E-Invoicing Market Size (2024 – 2030)

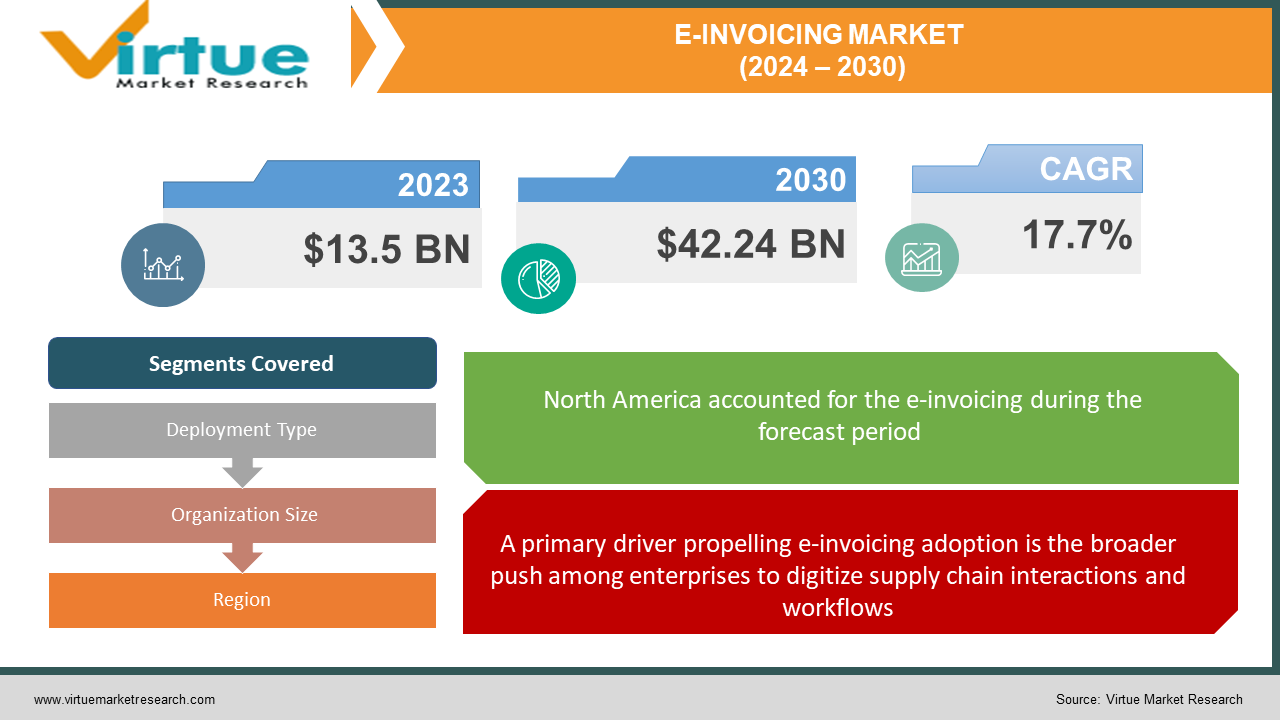

The E-Invoicing Market was valued at USD 13.5 Billion and is projected to reach a market size of USD 42.24 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 17.7%.

DOWNLOAD SAMPLE BROCHURE OF THIS REPORT

The automatic generation, sharing, and processing of digitally formatted invoice documents between a supplier and a buyer is known as e-invoicing. Paperless invoicing is made possible by e-invoicing, which also usually offers process automation advantages including purchase order, payment, and invoice auto-matching. Networked platforms also make real-time auditing and tracking easier.

The main advantages of electronic invoicing for suppliers are shorter payment cycles due to increased automation in the reconciliation process, decreased operational expenses by eliminating human labour and postal costs, and improved security via digital invoice records. Improved cash flow visibility throughout the procure-to-pay cycle and the ability to integrate e-invoicing data with other systems, such as accounting software, are two benefits for buyers.

Business-to-business and business-to-government invoice flows, including supplier payments and tax remittances, can both be included in e-invoicing. Supplier requirements are a means by which government organization's and large enterprises are driving adoption. E-invoicing increases efficiency for SMEs as well, but they could need training and subsidized on-ramps.

Key Market Insights:

Several compelling factors are driving the adoption of e-invoicing solutions, including government mandates, supply chain digitization efforts, and the need for greater financial control and efficiency. E-invoicing addresses pressing pain points around manual invoice processing costs and lack of real-time spend visibility. A core insight catalyzing uptake is that inefficient manual processing of paper invoices across accounts payable and receivable introduces significant hidden costs due to document errors, leakage, and latency.

