Global Electric & Hybrid Propulsion System Market (2024-2030)

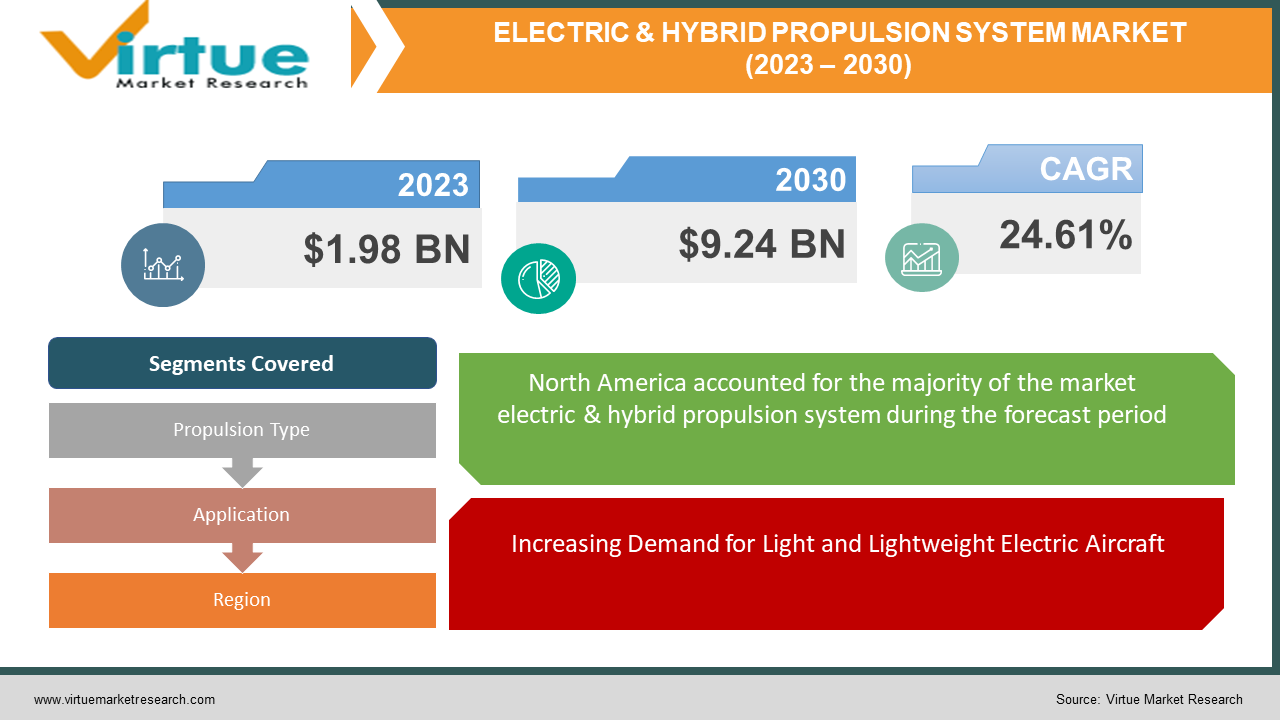

The Global Electric & Hybrid Aircraft Propulsion System Market, valued at USD 1.98 billion in 2023, is forecasted to attain a market size of USD 9.24 billion by 2030, with an anticipated CAGR of 24.61% during 2024-2030.

Electric-propelled unmanned aerial vehicles (UAVs) and model aircraft have been in use since the 1970s, but the first electrically-powered manned tethered helicopter emerged in 1917. The world witnessed the debut flight of the MB-E1, the inaugural electrically-propelled aircraft, in October 1973. Ongoing advancements aim to enhance the flying experience, with multiple electric-powered aircraft prototypes concurrently undergoing creation and testing. Hybrid-electric propulsion integrates traditional internal combustion engine systems with electric propulsion, effectively reducing atmospheric pollution caused by air travel. The hybrid electric propulsion models encompass parallel and series hybrid systems. Considerable government funding supports the development of high-speed propulsion designs, like ramjet and scramjet propulsion systems, enabling aircraft to sustain high velocities.

Key Market Insights:

The market share analysis presents a comprehensive strategy for evaluating suppliers' current standing in the electric and hybrid aircraft propulsion systems market. Detailed comparisons and analysis of vendor contributions regarding overall revenue, clientele base, and other critical data afford companies a comprehensive understanding of their performance and the challenges they confront in the pursuit of market share. This comprehensive study also furnishes vital insights into the industry's competitive landscape, encompassing factors such as consolidation, fragmentation, dominance, and amalgamation attributes noted during the baseline investigation period. Armed with this detailed information, vendors can devise more effective strategies and make informed decisions, gaining a competitive edge in the market.

