Egypt Renewable Energy Market Size (2025-2030)

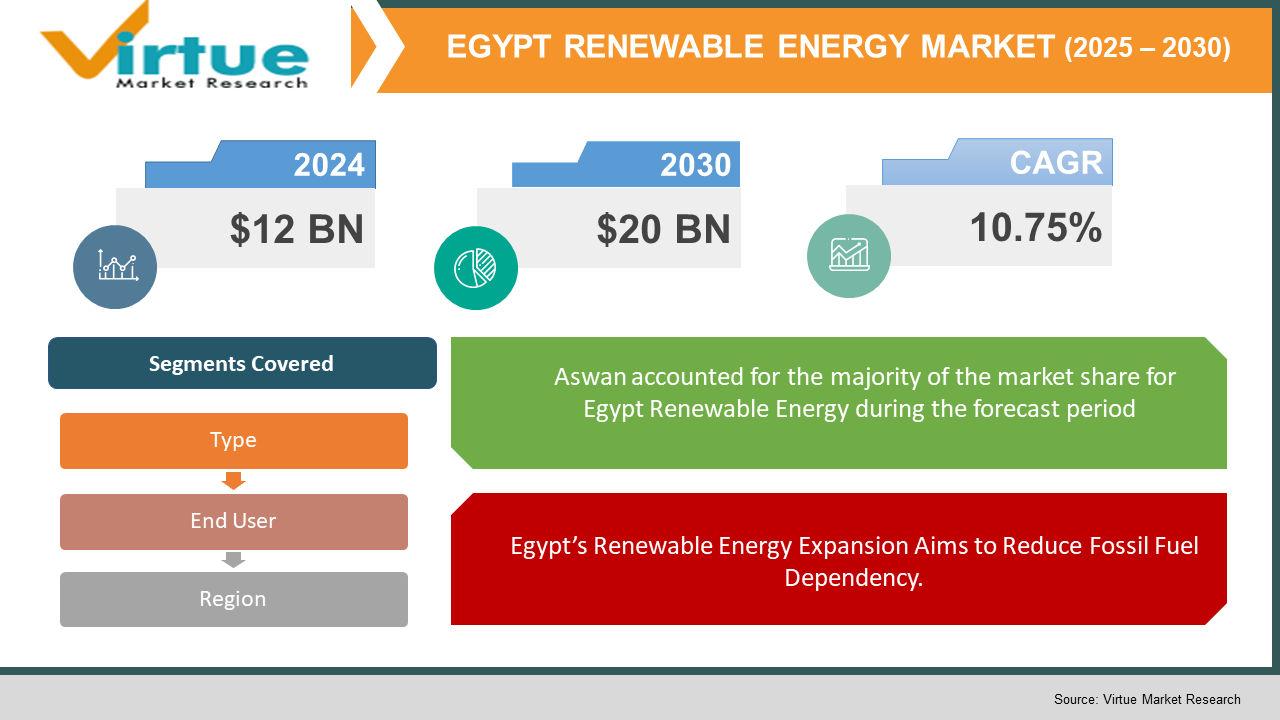

The Egypt Renewable Energy Market was valued at USD 12 billion in 2024 and is projected to reach a market size of USD 20 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 10.75%.

Renewable energy is energy obtained from natural resources like sunlight, wind, water, and biomass, which are replenished naturally. With increasing global concerns regarding climate change and energy security, the need for sustainable energy solutions has increased exponentially. The market for renewable energy is growing at a fast pace, fuelled by technological innovation, government policies, and rising investments. Nations across the globe are shifting towards clean energy to curb greenhouse gas emissions and lower dependence on fossil fuels. Egypt's renewable energy sector is picking up pace, backed by ambitious national goals, positive policies, and rich natural resources. Large-scale solar, wind, and hydropower projects are revolutionizing the energy sector, making Egypt a regional power. Along with this, advancements in green hydrogen production, energy storage, and smart grids are further driving the market's growth. With sustainability becoming a focus area, Egypt's renewable energy market is set to be an important driver of long-term economic and environmental returns.

Key Market Insights:

- The renewable energy sector is growing steadily across the world, fuelled by rising demand for clean power, advancements in technology, and policies for sustainability by governments.