Large organizations can waste millions annually on manual invoice handling. E-invoicing provides direct cost reduction, productivity gain, and working capital benefits. From a supplier perspective, e-invoicing permits faster payment cycles and cash flow through more automated reconciliation and settlement.

For buyers, e-invoicing improves visibility into inbound spend and outlay timing. It also facilitates better compliance with tax regulations when integrated with reporting systems. These advantages incentivize large corporations and government entities to use supplier mandates to accelerate adoption. Once onboarded, the ROI benefits become readily apparent to suppliers as well, creating a self-reinforcing cycle. SMEs gain efficiency but require subsidized onboarding and training.

E-Invoicing Market Drivers:

A primary driver propelling e-invoicing adoption is the broader push among enterprises to digitize supply chain interactions and workflows.

The broader momentum among enterprises across industries to digitize and streamline supply chain interactions and workflows is a prime catalyst driving adoption of e-invoicing solutions. Manual paper-based invoicing introduces major hidden costs and inefficiencies within supply chains. Lost documents, data entry errors, and lag times reconciling invoices with purchase orders and payments create significant administrative burdens.

E-invoicing provides an opportunity to directly reduce those costs through automation. Suppliers gain multiple benefits from e-invoicing including faster payment cycles through more automated reconciliation, lower operating expenses by eliminating manual workflows, and fewer errors enabling quicker order matching.

For buying organizations, e-invoicing improves visibility into cash outlay and upcoming liabilities, spend control across procurement, and integration with accounting systems. These compelling advantages incentivize both sides of supply chain transactions to embrace the transition once the initial onboarding obstacles are overcome. Leading organizations are increasingly mandating e-invoicing adoption across their supplier networks as part of broader initiatives to digitize procurement, logistics, and vendor management processes.

Another important factor contributing to the rise in the use of e-invoicing is regulatory compliance.

Regulatory compliance is another key driver behind the growth in e-invoicing adoption. Governments around the world are enacting e-invoicing mandates and guidelines to increase tax compliance and transparency. For example, Latin American countries such as Brazil, Mexico, Chile, and Argentina have passed reforms requiring companies to issue electronic tax invoices.

The European Union also enacted its B2G e-invoicing directive in 2017 making e-invoicing mandatory for public procurement activities. Such policy pushes compel companies to implement e-invoicing to remain compliant and qualified for public contracts.

E-invoicing additionally helps firms comply with environmental regulations as it supports sustainability initiatives to reduce paper waste and carbon emissions. As regulatory oversight continues to increase globally, e-invoicing provides a means for corporations to improve compliance, avoid penalties, and demonstrate social responsibility.

Unlock Market Insights: Get A FREE Sample Report Today!

E-Invoicing Market Restraints and Challenges:

When evaluating e-invoicing systems, the two main concerns for businesses are still data security and implementation costs.

Data security remains one of the top concerns for companies considering e-invoicing solutions. With invoice data transmitted and stored digitally, there is always the risk of cyberattacks, data breaches, and invoice fraud. Hackers could intercept invoice data and manipulate it for financial fraud or steal sensitive customer information. Companies may hesitate to adopt e-invoicing due to fears over data privacy and not wanting to put customer information at risk. Guaranteeing the security of data both in transit and storage requires investments in encryption, access controls, and other IT safeguards. Implementation costs and complexities present another adoption hurdle.

While e-invoicing promises long-term benefits, the initial setup can entail significant costs. Transitioning from paper to digital invoices requires investments in new software, integration with existing systems like ERPs, add-on features like digital signature capabilities, and user training. Small suppliers may lack the financial resources or IT staff required for a large-scale rollout. The fragmented e-invoicing vendor landscape also creates complexities in selecting and implementing solutions across disparate buyer-supplier ecosystems.

E-Invoicing Market Opportunities:

The growth of the global e-invoicing market presents several lucrative opportunities across areas like sustainability, analytics, and expanding into new geographies and segments. Two of the biggest areas of opportunity are integration of e-invoicing into procure-to-pay workflows and leveraging the technology for supply chain financing. Procure-to-pay (P2P) automation is gaining steam, enabling seamless management of procurement workflows from purchase requisitions to invoice payment. Integrating e-invoicing capabilities into P2P systems creates significant opportunities to further optimize invoice processing.

