GLOBAL DYES AND PIGMENTS MARKET (2024 - 2030)

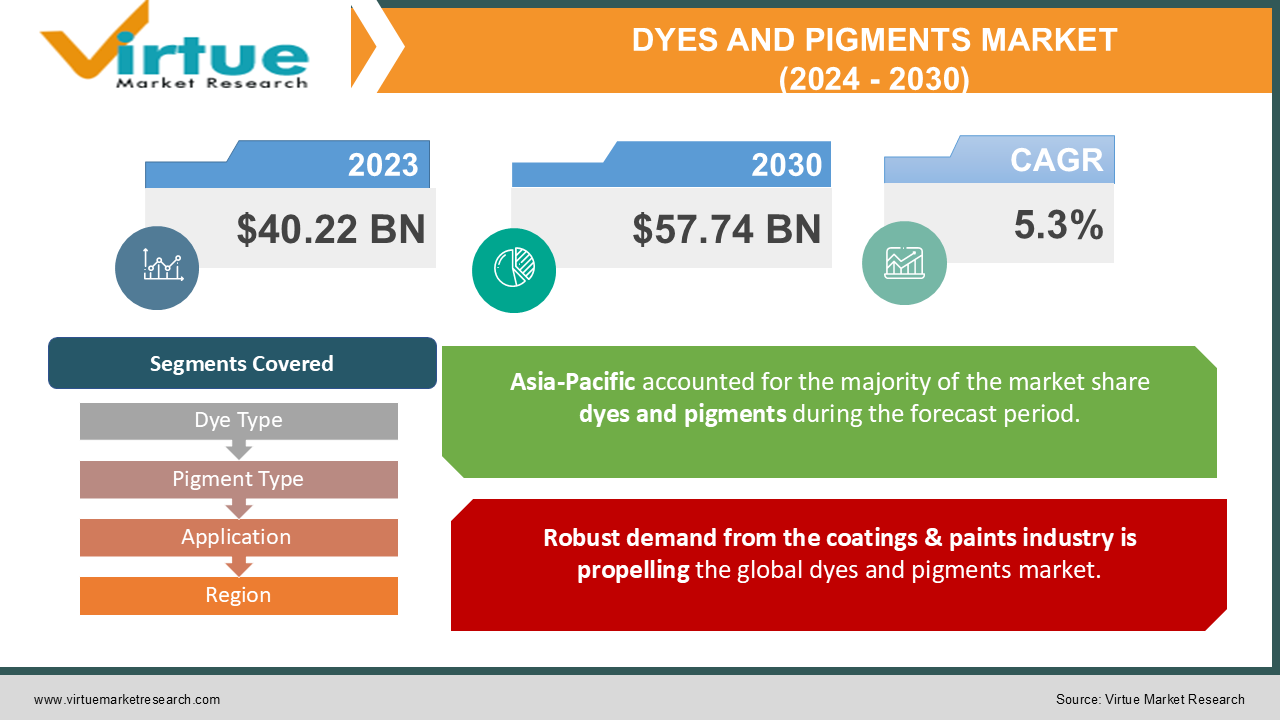

The Global Dyes And Pigments Market is valued at USD 40.22 billion in 2023 and is projected to reach a market size of USD 57.74 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.3%.

Colorants, also known as dyes and pigments, are compounds that impart colour to a material. They are frequently utilized in the printing ink, paint and coating, textile, and plastic industries. While pigments usually remain stable in UV light, dyes are coarser and less stable than pigments. When dyes are added to a substance, they absorb the colouring material in the air and disintegrate it. The use of products for corrosion prevention and surface protection increases as a result of this factor. Due to population growth and economic development, the textile and paints and coatings industries are expanding, which is driving up demand for their products. Additionally, the demand for printing ink increased as a result of the expanding e-commerce sector, which is fueling the expansion of the dyes and pigments market.

Dyes are used for many different purposes in the domains of decoration, aesthetics, and art. They come in a broad range of forms, including granules, liquids, pastes, pellets, dry powders, and chips. The pigment appears as an insoluble, powdery material and can be either organic or inorganic. High tinting strength, excellent baking stability, remarkable resistance to solvents, easily dispersible nature, high baking stability, and distinctive yet complementary hues are only a few of the advantageous qualities of pigments.

Key Market Insights:

Important trends and insights are being seen in the global dyes and pigments market. There has been a major shift towards sustainable practices due to increased environmental awareness. In line with customer desires, advances in bio-based substitutes and environmentally friendly colorants are becoming more popular. Production methods and applications are changing as a result of technological developments in digital printing and nanotechnology. The COVID-19 pandemic has created difficulties, impacted supply chains, and necessitated flexible approaches. Market dynamics are influenced by changing trends, and industries such as packaging and textiles continue to be key users. Industry standards are being shaped by regulatory measures that tackle environmental concerns, highlighting the critical role of sustainability in the global dyes and pigments market.

