Electric Vehicle Battery Recycling Market Size (2024 – 2030)

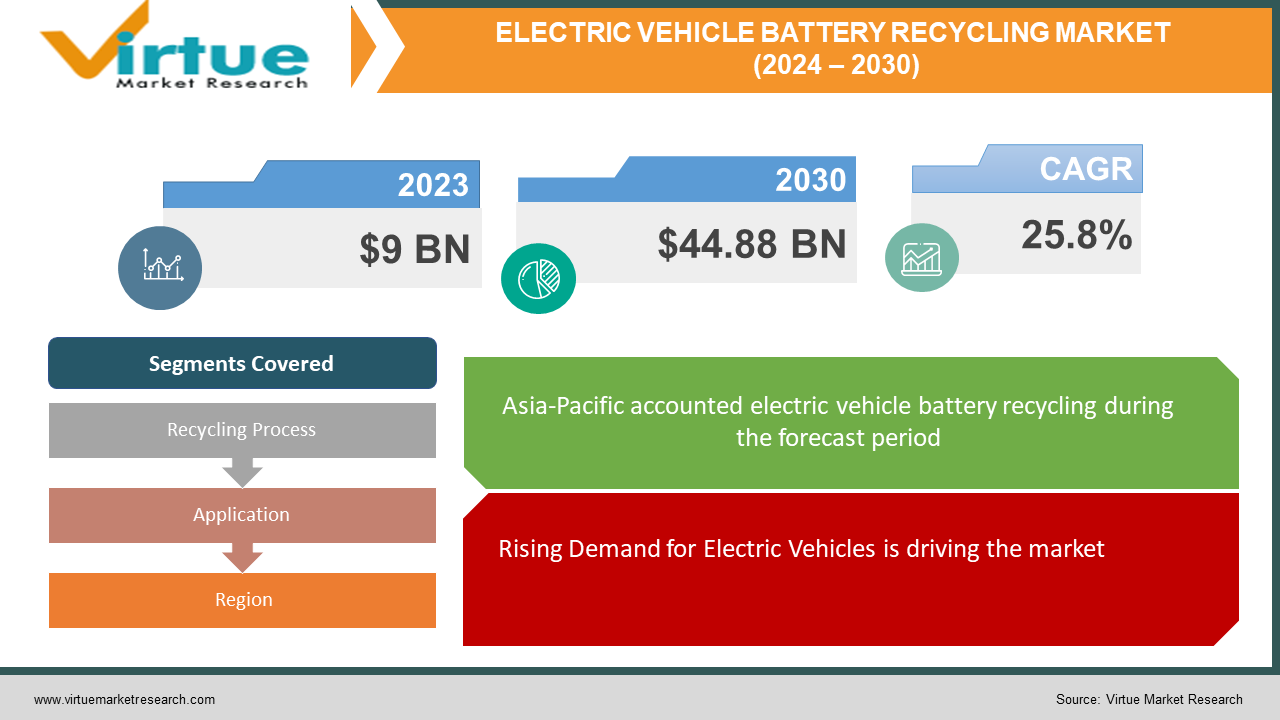

The Global Electric Vehicle Battery Recycling Market was valued at USD 9 billion in 2023 and will row at a CAGR of 25.8% from 2024 to 2030. The market is expected to reach USD 44.88 billion by 2030.

Key Market Insights:

The electric vehicle battery recycling market is poised for significant growth. This surge is driven by the rising popularity of electric vehicles and the increasing need for sustainable battery management. As more EVs hit the road, the number of used batteries requiring proper disposal and recycling will climb. Stringent environmental regulations and government initiatives are further accelerating the market. Lithium-ion batteries, the dominant EV battery type, are a key area of focus, with recycling processes like hydrometallurgy and pyrometallurgy being employed to recover valuable materials. The market is witnessing collaboration between automakers and recycling companies to establish a robust end-of-life battery infrastructure. This will be crucial for ensuring a sustainable future for electric mobility.

