Electric Rope Shovel Market Size (2024 – 2030)

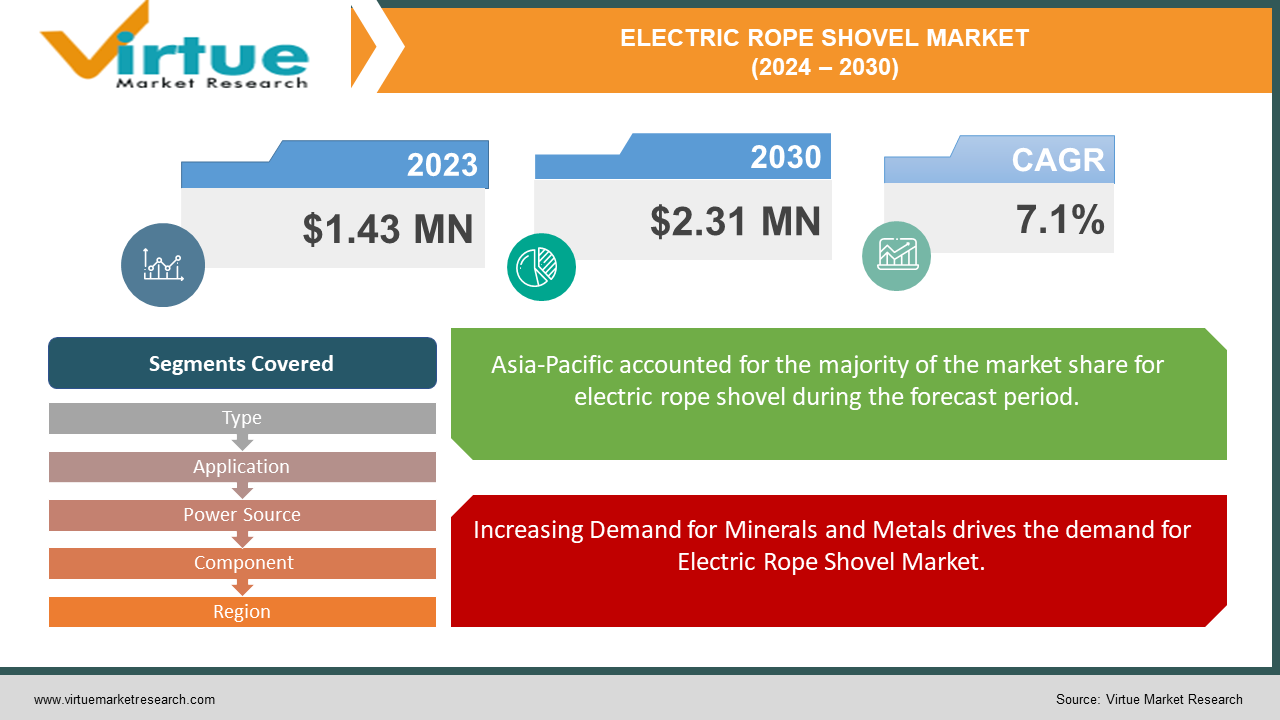

The Global Electric Rope Shovel Market is valued at USD1.43 Million and is projected to reach a market size of USD 2.31 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.1%.

The electric rope shovel market has been a crucial part of the mining and construction industries for many years. These powerful machines are used to excavate large amounts of earth, rock, and other materials. As the world continues to develop, the demand for such equipment remains strong. This article explores the factors driving the market, including long-term and short-term influences, opportunities, trends, and the impact of COVID-19. An opportunity in the electric rope shovel market lies in technological advancements. Innovations in automation and remote monitoring are transforming the way mining equipment is used. Modern electric rope shovels are now equipped with advanced sensors and data analytics tools that allow operators to monitor performance in real-time. These technologies not only enhance productivity but also improve safety by reducing the need for human intervention in hazardous environments.

A notable trend in the industry is the increasing focus on predictive maintenance. Traditional maintenance methods involve regular inspections and servicing based on a set schedule. However, predictive maintenance uses data analytics and machine learning to predict when equipment is likely to fail. By analyzing data from sensors and historical performance, operators can identify potential issues before they become critical.

Key Market Insights:

The Electric Rope Shovel Market is projected to expand at a compound annual growth rate of over 7.1% in the coming seven years, propelled by increasing urbanization and population growth in major cities worldwide.

Komatsu Ltd. (Japan), Caterpillar Inc. (United States), and Hitachi Construction Machinery Co., Ltd. (Japan) are 3 major key players in the Electric Rope Shovel Market.