Global Dyes And Pigments Market Drivers:

Robust demand from the coatings & paints industry is propelling the global dyes and pigments market.

Pigments and dyes are essential for giving materials color. The coating and paints sector's growing demand is expected to propel the industry's expansion. In addition, the demand for dyes and pigments is being driven by a greater knowledge of their advantageous qualities, which include color, toughness, corrosion resistance, mechanical strength, and clarity. Further boosting their sales is the growing usage of these compounds in ornamental, automotive, and architectural applications. The growing need for coatings in the manufacturing sector is anticipated to propel the dyes and pigments market's growth.

Growing demand from the textiles industry is also driving the global dyes and pigments market growth.

Usually, textiles are colored to make them visually appealing. A cloth can be colored in two ways: by dying it or via substratum impression. The process of using a dye to add color to textile materials is called dying. The product is applied to the materials to color them. There are many distinct types of dyes, each having unique characteristics and fiber-affinity, including direct dyes, vat dyes, reactive dyes, Sulphur dyes, disperse dyes, acid dyes, and metal complex dyes. Textile dyes consist of substantial or comparable dyes that have a strong affinity for cellulose fibres, as well as acid dyes, which are mostly used to dye linen, silk, and nylon. Synthetic product types like yarns and fibers are dyed using pigments and dyes. Thus, the growth of the global textile industry is driving the market growth of this market.

Increasing demand for sustainable and eco-friendly dyes and pigments is another important market driver.

Essential components utilized in a variety of sectors, such as textiles, paints & coatings, plastics, printing inks, and others, are driving the market's compound annual growth rate (CAGR) for dyes and pigments. The market for these dyes and pigments is being driven by the increasing awareness of environmental issues and the need for sustainable and eco-friendly materials. In industrialized economies, where customers are growing increasingly aware of the environmental impact of the things they buy, this trend is especially powerful. Because they are non-toxic and biodegradable, organic and natural dyes and pigments are becoming more and more popular among people who care about the environment. To keep up with this increasing demand, manufacturers are making investments in the creation of new sustainable products.

Global Dyes and Pigments Market Restraints and Challenges:

Stringent regulations regarding waste generation may hinder the market growth of the global dyes and pigments market.

Substances from this industry have been categorized as harmful by the EPA by the Property, Conservation and Recovery Act (RCRA). The product's manufacturing waste is categorized as EPA hazardous waste K181. The waste is generated during the on-site preparation and processing of dyes and pigments at industrial plants. These product groupings find extensive applications in the fields of apparel, paper, textiles, leather, inks, paints and coatings, meats, medications, and cosmetic coloring. The manufacture of dye and pigment waste is produced and maintained at up to 36 sites nationwide, which this regulation may potentially affect. According to the EPA, each year, these facilities generate over 36,000 metric tons of garbage that could be impacted. The industry's waste hurts aquatic life, humans, and water bodies. Therefore, the trash produced by this industry is probably going to hinder the market's expansion.

The rise in health and safety concerns because of synthetic dyes and pigments may affect the growth of this market.

The inclusion of dangerous compounds in pigments and dyes, which can hurt human health, is one of the main causes of concern. According to studies, prolonged exposure to these chemicals can raise the chance of getting skin, bladder, and lung cancers, among other cancers. The possible toxicity of pigments and dyes when they come into touch with the skin is another significant health issue. Moreover, the production and application of specific dyes and pigments raise concerns about environmental safety. The production of synthetic dyes and pigments uses a lot of water and energy and is based on non-renewable resources. In addition to having a detrimental effect on water availability, treating wastewater that contains colors and pigments can contaminate and destroy aquatic life. Therefore, throughout the projected period, these factors are anticipated to hinder the growth of the worldwide dyes and pigments market.

Global Dyes And Pigments Market Opportunities:

Many factors have contributed to the growth of the textile industry, such as the depletion of available capital globally, rapid changes and climate-related uncertainty, population growth, increased awareness of organic products, and technological advancements. As local demand in the Asia-Pacific area has steadily expanded, luxury brands have started to enter the market. The global textile market is dominated by the United States, China, Japan, and India. China was the world's leading producer and exporter of textile clothing in 2018. China topped the world in textile output in 2018 and accounted for about a quarter of the global textile market, with an increase in textile exports of nearly 3 percent. France, Italy, the Netherlands, Spain, and Germany are the top exporters of textiles from Europe, making up about 32.1 percent of all textile exports worldwide. India has the world's third-largest textile manufacturing industry. One of the biggest consumers of textiles has been the United States.

