Edible insects Market Size (2024 – 2030)

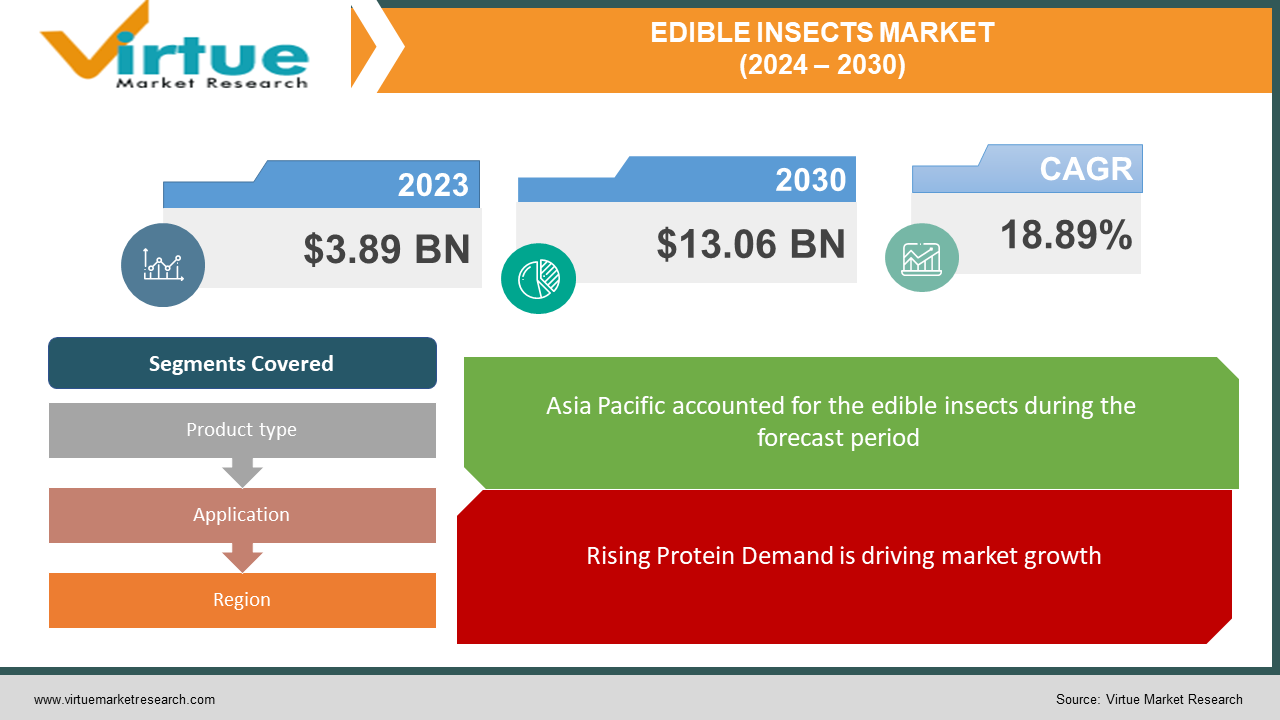

The Global Edible insects Market was valued at USD 3.89 billion in 2023 and will grow at a CAGR of 18.89% from 2024 to 2030. The market is expected to reach USD 13.06 billion by 2030.

Key Market Insights:

The edible insect market is in its early stages but buzzing with potential. Driven by environmental concerns about traditional protein sources and a growing acceptance of insects as food, the market is expected to witness significant growth. Insects boast a high protein content, require minimal resources to raise, and have a lower environmental impact compared to livestock. Asia and Latin America currently dominate the market due to their cultural acceptance of insects as food. However, Europe and North America are catching up, with increasing investment in insect farming and a growing willingness to try novel protein sources. Key market insights include the rising demand for healthy and sustainable food options, the development of innovative insect-based products like protein bars and flours, and the increasing focus on overcoming the "ick factor" through creative marketing and education. As consumer awareness and acceptance rise, the edible insect market is poised for significant expansion in the coming years.

Global Edible Insects Market Drivers:

Rising Protein Demand is driving market growth

As the global population surges towards 13 billion by 2030, securing sufficient and sustainable protein sources becomes a critical challenge. Traditional livestock farming struggles to keep pace, often contributing to environmental degradation. Here's where insects emerge as a game-changer. Packed with protein, some even exceeding the levels found in beef, insects offer a highly nutritious alternative. Moreover, they require significantly less land, water, and feed compared to conventional livestock, making them a champion of sustainability. This efficiency translates to a powerful solution for meeting the rising protein demand without placing further strain on our planet's resources. With their potential to bridge the protein gap sustainably, edible insects are poised to play a significant role in feeding the future.

