E-Cigarette Market Size (2023 – 2030)

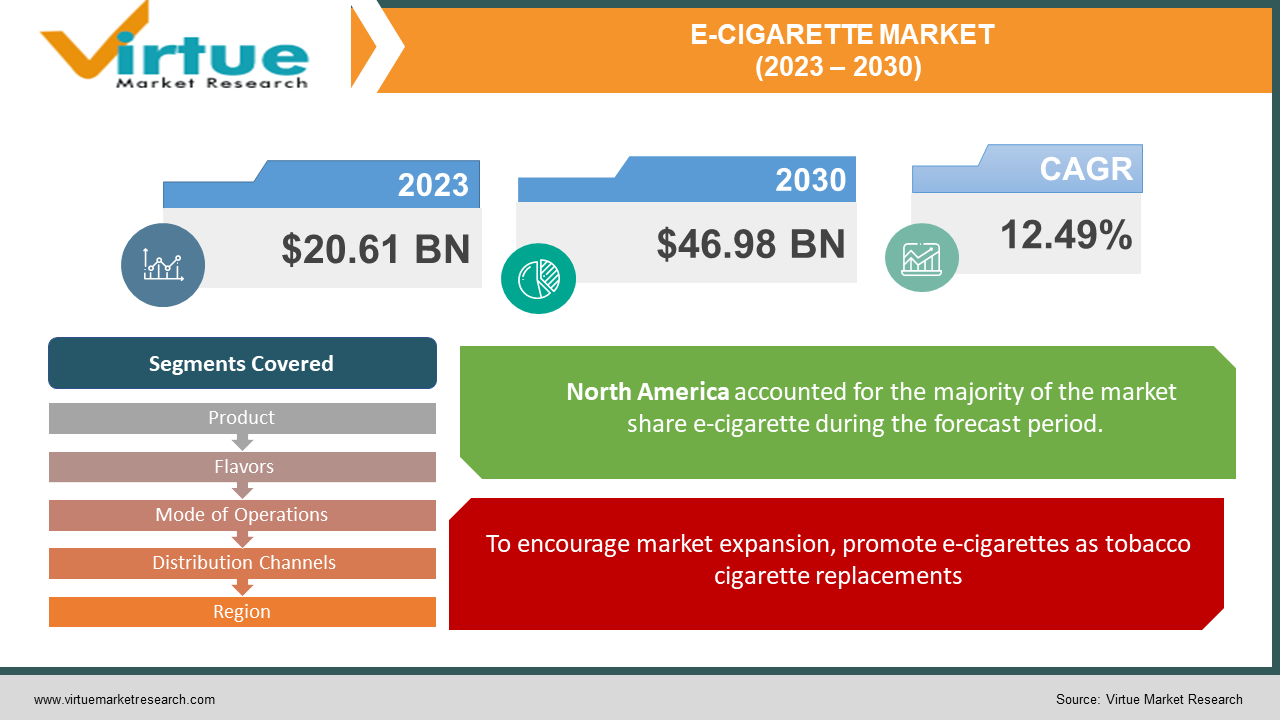

The Global E-Cigarette Market is valued at USD 20.61 billion in 2023 and is projected to reach a market size of USD 46.98 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 12.49%.

An e-cigarette is a version of a cigarette that includes tobacco. E-cigarettes also called vapor pens have a battery that heats a liquid to produce an aerosol. Unlike water vapor, e-cigarettes also contain nicotine extracted from tobacco along, with substances like chemicals, flavorings, and propylene glycol. The younger generation has shown interest in these devices due to clever marketing strategies employed by e-cigarette manufacturers. However recent studies indicate that even brands claiming to be nicotine-free may still have amounts of the addictive substance present. Despite the expansion of the e-cigarette industry it faces challenges and obstacles related to recent research findings, on their safety. Throughout the projected time frame the popularity of e-vapes is expected to keep increasing; however, it might encounter restrictions compared to previous years.

Key Market Insights:

According to reports, from the World Health Organization (WHO) over 1.27 billion individuals worldwide are addicted to smoking, which is widely recognized as detrimental, to health in the term.

According to a study published in the Harm Reduction Journal, it was found that 40.3 million people, in 49 countries primarily consisted of nations while the remaining 152 countries had, around 17.8 million individuals who purchased e-cigarettes.

According to a research report, from the CDC Foundation, Truth Initiative, and CDC it was discovered that there was a rise in e-cigarette sales between January 2020 and December 2022. The study revealed a 46.6% increase in e-cigarette unit sales during this period with the number of e-cigarette brands also rising by 46.2% going from 184 to 269.

