Earthmoving Equipment Market Size (2025-2030)

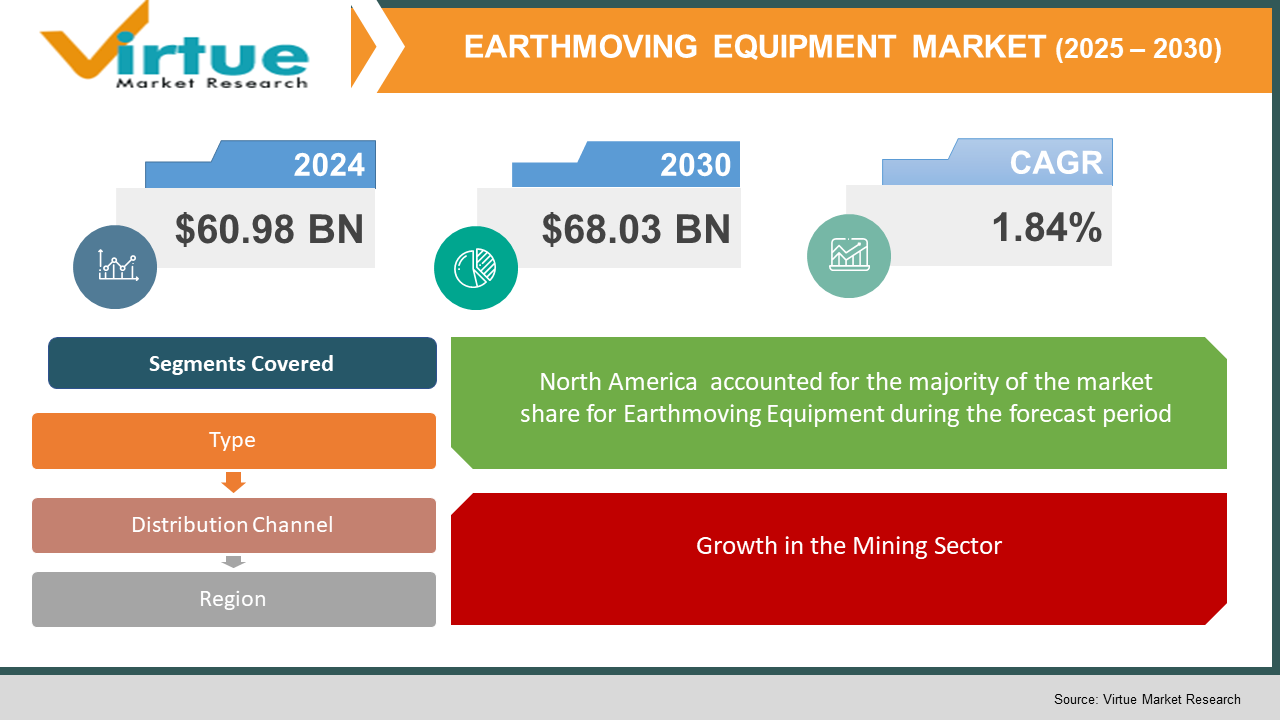

The Earthmoving Equipment Market was valued at USD 60.98 Billion in 2024 and is projected to reach a market size of USD 68.03 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 1.84%.

The earthmoving equipment market encompasses the manufacturing, sales, and rental of a broad range of machinery used for moving and shaping earth. This equipment is essential for various construction, mining, and infrastructure projects, playing a crucial role in site preparation, excavation, material handling, and land development. The market includes a diverse range of machinery, such as excavators, bulldozers, loaders, backhoes, skid steers, motor graders, and dump trucks. These machines vary in size, power, and functionality, catering to different project requirements. The market is driven by factors such as global infrastructure development, urbanization, mining activities, and increasing construction spending. The market is characterized by a mix of large multinational manufacturers and smaller regional players. Technological advancements, such as the integration of electronics, hydraulics, and automation, are transforming the earthmoving equipment industry, improving machine performance, fuel efficiency, and operator safety. The increasing focus on sustainability and emission reduction is also influencing the market, leading to the development of more environmentally friendly equipment. The earthmoving equipment market is closely tied to the overall health of the construction and mining industries, with fluctuations in these sectors directly impacting equipment demand. The market also involves a significant rental segment, providing cost-effective solutions for short-term projects or smaller contractors.

Key Market Insights:

- The construction sector accounts for approximately 62% of total earthmoving equipment demand.

- 30% of all earthmoving equipment sold in 2024 will be used in mining operations.

- More than 75% of new earthmoving machines feature telematics and IoT connectivity for real-time performance tracking.

- Hydraulic excavators remain the most in-demand earthmoving equipment, accounting for over 35% of total unit sales.

- Sales of electric and hybrid earthmoving equipment are expected to grow by 48% year-over-year in 2024.

- Over 90% of manufacturers have incorporated AI-based predictive maintenance in their equipment lines in 2024.

- Over 70% of construction firms are using earthmoving equipment with automation features.

- The resale market for used earthmoving machinery is valued at $25 billion in 2024.

