Global Drones for Energy Sector Market size (2023 - 2030)

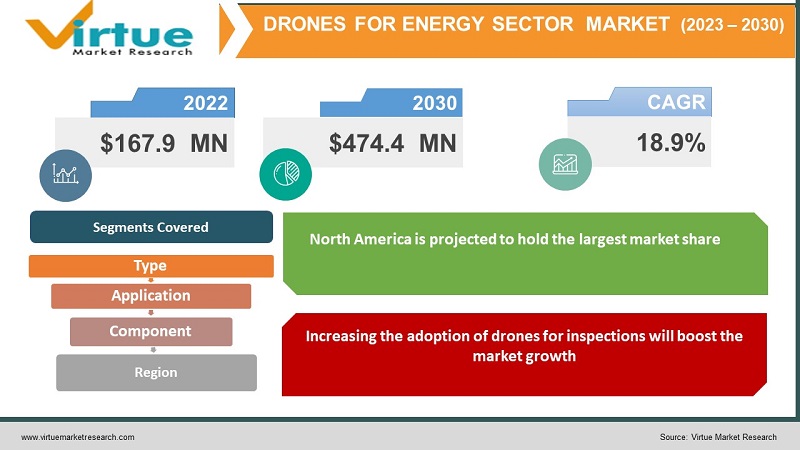

In 2022, the Global Drones for Energy Sector Market was valued at $167.9 million and is projected to reach a market capitalization of $474.4 million by 2030. Over the forecast period of 2023-2030, the market is anticipated to grow at a CAGR of 18.9%.

Market Overview

Drones in the energy sector are projected to see substantial growth in the future years. Drones, also known as unmanned aerial vehicles (UAVs), are increasingly being employed in the energy business for inspections, surveys, and mapping. Drones can help energy businesses save time and money while improving safety and efficiency. Traditional means of inspection, like helicopters or climbers, can be costly and risky, drones on the other hand, can examine electricity lines and transmission towers in a safe and efficient manner, giving high-resolution photos and data that can be utilised to identify and correct any concerns. This can assist energy firms in preventing power outages and lowering maintenance expenses. They are likely to rise in the future years as advanced technology such as thermal imaging cameras, LiDAR sensors, and data processing software become more widely available. These technologies can assist to enhance the accuracy and efficiency of inspections, surveys, and mapping, making it simpler for energy businesses to identify and fix concerns in a timely manner. It is predicted to increase dramatically in the coming years due to their potential to save energy businesses time and money while also enhancing safety and efficiency. However, to fully utilise the benefits of drones in their operations, energy businesses will need to solve problems such as legal framework and a shortage of qualified labour.

Drones for Energy Sector Market Driver:

Increasing the adoption of drones for inspections will boost the market growth

Drones are increasingly being used to monitor electricity lines, transmission towers, oil and gas pipelines, and other forms of energy infrastructure as they can check these facilities securely and effectively, producing high-resolution photographs and data that can be utilised to diagnose and correct any problems. They can further assist energy firms in preventing outages and lowering maintenance expenses.

Cost savings associated with the use of drones in the energy sector is a significant driver for the growth of the market.

Drones can help energy firms save time and money by lowering the expenses of traditional inspection and survey methods. They may also be used to survey land for possible wind and solar energy projects, as well as to map an area's terrain and vegetation. This data may be used to determine the optimal site for energy projects and to plan for their construction and upkeep, potentially saving energy corporations a large amount of money.

Drones for Energy Sector Market Challenges:

Scarcity of trained employees will impede the market growth

Drones in the energy industry necessitate the usage of qualified personnel that is trained to operate and maintain these vehicles. However, there is a present scarcity of employees with the requisite skillset and expertise to efficiently operate and maintain drones. Hence, energy businesses may find it challenging to embrace and successfully employ drones in their operations due to a shortage of competent labour. Businesses will need to engage in training and development programmes to guarantee that they have the manpower needed to efficiently operate and maintain drones. This comprises pilot, engineer, and technician training. Overall, a competent workforce is a big impediment to the expansion of the drone business in the energy sector.

Impact of COVID-19 on Drones for the Energy Sector Market

The COVID-19 pandemic has had an influence on the energy drone industry. The early breakout of the pandemic triggered a market slowdown as energy companies curtailed their expenditure on drones and other non-essential equipment. However, as the pandemic advanced, the demand for drones in the energy industry began to rebound. The usage of drones in the energy industry has been viewed as a crucial service since it delivers critical data and information that may aid in the operation and maintenance of energy infrastructure. The pandemic has also disrupted supply chains, affecting the drone business and the availability of drones for the energy sector. Furthermore, the pandemic has reduced the number of pilots available to operate drones. Overall, COVID-19 has had a mixed influence on the market for energy-related drones.

DRONES FOR ENERGY SECTOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

18.9% |

|

Segments Covered |

By Type, Application, Component, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DJI (China), Microdrones (Germany), Aibotix GmbH Limited (UK), Drone America (US), Draganfly Innovations Inc. (US), ING Robotic Aviation (Canada), Aeryon Labs Plc. (UK), AeroVironment Inc. (US), Ascending Technologies Inc. (Canada), Univision (Canada) |

Drones for Energy Sector Market Segmentation

Drones for Energy Sector Market Segmentation - By Type

- Fixed-wing drones

- Rotary-wing drones

- Hybrid drones

Fixed-wing drones are drones with wings that give lift and are meant to fly like aeroplanes. They are commonly employed for long-distance flying and are ideal for surveying and mapping applications in the energy sector. They are primarily employed for short-distance flights and are ideal for inspection applications in the energy sector. Hybrid drones combine the properties of fixed-wing and rotary-wing drones and can fly in both vertical and horizontal modes. Because of their adaptability in a variety of applications, they are increasingly being employed in the energy industry.