Electric Vehicle Battery Recycling Market Drivers:

Rising Demand for Electric Vehicles is driving the market

The booming electric vehicle (EV) market is a double-edged sword for battery recycling. As EV sales soar, so too will the number of batteries reaching their end-of-life. This surge creates a pressing need for robust recycling infrastructure. Inefficient processes simply won't cut it – we need effective methods to handle the ever-growing mountain of used batteries. This presents a tremendous opportunity for the EV battery recycling market, as it fuels the development and implementation of innovative technologies to recover valuable materials and ensure a sustainable future for electric mobility.

Focus on Sustainability and Circular Economy is driving the market growth

The specter of environmental damage from improperly disposed lithium-ion batteries is driving a regulatory revolution. Governments are tightening their grip on battery disposal, recognizing the toxic cocktail of materials these power packs contain. Landfills are no longer seen as a viable option – leaks from degraded batteries can contaminate soil and water sources, posing a serious threat to ecosystems and human health. To combat this, stricter regulations are being implemented. These regulations often mandate minimum recycling targets, forcing manufacturers and consumers alike to prioritize responsible battery disposal. This push isn't just about curbing environmental harm; it's also about creating a more sustainable battery future. By mandating recycling, governments are incentivizing the development of innovative and efficient recycling technologies. These advancements will not only help meet recycling targets but also recover valuable materials like lithium, cobalt, and nickel. This recovered bounty can then be fed back into the battery production cycle, reducing dependence on virgin resources and minimizing the environmental impact of mining. In essence, stricter regulations are acting as a catalyst, pushing the EV battery industry towards a closed-loop system that benefits both the environment and the long-term viability of electric mobility

Stringent Environmental Regulations is driving the market growth

The growing focus on sustainability and the circular economy presents a perfect marriage with EV battery recycling. Linear economies, where resources are extracted, used, and then discarded, are becoming increasingly unsustainable. EV battery recycling disrupts this cycle by creating a closed-loop system for battery materials. Instead of mining virgin lithium, cobalt, and nickel for new batteries, recycling recovers these valuable resources from used batteries. This not only reduces environmental damage from mining but also conserves finite resources for future generations. Furthermore, recycling reduces the overall waste generated by the EV industry, keeping landfills from overflowing with toxic battery components. This focus on a circular economy extends beyond environmental benefits. By recovering valuable materials, recycling helps to stabilize the supply chain for battery metals, mitigating price fluctuations and potential shortages. This translates to a more secure and cost-effective EV industry, ultimately accelerating the transition towards a sustainable transportation future. In essence, EV battery recycling embodies the principles of a circular economy, minimizing waste, conserving resources, and creating a win-win scenario for both the environment and the economic viability of electric vehicles.

Global Electric Vehicle Battery Recycling Market challenges and restraints:

High Recycling Cost is restricting the market growth

The Achilles' heel of lithium-ion battery recycling lies in its current methods. These processes, often involving pyrometallurgy or hydrometallurgy, are expensive due to complex machinery and energy-intensive steps like high-temperature separation. This high cost makes using recycled materials less appealing compared to readily available, virgin resources. It's like paying a premium for something that might have been brand new for less. This not only discourages recycling but also creates a vicious cycle – the higher the demand for virgin materials, the higher the environmental impact of mining and extraction. To truly close the loop on lithium-ion batteries, a shift towards more efficient and cost-effective recycling technologies is crucial.

Limited Recycling Infrastructure is restricting the market growth

The world is facing a looming EV battery waste crisis. The current infrastructure for recycling these batteries is woefully inadequate. We simply don't have enough dedicated EV battery recycling plants scattered around the globe. This lack of facilities creates a major bottleneck, especially considering the projected exponential growth in electric vehicles. Imagine a highway designed for a trickle of cars suddenly slammed with a tidal wave of traffic. That's the situation we're hurtling towards. The limited capacity of existing plants means a significant portion of spent batteries will likely end up in landfills, leaching harmful chemicals or being improperly treated, posing environmental and health risks. This shortage also creates a missed opportunity to recover valuable resources like lithium, cobalt, and nickel. Building a robust network of EV battery recycling plants is not just about environmental responsibility, it's about creating a sustainable and secure supply chain for the future of electric mobility.