According to the 2022 National Youth Tobacco Survey, high school students approximately 2.5 million currently use e-cigarettes.

The increasing availability of flavored products is a concerning issue. According to the report by December 2022 79.6% of disposable unit sales included flavors, like fruit, clove, spice, chocolate, alcoholic beverages, candy, desserts, or other flavors. Nearly half of the high school students who use e-cigarettes engage in vaping every day which could lead to a lifetime of nicotine addiction and an elevated vulnerability, to becoming addicted to substances.

E-Cigarette Market Drivers:

To encourage market expansion, promote e-cigarettes as tobacco cigarette replacements.

The growing preference, for e-cigarettes over cigarettes, is driven, in part by the belief that they're a safer alternative. This perception is gaining popularity leading more people to switch and increasing the demand for e-cigarette products. One reason for this shift is that e-cigarettes produce vapor of smoke, which typically contains harmful substances compared to the smoke produced by burning tobacco in traditional cigarettes. The reduced presence of chemicals appeals to those looking for a harmful option. Additionally, e-cigarettes offer the flexibility to choose levels of nicotine concentration allowing users to gradually reduce their nicotine intake or have control over their consumption. This customizable feature caters, to individuals who are looking to manage their addiction or quit smoking altogether thereby driving the market growth.

Numerous flavored versions are being introduced.

The wide range of flavors available, such, as fruits, desserts, candies, and beverages is appealing to a group of consumers. These flavors replicate enjoyable tastes, which enhances the pleasure and enjoyment of using e-cigarettes. Additionally, the availability of flavors attracts nonsmokers, including people who are intrigued by the taste options. Furthermore, flavors also play a role in aiding individuals who want to quit smoking cigarettes. Flavored e-cigarettes are often more satisfying and appealing to smokers looking for an alternative making the transition smoother and increasing the adoption rate of these products. Moreover, by offering levels of sweetness and complexity, in flavors, it is possible to cater to regional or cultural preferences. This adaptability helps increase consumer involvement and market penetration.

E-Cigarette Market Restraints and Challenges:

Studies revealing that e-cigarettes contain dangerous ingredients may limit the industry.

Recently there has been a surge, in studies and research aimed at gaining an understanding of the safety claims surrounding e-cigarettes. Some of these studies suggest that harmful chemicals are present in e-cigarettes and that they can be just as addictive as cigarettes. For example, the Centers for Disease Control and Prevention published a report stating that harmful substances, including nicotine, can be found in e-cigarette aerosols. It is advised that children, teenagers, pregnant women, and individuals with conditions avoid using e-cigarettes for the reasons conventional cigarettes are not recommended. However, there is still a lack of research on the differences, between regular cigarettes and their electronic counterparts. Further studies are necessary to comprehend the risks associated with the excessive use of e-cigarettes.

Several nations have banned and strictly enforced the sale of e-cigarettes, posing barriers to expansion.

E-cigarettes have been prohibited in countries due, to the health risks associated with their use. In August 2022 there was an incident where a Juul e-cigarette, which was flavored like candy caught fire. In response, US officials promptly imposed a ban on the sale of flavors. Moreover, in June 2023, the United States Food and Drug Administration issued warning letters to stores that were selling e-cigarettes with candy and fruit flavors. The country has taken measures to restrict the sale of disposable electronic cigarettes as they have significant environmental impacts as well. According to the American Health Organization eight countries, in North America have banned cigarette sales.

E-Cigarette Market Opportunities:

Product availability is increasing through multiple distribution methods.

E-cigarettes can be found in places, such, as specialty e-shops, supermarkets, hypermarkets, tobacconists, convenience stores, and online platforms. This wide availability makes it convenient for consumers to buy e-cigarettes as part of their shopping routine. Additionally, the different distribution channels offer opportunities for consumers to learn more about e-cigarettes. The staff at specialty e-shops and tobacconists are knowledgeable. Can provide information, advice, and recommendations to help consumers make informed decisions about which e-cigarette products to choose. Moreover, online platforms offer convenience since consumers can browse and purchase e-cigarette products from the comfort of their homes without needing to visit stores. This level of convenience is particularly attractive to individuals or those who may not have access to brick-and-mortar stores. As a result of these factors the market, for e-cigarettes is experiencing the opportunity to grow.

