Electric Cleansing Brush Market Size (2024 – 2030)

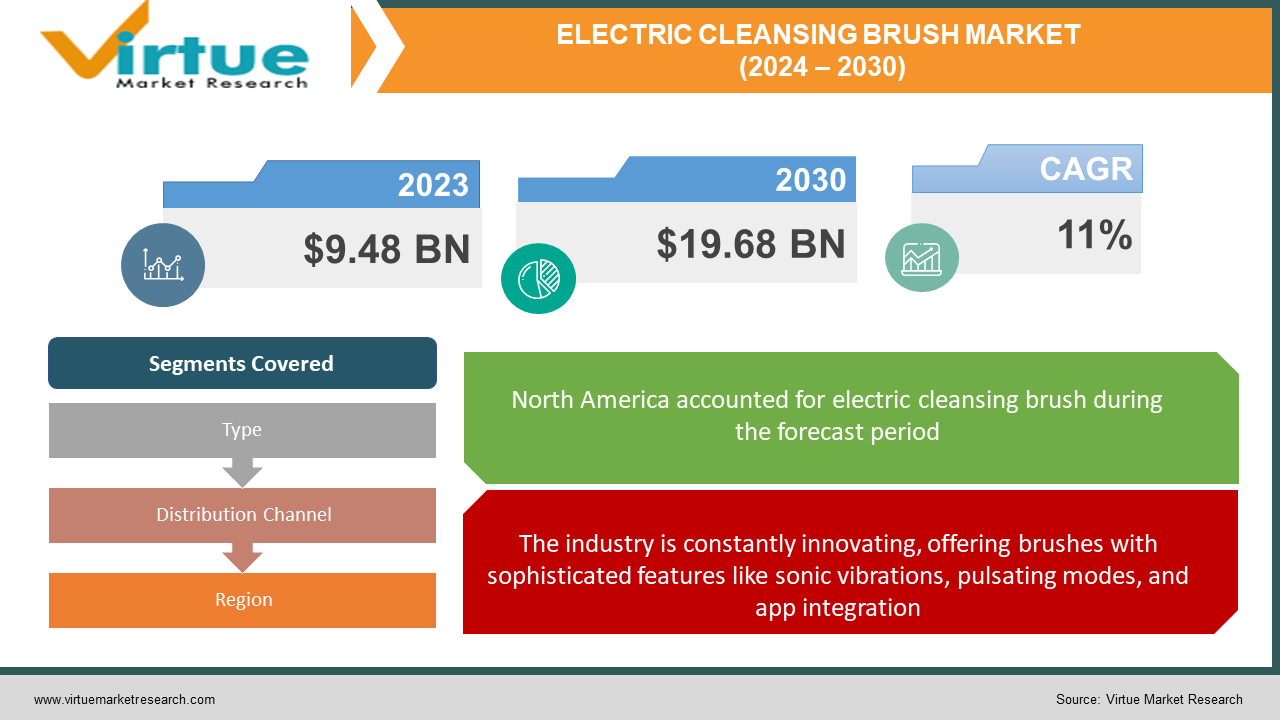

The electric cleansing brush market was valued at USD 9.48 billion in 2023 and is projected to reach a market size of USD 19.68 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 11%.

Over the past ten years, the market for electric cleansing brushes has expanded significantly due to rising customer demand for more convenient and efficient face washing and exfoliating. To deeply cleanse the skin and remove dirt, oil, and makeup residues more thoroughly than manual cleansing alone, electric cleansing brushes use revolving or oscillating bristles that are powered by a battery or electrical outlet. Leading brands in the market for electric washing brushes are Clinique, Olay, Pixnor, Foreo, PMD, and Clarisonic. Beyond face brushes, the industry has grown significantly to include electric body brushes, conductive copper bristle anti-aging brushes, portable versions, and reasonably priced solutions from mass-market manufacturers. A basic rotating face scrub brush costs less than $10, but higher-end oscillating brushes with various speed settings and attachments can cost more than $200. Influencer marketing on social media sites like YouTube and Instagram, where beauty vloggers have pushed the advantages of electric brushes for deep cleaning and exfoliation, has contributed to the market's expansion. This has increased interest in targeting not only female consumers but also the expanding men's grooming market. Sales were further boosted by the COVID-19 outbreak as consumers turned their attention to at-home skincare regimens.