Asia-Pacific & Latin America account for approximately 70-80 % of the Electric Rope Shovel Market, driven by Increasing Demand for Minerals and Metals, Technological Advancements and Automation, Increasing Investment in Infrastructure Development, and Focus on Predictive Maintenance.

Electric Rope Shovel Market Drivers:

Increasing Demand for Minerals and Metals drives the demand for Electric Rope Shovel Market.

The global demand for minerals and metals is rising due to population growth and industrialization. Minerals like copper, iron, and coal are vital for various industries, including construction, electronics, and energy. As the need for infrastructure development and technological products grows, mining companies expand their operations, necessitating efficient excavation equipment like electric rope shovels. These machines are indispensable in large-scale mining projects, making them crucial for meeting the world's increasing resource needs.

Focus on Predictive Maintenance has boosted the market for Electric Rope Shovel Market

Maintenance and operational efficiency are critical concerns in the mining industry. Traditional maintenance methods involve routine inspections and servicing, which can lead to unexpected downtime and high costs. Predictive maintenance, on the other hand, uses data analytics and machine learning to predict equipment failures before they occur. By analyzing sensor data and historical performance, operators can schedule maintenance activities proactively, reducing downtime and extending the lifespan of electric rope shovels. The adoption of predictive maintenance strategies is growing, driving demand for shovels equipped with advanced monitoring and diagnostic tools.

Increasing Investment in Infrastructure Development drives the market demand for Electric Rope Shovel Market.

Governments and private sectors worldwide are investing heavily in infrastructure development. Projects such as road construction, urban development, and renewable energy installations require extensive excavation work. Electric rope shovels are essential for these large-scale projects due to their ability to move vast amounts of earth and materials efficiently. The surge in infrastructure projects fuels the demand for electric rope shovels, as they are vital for completing construction tasks on time and within budget.

Technological Advancements has boosted the market for Electric Rope Shovel Market

The mining industry is embracing technological advancements to enhance efficiency and safety. Modern electric rope shovels are equipped with advanced automation and remote monitoring capabilities. These technologies allow operators to control and monitor the machines from a distance, reducing the need for on-site personnel and minimizing the risk of accidents. Automation also improves operational efficiency by enabling precise and consistent performance. As mining companies seek to enhance productivity and safety, the adoption of technologically advanced electric rope shovels is on the rise.

Electric Rope Shovel Market Restraints and Challenges:

One of the significant restraints in the electric rope shovel market is the high initial investment required for purchasing these machines. Electric rope shovels are advanced pieces of equipment with complex designs and state-of-the-art technology, making them expensive. The substantial capital expenditure needed for acquiring these shovels can be a deterrent for smaller mining companies or those with limited budgets. Additionally, the maintenance and operational costs of electric rope shovels are also high. Regular servicing, replacement of parts, and ensuring the machinery operates at peak efficiency require considerable financial resources. These ongoing costs can strain the budgets of mining operations, especially those operating in economically volatile regions or facing fluctuating commodity prices. The high initial and maintenance costs can limit the adoption of electric rope shovels, particularly among smaller players in the market.

Electric Rope Shovel Market Opportunities:

The use of IoT sensors and AI in electric rope shovels enables predictive maintenance, which can significantly reduce operational costs and improve equipment longevity. IoT sensors continuously monitor various parameters such as temperature, vibration, and pressure, providing real-time data on the shovel's performance. AI algorithms analyze this data to predict potential failures and maintenance needs before they become critical issues. By scheduling maintenance proactively, mining companies can avoid unexpected breakdowns, reduce downtime, and optimize the lifespan of their equipment.

Advanced data analytics tools can process the vast amounts of data generated by electric rope shovels, offering insights into operational efficiency and areas for improvement. These analytics can help identify patterns and trends in equipment performance, allowing companies to make data-driven decisions to enhance productivity. For example, data analytics can reveal optimal digging techniques, efficient energy usage patterns, and the best times for maintenance, leading to more streamlined and cost-effective operations.

ELECTRIC ROPE SHOVEL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.1% |

|

Segments Covered |

By Type, Application, Power Source, Component, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Komatsu Ltd. (Japan), Caterpillar Inc. (United States), Hitachi Construction Machinery Co., Ltd. (Japan), Liebherr Group (Switzerland), Terex Corporation (United States), XCMG Group (China), Bucyrus International, Inc. (United States), P&H Mining Equipment, Inc. (United States), Sandvik AB (Sweden), ZMJ Group (China), Zoomlion Heavy Industry Science & Technology Co., Ltd. (China), SANY Group (China), BEML Limited (India), Zhengzhou Coal Mining Machinery Group Co., Ltd. (China), L&H Industrial (United States), Northern Heavy Industries Group Co., Ltd. (China), Taiyuan Heavy Industry Co., Ltd. (China), FLSmidth & Co. A/S (Denmark), Kawasaki Heavy Industries, Ltd. (Japan), BelAZ (Belarus) |

Electric Rope Shovel Market Segmentation: By Type

-

< 20 MT

-

20-50 MT

-

50 MT

The largest segment by type is the > 50 MT category. These heavy-duty shovels are predominantly used in large-scale mining operations due to their ability to handle vast amounts of material efficiently. Industries that require the extraction of significant volumes, such as coal and iron ore mining, favor these large-capacity shovels. Their robust construction and powerful performance make them indispensable for major mining projects, driving their dominance in the market.