Drones for Energy Sector Market Segmentation - By Application

- Inspection

- Mapping and Surveying

- Monitoring and Maintenance

- Others

Drones are being utilised more and more to monitor power lines, transmission towers, oil and gas pipelines, and other energy infrastructure. Drones can check these buildings securely and effectively, producing high-resolution photographs and data that can be utilised to diagnose and correct any problems. This is predicted to be the market's largest segment. Drones are also being employed in the energy sector for surveying and mapping. This data may be used to determine the ideal location for energy projects and to plan for their development and upkeep. Drones may also be used to monitor the functioning of energy infrastructure, such as wind turbines, solar panels, and other renewable energy equipment. Drones may also be used to monitor oil and gas pipelines, such as identifying leaks and other problems. They are also employed in other energy-related applications such as search and rescue, security, and emergency response.

Drones for Energy Sector Market Segmentation - By Component

- Hardware

- Software

- Service

The hardware part comprises the drones themselves, as well as the cameras, sensors, and other data and picture collection devices. Because of the rising deployment of drones in the energy sector, this category is likely to have the greatest share of the market. The software section covers the software needed to control the drones as well as the software required to handle and analyse the data and photos acquired by the drones. This category comprises flight planning, navigation, data processing, and data analysis software. Services linked with the usage of drones in the energy industry, such as training, maintenance, and repair, are included in the services section. Consulting services for the selection, deployment, and operation of drones in the energy sector are also included in this section.

Drones for Energy Sector Market Segmentation - By Region

- North America

- Europe

- Asia-Pacific

- South America

- Rest of the World

Due to the existence of key players in the region and the growing use of drones in the energy sector, North America is projected to hold the largest market share. Due to the region increasing drone adoption, Europe is also anticipated to be a sizable market for drones in the energy sector. Asia Pacific is thought to represent a sizable market for drones in the energy sector due to the region's growing adoption of drones.

Recent Development

- August 2021: Indian Oil Corporation (IOC) announced that it is using drones to check its massive network of pipelines across the country. The country's largest oil corporation already employs a combination of advanced equipment and patrolling to identify any leakage from the pipeline network's 15,000-kilometer length.

- August 2021- Qualcomm Technologies, enabled low-power computing and camera systems integrated with AI, and long-range connectivity.

Key players

- DJI (China)

- Microdrones (Germany)

- Aibotix GmbH Limited (UK)

- Drone America (US)

- Draganfly Innovations Inc. (US)

- ING Robotic Aviation (Canada)

- Aeryon Labs Plc. (UK)

- AeroVironment Inc. (US)

- Ascending Technologies Inc. (Canada)

- Univision (Canada)

The above list comprises the important key players in the Drones for Energy Sector Market.

Chapter 1. Drones for Energy Sector Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Drones for Energy Sector Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Drones for Energy Sector Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Drones for Energy Sector Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Drones for Energy Sector Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Drones for Energy Sector Market - By Component

6.1 Solutions

6.2. Services

6.3. Hardware

Chapter 7. Drones for Energy Sector Market - By Application

7.1. Inspection

7.2. Mapping and Surveying

7.3. Monitoring and Maintenance

7.4. Others

Chapter 8. Drones for Energy Sector Market - By Type

8.1. Fixed-wing drones

8.2. Rotary-wing drones

8.3. Hybrid drones

Chapter 9. Drones for Energy Sector Market – By Region

9.1. North America

9.2. Europe

9.3.The Asia Pacific

9.4.Latin America

9.5. Middle-East and Africa

Chapter 10. Drones for Energy Sector Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. DJI (China)

10.2. Microdrones (Germany)

10.3. Aibotix GmbH Limited (UK)

10.4. Drone America (US)

10.5. Draganfly Innovations Inc. (US)

10.6. ING Robotic Aviation (Canada)

10.7. Aeryon Labs Plc. (UK)

10.8. AeroVironment Inc. (US)

10.9. Ascending Technologies Inc. (Canada)

10.10. Univision (Canada)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In 2022, the Global Drones for Energy Sector Market was valued at $167.9 million and is projected to reach a market capitalization of $474.4 million by 2030

Drones are used mostly in inspection, surveying and mapping, monitoring, and other missions such as search and rescue, security, and emergency response

The primary problems confronting the drone industry in the energy sector include a shortage of qualified labour, privacy and security issues, and regulatory challenges. The market impact of the COVID-19 pandemic is also an issue for the business

The key advantages of deploying drones in the energy sector are increased efficiency and safety, lower prices, and greater data collecting and analytical capabilities. Drones can also serve to eliminate the need for human work and touch, improving safety and lowering expenses.

Drones may help energy companies in a variety of ways, including increased efficiency and safety, lower costs, and greater data collecting and analytic capabilities. Drones can also serve to eliminate the need for human work and touch, improving safety and lowering expenses. Furthermore, drones may assist energy organisations in promptly identifying and repairing any faults, reducing downtime and increasing production.