- Sales of tracked earthmoving equipment are expected to grow by 19% due to increasing demand for off-road performance.

- Hybrid diesel-electric bulldozers are expected to reduce fuel costs by 35% compared to traditional models.

- The average operating lifespan of modern earthmoving equipment has increased to 15 years, up from 12 years a decade ago.

- Over 200,000 units of excavators are expected to be sold globally in 2024.

Market Drivers:

Global Infrastructure Development and Urbanization is Driving the Market Growth:

Rapid urbanization and the increasing need for modern infrastructure are primary drivers of the earthmoving equipment market. Governments worldwide are investing heavily in infrastructure projects, including roads, bridges, airports, railways, and urban development. These projects require significant earthmoving activities, driving the demand for excavators, bulldozers, loaders, and other related machinery. The growing population and the expansion of cities are also contributing to the need for new housing, commercial buildings, and public facilities, further fueling the demand for earthmoving equipment. The increasing focus on improving transportation networks and connectivity also drives the market. The development of smart cities and sustainable infrastructure projects further supports the demand for advanced and efficient earthmoving equipment.

Growth in the Mining Sector:

The mining industry is a significant consumer of earthmoving equipment, utilizing these machines for extracting minerals and ores. The increasing global demand for raw materials, driven by industrialization and technological advancements, is boosting mining activities worldwide. This, in turn, is driving the demand for large and heavy-duty earthmoving equipment, such as excavators, loaders, and dump trucks. The exploration of new mining sites and the expansion of existing mines also contribute to market growth. The increasing use of automation and advanced technologies in mining operations is further driving the demand for sophisticated earthmoving equipment. The growing focus on mine safety and environmental sustainability is also influencing the development of new and improved earthmoving machinery.

Market Restraints and Challenges:

The earthmoving equipment market is closely tied to the performance of the construction and mining industries. These sectors are cyclical and can be affected by economic downturns, leading to fluctuations in equipment demand. A slowdown in construction projects or a decline in mining activities can significantly impact the sales and rentals of earthmoving machinery. Global economic conditions, commodity prices, and government policies can all influence the performance of these industries and, consequently, the earthmoving equipment market. The need for companies to manage these cyclical fluctuations and adapt to changing market conditions is a key challenge. Earthmoving equipment represents a significant capital investment for construction and mining companies. The high purchase price of these machines can be a barrier for smaller contractors or companies with limited financial resources. Access to financing and credit can also be a challenge, particularly during economic downturns. The need for companies to carefully manage their capital expenditures and secure financing for equipment purchases is a key consideration. The increasing availability of rental options and leasing programs is helping to mitigate this challenge for some companies.

Market Opportunities:

The earthmoving equipment industry is witnessing rapid technological advancements, creating opportunities for manufacturers to develop and introduce new and improved machines. The integration of electronics, hydraulics, and automation is leading to the development of more efficient, productive, and safer equipment. The increasing use of telematics, GPS, and other digital technologies is enabling better fleet management and improved operational efficiency. The development of electric and hybrid earthmoving equipment is also gaining traction, driven by the focus on reducing emissions and improving fuel efficiency. The ongoing research and development efforts in areas such as artificial intelligence, machine learning, and autonomous operation are expected to further transform the industry. The rental segment of the earthmoving equipment market is experiencing growth, providing cost-effective solutions for short-term projects or smaller contractors. Renting equipment allows companies to avoid large capital expenditures and provides flexibility to access specialized machinery for specific tasks. The increasing availability of rental options and the convenience of renting equipment are driving this trend. The growth of the sharing economy and the increasing focus on asset utilization are also contributing to the growth of the rental market. The rental segment offers opportunities for both equipment manufacturers and rental companies.

EARTHMOVING EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

1.84% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Caterpillar, Komatsu, Volvo Construction Equipment, Hitachi Construction Machinery, Liebherr, John Deere Construction & Forestry |

Earthmoving Equipment Market Segmentation:

Earthmoving Equipment Market Segmentation by Type:

- Excavators

- Bulldozers

- Loaders

- Backhoes

- Skid Steer Loaders

- Motor Graders

- Dump Trucks

- Other Equipment (e.g., compactors, trenchers)

Most Dominant Type: Excavators are the most dominant type due to their versatility and wide range of applications in construction, mining, and other earthmoving activities.

Fastest-Growing Type: Electric and hybrid earthmoving equipment are experiencing rapid growth due to the increasing focus on sustainability and emission reduction.

Earthmoving Equipment Market Segmentation by Distribution Channel:

- Dealerships

- Direct Sales

- Online Platforms

- Rental Companies

Most Dominant Distribution Channel: Dealerships remain the most dominant channel due to their established networks, after-sales service capabilities, and ability to provide customized solutions.

Fastest-Growing Distribution Channel: Online platforms are experiencing rapid growth due to the convenience and accessibility they offer to customers.

Earthmoving Equipment Market Segmentation by Regional Analysis:

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Most Dominant Region: Historically, North America and Europe have been dominant markets. However, the Asia Pacific region is rapidly becoming a major player. North America represents a significant market due to its large construction and mining industries and ongoing infrastructure development.

