Electric Vehicle Charging Station Market size (2025-2030)

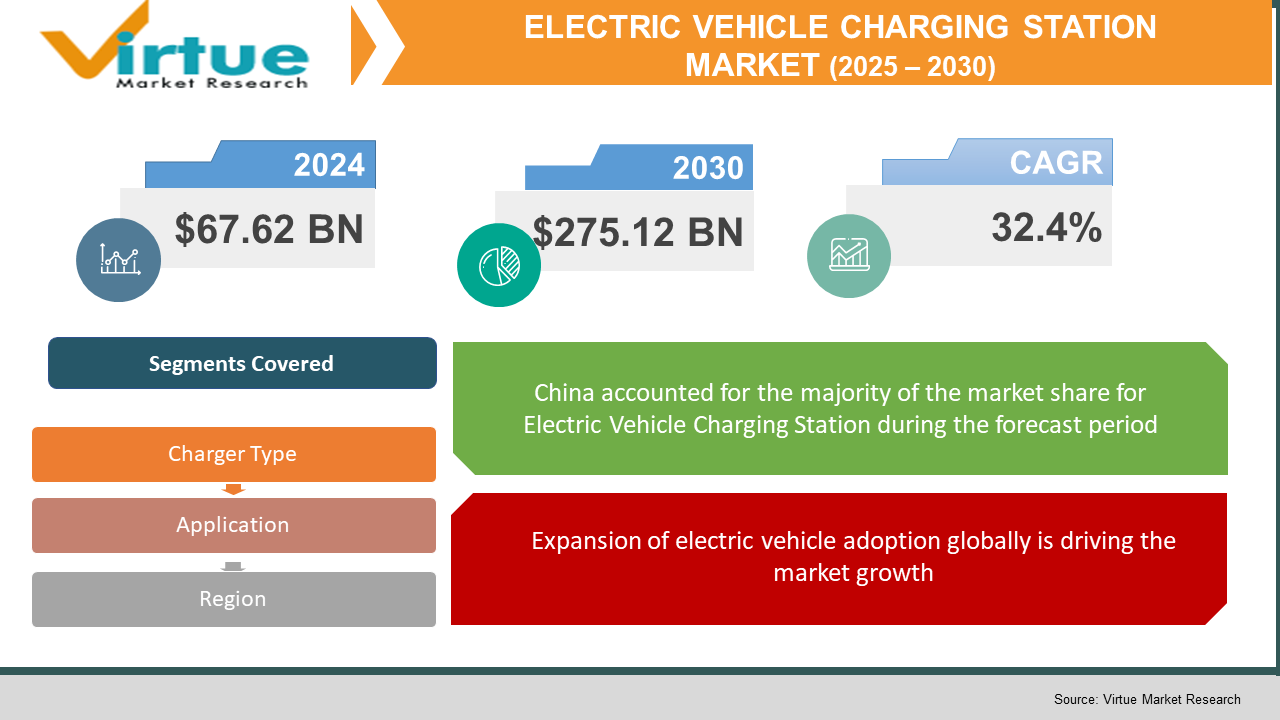

The Global Electric Vehicle Charging Station Market was valued at USD 67.62 billion in 2024 and is projected to grow at a compound annual growth rate of 32.4% from 2025 to 2030. By the end of 2030, the market is expected to reach approximately USD 275.12 billion.

Electric vehicle (EV) charging stations are critical infrastructure that offers power delivery systems for electric vehicle batteries. These charging stations are categorized into different types such as AC slow chargers, DC fast chargers, ultra-fast chargers, wireless charging pads, and standardized charging networks. Their deployment across residential, commercial, public, and highway settings is driven by rising electric vehicle adoption, supportive government policies, investment in smart grid integration, and advances in charging technologies. Rapid expansions in EV fleets, including passenger cars, buses, commercial vehicles, and two-wheelers, particularly in major markets like China, Europe, the United States, and India, have created strong demand for robust charging infrastructure. Furthermore, global initiatives and emissions regulations targeting carbon neutrality by 2050 are fostering strategic partnerships among automakers, utility companies, and governments to accelerate charger network development at scale.

