Drone Software Market Size (2023 – 2030)

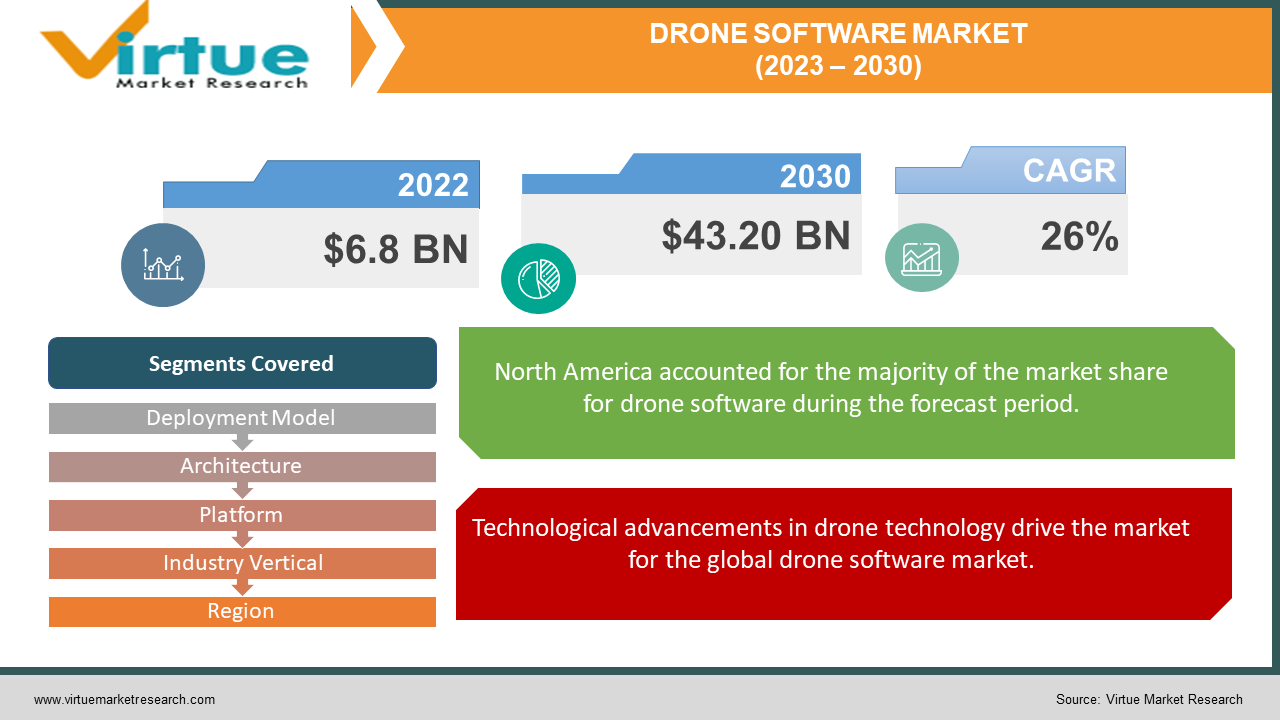

The Global Drone Software Market was valued at USD 6.8 billion and is projected to reach a market size of USD 43.20 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 26%.

Drone software has gained immense popularity in recent times, due to rapid technological advancements in various industries. Further, the increase in demand for drones for gaining insights such as for agriculture and construction, capturing distant places, and mapping purposes has developed the market for drone software. Moreover, in the present scenario, an increase in demand for advanced and automated drone software has induced software companies to develop AI-enabled drone software that provides real-time data analysis in various sectors. Furthermore, sector and product-specific development in drone technology such as the development of agriculture crop software for analyzing crop patterns, has further boosted the growth of drone software in the market. Furthermore, the future holds positive for the drone software market as advancements in AI and automation software technologies transform complex working operations such as mapping distant places, analyzing emergencies and response, studying the environment & monitoring wildlife habitat patterns for its conservation, and others.

Key Market Insights:

-

As of 2023, The FAA (Federal Aviation Administration), has 855,860 drones registered in the USA.

-

DJI is the largest consumer drone manufacturer with a market share of 54% globally, and 80% in the USA, as of the year 2022.

-

According to the US Department of Defense (DoD) estimates, the Pentagon has more than 11,000 unmanned aerial systems in support of domestic training events and overseas contingency missions.

-

As per Drone Survey Services, Crop spraying by drones has proved 40%-60% times faster than manual spraying in agriculture.

-

A recent survey found that 79% of online buyers would be willing to receive their delivery by drone.