E-CIGARETTE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

12.49% |

|

Segments Covered |

By Product, Flavors, Mode of Operations, Distribution Channels, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Philip Morris International Inc., Altria Group Inc., British American Tobacco PLC, Japan Tobacco, Inc., Imperial Tobacco Group, International Vapor Group, Nicotek LLC, NJOY Inc., Reynolds American Inc., ITC Limited, J WELL France |

E-Cigarette Market Segmentation: By Product

-

Modular E-Cigarette

-

Rechargeable E-Cigarette

-

Next-Generation E-Cigarette

-

Disposable E-Cigarette

In 2022, based on the product, the Rechargeable E-Cigarette segment accounted for the largest revenue share by almost 65% and has led the market. The popularity of e-cigarettes is primarily attributed to their benefits compared to disposable e-cigarettes. These advantages include expenses, improved performance, and eco-friendliness.

One of the rapidly expanding segments, in the e-cigarette market is the next-generation e-cigarette, which exhibits a Compound Annual Growth Rate (CAGR) of 25%. Although in its development stages, next-generation e-cigarettes offer various advantages when compared to traditional ones. These advantages encompass enhanced flavor delivery, longer battery life, and advanced features.

E-Cigarette Market Segmentation: By Flavors

-

Tobacco

-

Botanical

-

Fruit

-

Sweet

-

Beverage

-

Others

In 2022, based on the Flavors, the Tobacco segment accounted for the largest revenue share by almost 45% and has led the market. This is because a lot of people who use e-cigarettes are smokers who are transitioning to e-cigarettes as an option. By using tobacco-flavored e-cigarettes they can still enjoy the taste and feeling of smoking cigarettes while decreasing their exposure, to toxins.

Fruit-flavored e-cigarettes are taking the lead as the expanding choice boasting an impressive annual growth rate of 20%. These fruity concoctions have gained popularity among new e-cigarette users who are drawn to their delightful and invigorating flavors. Seasoned e-cigarette enthusiasts find themselves gravitating towards fruit-flavored options enjoying the array of flavors available, to them.

E-Cigarette Market Segmentation: By Mode of Operations

-

Automatic E-Cigarette

-

Manual E-Cigarette

In 2022, based on the Mode of Operations, the Automatic E-cigarette segment accounted for the largest revenue share by almost 70% and has led the market. Automatic e-cigarettes are simpler to use compared to e-cigarettes because they don't require the user to press a button, for activation. By taking a puff on the e-cigarette it becomes. Starts the vaporization process. This convenience makes e-cigarettes appealing to both newcomers. Experienced users who seek a hassle-free vaping experience.

On the other hand manual e-cigarettes are gaining popularity at a rate with a Compound Annual Growth Rate (CAGR) of 15%. Manual e-cigarettes come with advantages, over their counterparts, including better performance, more customization options, and longer battery life. They are particularly favored by experienced users who prefer having control over their vaping experience.

E-Cigarette Market Segmentation: By Distribution Channels

-

Specialty E-Cig Shops

-

Online

-

Supermarkets and Hypermarkets

-

Tobacconist

-

Others

In 2022, based on the Distribution Channels, the Online segment accounted for the largest revenue share by almost 40% and has led the market. The popularity of online shopping, for e-cigarettes is primarily due to its convenience and the wide range of products available. Online retailers attract customers with prices and free shipping making them a preferred option among e-cigarette consumers.

Among distribution channels specialty e-cig shops have experienced growth with a Compound Annual Growth Rate (CAGR) of 15%. These shops stand out by offering a selection of e-cigarette products and accessories along, with expert advice and assistance. As a result, they are favored by both novice and seasoned e-cigarette users.

E-Cigarette Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, the North American region dominated the global medical tourism market with a revenue of 30%. The e-cigarette market, in the Asia Pacific region is witnessing growth. This can be attributed to factors such as increasing income growing awareness regarding the benefits of harm reduction through e-cigarettes and relatively relaxed regulations. Additionally, a large and youthful population, a burgeoning class, rapid urbanization rising disposable incomes, and a better understanding of the health risks associated with cigarettes have all played a significant role, in driving this growth. Moving forward it is anticipated that the market will continue to expand with growth expected in the e-cigarette segment owing to its affordability and convenience.

COVID-19 Impact Analysis on the Global E-Cigarette Market:

The sales of the cigarette industry were affected by COVID-19 as brick-and-mortar stores faced disruptions. As a result, consumers turned to channels to purchase products leading to an increase, in online sales for e-cigarette products.

However as lockdown restrictions ease and logistics improve with measures for COVID-19, the consumer goods industry is expected to grow. This growth is anticipated to boost the sales of e-cigarette products, in the forecast period.