Growing Awareness and Acceptance is driving the market growth

In Western cultures, the idea of insects on the dinner plate is slowly shedding its "ick factor." Educational campaigns are playing a crucial role, in dispelling myths and highlighting the environmental and nutritional benefits of entomophagy (insect consumption). Innovative food companies are further chipping away at resistance by creating delicious and visually appealing insect-based products like protein bars, cricket flour pasta, and even chocolate-coated insects. These cleverly designed options introduce adventurous eaters to the world of edible insects in a familiar and non-threatening way. As consumers become more informed and exposed to these creative culinary creations, the "ick factor" is gradually replaced with intrigue and acceptance, paving the way for edible insects to become a more normalized part of the Western diet.

Innovation in Insect Farming is driving the market growth

The world of insect farming is buzzing with innovation! Advancements in techniques are streamlining the process, making it both efficient and cost-effective to raise insects for food. This translates to exciting benefits for consumers. Vertical farming techniques allow for higher insect yields in smaller spaces, while automation minimizes manual labor and ensures consistent quality. Scientists are also exploring ways to optimize insect diets, potentially using food waste streams as a sustainable and cost-cutting measure. These innovations not only improve efficiency but also pave the way for a wider variety of insects to be farmed for food. This, in turn, leads to greater availability of insect-based products on the market, offering consumers a broader range of options to explore the exciting world of entomophagy.

Global Edible insects Market challenges and restraints:

Limited Product Variety and Availability is restricting the market growth

Currently, the edible insect market resembles a culinary work in progress. While the potential for delicious and nutritious insect-based products is vast, consumer options remain limited. This lack of variety can be a major turn-off for potential insect eaters. Imagine a world where your supermarket shelves boast just one type of fruit or vegetable - that's the current state of edible insects. This limited selection fails to cater to diverse palates and preferences, hindering the market's ability to gain widespread appeal. However, this is a hurdle that innovation can overcome. As the market grows, we can expect a wider range of insect-based products to emerge, from familiar formats like protein bars and pasta to more adventurous culinary creations. This diversity will be key to attracting a broader audience and transforming edible insects from a niche curiosity to a mainstream dietary staple.

Regulations concerning insect farming and processing are restricting the market growthNavigating the regulatory landscape of edible insects can be a real bugbear for businesses. Unlike traditional livestock, insect farming and processing for human consumption are subject to regulations that vary considerably across the globe. Some countries have well-established frameworks, while others have limited or even non-existent regulations. This uncertainty creates a challenge for companies entering the market. Unclear regulations make it difficult to plan for large-scale production and distribution, hindering investment and innovation. Furthermore, companies hoping to export their insect-based products face an additional layer of complexity, as they need to comply with the regulations of both their home country and the intended destination. Streamlining and harmonizing regulations across different regions would be a major step forward for the edible insect market, fostering a more predictable and supportive environment for businesses to thrive.

Market Opportunities:

The edible insects market is buzzing with exciting opportunities. Growing concerns about environmental impact and resource depletion are propelling insects as a sustainable, protein-rich alternative to traditional livestock. With a projected CAGR exceeding 18%, the market offers immense potential. Rising health consciousness is creating a demand for insect-based flours, snacks, and protein bars, appealing to consumers seeking convenient and nutritious options. The Asia Pacific region, with its adventurous palates and high growth rate, presents a lucrative market for innovative insect-based products. As regulatory hurdles ease and consumer acceptance increases, the future looks bright for insect-based food ventures.

EDIBLE INSECTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

18.89% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ÿentomophagy, Exo Protein, BugBurger, Chirps Chips, Littlehoppers, Next Millennium Farms, serangga, Proti-Farm, Tiny Farms, EntoCycle |

Edible insects Market Segmentation - by Product Type

-

Whole Insects

-

Insect Flour

-

Insect Oil

In the world of edible insects, insect flour and powder reign supreme. This versatile ingredient takes the crown due to its user-friendliness and vast application possibilities. Unlike whole insects, which cater to the adventurous with their roasted, dried, or flavored forms, insect flour seamlessly integrates into familiar food products. Imagine protein bars with a cricket flour boost, or cookies getting a nutritional upgrade with a sprinkle of insect powder. This ease of incorporation makes insect flour a game-changer, allowing even non-adventurous eaters to reap the nutritional benefits of insects without encountering the "ick factor" associated with whole insects. While whole insects and insect oil hold promise for niche markets, insect flour, and powder dominate the edible insect market, paving the way for a more approachable and mainstream experience