Key market insights:

Public charging accounts for approximately 62 % of the total installed charging infrastructure, while private residential installations continue to increase steadily

Level 2 ac charging creates over 70 % of ev home charger installations due to lower upfront costs and compatibility with existing electrical systems

DC fast charging and ultra-fast charging are growing at a combined cagr of 38 % from 2025 to 2030, driven by long-distance travel needs and fleet applications

Asia-pacific region holds over 45 % market share in terms of charger units installed globally, fueled by china and india’s aggressive ev targets

Wireless and bidirectional charging technologies are emerging with pilot deployments, expected to grow at cagr of 28 % by 2030

Collaborations between automakers, charging-as-a-service providers, and utility companies have increased by 48 % in the past three years to streamline network development

Global Electric Vehicle Charging Station Market Drivers

Expansion of electric vehicle adoption globally is driving the market growth

Global sales of electric vehicles have been increasing rapidly, surpassing 14 million units in 2023 and continuing to grow in 2024. this surge in ev adoption is the primary driver for the charging station market. as more consumers and fleets switch to electric, the need for reliable, accessible, and fast charging infrastructure becomes critical. governments worldwide have set ambitious ev targets, incentivizing automakers and consumers through subsidies, tax rebates, and regulatory mandates. china aims for 50 % of new car sales to be new energy vehicles by 2035, while the eu and the us have introduced zero-emission vehicle mandates. these supportive policies stimulate investment in charging networks and encourage public and private entities to deploy station infrastructure. as electric vehicle range improves and costs decline, consumer confidence increases, prompting urban planners, operators, and businesses to expand charging infrastructure. this virtuous cycle bolsters demand for grid-ready electrical upgrades, smart charging solutions, and interoperability among charging networks. with passenger, commercial, and fleet vehicles increasingly electrified, the expansion of ev adoption remains the central growth engine for charging infrastructure deployment.

Government incentives and regulations supporting network deployment is driving the market growth

Government policies and regulations are playing a crucial role in accelerating the rollout of charging infrastructure. many nations offer financial incentives for charger installations, including grants, tax credits, and subsidies targeting residential, commercial, and public charging stations. these incentives reduce upfront investment barriers for operators and businesses, making charger deployment financially attractive. countries such as germany, france, the united kingdom, and the united states have implemented national-level programs to subsidize the deployment of dc fast chargers along highways and in urban hubs. similarly, local governments and municipalities provide grants for ev-ready building codes and on-street residential charging, increasing accessibility. regulatory standards are also being introduced to ensure interoperability, cybersecurity, and payment integration within charging networks. some governments mandate minimum numbers of public chargers per ev on the road, and set regulations for energy management, load balancing, and vehicle-grid integration. utility companies also offer incentive programs and time-of-use pricing to align charging demand with grid capacity. these policy frameworks create an enabling environment for private and public investment, reducing risk and accelerating infrastructure deployment to meet growing ev charging needs.

Technological advancements in charging solutions and smart charging systems is driving the market growth

Innovation in charging technology and intelligent energy management systems is enhancing the efficiency, speed, and sustainability of electric vehicle infrastructure. the introduction of ultra-fast dc chargers with power outputs exceeding 150kw is reducing charging times to under 20 minutes for compatible vehicles. wireless charging systems are emerging for convenient residential and fleet use, with inductive pads and robotic in-motion charging pilots. bidirectional chargers, supporting vehicle-to-grid and vehicle-to-home applications, are enabling evs to act as mobile energy storage assets, improving grid resiliency and offering new revenue streams for vehicle owners. charging management platforms integrated with artificial intelligence and cloud analytics allow operators to optimize energy loads, shift charging to off-peak periods, and reduce operational costs. these platforms support dynamic pricing, reservation systems, and real-time station monitoring to improve utilization and uptime. cybersecurity protocols are being embedded to protect payment systems and data privacy. renewable-powered charging stations combining solar canopy systems and energy storage reduce carbon footprint and grid dependency. standardization efforts like o c p i and c h a d e m o interfaces ensure cross-brand compatibility, ease of use, and broader network access. collectively, these technological advancements are transforming charger networks into intelligent, customer-friendly, and resilient infrastructure systems.

Global Electric Vehicle Charging Station Market Challenges and Restraints

High infrastructure investment and operational costs is restricting the market growth

Developing a widespread, reliable charging network requires substantial capital investment in hardware, site development, electrical upgrades, and installation. costs escalate with the deployment of dc fast chargers and ultra-fast chargers, which can range between usd 50,000 and usd 150,000 per unit excluding land and grid connection expenses. additional costs include trenching, transformers, pay systems, signage, and civil works. operational expenditures such as maintenance, software management, electricity procurement, and customer service also require ongoing financing. in urban centers, real estate costs and retrofit challenges make location selection complex and expensive. charging station developers often face uncertain return on investment due to evolving ev adoption rates, variable utilization, and pricing models. this creates financing challenges and impacts commercial viability. moreover, interoperability, billing coordination, and network integration further complicate deployments. while public-private partnerships mitigate some risks, many markets still face slow payback periods, requiring governmental co-funding and incentives to bridge funding gaps. the high capital intensity and complexity of charging infrastructure investment remain significant restraints for widespread market rollout.

