsidies, and emissions controls. These laws and policies encourage companies to invest in EV charging infrastructure, which boosts the market for EV charging stations overall.

EV Charging Station Market Drivers:

The increasing utilization of electric vehicle charging stations with vehicle-to-grid functionality is a key driver in the EV charging station market

With vehicle-to-grid (V2G) charging, electric vehicles can exchange power with the power grid. Electric vehicles can now store excess energy and return it to the grid when needed thanks to this technology. This increases the value of electric cars and improves the performance of the electric system.

Increasing sustainability is a driving factor contributing to the growth of the EV charging station market

Installing charging stations communicates to prospective customers and workers that you're promoting sustainability and cutting emissions, which helps the environment. Providing electric vehicle (EV) charging stations is one of the simplest things a business can do to advance its sustainability initiatives. Selecting an intelligent EV charging setup is an easy decision if you want to incorporate EV charging into your business's eco-friendly initiatives. Dashboards are frequently used in smart EV charging to control and track the charging procedure.

Development in EV infrastructure plays a crucial role as a driver in the EV charging station market

The business that manufactures EV charging stations also offers a cloud-connected smartphone app to make it easier for owners of electric vehicles (EVs) to locate charging locations. This benefits EV users as well as increasing business for the companies that are housing the charging stations. Additionally, it helps expand the network of EV charging locations, increasing profitability for companies that provide EV charging services. Finally, the manufacturers of these charging stations, Griden, provide continuing assistance for the installation and maintenance of the stations, guaranteeing that businesses can continue to turn a profit.

EV Charging Station Market Challenges and Restraints:

Governments now impose stringent laws governing the locations of charging stations, mandating that service providers adhere to particular standards when putting them in. Plot owners, local governments, and utility companies must grant permission to comply with regulations and transfer energy, particularly in cases where charging stations are located on private property. The grid, utilities, and charging manufacturers are involved in several agreements, logistics, and communication channels. Reaching an agreement for the widespread installation of an inexpensive, dependable, and secure network for charging electric vehicles presents difficulties, though. To implement the processes and technologies made possible by the vehicle-to-grid infrastructure, these partners must coordinate with one another. Withheld information from the government or utility companies frequently causes delays, which hinder development and hurt the profitability of projects.

Ultra-fast chargers and Level 3 fast chargers start off costing more. The slower Level 1 and Level 2 chargers provide enough driving range in 6–16 hours, whereas most people are used to refueling fossil fuel cars in 5–7 minutes. Less than 30 minutes are needed to fully charge the rapid chargers.

EV Charging Station Market Opportunities:

The need to build infrastructure for charging electric vehicles has been highlighted by their increasing popularity. Leading electric vehicle markets are making large investments in research and development to create quicker and more effective charging techniques, as well as in the infrastructure necessary for charging electric vehicles. It is anticipated that automakers will make significant investments to meet the growing demand for electric vehicles and to be key players in the market's advancement. Electric vehicles are becoming more commonplace as part of a larger trend in mobility, which also includes the trends of autonomy, connectivity, and shared transportation. It is anticipated that incorporating these developments will result in notable decreases in emissions, traffic jams, and mishaps. The notion that every adult should own a combustion vehicle is changing as last-mile transportation options like carpooling and electric scooters, mopeds, and bicycles become more popular. Additionally, connected electric cars produce useful data that planners can utilize to improve road and parking infrastructure. The arrival of intelligent electric vehicle charging stations initiates a momentous shift that will eventually lead to more room for bicyclists, pedestrians, and green spaces.

EV CHARGING STATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

36% |

|

Segments Covered |

By Charging Station Type, Supplier Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABB Ltd., ChargePoint, Inc., EVgo Services LLC., Allego, Scheinder Electric, Blink Charging Co., Wi Tricity Corporation, Toshiba Corporation., AeroViroment, Inc., Mojo Mobility, Inc. |

EV Charging Station Market Segmentation: By Charging Station Type

-

AC Charging

-

DC Charging

-

Wireless Charging

By producing the most income, DC charging stations dominated the worldwide market for electric vehicle charging in 2023. This is a result of DC stations' affordable prices and rapid charging capabilities. DC chargers, in contrast to other stations, transform power before it enters the car's converter to directly charge the battery. The increased use of technologies such as RFID and Near-field Communication (NFC) on highways is also a factor in the rise in DC charging stations.

EV Charging Station Market Segmentation: By Supplier Type

-

OE Charging Station

-

Private Charging Station

Since public charging stations are less expensive for manufacturers, they generated the most revenue in 2023. These stations are accessible to all users and offer ample parking. Conversely, owners or a select group of people can only use private charging stations, which are typically found in homes or workplaces. This is the reason why public charging station construction is of greater interest to automakers and utilities. Thus, the benefits that public stations have over private ones are what are fueling the market's expansion.

EV Charging Station Market Segmentation: By End User

-

Private type

-

Public type

Having a high-quality and state-of-the-art electric vehicle (EV) charging station is crucial for your business or local government. Many businesses wish to convert to electric fleets and offer customers and guests the ability to charge their vehicles. For this, think about utilizing EV Connect. This platform enables charging in a variety of locations, including hotels, public spaces, and private spaces. This platform builds and maintains a dependable, adaptable cloud system. Both charging stations and users are under its authority. In addition to managing multiple charging networks, interacting with drivers, offering assistance, and integrating with energy systems via an open API, the service has other features.