- Solar and wind energy are driving the industry, as falling costs and enhanced efficiency have made them more comparable with conventional fossil fuels. Governments are spending on large-scale deployments, energy storage technologies, and grid upgrades to maximize the utilization of renewable resources.

- In Egypt, the market is growing fast because of the nation's rich solar and wind resources, encouraging policies, and robust international investment. The government seeks to have 42% of electricity come from renewables by 2035, with significant projects such as the Benban Solar Park and Gulf of Suez Wind Farm taking centre stage.

- Egypt is also becoming a possible hub for green hydrogen production, yet another investment enabler. As the economy expands, such issues as grid stability, energy storage, and funding remain, but advances in progress paint a bright outlook for renewable power in Egypt.

Egypt Renewable Energy Market Drivers:

Egypt’s Renewable Energy Expansion Aims to Reduce Fossil Fuel Dependency.

Egypt's strategic emphasis on diversifying away from imported fossil fuels, especially natural gas and oil, has been a major impetus in the rapid uptake of renewable energy sources. Traditionally reliant on fossil fuel imports to satisfy its increasing energy needs, the nation has seen the economic and strategic risks involved with volatile global oil and gas prices, geopolitical tensions, and supply chain interruptions. Investing in renewable energy would enable Egypt to diversify its energy mix, decrease the fiscal cost of fuel imports, and improve overall energy security. The government has launched ambitious policies and reforms to promote the growth of solar, wind, and hydroelectric energy, and offers incentives for local and foreign investors. Grand ventures like the Benban Solar Park and the Gulf of Suez Wind Farm embody Egypt's initiative to utilize its rich natural resource base, viz., high solar irradiance and robust coastal wind, to provide sustainable and economic electricity. The shift not only guarantees a stronger and more dependable energy supply but also lowers carbon emissions, fulfilling international sustainability imperatives. In addition, through reduced dependence on imported fossil fuels, Egypt has the potential to redirect financial resources toward infrastructure development, technological innovation, and economic expansion. Through increased renewable energy capacity, Egypt is becoming a regional clean energy leader, driving job creation, industrialization, and long-term environmental stewardship.

Egypt's commitment to international agreements like the Paris Agreement drives investments in renewable energy to reduce greenhouse gas emissions and address climate change.

Egypt's adherence to international treaties, especially the Paris Agreement, has been a key impetus to its renewable energy sector. In keeping with the world's climate objectives, Egypt has focused on lowering greenhouse gas emissions and addressing climate change using clean energy alternatives. This dedication has drawn high levels of domestic and international investment in renewable energy initiatives, encouraging the growth of solar, wind, and hydroelectric power. The government has put in place policies, incentives, and regulatory systems to foster private-sector investment, guaranteeing a shift to cleaner sources of energy. Egypt is now poised to become a regional champion of renewable energy, improving energy security and economic growth while meeting its environmental obligations.

Egypt Renewable Energy Market Restraints and Challenges:

Integrating intermittent renewable energy sources like solar and wind into the existing grid infrastructure can be complex.

Blending intermittent renewable power sources like wind and solar with Egypt's existing grid system poses a major technical challenge. Unlike traditional power stations that offer a constant and reliable electricity supply, renewable energy supply varies with the weather, the time of day, and the seasons. This variation can cause instability in the grid, voltage changes, and mismatches between supply and demand, which complicates the provision of a stable power supply. To meet these challenges, Egypt needs to invest in sophisticated grid management technology, energy storage, and smart grid infrastructure to increase flexibility and responsiveness. Battery storage systems, overhauling transmission networks, and demand-side management can all assist in balancing the grid and increasing resilience. Also, incorporating forecasting models and digital monitoring technology can assist grid operators in anticipating and managing renewable energy output fluctuations. A collaboration by the government, the utility, and private sector parties is needed to build a robust and resilient energy infrastructure with enough capacity to hold Egypt's increasing portion of renewables. Overcoming such technical hindrances enables Egypt to unlock the full potential of its renewables and guarantee the grid's stability along with its energy security for the long term.

