Dry Natural Gas Market Size (2024 – 2030)

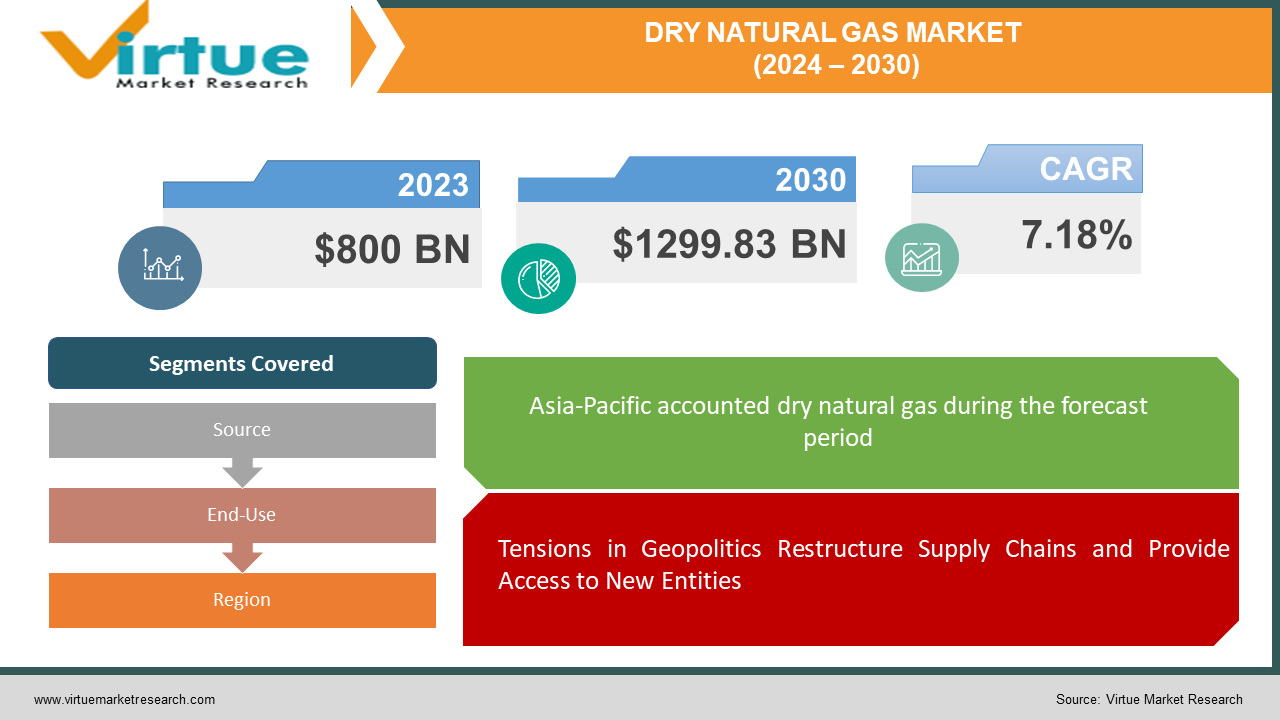

The Global Dry Natural Gas Market was valued at USD 800 Billion and is projected to reach a market size of USD 1299.83 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.18%.

Dry natural gas is the methane-rich form that enters our homes and businesses, as opposed to wet gas, which is extracted straight from the ground. In addition to methane, wet gas also contains a mixture of heavier hydrocarbons that, in certain situations, can condense into liquids. Wet gas is processed to eliminate these contaminants, water, sulfur compounds, and the heavier hydrocarbons known as natural gas liquids (NGLs) to turn them into dry gas. Dry natural gas is now ready for pipeline transit. Global dry natural gas market is being driven by geopolitical concerns.

Key Market Insights:

Dry gas, with its high methane content, flows more easily during transportation since those heavier components can condense and produce obstructions. As a result of the removal of these heavier hydrocarbons, more gas may be carried in a single pipeline . In other words, the dry natural gas we use for cooking, heating, and electricity production is wet gas that has been purified for safe and effective pipeline transmission. The market for dry natural gas is expected to expand due to the growing need for a more environmentally friendly coal substitute and advancements in technology for LNG storage and transportation, which will open new markets.

