E-Axle Market Size (2025 – 2030)

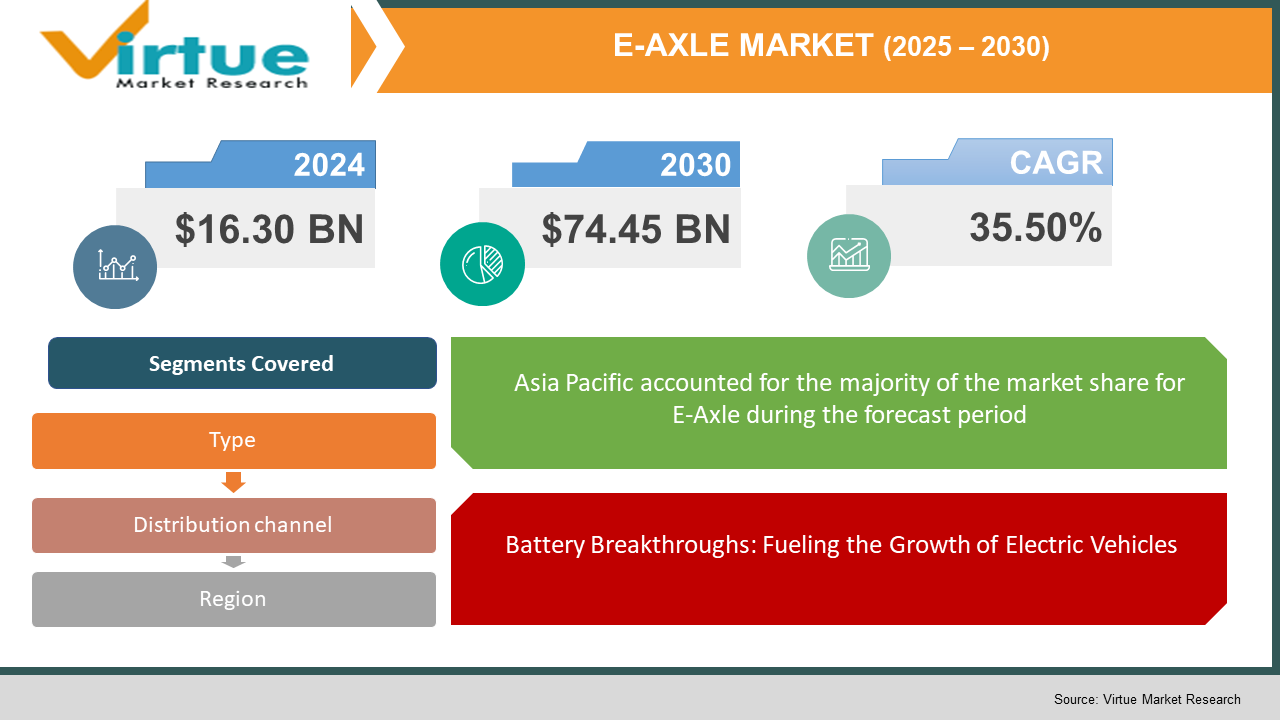

The E-Axle Market was valued at USD 16.30 Billion in 2024 and is projected to reach a market size of USD 74.45 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 35.50%.

The landscape of the E-Axle market in 2024 is a dynamic interplay between established automotive suppliers, specialized E-Axle manufacturers, and even some of the major automotive original equipment manufacturers (OEMs) who are increasingly bringing E-Axle production in-house. This competitive environment fosters a rapid pace of technological advancement and a continuous evolution of product offerings. The global push towards electrification, driven by stringent emission regulations and attractive government incentives, acts as a powerful tailwind for the E-Axle market. Furthermore, the increasing awareness and acceptance of electric mobility among consumers across the globe are translating into tangible sales figures for electric vehicles, thereby directly boosting the demand for E-Axles. The market in 2024 is also witnessing a growing trend towards customization and modularity, with manufacturers offering a range of E-Axle solutions tailored to specific vehicle platforms and performance requirements. This adaptability is crucial in catering to the diverse needs of the automotive industry, ranging from compact city cars to high-performance SUVs and even commercial vehicles.

Key Market Insights:

- Battery electric vehicles (BEVs) constituted the largest segment by electric vehicle type in 2024, accounting for over 63% of the market share, indicating a strong preference for fully electric powertrains.