Edible insects Market Segmentation - By Application

-

Human Consumption

-

Animal Feed

The edible insect market is primarily driven by human consumption, with a clear focus on developing innovative and appealing food products for people. This segment holds the most significant potential for market growth, fueled by the rising demand for healthy, sustainable protein sources and the increasing willingness of consumers to explore new culinary experiences. While insects are showing promise as a sustainable protein source for animal feed in the pet food and aquaculture industries, this application currently occupies a smaller market share. The human consumption segment is the main engine propelling the edible insect market forward, with its focus on creating delicious and convenient insect-based food options that can compete with traditional protein sources.

Edible insects Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The edible insect market is a fascinating tapestry woven from regional preferences and growth trajectories. Currently, Asia and Latin America hold the dominant market share. Their historical and cultural acceptance of entomophagy (insect consumption) has fueled a strong foundation for this industry. However, the fastest growth is projected to occur in North America and Europe. As environmental concerns and health consciousness rise in these regions, consumers are becoming more open to the idea of edible insects. This, coupled with increasing investment in insect farming and innovative product development, positions North America and Europe as the future battlegrounds for market dominance in the exciting world of edible insects.

COVID-19 Impact Analysis on the Global Edible Insects Market

The COVID-19 pandemic had a mixed impact on the global edible insects market. On the one hand, supply chains faced disruptions due to lockdowns and travel restrictions, hindering production and distribution. Additionally, restaurant closures led to a decline in the out-of-home consumption of insect-based snacks. However, the pandemic also presented unexpected opportunities. Heightened awareness of food system vulnerabilities increased interest in sustainable protein sources, potentially boosting the image of edible insects. Moreover, with people cooking more at home, there was a potential rise in the exploration of novel ingredients like insect-based flours for home cooking. Overall, COVID-19's long-term effect remains to be seen. While initial challenges existed, the focus on sustainable food systems might position the edible insect market for future growth.

Latest trends/Developments

The edible insect market is experiencing a wave of exciting developments. One major trend is the rise of insect-based flours and powders used in baking and cooking. These products offer a nutritious and sustainable alternative to traditional flours, appealing to health-conscious consumers and environmentally responsible businesses. Additionally, there's a growing focus on convenience and accessibility. Insect-based protein bars and snacks are gaining traction, making it easier for people to incorporate insects into their diets. Notably, the Asia Pacific region is leading the charge in innovative flavors and textures. Manufacturers are experimenting with various insect species and incorporating them into familiar food formats like chips and cookies to entice adventurous palates. Furthermore, advancements in vertical farming technology are streamlining insect production, potentially leading to lower costs and wider availability of edible insects in the future.

Key Players:

-

Ÿentomophagy

-

Exo Protein

-

BugBurger

-

Chirps Chips

-

Littlehoppers

-

Next Millennium Farms

-

serangga

-

Proti-Farm

-

Tiny Farms

-

EntoCycle

Chapter 1. Edible Insects Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Edible Insects Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Edible Insects Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Edible Insects Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Edible Insects Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Edible Insects Market – By Product Type

6.1 Introduction/Key Findings

6.2 Whole Insects

6.3 Insect Flour

6.4 Insect Oil

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Edible Insects Market – By Application

7.1 Introduction/Key Findings

7.2 Human Consumption

7.3 Animal Feed

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Edible Insects Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Edible Insects Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Ÿentomophagy

9.2 Exo Protein

9.3 BugBurger

9.4 Chirps Chips

9.5 Littlehoppers

9.6 Next Millennium Farms

9.7 serangga

9.8 Proti-Farm

9.9 Tiny Farms

9.10 EntoCycle

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Edible Insect Market was valued at USD 3.89 billion in 2023 and will grow at a CAGR of 18.89% from 2024 to 2030. The market is expected to reach USD 13.06 billion by 2030.

Innovation in Insect Farming, Growing Awareness, and Acceptance, and Rising Protein Demand are the reasons that are driving the market.

Based on Product Type it is divided into three segments – Whole Insects, Insect Flour, Insect Oil

Asia-Pacific is the most dominant region for the Edible insects Market.

Ÿentomophagy, Exo Protein, BugBurger, Chirps Chips