Key Market Insights:

The global rise of technologically advanced beauty devices has brought power cleansing to the forefront. Vibrating and spinning bristles promise a deeper clean, harnessing sonic pulsations up to 7,000 times per minute to sweep away impurities. This new electric platform brings cleansing into the 21st century. Behind the numbers, these power brushes speak to larger trends in skin health and beauty gadgets. As consumers become more aware of inflammation, sensitivity, and the importance of hygiene, electric options promise a sterile, thorough turnaround in one's cleansing routine. It ties into the wider "minimalism" movement of gentle care, too. Brands are betting on that potential. But more competitors enter the ring every year, tapping into demand for portable sizes, glow-boosting extras like conductive copper, and accessibility for an average Jane budget. Even billion-dollar conglomerates like L'Oreal and P&G have added powered facial brushes to their stacks. Asia-Pacific may steer future growth as generations like China's and India's increasingly drive the cosmetics landscape. Analysts predict this region could expand by nearly 9% annually through 2030. Yet North America still dominates overall with 1/3 of revenues, powered by high discretionary spending.

Electric Cleansing Brush Market Drivers:

The industry is constantly innovating, offering brushes with sophisticated features like sonic vibrations, pulsating modes, and app integration.

As beauty consumers become more invested in achieving healthy, radiant complexions, deep pore cleansing has increasingly been recognized as a critical part of one's regimen. Manual face washing alone often proves inadequate for thoroughly removing all dirt, makeup residues, and other impurities locked within pores or clinging to the skin. When left uncleared over time, these residues can lead to blackheads, acne breakouts, enlarged pores, or dullness. Powered electric cleansing brushes address this need for deeper cleansing by leveraging their high-frequency vibrations or spinning oscillations to cleanse up to seven times more effectively than relying solely on one's hands. Market-leading sonic technology in devices like the Foreo Luna 3 generates up to 8000 T-Sonic pulsations per minute to purge impurities while remaining gentle on delicate facial skin. Slow sonic movements also aid in the penetration of creams or cleansers into the skin for maximum absorption. Quantitative lab analyses conducted by brands continue to demonstrate electric options for eliminating over 99% of residue and makeup, versus roughly 40% removal for standard hand cleaning. Consistently achieving this level of cleansing depth minimizes the likelihood of pore congestion issues while promoting brighter, balanced, and soothed skin long-term. As more clinical evidence and testing validate the superior cleansing and anti-inflammatory abilities of electric options, it continues to drive consumer demand within the global skincare devices industry, projected to reach over $33 billion by 2028.

Manufacturers are continuously upgrading electric brushes with modern bristle materials like antimicrobial copper, along with adjustable speed settings, attachments, and smart features like app connectivity.

As the electric facial brush market matures, beauty technology brands continue to unveil substantial upgrades to their cleansing devices for more personalized and high-performance skin pampering. One key driver fueling sales growth is the advances in brush heads using modern materials now available. For example, market leader Foreo has introduced brushes integrating antimicrobial copper bristles, which provide anti-aging properties. The copper generates a gentle electric current during application to stimulate skin cell renewal and collagen production in a safe, natural manner. Other brands offer replaceable silicone brush attachments customized for sensitive, oily, or combination skin types. These effectively massage the skin without the irritation that manual brushes with nonporous bristles often cause among certain users. Beyond brushes, additional integrated features allow consumers to treat specific complexion concerns or access more value within one ergonomic device. Top brands now include built-in LED light therapy claimed to accelerate firming and brightening effects. Some electric options also synchronize with accompanying beauty phone apps, which analyze skin post-cleanse to provide custom guidance on problem areas needing extra TLC or product pairings. Such extended functionalities enable brands to justify premium pricing while heightening perceived worth, rather than just being a pricier substitute for manual face scrubbing. Global consumer surveys indicate over 65% of beauty shoppers are willing to invest more in multifunctional electric options that visibly enhance their daily regimen.