Market Opportunities:

The surging sales of electric vehicles are creating a goldmine in disguise - a massive opportunity for EV battery recycling. As more batteries reach their end-of-life, the demand for efficient and economical recycling processes will skyrocket. Companies that can develop cost-competitive recycling technologies, particularly those with lower energy consumption, will be well-positioned to dominate this growing market. Additionally, innovation in areas like sorting and dismantling systems to handle the complex chemistry of Lithium-ion batteries will be highly sought after. Furthermore, with the global push for a circular economy and stricter regulations on battery waste, opportunities exist for building and operating state-of-the-art recycling facilities. Collaborations between automakers, battery manufacturers, and recycling companies can create a closed-loop system, ensuring responsible battery management and a secure supply chain for critical battery materials. By addressing the environmental and economic challenges of EV battery waste, this market offers a chance to be a frontrunner in sustainability and reap significant financial rewards.

ELECTRIC VEHICLE BATTERY RECYCLING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

25.8% |

|

Segments Covered |

By Recycling Process, Application,and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

American Manganese Inc., BASF SE, Glencore, Johnson Matthey Plc, Li-Cycle Corp., Redwood Materials Inc., Retriev Technologies Inc., Samsung SDI Co. Ltd. |

Electric Vehicle Battery Recycling Market segmentation - by Recycling Process

-

Hydrometallurgical Process

-

Pyrometallurgical Process

-

Physical/Mechanical Process

In the realm of EV battery recycling, the crown belongs to the Hydrometallurgical Process. This method, which utilizes aqueous solutions to extract valuable metals, reigns supreme for several reasons. Firstly, it's generally more cost-effective compared to the high-heat approach of pyrometallurgy, especially for intricate Lithium-ion battery compositions. Secondly, it boasts a friendlier environmental footprint by minimizing air pollution and hazardous waste generation. Finally, hydrometallurgy offers a more precise extraction of these precious materials, resulting in a purer end product. While both pyrometallurgy and physical/mechanical processes have their roles, hydrometallurgy's efficiency, economic edge, and environmental benefits solidify its dominance in the current EV battery recycling landscape.

Electric Vehicle Battery Recycling Market segmentation - By Application

-

Electric Cars

-

Electric Buses

-

Energy Storage Systems

The undisputed king of the Electric Vehicle Battery Recycling Market by application is the electric car segment. This dominance is due to the sheer volume of electric cars being produced and sold globally compared to electric buses and energy storage systems. As more and more consumers switch to electric vehicles, the number of batteries reaching their end-of-life will naturally rise. This creates a massive demand for recycling solutions specifically tailored to electric car batteries. While electric buses and energy storage systems are also important contributors to the market, their smaller scale currently places them behind the electric car segment.

Electric Vehicle Battery Recycling Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

-

The current king of the Electric Vehicle Battery Recycling Market by region is Asia Pacific. This continent boasts the largest market share, driven by a powerful combination of factors. Firstly, booming electric vehicle adoption in countries like China, Japan, and South Korea translates to a significant influx of used batteries in need of recycling. Secondly, Asia Pacific is a manufacturing hub for both EVs and batteries, fostering a strong ecosystem for recycling infrastructure and technology development. Lastly, with a skilled workforce and established recycling industries, the region is well-positioned to capitalize on this growing market. While North America and Europe have strong contenders and advanced technology, Asia Pacific's sheer volume of batteries and supportive environment solidify its dominance for now.

COVID-19 Impact Analysis on the Global Electric Vehicle Battery Recycling Market

The COVID-19 pandemic threw a curveball at the burgeoning EV battery recycling market. Initial disruptions were significant. Lockdowns and supply chain slowdowns hampered the production of new EVs, consequently reducing the influx of batteries reaching their end-of-life. This led to a temporary decrease in demand for recycling services. Additionally, pandemic-related shutdowns at recycling facilities themselves caused temporary setbacks. However, the impact wasn't entirely negative. As governments rolled out stimulus packages, some included measures promoting sustainable practices, which in some cases benefitted EV battery recycling initiatives. Furthermore, the pandemic heightened awareness of resource security and the importance of a circular economy. This focus on sustainability could act as a long-term tailwind for the EV battery recycling market, as it aligns perfectly with these goals. Overall, while COVID-19 caused a temporary hiccup, the long-term growth trajectory of the EV battery recycling market is expected to remain positive, driven by the rising tide of electric vehicle adoption, stricter environmental regulations, and the continued push for a more sustainable future.