-

As per the Civil Aviation Administration of China, there were 781,000 registered drone users in 2021 and the total number of drones registered was 832,000.

Drone Software Market Drivers:

Technological advancements in drone technology drive the market for the global drone software market.

Technological advancements in drone technology have made it easier for industries to perform tasks effectively and quickly. Moreover, with the development of drone hardware such as the use of advanced sensors, cameras, propellers, advanced landing gear, and smart flight controllers has increased the demand for drone software in the market. Drone software helps the hardware to communicate the data effectively to the users. These include advanced GPS software and obstacle detection software which is integrated into the sensors and cameras that provide information regarding the location, obstacles in the location, and capturing images for analyzing and mapping purposes. These are usually used for military and protection purposes. Further, advanced drone photography software for aerial photography and videography purposes is increasingly demanded by vloggers, travelers, and tourism boards and agencies. Moreover, AI and machine learning-based software enable to track the drone’s flight and improve its performance remotely. Additionally, software optimization features in drone software such as power management of the drone and planning of the drone’s route have further boosted the demand for drone software in the market. Moreover, autonomous flight features in the software enable users to automate the navigation and path-planning process in various applications such as agriculture and infrastructure mapping.

Rising security concerns boost the demand for drone software in the market.

The increasing safety concerns across geographical borders have increased the need for robust and secured drone software that provides real-time location information and protects large volumes of data through encryption. Further, geofencing features have enabled security personnel to create virtual boundaries in their regions that can prevent the unauthorized access of drones and restrict the flying of drones in airports, military areas, and sensitive government locations. Moreover, rising trends in remote technology have led to the development of drone software with remote identification features that enable security personnel to remotely identify the identities of drones such as the location information. This information is then received by the authority person in concern and helps them in monitoring drone flight. This is mostly used for Air Force security. Furthermore, advanced drones such as those with encrypted sensor technology are used widely in the military and defense sectors for ensuring data security and for capturing sensitive data such as images or videos of target or attacker drones. Furthermore, rising demand for border security has gradually increased the usage of drone software with enhanced security features such as collision and obstacle avoidance, emergency landing, risk and danger routes, and others.

Drone Software Market Restraints and Challenges:

Data privacy and security concerns can reduce the market demand for drone software. Drone software contains a large amount of sensitive data, which is exposed to cyber threats such as data breaches, data leaks, and virus attacks, which can damage the functioning of drones and hence reduce the demand for drone software in the market.

Drone Software Market Opportunities:

The Global Drone Software Market is anticipated to deliver lucrative opportunities for businesses, which include acquisitions, partnerships, collaborations, product launches, and agreements during the forecasted period. Furthermore, growing trends in AI and data analytics and an increase in demand for automation technologies are predicted to develop the market for drone software and enhance its future growth opportunities.

DRONE SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

26% |

|

Segments Covered |

By Deployment Model, Architecture, Platform, Industry Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DroneBase Inc, DJI, ESRI, Pix4D, DroneDeploy, PrecisionHawk, Inc, Skydio, Yuneec, OpenDroneMap, ArduPilot, Agiosoft Metashape |

Drone Software Market Segmentation: By Deployment Model

-

Cloud-Based

-

On-Premise

In 2022, based on market segmentation by deployment model, cloud-based occupies the highest share of about 23.9% in the drone software market. Cloud-based drone software is hosted on third-party service providers that help in managing, maintaining, and upgrading drone software. Moreover, this software offers increased scalability that allows various industries to handle large sets of data easily and greater accessibility that allows users to gain access to data from any location and device.

The on-premise segment is the fastest-growing segment during the outlook period. This software is installed and operated at the local servers of the specific industry, enabling complete data control and software customization options to the users.

Drone Software Market Segmentation: By Architecture

-

Closed Source

-

Open Source

In 2022, based on market segmentation by architecture, open-source drone software occupies the highest share of about 27% in the market. Open-source drone software is developed by a community of developers and collaborators and is accessible to the public free of cost. That is, anybody can view, edit, and distribute the code of the software. Moreover, open-source software provides increased transparency and enable users to customize their software as per their requirement, thus increasing the effectiveness of the software. Furthermore, open-source drone software is mostly used for research and analysis purposes by educational and research institutes.

The closed-source segment is the fastest-growing segment during the forecast period. This type of drone software is managed and developed by a specific company and does not allow public access to the code of the software. This software provides subscription-based services to the users that allow them to gain access to the specific features of the software. Furthermore, closed-source drone software is mostly used in the construction, military, and defense sectors for enhanced safety, security, and reliability.