Egypt Renewable Energy Market Opportunities:

Egypt's renewable energy sector offers tremendous opportunities fueled by positive government policies, natural resources galore, and rising investment in clean energy infrastructure. Strategically located and blessed with high levels of solar irradiation, Egypt can become a regional hub for solar energy, while the strong coastal winds make Egypt a prime location for large-scale wind farms. The ambitious renewable energy goals of the government, such as powering 42% of electricity with renewables by 2035, have drawn impressive domestic and foreign investments. Tax credits, regulatory reform, and public-private partnerships all add to the market appeal. Egypt's burgeoning population and expanding industry also add to the rising energy demand, creating opportunities for further renewable energy development. The development of green hydrogen projects and possible energy exports to Europe and Africa also offer profitable opportunities. With the use of technological innovation, digitalization, and energy storage technologies, Egypt can overcome current challenges and emerge as a leader in the world's renewable energy transition, generating economic growth, employment, and long-term sustainability.

EGYPT RENEWABLE ENERGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

10.75% |

|

Segments Covered |

By Type, end user, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Egypt |

|

Key Companies Profiled |

Vestas Wind Systems AS, Siemens Gamesa Renewable Energy SA, Scatec Solar ASA, SkyPower Ltd., and New & Renewable Energy Authority |

Egypt Renewable Energy Market Segmentation:

Egypt Renewable Energy Market Segmentation: By Type

- Hydro Power

- Wind Power

- Solar Power

- Bioenergy

- Others

Egypt's renewable energy sector is divided into hydropower, wind power, solar power, bioenergy, and others, all of which are significant to Egypt's shift toward clean energy. Hydropower has been a traditional source of energy, with the Aswan High Dam being one of the major sources of the national grid. Nevertheless, attention is being increasingly drawn towards solar power, and Egypt is capitalizing on its sheer amount of sunshine to establish megascale schemes such as the Benban Solar Park. Wind energy is also a fast-growing sector, specifically in the Gulf of Suez, where frequent gales ensure suitable conditions for vast wind farms. Bioenergy, although at the beginning of its growth trajectory, has prospects of increasing with waste-to-energy plants and biomass developments. Other renewables, such as newer technologies, geothermal, and tidal power, can potentially take off as Egypt further diversifies its energy base.

Egypt Renewable Energy Market Segmentation: By End User

- Industrial

- Residential

- Commercial

Egypt's renewable energy market is also divided by end users, such as industrial, residential, and commercial. The industrial sector is the biggest user of renewable energy, fueled by the demand for sustainable and affordable power solutions to drive manufacturing, mining, and other power-hungry industries. The residential market is witnessing the growing use of solar panels and distributed renewable energy systems, especially in rural regions where off-grid solutions are necessary for electrification. In contrast, the commercial market, such as businesses, hotels, and office complexes, is going for renewable energy solutions to minimize operational expenses, enhance sustainability profiles, and meet environmental regulations.

Egypt Renewable Energy Market Segmentation: Regional Analysis:

Egypt's renewable energy industry is geographically varied, with each area of the country contributing in its way to its clean energy development. The Upper Egypt and Aswan area has a high concentration of solar power projects with abundant solar radiation. The Gulf of Suez and the Red Sea area are the forerunners in wind energy production because of constant and strong coastal winds. Cairo and other cities are experiencing growth in distributed solar solutions for domestic and commercial applications, whereas rural and distant regions are experiencing off-grid and mini-grid renewable energy projects to enhance electricity access. As the nation continues to build its energy infrastructure, every region is poised to contribute to Egypt's renewable energy goals.

COVID-19 Impact Analysis on the Egypt Renewable Energy Market:

The COVID-19 pandemic had a two-sided effect on Egypt's renewable energy sector, disrupting it in the short run but also pushing long-term sustainability efforts forward. In the initial stages of the pandemic, supply chain disruptions, project delays, and lower workforce availability hindered the pace of renewable energy installations. Investment inflows were short-term impacted as global financial markets were uncertain, and logistical issues affected the importation of key components for solar and wind projects. But the crisis also underscored the need for energy security and robust, decentralized power solutions, leading the Egyptian government to reaffirm its commitment to renewable energy. As economic recovery plans began to take form, Egypt gave priority to green energy investments backed by international finance and policy support. The pandemic also hastened the transition to digitalization in energy management and grid modernization, facilitating improved integration of renewables. Overall, though COVID-19 presented short-term challenges, it reinforced Egypt's long-term vision for a diversified and sustainable energy sector.