Latest trends/Developments

The world of EV battery recycling is buzzing with exciting developments. One key trend is the rise of hydrometallurgical and bioleaching techniques. These processes offer a more environmentally friendly alternative to traditional pyrometallurgy by using water-based solutions or even microbes to extract valuable materials. This reduces energy consumption and air pollution, making it a more sustainable option. Another hot topic is the development of black mass recycling. Black mass is the leftover material after shredding a used battery. New technologies are emerging to efficiently recover valuable metals like lithium, cobalt, and nickel from this complex mixture. Additionally, carmakers and recyclers are forging partnerships to establish a robust closed-loop supply chain. This ensures a smooth transition for used batteries from vehicles to recycling plants and back into new battery production. Advancements in battery design are also playing a role. Some manufacturers are exploring second-life applications for used batteries, giving them a chance to power stationary energy storage systems before final recycling. Finally, there's a growing focus on artificial intelligence (AI) and machine learning (ML) to optimize recycling processes. These technologies can help improve sorting accuracy, maximize material recovery rates, and streamline the entire recycling operation. In essence, the EV battery recycling landscape is brimming with innovation, paving the way for a more sustainable and efficient future for electric vehicles.

Key Players:

- American Manganese Inc.

-

BASF SE

-

Glencore

-

Johnson Matthey Plc

-

Li-Cycle Corp.

-

Redwood Materials Inc.

-

Retriev Technologies Inc.

-

Samsung SDI Co. Ltd.

Chapter 1. ELECTRIC VEHICLE BATTERY RECYCLING MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. ELECTRIC VEHICLE BATTERY RECYCLING MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. ELECTRIC VEHICLE BATTERY RECYCLING MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. ELECTRIC VEHICLE BATTERY RECYCLING MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. ELECTRIC VEHICLE BATTERY RECYCLING MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. ELECTRIC VEHICLE BATTERY RECYCLING MARKET – By Recycling Process

6.1 Introduction/Key Findings

6.2 Hydrometallurgical Process

6.3 Pyrometallurgical Process

6.4 Physical/Mechanical Process

6.5 Y-O-Y Growth trend Analysis By Recycling Process

6.6 Absolute $ Opportunity Analysis By Recycling Process, 2024-2030

Chapter 7. ELECTRIC VEHICLE BATTERY RECYCLING MARKET – By Application

7.1 Introduction/Key Findings

7.2 Electric Cars

7.3 Electric Buses

7.4 Energy Storage Systems

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. ELECTRIC VEHICLE BATTERY RECYCLING MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Recycling Process

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Recycling Process

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Recycling Process

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Recycling Process

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Recycling Process

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. ELECTRIC VEHICLE BATTERY RECYCLING MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 American Manganese Inc.

9.2 BASF SE

9.3 Glencore

9.4 Johnson Matthey Plc

9.5 Li-Cycle Corp.

9.6 Redwood Materials Inc.

9.7 Retriev Technologies Inc.

9.8 Samsung SDI Co. Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Electric Vehicle Battery Recycling Market was valued at USD 9 billion in 2023 and will row at a CAGR of 25.8% from 2024 to 2030. The market is expected to reach USD 44.88 billion by 2030.

Rising Demand for Electric Vehicles, Focus on Sustainability and Circular Economy these are the reasons which is driving the market.

Based on application it is divided into three segments – Electric Cars, Electric Buses, Energy Storage Systems.

Asia-pacific is the most dominant region for the Electric Vehicle Battery Recycling Market.

American Manganese Inc., BASF SE, Glencore, Johnson Matthey Plc