Over 12% of transportation-related emissions are attributable to aviation, with a projected doubling in size by 2050. Additionally, the air travel experience has diminished due to increased congestion, prolonged wait times, extended final-mile travel, and higher risk of contracting illnesses from fellow travellers.

The primary drivers shaping the global electric and hybrid aircraft propulsion system market include:

Increasing Demand for Light and Lightweight Electric Aircraft:

The market growth is primarily propelled by the escalating need for lightweight, low-weight electric aircraft. General aviation (GA) segments, often favoring light aircraft for testing, significantly drive the electric aircraft market. Initiatives like Urban Air Taxi, employing ultralight planes for urban transport, have oriented industry developments toward providing services within a 31-mile radius.

Growing Need for Short-Haul Range Connectivity:

Short-haul flights, vital for enhancing traveller convenience, boosting local economies, and connecting smaller cities, are driving the demand for electric and hybrid aircraft propulsion systems. Hybrid aircraft, with their higher fuel efficiency, particularly suit short-haul flights, especially those utilizing electric propulsion systems, thus presenting potential fuel consumption reductions for airlines operating short-haul routes frequently.

Awareness and Advocacy for Environmental Sustainability:

The environmental friendliness of hybrid aircraft, characterized by reduced noise and emission levels, addresses the environmental concerns associated with short-haul flights. The reduced noise levels during take-off and flight make electric-propelled hybrid aircraft suitable for regions sensitive to noise pollution, potentially garnering support for regional air operations and diminishing local resistance.

Challenges and opportunities within the global electric and hybrid aircraft propulsion system market:

Challenges regarding weight and payload management significantly impact market growth.

The market holds considerable potential by aligning hybrid aircraft technology with sustainable development goals, focusing on social, environmental, and economic factors.

Hybrid aviation technology presents opportunities for innovation and investment in allied industries, potentially advancing sustainable technology and other sectors.

Adoption of hybrid aircraft demonstrates commitment to sustainability and enhances brand image and CSR programs for airlines and businesses.

ELECTRIC & HYBRID PROPULSION SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

24.61% |

|

Segments Covered |

By Propulsion Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Airbus S.A.S., 3W International GmbH, Boeing, Cranfield Aerospace Solutions, General Electric Company, GKN Aerospace Services Limited, Honeywell International Inc., Israel Aerospace Industries Ltd., Lockheed Martin Corporation, MagniX, Rolls-Royce Holdings plc., Safran S.A., Siemens AG, Raytheon Technologies Corporation, Leonardo S.p.A, Other Prominent Players |

Global Electric and Hybrid Aircraft Propulsion System Market Segmentation - by Propulsion Type

-

All-Electric Propulsion

-

Hybrid-Electric Propulsion

The dominance of the hybrid-electric propulsion segment in the global electric and hybrid aircraft propulsion systems market is anticipated due to significant projected investments in the commercial aviation industry. This segment efficiently combines the additional power of conventional engines with the efficacy of electric systems. Notably, the Hybrid-Electric Propulsion category is predicted to exhibit the fastest growth during the forecast period. This trend underscores the industry's focus on equilibrium and performance, indicating a rising preference for hybrid solutions.

Global Electric and Hybrid Aircraft Propulsion System Market Segmentation - by Application

-

Civil Aircraft

-

Military Aircraft

The strong demand for short-haul connecting flights is expected to propel the civil aircraft segment's dominance in the global market for electric and hybrid aircraft propulsion systems. Anticipated growth is attributed to rising consumer consciousness about sustainability, driving the adoption of electric or hybrid aircraft propulsion. Consequently, the global market for electric and hybrid aircraft propulsion systems is projected to prominently feature the civil aircraft segment, especially witnessing substantial growth. The civil aircraft sub-segment demonstrates the fastest growth rate, signifying the enduring need for environmentally friendly solutions in commercial aviation.

Global Electric and Hybrid Aircraft Propulsion System Market Segmentation - by Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Throughout the forecast period, North America is expected to maintain a dominant position, accounting for approximately 38% of the global market for electric and hybrid flight propulsion systems. This anticipation arises from the region's burgeoning research and development in next-generation aircraft, fostering increased demand for electric and hybrid-electric aircraft propulsion systems. North America's robust aerospace sector, technological advancements, and firm support for electric and hybrid aircraft solutions contribute significantly to its prominence. However, while North America stands as the largest market, it may not necessarily exhibit the fastest expansion, considering the rapidly evolving market dynamics in other regions, particularly Asia-Pacific.