Latest Trends/ Developments:

Egypt's renewable energy sector is seeing major progress, fuelled by technological advancements, policy changes, and rising global investment. The growth of big solar and wind schemes stands out among the most significant trends, with the nation proceeding aggressively with high-ambition plans such as the Benban Solar Park and the Gulf of Suez Wind Farm. These initiatives are supporting Egypt in its goal of producing 42% of its electricity from renewable sources by 2035. Another significant development is the increasing interest in green hydrogen production, with Egypt making itself a candidate for becoming a hub for hydrogen exports to Europe and Africa. Several deals have been signed with foreign investors and energy firms to build large-scale green hydrogen facilities based on the country's rich renewable energy resources. Moreover, smart grid modernization and energy storage solutions are increasingly becoming popular, responding to the problem of how to integrate intermittent renewable energy sources such as solar and wind into the national grid. The use of battery storage technologies and digital grid management systems is improving grid stability and efficiency. Foreign direct investments (FDIs) and public-private partnerships (PPPs) are also on the rise, with the Egyptian government still providing incentives, tax allowances, and welcoming regulations to woo investors. Another trend in development is the growth of decentralized renewable energy solutions, mainly for rural and off-grid populations, with mini-grids and microgrids playing a leading role in enhancing access to electricity among remote villages. In addition, corporate sustainability efforts are fueling demand for renewable energy in the commercial and industrial markets, with companies investing in on-site solar installations and entering into power purchase agreements (PPAs) to lower carbon footprints. The focus on digitalization, such as AI-based energy management, predictive maintenance of renewable assets, and blockchain-enabled energy trading platforms, is also reshaping the industry.

Key Players:

- Vestas Wind Systems AS

- Siemens Gamesa Renewable Energy SA

- Scatec Solar ASA

- SkyPower Ltd.

- New & Renewable Energy Authority

- Toyota Tsusho Corporation

- Orascom Development Holding AG

- Elsewedy Electric Co.

Chapter 1. EGYPT RENEWABLE ENERGY MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. EGYPT RENEWABLE ENERGY MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. EGYPT RENEWABLE ENERGY MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. EGYPT RENEWABLE ENERGY MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. EGYPT RENEWABLE ENERGY MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. EGYPT RENEWABLE ENERGY MARKET – By Type

6.1 Introduction/Key Findings

6.2 Hydro Power

6.3 Wind Power

6.4 Solar Power

6.5 Bioenergy

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. EGYPT RENEWABLE ENERGY MARKET – By End User

7.1 Introduction/Key Findings

7.2 Industrial

7.3 Residential

7.4 Commercial

7.5 Y-O-Y Growth trend Analysis By End User

7.6 Absolute $ Opportunity Analysis By End User , 2025-2030

Chapter 8. EGYPT RENEWABLE ENERGY MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By End User

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. EGYPT RENEWABLE ENERGY MARKET– Company Profiles – (Overview, Packaging Type Portfolio, Financials, Strategies & Developments)

9.1 Vestas Wind Systems AS

9.2 Siemens Gamesa Renewable Energy SA

9.3 Scatec Solar ASA

9.4 SkyPower Ltd.

9.5 New & Renewable Energy Authority

9.6 Toyota Tsusho Corporation

9.7 Orascom Development Holding AG

9.8 Elsewedy Electric Co.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Egypt Renewable Energy Market was valued at USD 12 billion in 2024 and is projected to reach a market size of USD 20 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 10.75%.

Egypt's focus on reducing its reliance on imported fossil fuels, particularly natural gas and oil, drives the adoption of renewable energy sources. Diversification enhances energy security and mitigates supply risks.

Based on the Service Provider, the Egypt Renewable Energy Market is segmented into Power Generation Companies, Project Developers, Grid Integration & Transmission Service Providers, and Energy Storage & Battery Solution Providers.