The 20-50 MT segment is the fastest growing. These mid-range shovels offer a balance between capacity and operational flexibility, making them suitable for a variety of mining and construction tasks. As smaller and medium-sized mining operations expand and new mining projects begin, the demand for these versatile shovels increases. Their adaptability and cost-effectiveness contribute to their rapid growth.

Electric Rope Shovel Market Segmentation: By Application

-

Mining

-

Construction

-

Others

Mining remains the largest application segment for electric rope shovels. The mining industry’s continuous need for efficient material handling equipment sustains the demand for electric rope shovels. They are crucial for extracting minerals and metals, essential for various industries, from electronics to construction. The extensive use of electric rope shovels in large-scale mining operations underscores their significant market share.

The construction segment is the fastest growing. As global infrastructure projects increase, the demand for robust excavation equipment rises. Electric rope shovels are ideal for large construction sites requiring substantial earth-moving capabilities. The ongoing urbanization and infrastructure development in emerging economies drives this rapid growth, as these shovels become essential tools for large-scale construction projects.

Electric Rope Shovel Market Segmentation: By Power Source

-

Diesel

-

Electric

Electric-powered rope shovels are the largest segment by power source. Their popularity stems from their efficiency and lower environmental impact compared to diesel-powered alternatives. Electric shovels offer lower operating costs and reduced emissions, making them a preferred choice in an industry increasingly focused on sustainability.

Electric shovels are also the fastest-growing segment. The global push towards greener technologies and the increasing emphasis on reducing carbon footprints propel the adoption of electric-powered equipment. Mining companies are transitioning to electric shovels to comply with environmental regulations and improve operational efficiency, driving the segment’s growth.

Electric Rope Shovel Market Segmentation: By Component

-

Hoist System

-

Propelling System

-

Crowd System

-

Swing System

The hoist system is the largest segment by component. It is a critical part of the electric rope shovel, responsible for lifting and lowering the shovel's bucket. The efficiency and reliability of the hoist system directly impact the shovel's performance, making it a focal point for manufacturers and operators alike.

The swing system segment is the fastest growing. It allows the shovel to rotate and position itself accurately for excavation tasks. Advances in technology, such as improved precision and durability, are driving the increased adoption of advanced swing systems. Enhanced performance and reduced downtime contribute to the rapid growth of this segment.

Electric Rope Shovel Market Segmentation: By Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest regional market for electric rope shovels. The region’s vast mining activities, particularly in countries like China and India, drive the high demand. The booming construction industry, fueled by rapid urbanization and infrastructure development, further solidifies Asia-Pacific’s position as the largest market.

Latin America is the fastest-growing regional segment. The region’s rich mineral resources and increasing mining investments attract significant demand for electric rope shovels. Countries like Brazil and Chile are expanding their mining sectors, which, combined with favorable government policies and foreign investments, drive the rapid growth of the market in this region.

COVID-19 Impact Analysis on Electric Rope Shovel Market:

The COVID-19 pandemic has had a profound impact on industries worldwide, and the electric rope shovel market is no exception. This segment, integral to mining and construction operations, experienced a range of challenges and changes brought about by the global health crisis. Here’s an in-depth analysis of how COVID-19 has influenced this market:

The onset of the COVID-19 pandemic in early 2020 caused significant disruptions in global supply chains. Manufacturing plants and assembly lines for electric rope shovels were temporarily shut down due to lockdowns and restrictions, leading to delays in production and delivery. The supply of critical components, such as engines, electronic parts, and steel, was severely affected as international trade came to a halt. This created a backlog of orders and extended lead times for new equipment.

Latest Trends/ Developments:

The integration of automation and remote operation capabilities continues to be a prominent trend in the electric rope shovel market. Manufacturers are incorporating advanced control systems and artificial intelligence (AI) algorithms to enable autonomous operation and remote monitoring of electric rope shovels. This allows for improved efficiency, safety, and productivity in mining and construction operations.