Grid capacity limitations and electric utility integration is restricting the market growth

Electrical grid infrastructure in many regions is not yet equipped to handle the rapidly increasing demand created by high-power charging ecosystems. installing multiple ultra-fast charging stations, especially in urban and highway environments, places stress on local transformers and distribution networks, leading to grid bottlenecks and potential service disruptions. utilities may impose infrastructure upgrade requirements such as new distribution lines or substation improvements as preconditions for licensing high-power charger installations. this adds timelines and costs to projects. additionally, integrating renewable energy sources and storage systems with chargers requires complex energy management systems and regulatory approvals. without adequate grid capacity planning and smart energy coordination, charger rollouts could exacerbate peak load issues and delay deployments. utilities and network operators must coordinate closely with charging station developers to design grid-ready infrastructure, employ load balancing, demand response strategies, and invest in scalable and dynamic electrical systems. overcoming these technical and regulatory hurdles is essential to ensuring seamless charger deployment and avoiding localized grid instability.

Market opportunities

The electric vehicle charging station market offers substantial opportunities driven by long-term systemic change in mobility. first, expansion in emerging economies such as india, southeast asia, latin america, and the middle east provides vast untapped potential due to low current charger density and rising ev adoption. governments in these regions are setting ambitious transportation electrification targets, creating greenfield opportunities for charger network developers. second, fleet electrification by delivery services, ride-hailing platforms, and public transportation systems presents new business models, such as depot-based bulk charging, opportunity charging stations and second-life battery integrated systems. these fleet solutions improve station utilization and provide stable demand patterns. third, integration of charging with renewable energy sources, battery storage, solar canopies, and microgrids can offer sustainable, off-grid solutions with lower operating costs. fourth, vehicle-to-grid integration allows evs to act as distributed energy resources, supporting grid resilience during peak demand and providing aggregator revenue streams. fifth, charging-as-a-service and subscription revenue models can enhance financial returns for property owners, automakers, and utilities. finally, advancement in ultrafast charging and wireless technologies creates premium charging hubs capable of replicating fueling station convenience, increasing EV adoption by addressing range anxiety concerns, and supporting urban and intercity travel.

ELECTRIC VEHICLE CHARGING STATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

32.4% |

|

Segments Covered |

By charger type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Tesla Supercharger, ChargePoint, EVgo, IONITY, Blink Charging, Electrify America, ABB, Siemens. |

Electric Vehicle Charging Station Market segmentation

Electric Vehicle Charging Station Market By Charger Type:

- Level 1 ac slow charger

- Level 2 ac charger

- DC fast charger

- Ultra-fast charger (>150 kW)

- Wireless charging system

Level 2 ac chargers are the most widely installed globally, particularly for residential and commercial applications. their affordability, ease of installation, and compatibility with home and workplace electrical systems make them preferred choices. Level 2 charging delivers sufficient daily charging capacity for most vehicle owners without requiring costly infrastructure upgrades or premium payment systems. the ubiquity of these chargers in parking facilities, hotels, workplaces, and neighborhoods positions them as the backbone of everyday charging habits and a mass-market enabler for broader ev adoption.

Electric Vehicle Charging Station Market By Application:

- residential charging

- public charging stations

- highway fast charging corridors

- commercial and fleet charging (buses, taxis, logistics)

- workplace charging

Public charging stations constitute the largest application segment. They offer accessibility for non-home charging needs and support EV ownership in multifamily dwellings where home installation is not feasible. public stations include retail sites, parking garages, curbside chargers, and urban mobility hubs. growth in public charging is driven by urban planners, automotive OEMs, and charging network operators targeting visibility, convenience, and rapid turnaround for customer journeys. they also act as catalysts for cross-border travel, toll roads, and tourism. as cities target zero-emission zones and businesses integrate charging amenities to attract customers, public charging continues to be the dominant use case for charging infrastructure.

Electric Vehicle Charging Station Market Regional segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

China alone represents the largest national market, with more than 1.3 million public chargers installed and aggressive government support. India has included charger deployment in national infrastructure plans, while southeast asian economies are following suit with regional EV roadmaps. Japan and south korea focus on fast and wireless charging pilots, leveraging advanced utility frameworks. the region’s dominance is supported by low-cost manufacturing, economies of scale, urban density that favors shared mobility, and multi-stakeholder collaboration. moreover, platform-based rollouts by major automakers, utility partnerships, and energy service providers facilitate faster expansion. with combined policies, capital availability, and growing EV fleets, the Asia-Pacific region is expected to remain at the forefront of charging station deployment through the end of the decade.