Latest Trends/ Developments:

Many people, around the world are viewing e-cigarettes or vapes as an alternative to cigarettes. The fact that e-cigarettes are more cost-effective than ones is also contributing to the market growth. For example, a disposable e-cigarette usually costs between $1 and $15 per item. Starter kits with batteries typically come with pods that can cost anywhere from $25 to $150 or even more while liquid refill kits usually amount to around $50 to $75, per month. The average price, for a pack of Marlboro Reds is typically between $13 and $15. Each cigarette contains up to 1.9 milligrams of nicotine. The reasonable pricing of e-cigarettes along with the marketing approach based on affordability motivates consumers to purchase them. The low cost of e-cigarette models is appealing to customers as it offers an option. Additionally, the refillable feature of e-cigarettes adds value by providing a cost-effective solution, for individuals.

British American Tobacco has recently introduced the Vuse iPod, a user-friendly vaping device. With a range of flavors and nicotine options available, the Vuse ePod is designed to cater to preferences.

Key Players:

-

Philip Morris International Inc.

-

Altria Group Inc.

-

British American Tobacco PLC

-

Japan Tobacco, Inc.

-

Imperial Tobacco Group

-

International Vapor Group

-

Nicotek LLC

-

NJOY Inc.

-

Reynolds American Inc.

-

ITC Limited

-

J WELL France

In June 2022 it was reported that Supreme had agreed to acquire Liberty Flights Holdings, a vaping brand in a deal of GBP 14.75 million. The acquisition will involve a payment of GBP 7.75 million followed by a GBP 2 million, as deferred consideration. Additionally, there is a possibility of earning up to GBP 5 million based on performance-related earn-out payments.

In July 2021 Japan Tobacco Inc. Introduced Ploom X as its generation tobacco device. This product is now available, throughout Japan including convenience stores and select tobacco retail stores.

Chapter 1. E-Cigarette Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. E-Cigarette Market – Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. E-Cigarette Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. E-Cigarette Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. E-Cigarette Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. E-Cigarette Market – By Product

6.1 Introduction/Key Findings

6.2 Modular E-Cigarette

6.3 Rechargeable E-Cigarette

6.4 Next-Generation E-Cigarette

6.5 Disposable E-Cigarette

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2023-2030

Chapter 7. E-Cigarette Market – By Flavors

7.1 Introduction/Key Findings

7.2 Tobacco

7.3 Botanical

7.4 Fruit

7.5 Sweet

7.6 Beverage

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Flavors

7.9 Absolute $ Opportunity Analysis By Flavors, 2023-2030

Chapter 8. E-Cigarette Market – By Mode of Operations

8.1 Introduction/Key Findings

8.2 Automatic E-Cigarette

8.3 Manual E-Cigarette

8.4 Y-O-Y Growth trend Analysis By Mode of Operations

8.5 Absolute $ Opportunity Analysis By Mode of Operations, 2023-2030

Chapter 9. E-Cigarette Market – By Distribution Channels

9.1 Introduction/Key Findings

9.2 Specialty E-Cig Shops

9.3 Online

9.4 Supermarkets and Hypermarkets

9.5 Tobacconist

9.6 Others

9.7 Y-O-Y Growth trend Analysis By Distribution Channels

9.8 Absolute $ Opportunity Analysis By Distribution Channels, 2023-2030

Chapter 10. E-Cigarette Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Product

10.1.2.1 By Flavors

10.1.3 By Mode of Operations

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Product

10.2.3 By Flavors

10.2.4 By Mode of Operations

10.2.5 By By Distribution Channels

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Product

10.3.3 By Flavors

10.3.4 By Mode of Operations

10.3.5 By By Distribution Channels

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Product

10.4.3 By Flavors

10.4.4 By Mode of Operations

10.4.5 By By Distribution Channels

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Product

10.5.3 By Flavors

10.5.4 By Mode of Operations

10.5.5 By By Distribution Channels

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. E-Cigarette Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Philip Morris International Inc.

11.2 Altria Group Inc.

11.3 British American Tobacco PLC

11.4 Japan Tobacco, Inc.

11.5 Imperial Tobacco Group

11.6 International Vapor Group

11.7 Nicotek LLC

11.8 NJOY Inc.

11.9 Reynolds American Inc.

11.10 ITC Limited

11.11 J WELL France

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global E-Cigarette Market was valued at USD 18.32 billion and is projected to reach a market size of USD 46.97 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 12.49%.

To encourage market expansion, and promote e-cigarettes as tobacco-cigarette replacements, numerous flavored versions are being introduced.

Based on Service Provider, the Global E-Cigarette Market is segmented into Tobacco, Botanical, Fruit, Sweet, Beverage

North America is the most dominant region for the Global E-Cigarette Market.

Philip Morris International Inc., Altria Group Inc., British American Tobacco PLC, Japan Tobacco, Inc., and Imperial Tobacco Group are the key players operating in the Global E-Cigarette Market.