GLOBAL DYES AND PIGMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.3 % |

|

Segments Covered |

By Dye Type, Pigment Type, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE (Germany), DIC CORPORATION (Japan), Clariant (Switzerland), Sudarshan Chemical Industries Limited (India), Huntsman International LLC. (U.S.), Atul Ltd (India), Cabot Corporation (U.S.), DuPont (U.S.), Kiri Industries Ltd. (India), KRONOS Worldwide, Inc. (U.S.) |

GLOBAL DYES AND PIGMENTS MARKET : SEGMENTATION :

Market Segmentation: By Dye Type:

- Acid Dyes

- VAT Dyes

- Disperse Dyes

- Reactive Dyes

- Direct Dyes

The demand for pigments and colors was fueled by reactive dyes, which accounted for 54.23% of total sales in 2023. These colors, which are made up of organic compounds with intense colors, are mostly used in silk tinting. Because of their vibrant color range and excellent fading resistance, these are perfect for coloring cotton and rayon. During the dying process, a covalent bond between the fiber and the reactive dye may form. There's also an active group, a connecting group, and a parent pigment. Owing to these advantages, it possesses attributes that are superior to and on par with other colors utilized in cellulose fibers. Reactive dyes come in a wide range of colors, and their use as colorants for wool and nylon is growing.

Reactive dye use is being driven by the expanding textile industry and a movement in consumer preferences towards sustainable textile solutions. In contrast, the vat sub-segment is anticipated to grow quickly over the course of the projection period because of its widespread use in cellulose fibers. Organic substances called vat dyes are used to color leather, viscose rayon, and cotton fiber. The increased usage of dispersed dyes for dyeing nylon, cellulose triacetate, and acrylic fibers is the reason behind the need for them.

Market Segmentation: By Pigment Type:

- Organic Pigments

- Inorganic Pigments

- Titanium Dioxide Pigments

Inorganic pigments currently have a larger market share than organic pigments. Significant wetness, deeper color, and leanness are predicted to be attributes of inorganic pigments that will provide a favorable look for market advancement over the projection year. Revenue growth for organic pigments is predicted to reach 5.47% CAGR between 2024 and 2030. Strict regulations about inorganic pigments are anticipated to provide organic pigments with promising opportunities through internal product substitution.

Pigment colors can be used with the components of medicine or utilized to paint certain things. Colorants for food and drink as well as skin care products are called organic pigments. Inorganic pigments employ chemical formulas for various purposes to give the substance the necessary characteristics. Metallic oxides, chromates, sulphates, and other substances generated from inorganic metal compounds and salts are used as inorganic pigments. Industrial coatings such as house paints, car refinishes, printing inks, and plastics are the main uses for inorganic pigments.

Market Segmentation: By Application:

- Printing Inks

- Textiles

- Paper

- Leather

- Plastics

- Paints & Coatings

- Construction

- Others

With a sales share of almost 59.74% in 2023, the textiles sector commanded the lion's share of the market. Between 2024 and 2030, the printing ink category is predicted to grow at the quickest rate. The market for digital printing is expected to grow, which would raise demand for the dyes used in printing inks. Chemicals called dyes are applied to a surface to impart color by momentarily altering the crystal structure of the materials being dyed. These compounds are frequently utilized in the textile sector because of their great dyeing capacity. Due to inefficiencies in the dyeing process, the textile industry wastes up to two hundred thousand tons of these colors annually throughout the dyeing and finishing processes.

Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

The report offers market insights for North America, Europe, Asia-Pacific, and the rest of the world by region. Due to demand from the region's textile, building, and automotive industries, the Asia Pacific Dyes and Pigments market area will dominate this one. Moreover, encouraging government initiatives to support the expansion of the domestic chemical sector has also contributed significantly to the rise in the availability of dyes and pigments. In addition, the market for dyes and pigments in China had the most market share, while the market in India had the quickest rate of growth in the area.

Asia Pacific accounted for a staggering 63 percent of the global market. Global consumer spending is likely to rise as the middle class expands. This component will help the textile and plastic industries grow, which will accelerate the market's growth. The textile industry, which is most likely the primary driver of demand, accounted for more than half of the demand for dyes and pigments. Asia-Pacific will remain the primary destination for the consumption of dyes and pigments due to the region's production of most consumer plastic items and textiles.