COVID-19 Impact Analysis on the Electric Vehicle Charging Station Market

The covid-19 pandemic temporarily disrupted charging station installations and operational activities during 2020. lockdowns hindered construction and installation projects, delayed supply chains for components such as chargers, cables, and substations, and slowed permitting processes. reduced public mobility led to lower charger usage and impacted revenue models for station operators. however, the pandemic accelerated policy support as governments recognized the dual benefits of mobility electrification and economic recovery. stimulus packages in europe and north america included incentives for charger deployment and ev purchases. post-pandemic travel recovery, especially domestic EV usage, accelerated fleet electrification and charging demand at depots, logistics centers, and public spaces. the trend toward remote work and private vehicle travel increased home charging demand. additionally, digitalization picked up pace—station operators invested in contactless payment, remote diagnostics, and app-based services. charging network planning also shifted to account for public health protocols, grid resilience, and solar+storage integration. overall, while the pandemic caused short-term slowdowns, it ultimately reinforced the strategic importance of charging infrastructure and catalyzed digital and decentralized deployment models.

Latest trends/Developments

Recent years have seen several notable trends in charging station development. ultra-fast dc chargers (>150kw) are being deployed along highways and in urban hubs to enable rapid recharging during long-distance travel. pilot projects using wireless inductive charging pads and in-motion charging tests in europe and asia aim to redefine public charging convenience. vehicle-to-grid (v2g) technology trials are underway in japan, the netherlands, and california, allowing evs to act as mobile energy storage. solar-powered charging stations with integrated battery storage provide sustainable and off-grid charging solutions. subscription-based charging-as-a-service models bundle charging hardware, software, and billing under one contract, targeting property owners, fleet managers, and automakers. interoperability initiatives and roaming protocols ensure users can access any network with a single account. smart charging platforms use dynamic load management to minimize grid impact and reduce operational costs. charge point operators are investing in value-added services like predictive maintenance, reservation systems, and loyalty programs. partnerships between utilities, automakers, and retailers are increasing, offering bundled mobility, energy, and retail experiences. as technology and market models mature, these trends facilitate seamless and accessible charging infrastructure aligned with consumer convenience and sustainability expectations.

Key Players:

- Tesla Supercharger network

- ChargePoint

- EVgo

- IONITY

- Blink Charging

- Electrify America

- ABB

- Siemens

- BP Pulse

- Delta Electronics

Chapter 1. Electric Vehicle Charging Station Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary source

1.5. Secondary source

Chapter 2. ELECTRIC VEHICLE CHARGING STATION MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. ELECTRIC VEHICLE CHARGING STATION MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. ELECTRIC VEHICLE CHARGING STATION MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. ELECTRIC VEHICLE CHARGING STATION MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. ELECTRIC VEHICLE CHARGING STATION MARKET – By Charger Type

6.1 Introduction/Key Findings

6.2 Level 1 ac slow charger

6.3 Level 2 ac charger

6.4 DC fast charger

6.5 Ultra-fast charger (>150 kW)

6.6 Wireless charging system

6.7 Y-O-Y Growth trend Analysis By Charger Type

6.8 Absolute $ Opportunity Analysis By Charger Type , 2025-2030

Chapter 7. ELECTRIC VEHICLE CHARGING STATION MARKET – By Application

7.1 Introduction/Key Findings

7.2 residential charging

7.3 public charging stations

7.4 highway fast charging corridors

7.5 commercial and fleet charging (buses, taxis, logistics)

7.6 workplace charging

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. ELECTRIC VEHICLE CHARGING STATION MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Charger Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Charger Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Charger Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Charger Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Charger Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. ELECTRIC VEHICLE CHARGING STATION MARKET – Company Profiles – (Overview, Product Charger Type , Portfolio, Financials, Strategies & Developments)

9.1 Tesla Supercharger network

9.2 ChargePoint

9.3 EVgo

9.4 IONITY

9.5 Blink Charging

9.6 Electrify America

9.7 ABB

9.8 Siemens

9.9 BP Pulse

9.10 Delta Electronics

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Electric Vehicle Charging Station Market was valued at USD 67.62 billion in 2024 and is projected to grow at a compound annual growth rate of 32.4% from 2025 to 2030. By the end of 2030, the market is expected to reach approximately USD 275.12 billion.

Key drivers include rapid EV adoption, government incentives and robust technology advancements in charging.

Segments include charger type (ac level 1 & 2, dc fast, ultra-fast, wireless) and application (residential, public, highway, fleet).

Asia-Pacific is the dominant region accounting for over 45 % of charger units, driven by China and India.

Leading players include Tesla Supercharger, ChargePoint, EVgo, IONITY, Blink Charging, Electrify America, ABB, Siemens.