- The rear application segment dominated the market in 2024, holding a 71% share, as manufacturers prioritize rear E-axle setups for optimized power distribution and handling. The front E-Axle segment is anticipated to experience rapid growth, with an expected CAGR of 41.7% in the coming years, fueled by the increasing production of entry- and mid-level electric passenger cars.

Market Drivers:

Battery Breakthroughs: Fueling the Growth of Electric Vehicles.

This monumental shift is not merely a trend; it is a fundamental restructuring driven by increasingly stringent environmental regulations imposed by governments worldwide, coupled with a growing environmental consciousness among consumers. Governments across the globe are implementing a range of policies to incentivize the adoption of electric vehicles, including tax credits, subsidies, and the establishment of charging infrastructure. These supportive measures are making electric vehicles more economically viable and appealing to a wider range of consumers. Furthermore, the continuous advancements in battery technology are playing a crucial role in driving EV adoption.

Another significant driver fueling the E-Axle market in 2024 is the relentless innovation and technological advancements within the E-Axle systems themselves.

The quest for higher performance, greater efficiency, and reduced costs is a constant driving force in the automotive industry, and this is particularly true in the rapidly evolving field of electric powertrains. E-Axle manufacturers are continuously pushing the boundaries of engineering and materials science to develop more advanced and sophisticated systems. One key area of innovation is the improvement of power density. Manufacturers are striving to create E-Axles that can deliver more power from a smaller and lighter package. This is crucial for optimizing vehicle performance, range, and overall efficiency. Advancements in electric motor design, such as the use of more powerful magnets and improved winding techniques, are contributing to higher power densities. Similarly, innovations in gearbox design, including the use of more compact and efficient gear arrangements, are helping to reduce the overall size and weight of the E-Axle. Another critical area of technological advancement is the improvement of efficiency. Even small gains in efficiency can have a significant impact on the overall range and energy consumption of an electric vehicle.

Market Restraints and Challenges:

Despite the strong growth trajectory of the E-Axle market in 2024, several restraints and challenges continue to shape its development. One significant hurdle is the high initial cost associated with E-Axle technology. While the cost of electric vehicles has been gradually decreasing, the powertrain components, including the E-Axle, still represent a substantial portion of the overall vehicle cost. The advanced materials, sophisticated engineering, and precision manufacturing required for E-Axle production contribute to this higher price point. This cost factor can be a barrier to wider adoption, particularly in price-sensitive markets and for consumers who are still on the fence about transitioning to electric vehicles. While economies of scale are expected to eventually drive down costs, the current pricing remains a challenge for both E-Axle manufacturers and automotive OEMs. Another significant restraint is the lack of standardization across the industry. Unlike some components in traditional internal combustion engine vehicles, there is currently no universal standard for E-Axle designs, interfaces, or performance specifications. This lack of standardization can create complexities for OEMs in terms of sourcing and integrating E-Axles into their vehicle platforms. It can also hinder interoperability and potentially slow down the pace of innovation as manufacturers may be hesitant to invest heavily in proprietary technologies that may not become industry standards. Establishing industry-wide standards could streamline development, reduce costs, and foster greater competition within the market. Supply chain complexities also present a considerable challenge for the E-Axle market in 2024. The production of E-Axles relies on a range of specialized components, including rare earth magnets, power semiconductors, and precision-engineered gears.

Market Opportunities:

Despite the aforementioned challenges, the E-Axle market in 2024 is brimming with opportunities for growth and innovation. The increasing demand for high-performance electric vehicles presents a significant avenue for E-Axle manufacturers. As consumers become more familiar with the capabilities of EVs, there is a growing appetite for models that offer exhilarating acceleration, high top speeds, and superior handling. E-Axles play a crucial role in delivering this performance, and manufacturers that can develop systems with higher power and torque outputs, while maintaining efficiency and compactness, are well-positioned to capitalize on this trend. The development of advanced features and functionalities within the E-Axle also presents substantial opportunities. This includes the integration of sophisticated torque vectoring systems, which can enhance vehicle handling and stability, as well as the incorporation of regenerative braking capabilities to improve energy efficiency. Smart E-Axles that can communicate with other vehicle systems and adapt their performance based on driving conditions offer another promising area for innovation. Furthermore, the expansion of the electric vehicle market into new segments, such as light commercial vehicles, electric buses, and even electric trucks, creates fresh opportunities for E-Axle manufacturers. These different vehicle segments have unique performance requirements and operating conditions, necessitating tailored E-Axle solutions. Manufacturers that can develop and offer a diverse portfolio of E-Axles catering to these varied needs will have a significant competitive advantage. The growing focus on sustainability and the circular economy also presents opportunities for the E-Axle market. This includes the development of E-Axles that are designed for easier disassembly and recycling at the end of their life, as well as the use of more sustainable materials in their production.