Drone Software Market Segmentation: By Platform

-

Desktop-Based Software

-

Application-Based Software

In 2022, based on market segmentation by platform, desktop-based software occupies the highest share of about 23% in the market. Desktop-based drone software is installed and runs on desktop computers or laptops, allowing users to operate and monitor drone flight from these devices. One of the major advantages of this software is that it allows users to use it offline and monitor remote areas with ease. Moreover, trends in AI technology have enabled users of desktop software to use it for 3D mapping and data analysis purposes such as for construction, infrastructure development, and other purposes.

The application-based software is the fastest-growing segment during the forecast period. Due to the rise in smartphone usage, there is an increase in demand for application-based drone software in the market. This software can be installed and run on mobile devices, allowing users to remotely monitor drone flight easily via smartphone. Moreover, cloud-based integration allows users to perform data management and analysis of complex and large data sets in real time. Furthermore, application drone software is widely used for monitoring and gathering insights into the environment, public places, and agricultural lands.

Drone Software Market Segmentation: By Industry Vertical

-

Environment

-

Agriculture

-

Construction

-

Military & Defense

-

Flim & Entertainment

-

Logistics & Transportation

-

Others

In 2022, based on market segmentation by industry vertical, military & and defense occupy the highest share of about 28% in the market. Drone software is increasingly used in the military & and defense sector for improving the security of regions and preventing future collateral damages. Specialized drones such as those equipped with cameras, thermal imaging, and computer vision technology are used for surveillance purposes that help in capturing real-time pictures and videos of attacker drones and send alerts to command centers. Moreover, drone software enables military personnel to identify and track potential threats remotely, by using advanced AI algorithms. Additionally, secured and encrypted drone software enables security personnel to prevent unauthorized access to respective territory and online data. Furthermore, rising demand for integration technologies has led to the development of drone software that can be integrated into military systems for improved security and safety purposes.

The agriculture segment is the fastest-growing segment during the forecast period. Drone software is gaining momentum in agriculture due to its accuracy and increased performance in collecting and analyzing real-time data. Moreover, precision agriculture drone software has witnessed an increase in demand, as it enables farmers to monitor crop patterns, analyze soil response towards crop growth, and collect data on yield. These agricultural drones are equipped with advanced sensors such as multispectral and hyperspectral sensors, advanced cameras, propellers, and other parts that help in collecting crop health data. Furthermore, agriculture drone software offers GIS (Geographic Information System) integration that enables farmers to gather detailed insights regarding their fields, identify and analyze problematic areas in cultivation, monitor their crops remotely, and others. Furthermore, trends in data analytics and automation technologies have enabled farmers to perform historical analyses of their crop performance and optimize crop yield effectively.

Drone Software Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, based on market segmentation, North America occupies the highest share of about 29% in the market. Technologically advanced infrastructures and continuous development in drone technology have boosted the demand for drone software in the region. As per Drone Survey Services, businesses and governments spent a total of US $13 billion on drones in 2022.

Asia-Pacific is the fastest-growing segment during the forecast period. The rapid adoption of technology in agriculture and rising infrastructure projects due to increasing population and urbanization have boosted the demand for drone software in the region. As per the National Agro-Tech Extension and Service Center (NATESC), in 2021, more than 120,000 drones were used for spraying pesticides on 1.07 billion mu of farmland in China.

COVID-19 Impact Analysis on the Global Drone Software Market:

The pandemic had a significant impact on the drone software market. Due to restrictions in travel and social distancing norms, procurement of components required to build a drone witnessed a slowdown, leading to a reduction in the production of drones, and hence a decline in demand for drone software. However, the rising need for contactless delivery induced e-commerce platforms to adopt drone-delivering solutions, which increased the usage of drone software in the market. In addition, hospitals, clinical centers, and research labs used specialized drones to monitor the impact of virus infection in remote areas and provide immediate vaccine delivery to them, which increased the usage of drone software for monitoring the delivery process.

Latest Trends/ Developments:

-

The global Drone Software Market is reasonably split and fragmented with the existence of several global companies. These players are motivated to achieve higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. The growing trends in autonomous technology equipment such as drones, have developed the market for drone software. Autonomous drones require minimal human intervention and work on AI and machine learning technologies to provide real-time insights to the users. Moreover, growing trends in agricultural drones have induced software developers to build robust, secure, and efficient agricultural drone software that helps in monitoring crop patterns and mapping the field remotely. In addition, advanced drone software with 3D modeling capabilities is used in construction for infrastructure development and site inspection. Furthermore, the advent of AI and computer vision has made it easier for security personnel to detect obstacles, track unauthorized access in their territory, and counterattack. Moreover, the increase in environmental concerns has increased the usage of environmental monitoring drones for assessing pollution levels, analyzing wildlife, and evaluating environmental health. Furthermore, trends in contactless and faster delivery services, induced e-commerce platforms and food and Beverage companies such as Amazon, Domino, and others to adopt drone delivery services.