Electric Cleansing Brush Market Restraints and Challenges:

Despite increasing adoption, electric cleansing brushes remain relatively expensive purchases compared to manual face scrubbers.

While electric facial brushes promise transformative complexion benefits, their typically premium retail pricing remains a key barrier limiting mass adoption and market penetration globally. Cleaning devices from established brands range anywhere from $70 for a basic rotating face brush up to $300 for the top-tier sonic options featuring app connectivity and interchangeable brush heads. Compare this to simple manual face scrub brushes available for under $10 in drugstores. That vast pricing gap leads more budget-conscious shoppers to view electric brushes as unnecessary indulgences rather than daily skincare staples. This perception prevails strongly across lower-income demographics, including college students and the elderly on fixed pensions. However, manufacturers are deploying clever pricing strategies to overcome this affordability challenge. For example, offering cheaper electric brush models and stripping out fancy features allows for capturing wider demographics. Philips and P&G's Olay label have available options ranging from $20 to $30. Limited-time discounts bundled with replacement brush head subscriptions also make the value proposition more attractive. Brands are also heavily focused on influencer marketing campaigns to reshape perceptions around electric brushes as essential investments for self-care rather than frivolous splurges. The emphasis is on tangible results—cleaner pores, reduced acne, wrinkle prevention—to compel consumers of all income levels to redirect their budgets towards these multifunctional tools versus other inactive beauty products crowding shelves.

As the e-waste crisis worsens, the disposal of non-recyclable electric brush components raises ecological concerns. Eco-conscious consumers lean towards reusable silicone brush heads or more sustainably made models.

As consumer awareness grows around sustainability, the environmental impact of electric beauty devices has come under greater scrutiny. Facial cleansing brushes typically contain plastic bodies, nylon bristles, batteries, and electrical components—materials that raise serious ecological issues around sourcing, disposal, and durability. Critics point out the absurdity of the advice to "replace brush heads every 3 months" when each discarded head sits in landfills for hundreds of years. The perceived disposability also encourages imprudent manufacturing with no accountability for end-of-life recycling. This contradicts sustainability values growing among green shoppers, especially eco-mindful millennials, who make up the key target demographic. In response, a handful of brands have rolled out pilot programs to recover expired electric brushes and responsibly recycle components like lithium batteries. However, uptake remains low, given that participation requires proactive consumer effort. More importantly, recycling fails to address the root problems around minimized material usage and durable construction to lengthen product lifecycles. Several market analysts now forecast that eco-conscious preferences will compel more brands to prioritize sustainable design and green supply chains for electric brushes by 2025. This may involve using renewable bamboo handles or swapping out molded plastics for recyclable metals. Some startups also pioneer replaceable brush attachments using antimicrobial silicone rubber instead of single-use nylon tips. While greener electric options currently cost 20–30% more, their resonating ethics should overcome price barriers, especially among LOHAS consumers willing to pay more for eco-friendly quality.

Electric Cleansing Brush Market Opportunities:

Electric facial cleansing brushes currently have high adoption rates in North American and Western European markets. However, largely untapped growth potential lies in emerging economies like China, India, Indonesia, and South American countries, which have expansive middle-class demographics and rising disposable incomes prime for these beauty device purchases. Portability and convenience are driving more demand for compact, travel-optimized electric brushes to keep up regular cleansing routines while traveling. Miniaturized models enabling USB quick-charging and multi-voltage operation for on-the-go use present an innovation avenue for manufacturers. High consumer interest in collagen support and anti-aging will spur brushes with supplementary benefits beyond deep cleansing like integrated skin serums, conductive copper ion bristles, or customizable LED light therapy. Multifunctionality beyond just a powered scrubbing tool widens the competitive edge. Subscription-selling models for replacement brush heads after predefined periods offer recurring revenue visibility for brands while locking in customer loyalty.