COVID-19 Impact Analysis on the Global Electric and Hybrid Aircraft Propulsion System Market:

The COVID-19 pandemic significantly disrupted the growth and evolution of the global market for electric and hybrid aviation propulsion systems. A considerable downturn in air travel demand, accompanied by unprecedented challenges in the aviation sector, compelled numerous enterprises and research initiatives to reassess their objectives and strategies. Supply chain disruptions, delayed product development, and escalated financial risks were observed among businesses engaged in electric and hybrid aircraft propulsion.

Latest Trends/Developments:

In April 2022, Bharat Heavy Electricals (BHEL) and GE Power Conversion signed an agreement to bolster the native company's capacity in developing a complete integrated electric propulsion system for Indian Navy warships. February 2022 witnessed NASA and GE Aviation collaborating to craft a hybrid electric motor with megawatt-class capabilities. Boeing, chosen by GE Aviation, will modify the aircraft for in-flight testing of the propulsion system. Key Players in the aircraft manufacturing sector aim to construct lighter planes while maintaining or enhancing their load-carrying capacity. Therefore, the use of lightweight composites by aircraft manufacturers is primarily driven by the necessity to design high-performance aircraft within weight constraints. The rapid fabrication of airplane components through 3D printing, saving time, money, and space, becomes crucial in the electric aircraft sector, propelling market growth during the forecast period.

Major Players:

-

Airbus S.A.S.

-

3W International GmbH

-

Boeing

-

Cranfield Aerospace Solutions

-

General Electric Company

-

GKN Aerospace Services Limited

-

Honeywell International Inc.

-

Israel Aerospace Industries Ltd.

-

Lockheed Martin Corporation

-

MagniX

-

Rolls-Royce Holdings plc.

-

Safran S.A.

-

Siemens AG

-

Raytheon Technologies Corporation

-

Leonardo S.p.A

-

Other Prominent Players

Chapter 1. GLOBAL ELECTRIC AND HYBRID AIRCRAFT PROPULSION MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL ELECTRIC AND HYBRID AIRCRAFT PROPULSION MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL ELECTRIC AND HYBRID AIRCRAFT PROPULSION MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL ELECTRIC AND HYBRID AIRCRAFT PROPULSION MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL ELECTRIC AND HYBRID AIRCRAFT PROPULSION MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL ELECTRIC AND HYBRID AIRCRAFT PROPULSION MARKET – By Propulsion Type

6.1. All-Electric Propulsion

6.2. Hybrid-Electric Propulsion

Chapter 7. GLOBAL ELECTRIC AND HYBRID AIRCRAFT PROPULSION MARKET – By Application

7.1. Civil Aircraft

7.2. Military Aircraft

Chapter 8. GLOBAL ELECTRIC AND HYBRID AIRCRAFT PROPULSION MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Propulsion Type

8.1.3. By Application

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Propulsion Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Propulsion Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Propulsion Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Propulsion Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL ELECTRIC AND HYBRID AIRCRAFT PROPULSION MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Airbus S.A.S.

9.2. 3W International GmbH

9.3. Boeing

9.4. Cranfield Aerospace Solutions

9.5. General Electric Company

9.6. GKN Aerospace Services Limited

9.7. Honeywell International Inc.

9.8. Israel Aerospace Industries Ltd.

9.9. Lockheed Martin Corporation

9.10. MagniX

9.11. Rolls-Royce Holdings plc.

9.12. Safran S.A.

9.13. Siemens AG

9.14. Raytheon Technologies Corporation

9.15. Leonardo S.p.A

9.16. Other Prominent Players

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global market for electric and hybrid aircraft propulsion systems reached a valuation of USD 1.98 billion in 2023.

The expected growth of the global electric and hybrid aircraft propulsion system market is forecasted to be approximately 24.61% from 2024 to 2030.

The report segments the global electric and hybrid aircraft propulsion system market based on Propulsion Type (All-Electric Propulsion, Hybrid-Electric Propulsion) and Application (Civil Aircraft, Military Aircraft).

The electric and hybrid aircraft market presents significant opportunities due to its alignment with sustainable development principles, encompassing social, environmental, and economic factors.

The COVID-19 outbreak significantly influenced the growth trajectory of the global market for electric and hybrid aviation propulsion systems. However, there has been a resurgence in demand post the easing of pandemic-related restrictions.