E-AXLE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

35.05% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, BorgWarner Inc., Magna International Inc., GKN Automotive (now part of Dana Incorporated), Nidec Corporation |

E-Axle Market Segmentation:

E-Axle Market Segmentation by Type:

- Integrated E-Axle

- Non-Integrated E-Axle

The fastest-growing type of E-Axle in 2024 is the integrated E-Axle. This is primarily driven by the increasing focus on compactness, efficiency, and ease of integration in electric vehicle design. Integrated E-Axles, which combine the electric motor, gearbox, and power electronics into a single unit, offer several advantages, including reduced weight, smaller packaging, and simplified assembly processes for automotive manufacturers. This streamlined approach is particularly appealing for mass-market electric vehicles where cost and efficiency are paramount. The continuous advancements in power electronics and thermal management have made integrated E-Axles more capable and reliable, further fueling their adoption and growth in 2024.

The most dominant type of E-Axle in 2024 remains the integrated E-Axle. Having been adopted early on by many leading electric vehicle manufacturers, integrated systems have established a strong foothold in the market. Their inherent advantages in terms of space utilization and efficiency have made them the preferred choice for a wide range of electric vehicle applications, from compact cars to SUVs. The mature supply chain and established manufacturing processes for integrated E-Axles also contribute to their continued dominance in the market in 2024.

E-Axle Market Segmentation by Distribution Channel:

- Original Equipment Manufacturers (OEMs)

- Aftermarket

The fastest-growing distribution channel for E-Axles in 2024 is the aftermarket. As the number of electric vehicles on the road continues to rise, the demand for replacement parts and repair services for E-Axle systems is also experiencing significant growth. While E-Axles are designed to be durable, wear and tear, accidents, or component failures can necessitate replacements or repairs. The development of a robust aftermarket ecosystem, including specialized repair facilities and the availability of replacement E-Axle units and components, is crucial for supporting the growing fleet of electric vehicles.

The most dominant distribution channel for E-Axles in 2024 is the Original Equipment Manufacturers (OEMs) channel. This is because the vast majority of E-Axles are currently installed in new electric vehicles during the manufacturing process. Automotive OEMs either source E-Axles from specialized suppliers or manufacture them in-house for their electric vehicle production lines. The sheer volume of new electric vehicle sales ensures that the OEM channel remains the primary route for E-Axle distribution in 2024.

E-Axle Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The most dominant region in the E-Axle market in 2024 is Asia Pacific. This region's commanding position is underpinned by several factors. Firstly, China's overwhelming dominance in electric vehicle production and sales directly translates to a massive demand for E-Axles. The Chinese government's strong support for the EV industry through subsidies and regulations has fostered a thriving ecosystem of EV manufacturers and component suppliers. Additionally, other countries in the Asia Pacific region, such as Japan and South Korea, also have significant automotive industries and are increasingly focusing on electric vehicle production, further contributing to the region's dominance in the E-Axle market.