Dry Natural Gas Market Drivers:

Tensions in Geopolitics Restructure Supply Chains and Provide Access to New Entities:

Significant reorganization in the global dry natural gas market is being driven by geopolitical concerns. Disruptions to long-standing supply networks are forcing nations to reconsider their gas supplies and make significant investments in LNG infrastructure. This change in strategy has several implications. It encourages the search for fresh gas reserves, which may reveal undiscovered riches in areas that were previously unknown. Second, it creates opportunities for new export markets as nations with rich gas reserves try to take advantage of the rising demand for coal substitutes that are less harmful. A more stable and balanced energy environment is promoted by this supply chain diversification, which lowers dependency on any one source and lessens the dangers brought on by geopolitical instability. This transition is made possible by the emphasis on LNG infrastructure, which makes it possible to move natural gas over great distances and link markets that need energy with resource-rich areas. As a result, there are new opportunities and challenges for different players in the global gas market, which could change the dynamics of international energy commerce and lead to the formation of new alliances.

An Important First Step Towards a Sustainable Energy Future is dry Natural Gas

The dry natural gas industry is seeing innovation propelled by an increasing emphasis on cleaner energy sources. Considering the industry's efforts to lessen its environmental impact, natural gas is becoming a more appealing alternative to highly polluting fossil fuels like coal. One such technology is carbon capture and storage. The dry natural gas sector is being forced to innovate and discover ways to reduce its environmental impact by the increasing focus on clean energy sources. As a result, innovative technologies such as carbon capture and storage (CCS) have emerged. In essence, carbon capture and storage (CCS) keeps carbon dioxide emissions from natural gas production and transportation out of the environment. As a result, the industry's carbon footprint is much reduced, and natural gas is now seen as a more desirable alternative to extremely polluting fossil fuels like coal. Through the mitigation of environmental issues related to natural gas, carbon capture and storage (CCS) opens new opportunities for the sector and enables it to contribute to the shift towards a more sustainable energy landscape.

Global Dry Natural Gas Market Restraints and Challenges:

The path to success for the global dry natural gas industry is not without challenges. Natural gas emissions cause greenhouse gas emissions that may contribute to climate change. This could result in tighter regulations and a move towards renewable energy. Access to new markets is hampered by inadequate pipelines, particularly in developing regions. Price volatility and supply disruption are caused by geopolitical instability in important producing regions. Many variables contribute to the price volatility of the market itself, which makes long-term planning challenging. Lastly, the long-term dominance of natural gas is seriously threatened by the emergence of efficient and reasonably priced renewable energy sources like wind and solar power. To reduce environmental impact and increase efficiency, these issues necessitate innovation in extraction, transportation, and storage methods. Geopolitical threats can be mitigated by international cooperation and diversified supply chains. For the industry to succeed in the long run, it will be essential that it can overcome these obstacles and show how it can contribute to a sustainable energy future.

Global Dry Natural Gas Market Opportunities:

There are some bright spots in the dry natural gas market. Companies that can adapt will find several opportunities. Because it burns cleaner than coal, natural gas is a more appealing fuel option for nations battling climate change, which is driving up demand. Technological advances in liquefaction and FSRUs, for example, open new markets, particularly in developing nations that are rapidly industrializing and urbanizing and will require gas for industry and electricity. Dry natural gas becomes even more attractive when innovation increases extraction, processing, and transportation efficiency. A sustainable future is possible with the integration of dry natural gas and renewable biogas. Through the adoption of these prospects and the prioritization of sustainability, innovation, and cooperation, the dry natural gas sector can ensure its position within the dynamic energy arena.

DRY NATURAL GAS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.18% |

|

Segments Covered |

By Source, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cheniere Energy, Chevron, CNPC, Enbridge ExxonMobil, Gazprom, Gunvor Group Nigerian National Petroleum Corporation, Petronas |

Global Dry Natural Gas Market Segmentation: By Source

-

Onshore

-

Offshore

Due to its simple accessibility and cheaper extraction costs, onshore natural gas now holds the highest market share in the worldwide dry natural gas market, which is segmented by source. However, as technological advances make extraction more affordable, offshore natural gas is expected to increase at the highest rate due to its large unexplored supplies

Global Dry Natural Gas Market Segmentation: By End-Use

-

Electric Power

-

Residential

-

Transportation

-

Industrial

-

Commercial

-

Others

Although dry natural gas has many uses, the electric power industry is currently its largest user, particularly in areas where coal-fired units are being replaced. The usage of cooking and heating in homes is very important. Compressed natural gas (CNG) is gaining popularity as a cleaner fuel for vehicles, while its growth is still modest. Dry natural gas is used extensively by industries for a variety of operations, as well as by commercial buildings for hot water and heating. Other specialized uses, such as the manufacturing of petrochemicals and aviation fuel, fall under a different category and may grow more slowly than the primary industries.