COVID-19 Impact Analysis on the Global Dyes And Pigments Market:

Because of the decline in demand and productivity, the COVID-19 pandemic had a major effect on the global market for dyes and pigments. Numerous dye and pigment industries were forced to reduce their processing capacity, adhere to social distancing, and put limitations on the mobility of both persons and commodities because of various governments instituting nationwide lockdowns. For a brief while, the closing of production plants, shipping delays, a lack of raw materials, and restricted supply chains hurt product prices. Moreover, the industry's expansion was negatively impacted by a notable fall in the demand for dyes and pigments across a range of applications, including textiles, paints & coatings, plastics, and printing inks. Nonetheless, pigments and dyes are essential components in the creation of printing inks. The packaging sector has been stimulated by the coronavirus's expanding spread because packaging offers completed items additional protection against the virus's transmission. Thus, despite the epidemic, this component is assisting in the market's recovery.

Latest Trends/ Developments:

Sudarshan Chemical Industries, a producer of premium pigments, and BTC Europe, a prominent distributor of specialty chemicals, inked a distribution agreement for the latter's line of organic and inorganic pigments throughout Europe. Through this partnership, BTC Europe will be able to provide a greater variety of pigments to its customers throughout Europe and broaden its product line.

The Textile Effects Business of Huntsman Corporation, a top supplier of textile chemicals and dyes, was bought by Archroma, a pioneer in specialty chemicals. Archroma's position in the textile sector was strengthened and its product line was greatly broadened by this acquisition. Huntsman Corporation's Textile Effects Business has a significant presence in the Asia-Pacific area and gives Archroma better access to this rapidly expanding market.

The Heubach Group announced the acquisition of Clariant's Pigments Business and formed a partnership with SK Capital Partners. Operating under the Heubach brand, the United company has grown to become a market leader in pigments with annual sales of over €900 million.

Key Players:

- BASF SE (Germany)

- DIC CORPORATION (Japan)

- Clariant (Switzerland)

- Sudarshan Chemical Industries Limited (India)

- Huntsman International LLC. (U.S.)

- Atul Ltd (India)

- Cabot Corporation (U.S.)

- DuPont (U.S.)

- Kiri Industries Ltd. (India)

- KRONOS Worldwide, Inc. (U.S.)

Chapter 1. GLOBAL DYES AND PIGMENTS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL DYES AND PIGMENTS MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL DYES AND PIGMENTS MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL DYES AND PIGMENTS MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL DYES AND PIGMENTS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL DYES AND PIGMENTS MARKET – By Dye Type

6. 1. Acid Dyes

6.2. VAT Dyes

6.3. Disperse Dyes

6.4. Reactive Dyes

6.5. Direct Dyes

Chapter 7. GLOBAL DYES AND PIGMENTS MARKET – By Pigment Type

7.1. Organic Pigments

7.2. Inorganic Pigments

7.3. Titanium Dioxide Pigments

Chapter 8. GLOBAL DYES AND PIGMENTS MARKET – By Application

8.1. Printing Inks

8.2. Textiles

8.3. Paper

8.4. Leather

8.5. Plastics

8.6. Paints & Coatings

8.7. Construction

8.8. Others

Chapter 9. GLOBAL DYES AND PIGMENTS MARKET, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Dye Type

9.1.3. By Pigment Type

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Dye Type

9.2.3. By Pigment Type

9.2.4. By Application

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Dye Type

9.3.3. By Pigment Type

9.3.4. By Application

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest South America

9.4.2. By Dye Type

9.4.3. By Pigment Type

9.4.4. By Application

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Dye Type

9.5.3. By Pigment Type

9.5.4. By Application

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL DYES AND PIGMENTS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. BASF SE (Germany)

10.2. DIC CORPORATION (Japan)

10.3. Clariant (Switzerland)

10.4. Sudarshan Chemical Industries Limited (India)

10.5. Huntsman International LLC. (U.S.)

10.6. Atul Ltd (India)

10.7. Cabot Corporation (U.S.)

10.8. DuPont (U.S.)

10.9. Kiri Industries Ltd. (India)

10.10. KRONOS Worldwide, Inc. (U.S.)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Dyes And Pigments Market size is valued at USD 40.22 billion in 2023.

The worldwide Global Dyes And Pigments Market growth is estimated to grow by around 5.3% from 2024 to 2030.

The Global Dyes And Pigments Market is segmented by Dye Type (Acid Dyes, VAT Dyes, Disperse Dyes, Reactive Dyes, Direct Dyes), by Pigment Type (Organic Pigments, Inorganic Pigments, Titanium Dioxide Pigments), by Application (Printing Inks, Textiles, Paper, Leather, Plastics, Paints & Coatings, Construction, Others).

Growing environmental concerns are expected to fuel expansion in the global dyes and pigments market. Industry participants can benefit greatly from the growing need for bio-based and sustainable colorants, the development of nanotechnology, and the growing uses in textiles and packaging.

The COVID-19 pandemic caused supply chain disruptions and demand fluctuations, which had a substantial effect on the global dye and pigment market. Market dynamics were challenged by decreased production and demand as a result of lockdowns and economic uncertainty.