EV Charging Station Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia Pacific emerged as the market leader for electric vehicle charging stations globally in 2023 and is expected to maintain its position as the most lucrative region in the years to come. The primary cause of this is the large sums of money that governments in nations like China, South Korea, Japan, and others have put into developing infrastructure for charging devices. For instance, to maintain its lead in the race for the adoption of electric vehicles, China announced in April 2020 that it intends to invest a sizeable sum of USD 1.43 billion in that year alone. To increase the use of electric vehicles in their respective regions, countries like Singapore, India, Korea, and Japan are also aggressively investing in the infrastructure necessary for charging them.

Proactive government initiatives are driving the growth of the Asia-Pacific market for electric vehicle charging stations. Furthermore, by 2050, the Japanese government hopes to have all new cars sold there to be hybrid or electric models. This action fits into a larger plan to cut greenhouse gas emissions, including carbon dioxide, by 80% per car by 2050. As a result, considerable market expansion is projected shortly in the area.

COVID-19 Impact on the Global EV Charging Station Market:

The global market for cars, including the market for electric vehicle (EV) charging stations, was impacted by the COVID-19 pandemic. People postponed purchasing electric cars due to travel restrictions and strict lockdowns in many locations. A shortage of raw materials also affected the EV charging station industry as a result of supply chain disruptions, primarily because China is a major supplier of materials. But by the end of 2020, the industry had improved, the lockdowns had subsided, and more people had started selecting electric vehicles, which helped the market expand once more.

Latest Trend/Development:

To expand its offering, Chargemaster PLC purchased Elektromotive Limited, a provider of infrastructure, along with its subsidiary. The top supplier of electric car chargers in the UK, Chargemaster PLC, was acquired by BP PLC, which rebranded it as BP Chargemaster. BP was able to create a fast and ultra-fast charging network in the UK thanks to this acquisition. In partnership with Ford, Siemens eMobility unveiled the Ford Charge Station Pro, an electric vehicle charger specifically engineered for the Ford F-150 Lightning. At 19.2 kW, the highest rating for a Level 2 charging station, this charger is the first bidirectionally ready EV solution for retail customers, having been certified by the industry standard UL 9741.

The BMW Group and Evergo have partnered to expand the electric vehicle (EV) charging infrastructure in Mexico. To install more than 4,000 new chargers across the nation, they intend to invest $200 million over the course of five years. Under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) program, $1.84 billion will be invested in India over the course of the next three to four years to increase the number of EV charging stations and expand the country's EV infrastructure. This is anticipated to have a favorable effect on India's EV charging station deployment.

Key Players:

-

ABB Ltd.

-

ChargePoint, Inc.

-

EVgo Services LLC.

-

Allego

-

Scheinder Electric

-

Blink Charging Co.

-

Wi Tricity Corporation

-

Toshiba Corporation

-

AeroViroment, Inc.

-

Mojo Mobility, Inc.

Chapter 1. EV Charging Station Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. EV Charging Station Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. EV Charging Station Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. EV Charging Station Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. EV Charging Station Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. EV Charging Station Market – By Charging Station Type

6.1 Introduction/Key Findings

6.2 AC Charging

6.3 DC Charging

6.4 Wireless Charging

6.5 Y-O-Y Growth trend Analysis By Charging Station Type

6.6 Absolute $ Opportunity Analysis By Charging Station Type, 2024-2030

Chapter 7. EV Charging Station Market – By Supplier Type

7.1 Introduction/Key Findings

7.2 OE Charging Station

7.3 Private Charging Station

7.4 Y-O-Y Growth trend Analysis By Supplier Type

7.5 Absolute $ Opportunity Analysis By Supplier Type, 2024-2030

Chapter 8. EV Charging Station Market – By End User

8.1 Introduction/Key Findings

8.2 Private type

8.3 Public type

8.4 Y-O-Y Growth trend Analysis By End User

8.5 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. EV Charging Station Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Charging Station Type

9.1.3 By Supplier Type

9.1.4 By By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Charging Station Type

9.2.3 By Supplier Type

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Charging Station Type

9.3.3 By Supplier Type

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Charging Station Type

9.4.3 By Supplier Type

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Charging Station Type

9.5.3 By Supplier Type

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. EV Charging Station Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ABB Ltd.

10.2 ChargePoint, Inc.

10.3 EVgo Services LLC.

10.4 Allego

10.5 Scheinder Electric

10.6 Blink Charging Co.

10.7 Wi Tricity Corporation

10.8 Toshiba Corporation

10.9 AeroViroment, Inc.

10.10 Mojo Mobility, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Precedence Research predicts that the electric vehicle charging station market size will be reached at USD 12 billion in 2023 and is anticipated to reach over USD 103.27 billion by 2030.

The electric vehicle charging station market is growing at a CAGR of 36.0% from 2024 to 2030.

The rising demand for electric vehicles is one of the prime factors for the aggressive growth of the EV charging station market.

The DC charging station will lead the global electric vehicle charging station market in the near future.