ELECTRIC CLEANSING BRUSH MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11% |

|

Segments Covered |

By Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Foreo, Philips, Clinique, L'Oreal, Conair, PMD Beauty, Michael Todd, MeLuna, Revlon |

Electric Cleansing Brush Market Segmentation: By Type

-

Sonic Cleansing Brushes

-

Rotating Cleaning Brushes

-

Silicone Cleansing Brushes

Sonic Cleansing Brushes currently hold the largest market share at around 40%, primarily due to their gentle cleansing action suitable for various skin types. They effectively remove dirt and oil without being too harsh, making them a popular choice for everyday use. Rotating cleaning brushes hold a market share of approximately 35%. These brushes are known for their deeper cleansing power, making them ideal for removing makeup and stubborn impurities. However, their harsher bristles might not be suitable for sensitive skin. Silicone cleaning brushes are the fastest-growing segment, with an estimated market share of 25% and a projected CAGR of over 18.6%. Their soft, flexible bristles are gentle on the skin and non-porous, preventing bacteria growth. This makes them an excellent option for sensitive skin and those seeking a hygienic cleansing experience.

Electric Cleansing Brush Market Segmentation: Distribution Channel

-

Mass Retailers

-

Specialty Stores

-

Online Retailers

Mass retailers, with a market share of 40–50%, are the largest growing segment. Drugstores, supermarkets, and discount stores offer a wide variety of electric cleansing brushes at competitive prices, making them accessible to a broad audience. Popular brands like Conair and Revlon are often found here. Specialty stores with a market share of 25–30% show good growth. Beauty supply stores and department stores offer a curated selection of electric cleansing brushes, often focusing on higher-end brands with advanced features. Popular brands like Clarisonic and Foreo are commonly found here. Online retailers with a market share of 20–25% are the fastest-growing. Online marketplaces and brand websites offer convenient access to a vast selection of electric cleansing brushes, often at competitive prices with exclusive deals and promotions. Popular platforms include Amazon, Ulta, and Sephora.

Electric Cleansing Brush Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America, with a market share of 35%, accounts for the largest share of over 1/3rd of the global electric cleansing brush industry. High awareness regarding advanced beauty devices and strong consumer purchasing power are the primary catalysts for growth. The US and Canadian markets have seen tremendous mainstream adoption of branded electric brush options from Clarisonic, Foreo, and PMD over the last decade. These regions also house the headquarters of many leading manufacturers. Established retail distribution channels like Sephora and Ulta also drive strong sales. High social media penetration aids in digital marketing campaigns and influencer branding, further popularizing premium cleansing devices. The presence of tech-savvy millennials and the general willingness to pay for innovative grooming products sustain the North American region's commanding market position. Asia-Pacific, with a market share of 20%, is forecast to be the fastest-growing region with a stellar CAGR of over 12% through 2028, owing to largely untapped markets with sizable youth demographics. Growing middle-class segments in China, Japan, South Korea, and India show a willingness to spend more on self-care-focused electric beauty devices. Their tech adaptability also results in quicker adoption of beauty gadget innovations. The influx of Korean skincare routines promotes facial cleansing discipline. Urbanization, leading to higher stress levels, also compels investment in progressive skin detoxing solutions. Multinational brands are prioritizing Asia-Pacific in global expansion strategies with localization initiatives, increased e-commerce focus, and influencer collaborations to heighten electric toothbrush visibility across diverse Asian markets.