E-invoicing improves visibility across the entire cycle, from receipt and validation to reconciliation. It also enhances connectivity between buyers and suppliers within P2P platforms. Vendors like SAP Ariba and others now provide integrated P2P and e-invoicing solutions for added efficiency gains.

Automating the handoff of invoice data from e-invoicing systems directly into P2P workflows eliminates manual steps and reduces cycle times. AP teams gain significant time savings by removing document handling and data entry. Overall, e-invoicing integration creates digital continuity that maximizes the benefits of P2P automation.

Another major opportunity is using e-invoicing infrastructure for supply chain financing programs. E-invoicing provides real-time visibility into invoice status and timing while also ensuring the authenticity of supplier invoices. This makes e-invoicing a natural backbone for dynamic discounting and supplier finance models. By sharing invoice data, buyers can offer early payment discounts to suppliers in return for accelerated invoice settlement. The immediacy and rich data of e-invoices enables innovative financing products. Financing providers can assess requests and release funding faster. Small suppliers benefit from accelerated access to capital. Large buyers improve their working capital by optimizing payment schedules. Startups like Taulia, Prime Revenue, and C2FO now offer programs leveraging the e-invoicing and supply chain financing synergy. Geographic expansion also provides growth opportunities as adoption spreads in emerging markets. Developing economies like Southeast Asia and Africa have fragmented financial systems primed for e-invoicing disruption. Younger demographics in these regions are eager to embrace digital payments capabilities.

E-INVOICING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17.7% |

|

Segments Covered |

By Deployment Type, Organization Size, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SAP Ariba, Oracle, Coupa Software, Trade shift, Basware, Esker, Bill.com |

SEGMENTATION ANALYSIS

E-Invoicing Market Segmentation: By Deployment Type

-

On-premises

-

Cloud-based

On-premises deployments account for the largest share of the e-invoicing market at approximately 60% as of 2023. Large enterprises and multinational corporations often opt for on-premises models to maintain tighter control over systems and data security. On-premises also allows deeper customization to a company's specific workflows and integrations with existing ERPs.

However, cloud-based e-invoicing is the faster growing segment, forecast to reach a 50% market share by 2026. Cloud-based e-invoicing provides easier scalability, quicker implementation times, and continuous updates. The cloud model is appealing to small and medium businesses that want to avoid large upfront investments and internal IT management burdens. Cloud deployment shifts the technical responsibilities onto vendors while providing 24/7 uptime and availability.

Companies pay for e-invoicing on a subscription basis, turning it into an operating expense rather than capital expenditure. Integration capabilities between cloud e-invoicing platforms and various accounting/ERP systems have improved significantly. This makes cloud models more viable for larger enterprises. Cloud also supports rolling out e-invoicing across different countries and subsidiaries more easily compared to on-premises.

E-Invoicing Market Segmentation: By Organization Size

-

Large Enterprises

-

Small & Medium-Sized Enterprises (SMEs)

Small and medium businesses currently represent the largest share of the e-invoicing market at approximately 65% as of 2023. The large volume of SMBs globally that issue and process invoices contributes to this significant market share.

However, large enterprises are the faster growing segment projected to account for over 50% of the market by 2025. The appetite for e-invoicing among large corporations and multinational companies is accelerating as they look to drive greater efficiency, cost savings, and regulatory compliance across large transaction volumes and complex supply chains. Large enterprises also have more resources to invest in digitization initiatives.

For small and medium enterprises, e-invoicing provides an affordable way to move away from paper-based processes while also keeping up with compliance mandates. The availability of simple, low-cost cloud-based e-invoicing solutions catered to SMB needs makes adoption easier. SMBs still represent the bulk of e-invoicing users, but large enterprises are becoming a primary engine of growth. Their appetite to digitize global procurement workflows at scale is accelerating e-invoicing innovation and expansion.

E-Invoicing Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America holds 30-35% global market share in 2023. The US and Canada are well-positioned for e-invoicing growth given their technological maturity and high invoice volumes. Early adoption of procurement automation lays the groundwork. Europe accounts for 25-30% market share, making it a dominant region presently. Adoption is strong across the UK, Nordics, Germany, Italy, and France. The EU’s push for e-invoicing in public procurement and B2G transactions drives consistent growth. Asia Pacific currently has 15-20% market share but is projected to reach 30% by 2026, making it the fastest growing region. Markets like China, India, Indonesia, and Malaysia are primed for e-invoicing disruption. Young demographics and mobile uptake propel digital payments. Latin America makes up 10-15% market share presently. Mexico, Brazil, Argentina, Colombia and Chile are growing rapidly thanks to government e-invoicing mandates and fintech innovations. The region is steadily moving away from paper-based invoicing. Middle East and Africa has around 5% market share. UAE and Saudi Arabia are growth markets for e-invoicing due to government smart city and e-governance initiatives. South Africa is also an emerging market as B2B processes digitize.