There is a growing emphasis on predictive maintenance solutions in the electric rope shovel market. By leveraging data analytics and machine learning algorithms, mining companies can predict equipment failures before they occur, allowing for proactive maintenance and minimizing downtime. Predictive maintenance not only improves equipment reliability but also reduces operational costs and enhances overall productivity.

The shift towards electric-powered rope shovels is gaining momentum as mining companies prioritize sustainability and environmental responsibility. Electric shovels produce fewer emissions compared to their diesel-powered counterparts, resulting in reduced environmental impact and lower operational costs over the long term. Manufacturers are investing in the development of more efficient electric drive systems and energy storage solutions to further enhance the sustainability of electric rope shovels.

Key Players:

-

Komatsu Ltd. (Japan)

-

Caterpillar Inc. (United States)

-

Hitachi Construction Machinery Co., Ltd. (Japan)

-

Liebherr Group (Switzerland)

-

Terex Corporation (United States)

-

XCMG Group (China)

-

Bucyrus International, Inc. (United States)

-

P&H Mining Equipment, Inc. (United States)

-

Sandvik AB (Sweden)

-

ZMJ Group (China)

-

Zoomlion Heavy Industry Science & Technology Co., Ltd. (China)

-

SANY Group (China)

-

BEML Limited (India)

-

Zhengzhou Coal Mining Machinery Group Co., Ltd. (China)

-

L&H Industrial (United States)

-

Northern Heavy Industries Group Co., Ltd. (China)

-

Taiyuan Heavy Industry Co., Ltd. (China)

-

FLSmidth & Co. A/S (Denmark)

-

Kawasaki Heavy Industries, Ltd. (Japan)

-

BelAZ (Belarus)

Chapter 1. Electric Rope Shovel Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Electric Rope Shovel Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Electric Rope Shovel Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Electric Rope Shovel Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Electric Rope Shovel Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Electric Rope Shovel Market – By Type

6.1 Introduction/Key Findings

6.2 < 20 MT

6.3 20-50 MT

6.4 50 MT

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Electric Rope Shovel Market – By Application

7.1 Introduction/Key Findings

7.2 Mining

7.3 Construction

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Electric Rope Shovel Market – By Power Source

8.1 Introduction/Key Findings

8.2 Diesel

8.3 Electric

8.4 Y-O-Y Growth trend Analysis By Power Source

8.5 Absolute $ Opportunity Analysis By Power Source, 2024-2030

Chapter 9. Electric Rope Shovel Market – By Component

9.1 Introduction/Key Findings

9.2 Hoist System

9.3 Propelling System

9.4 Crowd System

9.5 Swing System

9.6 Y-O-Y Growth trend Analysis By Component

9.7 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 10. Electric Rope Shovel Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Type

10.1.3 By Component

10.1.4 By Power Source

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Type

10.2.3 By Type

10.2.4 By Power Source

10.2.5 By Component

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Type

10.3.3 By Type

10.3.4 By Power Source

10.3.5 By Component

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Type

10.4.3 By Type

10.4.4 By Power Source

10.4.5 By Component

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Type

10.5.3 By Type

10.5.4 By Power Source

10.5.5 By Component

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Electric Rope Shovel Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Komatsu Ltd. (Japan)

11.2 Caterpillar Inc. (United States)

11.3 Hitachi Construction Machinery Co., Ltd. (Japan)

11.4 Liebherr Group (Switzerland)

11.5 Terex Corporation (United States)

11.6 XCMG Group (China)

11.7 Bucyrus International, Inc. (United States)

11.8 P&H Mining Equipment, Inc. (United States)

11.9 Sandvik AB (Sweden)

11.10 ZMJ Group (China)

11.11 Zoomlion Heavy Industry Science & Technology Co., Ltd. (China)

11.12 SANY Group (China)

11.13 BEML Limited (India)

11.14 Zhengzhou Coal Mining Machinery Group Co., Ltd. (China)

11.15 L&H Industrial (United States)

11.16 Northern Heavy Industries Group Co., Ltd. (China)

11.17 Taiyuan Heavy Industry Co., Ltd. (China)

11.18 FLSmidth & Co. A/S (Denmark)

11.19 Kawasaki Heavy Industries, Ltd. (Japan)

11.20 BelAZ (Belarus)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Electric Rope Shovel Market is valued at USD1.43 Million and is projected to reach a market size of USD 2.31 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.1%.

Increasing Demand for Minerals and Metals, Technological Advancements and Automation, Increasing Investment in Infrastructure Development, Focus on Predictive Maintenance.

Diesel and electric are the segments under the Electric Rope Shovel Market by power source.

Asia-Pacific is the most dominant region for the Electric Rope Shovel Market.

Latin America is the fastest-growing region in the Electric Rope Shovel Market.