-

In March 2023, a Nashik-based start-up in India, launched software for drones. These were used specifically in the agriculture sector for spraying insecticides. The software is named– AeroGCS Green and is developed by Passenger Drone Research Private Limited, that is meant to help farmers map their fields and lanes, where spraying is not done properly.

-

In March 2022, Asteria Aerospace, a Jio Platform subsidiary, launched a drone software platform – SkyDeck. This software is a cloud-based software platform that offers Drone-as-a-Service (DaaS) solutions for various industry verticals such as agriculture, surveying, industrial inspections, surveillance, and security. The software offers a unified dashboard and services platform for drone management, scheduling and executing of drone flights, data processing, visualization, and AI-based analysis for capturing aerial data. Moreover, the software can be used for various purposes such as agriculture, construction, mining, oil and gas industries, telecom, power and utilities, and others.

-

In June 2021, Alphabet Wing launched an application-based drone software in the USA. The app is named– OpenSky and is available in both Google Playstore and iOS app store. Moreover, the app is meant for airspace authorization and allows drone operators to request approval to operate in remote spaces easily and quickly.

Key Players:

-

DroneBase Inc

-

DJI

-

ESRI

-

Pix4D

-

DroneDeploy

-

PrecisionHawk, Inc

-

Skydio

-

Yuneec

-

OpenDroneMap

-

ArduPilot

-

Agiosoft Metashape

Chapter 1. Drone Software Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Global Drone Software Market– Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Drone Software Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Drone Software Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Drone Software Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Drone Software Market– By Deployment Model

6.1 Introduction/Key Findings

6.2 Cloud-Based

6.3 On-Premise

6.4 Y-O-Y Growth trend Analysis By Deployment Model

6.5 Absolute $ Opportunity Analysis By Deployment Model, 2023-2030

Chapter 7. Drone Software Market– By Architecture

7.1 Introduction/Key Findings

7.2 Closed Source

7.3 Open Source

7.4 Y-O-Y Growth trend Analysis By Architecture

7.5 Absolute $ Opportunity Analysis By Architecture, 2023-2030

Chapter 8. Drone Software Market– By Platform

8.1 Introduction/Key Findings

8.2 Desktop-Based Software

8.3 Application-Based Software

8.4 Y-O-Y Growth trend Analysis Platform

8.5 Absolute $ Opportunity Analysis Platform, 2023-2030

Chapter 9. Drone Software Market– By Industry Vertical

9.1 Introduction/Key Findings

9.2 Environment

9.3 Agriculture

9.4 Construction

9.5 Military & Defense

9.6 Flim & Entertainment

9.7 Logistics & Transportation

9.8 Others

9.9 Y-O-Y Growth trend Analysis Industry Vertical

9.10 Absolute $ Opportunity Analysis Industry Vertical, 2023-2030

Chapter 10. Drone Software Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Deployment Model

10.1.3 By Architecture

10.1.4 By Platform

10.1.5 By Industry Vertical

10.1.6 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Deployment Model

10.2.3 By Architecture

10.2.4 By Platform

10.2.5 By Industry Vertical

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Deployment Model

10.3.3 By Architecture

10.3.4 By Platform

10.3.5 By Industry Vertical

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Deployment Model

10.4.3 By Architecture

10.4.4 By Platform

10.4.5 By Industry Vertical

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Deployment Model

10.5.3 By Architecture

10.5.4 By Platform

10.5.5 By Industry Vertical

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Drone Software Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 DroneBase Inc

11.2 DJI

11.3 ESRI

11.4 Pix4D

11.5 DroneDeploy

11.6 PrecisionHawk, Inc

11.7 Skydio

11.8 Yuneec

11.9 OpenDroneMap

11.10 ArduPilot

11.11 Agiosoft Metashape

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Drone Software Market was valued at USD 6.8 billion and is projected to reach a market size of USD 43.20 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 26%.

Technological advancements in drone technology and Rising security concerns are the market drivers of the Global Drone Software Market.

Closed-Source and Open-Source are the segments under the Global Drone Software Market by architecture.

North America is the most dominant region for the Global Drone Software Market.

Asia-Pacific is the fastest-growing region in the Global Drone Software Market.