COVID-19 Impact Analysis on the E-Invoicing Market:

The COVID-19 pandemic has affected the global e-invoicing business in a variety of ways, increasing adoption in some areas while creating challenges for implementation in others. The market has on the whole, held up well under COVID, with growing interest in e-invoicing being driven by the broader trend of digitalization. Positively, several businesses hastened their transition away from paper-based processes due to the realities of COVID-19's work-from-home and social distancing policies. E-invoicing offered a means of digitizing the creation and sharing of invoices because staff members were unable to access physical offices or print invoices. This supported remote operations. During the pandemic, a lot of companies increased or used e-invoicing expressly to modify their accounts receivable and payment operations. E-invoicing interest was further heightened by COVID-19, which also brought touchless procure-to-pay procedures and B2B payments to the forefront of attention. During the epidemic, invoice fraud increased, which further highlighted the need for digital security. Here, electronic invoicing offers the required audit trails, legitimacy, and authenticity of invoices. These elements helped to facilitate the shift away from dangerous paper-based invoicing that were prone to fraud.

Latest Trends/ Developments:

E-invoicing is becoming integrated into broader procure-to-pay (P2P) platforms that manage the full sequence of procurement workflows. This allows seamless handoff of invoice data to payment reconciliation. Vendors like SAP Ariba, Coupa and Buyer Quest offer integrated P2P e-invoicing capabilities. Solutions are emerging to leverage the richness of e-invoice data for supply chain financing programs like dynamic discounting. By sharing e-invoice information, buyers can offer early payment discounts in exchange for faster settlement. Startups like Taulia, Prime Revenue and C2FO are tying e-invoicing into financing services. E-invoicing is converging with accounts payable automation functionality like 3-way invoice matching, approval routing and payment disbursements. AP automation maximizes the back-end benefits of e-invoicing data.

Key Players:

-

SAP Ariba

-

Oracle

-

Coupa Software

-

Trade shift

-

Basware

-

Esker

-

Bill.com

Chapter 1. E-Invoicing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. E-Invoicing Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. E-Invoicing Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. E-Invoicing Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. E-Invoicing Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. E-Invoicing Market – By Deployment Type

6.1 Introduction/Key Findings

6.2 On-premises

6.3 Cloud-based

6.4 Y-O-Y Growth trend Analysis By Deployment Type-

6.5 Absolute $ Opportunity Analysis By Deployment Type-, 2024-2030

Chapter 7. E-Invoicing Market – By Organization Size

7.1 Introduction/Key Findings

7.2 Large Enterprises

7.3 Small & Medium-Sized Enterprises (SMEs)

7.4 Y-O-Y Growth trend Analysis By Organization Size

7.5 Absolute $ Opportunity Analysis By Organization Size, 2024-2030

Chapter 8. E-Invoicing Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Deployment Type-

8.1.3 By Organization Size

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Deployment Type-

8.2.3 By Organization Size

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Deployment Type-

8.3.3 By Organization Size

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Deployment Type-

8.4.3 By Organization Size

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Deployment Type-

8.5.3 By Organization Size

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. E-Invoicing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 SAP Ariba

9.2 Oracle

9.3 Coupa Software

9.4 Trade shift

9.5 Basware

9.6 Esker

9.7 Bill.com

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

E-invoicing with automatic data entry, validations, and matching significantly decreases the likelihood of errors, preventing costly penalties or rework. Time spent on creating, printing, mailing, filing, and correcting traditional invoices is drastically reduced or eliminated, freeing employees for more value-add tasks.

Initial setup fees for advanced solutions or migration of existing systems can pose budgeting challenges, particularly for smaller enterprises. Transitioning staff from manual processes might require initial training and time spent adjusting to the new platform.

S SAP Ariba, Oracle, Coupa Software, Trade shift, Basware, Esker, Bill.com.

North America holding currently holds the largest market share, estimated around 35%.

Asia Pacific exhibits the fastest growth, driven by its increasing population, expanding economy.