COVID-19 Impact Analysis on the Electric Cleansing Brush Market.

Electric cleansing brush producers experienced significant supply chain interruptions when the COVID-19 pandemic struck in 2020. These difficulties were particularly felt by businesses that relied on Chinese imports for device assembly or brush components. Global inventory shortages were severed for more than two months due to factory shutdowns in numerous sections of China. Nonetheless, there were notable increases in customer demand, particularly from long-time owners buying replacement brush heads. During lockdowns, when people were unable to visit salons and had more time on their hands, they concentrated more on deep cleansing rituals and other forms of self-care at home. Influencers who used electric brushes to publish reviews on Instagram gave rise to the popular hashtags #Skincare and #SelfCare as a result. Budgets for digital marketing were shifted by several firms to performance marketing initiatives, customized mailings, and direct interaction with followers on social media who were cooped up at home. During lockdown, electric brush demo videos used by beauty advisers for virtual skin consultations demonstrated high conversion rates. This remote, individualized gadget suggestion service gave legitimacy to social commerce.

Latest Trends/ Developments:

Sustainable beauty is a mega-trend, with consumers preferring eco-friendly skincare devices with recyclable or replaceable components and responsibly sourced materials. Top brands are rolling out pilot trade-in programs for old electric brush returns and introducing models with renewable bamboo handles over plastic. Leading electric toothbrush makers are integrating IoT technology into devices for value-added user benefits beyond just cleansing. Examples include brushes with opt-in data sharing to track cleansing patterns or ones equipped with AI-enabled skin scanning to detect peel or renewal needs. Paired mobile apps also provide personalized tips adjusted to the weather and skincare products used. Compact, lightweight electric cleansing brush models continue to trend for their portability, USB quick-charging competency, and dual voltage compatibility for global trips. Main players offer TSA-approved mini brushes with clever fold-away designs to reduce carry footprints, appealing to frequent travelers unwilling to compromise on their cleansing routine. Rising investment by males in personal grooming routines, coupled with brands addressing masculinity barriers in electric brush marketing via rugged designs and education on skin benefits, continues to expand the niche men's segment. The industry value is projected to reach nearly $340 million by 2027, catering to modern, image-conscious male consumers.

Key Players:

-

Foreo

-

Philips

-

Clinique

-

L'Oreal

-

Conair

-

PMD Beauty

-

Michael Todd

-

MeLuna

-

Revlon

Chapter 1. Electric Cleansing Brush Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Electric Cleansing Brush Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Electric Cleansing Brush Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Electric Cleansing Brush Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Electric Cleansing Brush Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Electric Cleansing Brush Market – By Type

6.1 Introduction/Key Findings

6.2 Sonic Cleansing Brushes

6.3 Rotating Cleaning Brushes

6.4 Silicone Cleansing Brushes

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Electric Cleansing Brush Market – Distribution Channel

7.1 Introduction/Key Findings

7.2 Mass Retailers

7.3 Specialty Stores

7.4 Online Retailers

7.5 Y-O-Y Growth trend Analysis Distribution Channel

7.6 Absolute $ Opportunity Analysis Distribution Channel, 2024-2030

Chapter 8. Electric Cleansing Brush Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Electric Cleansing Brush Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Foreo

9.2 Philips

9.3 Clinique

9.4 L'Oreal

9.5 Conair

9.6 PMD Beauty

9.7 Michael Todd

9.8 MeLuna

9.9 Revlon

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Innovations and upgrades are the main drivers in this market.

Improper cleaning and maintenance, low-quality or harsh bristles, and various brands and models are the main concerns in the market.

L’Oréal S.A., Panasonic, Procter & Gamble (P&G), Philips, Conair Corporation, Shenzhen Moretop Technology Co., Ltd., TAO Clean and Roaman are the major players.

North America currently holds the largest market share, estimated at around 35%.

Asia-Pacific exhibits the fastest growth, driven by its increasing population and expanding economy.