Global Dry Natural Gas Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

If the market for dry natural gas is broken down into regions, Asia-Pacific leads in terms of market size and growth rate. The region's fast urbanization and economic growth, which are driving up demand for dry natural gas in industrial and power production activities, are the main drivers of this dominance. Asia-Pacific is at the forefront of the dry natural gas market due to its growing energy needs, however, other regions such as North America also play a part.

COVID-19 Impact Analysis on the Global Dry Natural Gas Market:

The COVID-19 outbreak dealt a wrench to the world market for dry natural gas. In 2020, demand fell significantly, especially from the industrial and power generation industries, because of lockdowns and a weakening global economy. Natural gas prices and production temporarily dropped as a result. Its effects were less severe than those of other fossil fuels, though. The market has seen hints of resiliency as economies have recovered and demand has increased. The long-term consequences of COVID-19 are still being felt. Natural gas is still anticipated to be a part of the energy mix, even though it may have sped up the transition to renewable energy sources, especially in areas with a shortage of renewable resources. For the sector to successfully navigate this changing environment, innovation, and cleaner technology will be key priorities.

Recent Trends and Developments in the Global Dry Natural Gas Market:

The market for dry natural gas is fluctuating globally. Supply chains are changing because of geopolitical unrest, with nations rushing to build LNG infrastructure to access new markets and sources of energy. Cleaner technologies like carbon capture are being developed in response to environmental concerns, yet the emergence of renewable energy sources poses a long-term problem. But as the world moves towards renewable energy, dry natural gas is becoming more and more recognized as a "bridge fuel," a cleaner substitute for coal. Innovations in liquefaction and transportation are creating new opportunities, especially in emerging nations, and are predicted to support the world's gas trade. The future of this sector will largely depend on its capacity to innovate, adapt, and negotiate these shifting dynamics.

Key Players:

-

Cheniere Energy

-

Chevron

-

CNPC

-

Enbridge

-

ExxonMobil

-

Gazprom

-

Gazprom

-

Gunvor Group

-

Nigerian National Petroleum Corporation

-

Petronas

Chapter 1. DRY NATURAL GAS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. DRY NATURAL GAS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. DRY NATURAL GAS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. DRY NATURAL GAS MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. DRY NATURAL GAS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. DRY NATURAL GAS MARKET – By Source

6.1 Introduction/Key Findings

6.2 Onshore

6.3 Offshore

6.4 Y-O-Y Growth trend Analysis By Source

6.5 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. DRY NATURAL GAS MARKET – By End-Use

7.1 Introduction/Key Findings

7.2 Electric Power

7.3 Residential

7.4 Transportation

7.5 Industrial

7.6 Commercial

7.7 Others

7.8 Y-O-Y Growth trend Analysis By End-Use

7.9 Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 8. DRY NATURAL GAS MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Source

8.1.3 By End-Use

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Source

8.2.3 By End-Use

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Source

8.3.3 By End-Use

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Source

8.4.3 By End-Use

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Source

8.5.3 By End-Use

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. DRY NATURAL GAS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cheniere Energy

9.2 Chevron

9.3 CNPC

9.4 Enbridge

9.5 ExxonMobil

9.6 Gazprom

9.7 Gazprom

9.8 Gunvor Group

9.9 Nigerian National Petroleum Corporation

9.10 Petronas

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Dry Natural Gas Market size is valued at USD 800 billion in 2023.

The worldwide Global Dry Natural Gas Market growth is estimated to be 7.18 % from 2024 to 2030.

The Global Dry Natural Gas Market is segmented By Source (Onshore, Offshore); By End-Use (Electric Power, Residential, Transportation, Industrial, Commercial, and Others), and by region.

The market for dry natural gas is expected to expand due to the growing need for a more environmentally friendly coal substitute and advancements in technology for LNG storage and transportation, which will open new markets.

At the beginning of the COVID-19 pandemic, lockdowns and a faltering global economy led to a notable decline in the demand for dry natural gas. Production and prices temporarily dropped as a result. Nevertheless, as economies have improved and demand has increased, the market has shown signs of resiliency.