Fastest-Growing Region: The Asia Pacific region is projected to be the fastest-growing market due to the factors mentioned above. The Asia Pacific region is expected to witness significant growth due to rapid urbanization, increasing infrastructure investment, and growing mining activities

COVID-19 Impact Analysis on the Market:

The COVID-19 pandemic had a complex and varied impact on the earthmoving equipment market. Initially, lockdowns and restrictions on construction activities in many parts of the world led to a decline in equipment demand. Supply chain disruptions also impacted the availability of components and finished machines. However, as economies recovered and governments implemented stimulus measures, including infrastructure spending, the market began to rebound. The pandemic also highlighted the importance of infrastructure resilience and the need for investments in healthcare facilities, transportation networks, and other essential infrastructure, which supported the demand for earthmoving equipment. The shift towards e-commerce and increased demand for logistics and warehousing also created opportunities for certain types of earthmoving equipment, such as material handling equipment. As the global economy continues to recover, the earthmoving equipment market is expected to continue its growth trajectory, driven by long-term trends such as infrastructure development, urbanization, and mining activities. The pandemic also accelerated the adoption of digital technologies in the construction and mining industries, which is influencing the development and use of earthmoving equipment.

Latest Trends and Developments:

location, and maintenance needs. This data can be used to optimize fleet management, improve fuel efficiency, and prevent downtime. The increasing focus on reducing emissions and promoting sustainability is driving the development and adoption of electric and hybrid earthmoving equipment. Manufacturers are investing in electric powertrains, battery technology, and alternative fuels such as hydrogen to power their machines. This trend is expected to accelerate as regulations become stricter and demand for cleaner equipment increases.

The integration of automation and autonomous technologies is transforming the earthmoving equipment industry. Manufacturers are developing machines with advanced features such as GPS-guided operation, remote control, and even fully autonomous capabilities. These technologies improve productivity, safety, and efficiency on construction and mining sites.

Connectivity and telematics are becoming increasingly important features in earthmoving equipment. These technologies allow for real-time monitoring of machine performance,

Key Players in the Market:

- Caterpillar

- Komatsu

- Volvo Construction Equipment

- Hitachi Construction Machinery

- Liebherr

- John Deere Construction & Forestry

- CNH Industrial (Case Construction Equipment, New Holland Construction)

- Hyundai Construction Equipment

- Doosan Infracore

- Kobelco Construction Machinery

- Sumitomo Construction Machinery

- Sany Heavy Industry

- XCMG

- LiuGong

- Zoomlion

Chapter 1. EARTHMOVING EQUIPMENT MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. EARTHMOVING EQUIPMENT MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. EARTHMOVING EQUIPMENT MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. EARTHMOVING EQUIPMENT MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. EARTHMOVING EQUIPMENT MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. EARTHMOVING EQUIPMENT MARKET – By Type

6.1 Introduction/Key Findings

6.2 Excavators

6.3 Bulldozers

6.4 Loaders

6.5 Backhoes

6.6 Skid Steer Loaders

6.7 Motor Graders

6.8 Dump Trucks

6.9 Other Equipment (e.g., compactors, trenchers)

6.10 Y-O-Y Growth trend Analysis By Type

6.11 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. EARTHMOVING EQUIPMENT MARKET – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Dealerships

7.3 Direct Sales

7.4 Online Platforms

7.5 Rental Companies

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel , 2025-2030

Chapter 8. EARTHMOVING EQUIPMENT MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Distribution Channel

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Distribution Channel

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Distribution Channel

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Distribution Channel

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Distribution Channel

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. EARTHMOVING EQUIPMENT MARKET – Company Profiles – (Overview, Packaging Type Portfolio, Financials, Strategies & Developments)

9.1 Caterpillar

9.2 Komatsu

9.3 Volvo Construction Equipment

9.4 Hitachi Construction Machinery

9.5 Liebherr

9.6 John Deere Construction & Forestry

9.7 CNH Industrial (Case Construction Equipment, New Holland Construction)

9.8 Hyundai Construction Equipment

9.9 Doosan Infracore

9.10 Kobelco Construction Machinery

9.11 Sumitomo Construction Machinery

9.12 Sany Heavy Industry

9.13 XCMG

9.14 LiuGong

9.15 Zoomlion

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The growth of the Earthmoving Equipment Market is driven by rapid urbanization, increasing infrastructure investments, rising mining activities, technological advancements, automation, and the shift toward fuel-efficient and electric machinery. The demand for smart, IoT-integrated equipment, rental services, and sustainable construction solutions further accelerates market expansion across multiple industries.

The main concerns in the Earthmoving Equipment Market include high initial costs, fluctuating raw material prices, supply chain disruptions, stringent environmental regulations, rising fuel expenses, labour shortages, increasing demand for automation, equipment maintenance costs, operational safety risks, and market competition from rental services and used equipment sales.

Caterpillar, Komatsu, Volvo Construction Equipment, Hitachi Construction Machinery, Liebherr, John Deere Construction & Forestry

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.