The fastest-growing region in the E-Axle market in 2024 is North America. While Asia Pacific currently holds the largest market share, North America is experiencing a rapid increase in electric vehicle adoption, driven by factors such as government incentives, the introduction of compelling new EV models (particularly in the truck and SUV segments), and the expansion of charging infrastructure. This surge in EV demand is directly fueling a high growth rate for the E-Axle market in the region.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a multifaceted impact on the E-Axle market. Initially, in early 2020, the pandemic caused significant disruptions to global supply chains and manufacturing operations, including those involved in the production of E-Axles and electric vehicles. Lockdowns, restrictions on movement, and factory closures led to a temporary slowdown in production and a decrease in consumer demand for automobiles, including EVs. This initial phase of the pandemic negatively impacted the E-Axle market, causing delays in shipments and a reduction in overall market activity. However, the pandemic also inadvertently accelerated certain trends that ultimately benefited the E-Axle market in the longer term. As governments worldwide implemented economic recovery measures, many focused on promoting green technologies and sustainable transportation. This resulted in increased incentives and support for the electric vehicle industry in several key markets, further strengthening the long-term prospects for E-Axles. Furthermore, the pandemic heightened awareness about air quality and environmental issues in many urban areas, potentially making electric vehicles a more appealing option for consumers seeking cleaner modes of transportation. As the world gradually emerged from the initial waves of the pandemic, the demand for electric vehicles rebounded strongly. Pent-up consumer demand, coupled with government support and the increasing availability of attractive EV models, led to a significant surge in electric vehicle sales.

Latest Trends and Developments:

The E-Axle market in 2024 is characterized by several key trends and developments that are shaping its future trajectory. One prominent trend is the increasing focus on higher integration levels. Manufacturers are continuously striving to integrate more components into the E-Axle unit, going beyond just the motor, gearbox, and inverter to include functionalities like thermal management systems and even braking components. This higher level of integration leads to more compact, efficient, and cost-effective systems. Another significant trend is the growing adoption of silicon carbide (SiC) power electronics in E-Axles. SiC semiconductors offer superior efficiency and power density compared to traditional silicon-based devices, allowing for smaller and lighter inverters with improved performance. The increasing availability and decreasing cost of SiC technology are driving its wider adoption in E-Axle systems in 2024. Furthermore, there is a strong emphasis on improving the efficiency and reducing the weight of E-Axles. Lighter and more efficient systems contribute to better overall vehicle range and performance. This is being achieved through advancements in motor design, the use of lightweight materials, and optimized gearbox designs. The development of multi-speed E-Axles is another notable trend. While single-speed transmissions are common in many EVs, multi-speed gearboxes can offer advantages in terms of efficiency at different speeds and improved acceleration.

Key Players in the Market:

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- BorgWarner Inc.

- Magna International Inc.

- GKN Automotive (now part of Dana Incorporated)

- Nidec Corporation

- Valeo

- Schaeffler AG

- AVL List GmbH

Chapter 1. E-AXLE MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. E-AXLE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. E-AXLE MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. E-AXLE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. E-AXLE MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. E-AXLE MARKET – By Type

6.1 Introduction/Key Findings

6.2 Integrated E-Axle

6.3 Non-Integrated E-Axle

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. E-AXLE MARKET – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Original Equipment Manufacturers (OEMs)

7.3 Aftermarket

7.4 Y-O-Y Growth trend Analysis By Distribution Channel

7.5 Absolute $ Opportunity Analysis By Distribution Channel , 2025-2030

Chapter 8. E-AXLE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Distribution Channel

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Distribution Channel

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Distribution Channel

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Distribution Channel

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Distribution Channel

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. E-AXLE MARKET – Company Profiles – (Overview, Packaging Type Type Portfolio, Financials, Strategies & Developments)

9.1 Robert Bosch GmbH

9.2 Continental AG

9.3 ZF Friedrichshafen AG

9.4 BorgWarner Inc.

9.5 Magna International Inc.

9.6 GKN Automotive (now part of Dana Incorporated)

9.7 Nidec Corporation

9.8 Valeo

9.9 Schaeffler AG

9.10 AVL List GmbH

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

. The primary drivers for E-Axle market growth include the escalating global adoption of electric vehicles, fueled by environmental regulations and consumer demand, alongside continuous technological advancements enhancing E-Axle performance, efficiency, and cost-effectiveness.

Key concerns in the E-Axle market include the high initial production costs, the absence of standardized designs, complexities and potential disruptions in the supply chain of critical components, and the requirement for specialized manufacturing capabilities.

Notable names in this sector include Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, BorgWarner Inc., Magna International Inc., GKN Automotive (now part of Dana Incorporated), Nidec Corporation

North America is the most dominant region in the market, accounting for approximately 35% of the total market share.

Asia Pacific although currently holding a smaller market share of 25%, is the fastest-growing region in the market.