Drone Payload Market Size (2025-2030)

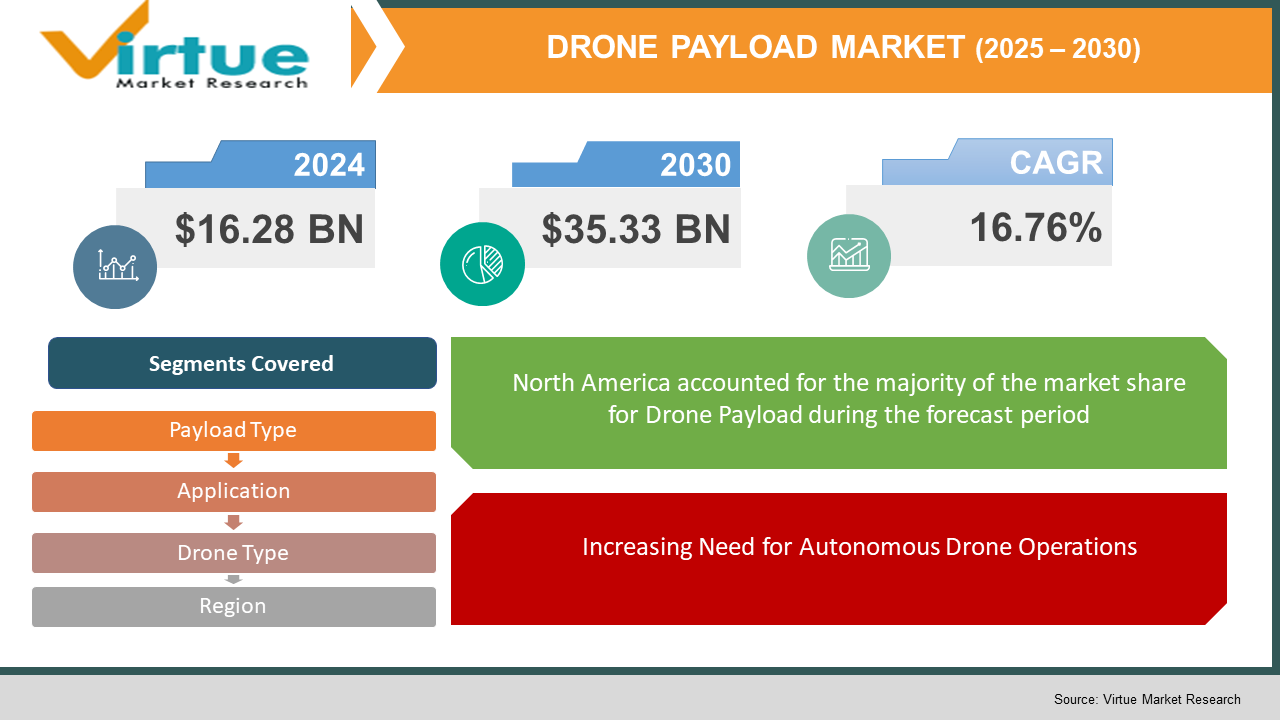

The Drone Payload Market was valued at USD 16.28 billion and is projected to reach a market size of USD 35.33 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 16.76%.

The drone payload market is rapidly growing, driven by advancements in drone technology and their expanding range of applications. Payloads, which include cameras, sensors, communication devices, and specialized tools, are essential components that enable drones to perform various tasks. This market serves multiple industries, including military and defense, agriculture, logistics, and infrastructure inspection. The increasing demand for aerial surveillance, precision agriculture, and real-time data collection has contributed to the market's growth. As drones become more versatile and cost-effective, payload innovations continue to enhance their functionality, making them an invaluable asset across sectors. With significant advancements expected in both hardware and software, the drone payload market is poised for continued expansion in the coming years.

Key Market Insights:

- Organizations such as Zipline have proliferated drone delivery services, having made more than 1.3 million deliveries in the U.S. alone and nearing 100 million miles worldwide. Such growth indicates that drones can significantly change logistics with their efficient, quick, and affordable delivery systems, particularly in remote or underdeveloped areas.

- The war in Ukraine has brought about accelerated progress and deployment of advanced drone payloads. The Ukrainian military, for instance, has ramped up mass production of fibre-optic drones with precise damage delivery and resistance against electronic jamming. This development reiterates the defence industry's status as a critical force in the technological advancement of drone payloads.

- In 2024, autonomous drones have made significant strides in sectors like agriculture and logistics. For example, drones equipped with AI and machine learning capabilities can now autonomously assess crop health, optimize irrigation, and even perform planting tasks. These autonomous capabilities, enabled by improved sensors and payload systems, are expected to revolutionize industries by reducing the need for human intervention and enhancing operational efficiency.

- In 2024, the Federal Aviation Administration (FAA) proposed regulations authorizing Beyond Visual Line of Sight (BVLOS) operations. This regulatory update is important to enable the widespread use of commercial drone services, especially in areas such as delivery and infrastructure inspection, by enabling drones to fly for longer distances without visual sight.

Drone Payload Market Drivers:

Innovation in Drone payload technology is Driving the Market Growth

The ongoing technological improvement in drone payload technologies is one of the biggest drivers for market expansion. Improvements in sensors, cameras, and imaging payloads, such as LiDAR and multispectral payloads, allow drones to carry out more sophisticated tasks with more precision. These developments enhance data fidelity and operational effectiveness, ushering in new applications within industries such as agriculture, defence, and logistics. With advancing technology, drones are able to execute tasks previously challenging or impossible, creating increasing demand for more advanced payload solutions.

Increasing Need for Autonomous Drone Operations

Autonomous drone growth has opened up a new realm for payload applications. Drone systems with artificial intelligence and machine learning features have the ability to fly autonomously, which suits them for tedious, dangerous, or hard-to-reach spaces. Autonomy in drone flying maximizes efficiency in drone activities, saving money and human efforts while enabling data collection on a larger scale. With advancing autonomous technology, fields such as farming, delivery services, and infrastructure inspection are moving more toward adopting drones for operations.

Relaxation of Drone Rules and Business Application

The relaxation of rules for drones in nations such as the U.S. and the rest of Europe has opened doors to new business opportunities. Regulatory bodies such as the Federal Aviation Administration (FAA) and other aviation administrations have established platforms enabling wider application of drones through operations like Beyond Visual Line of Sight (BVLOS) flights. These policy developments allow companies to use drones for an ever-wider variety of applications, ranging from delivery to industrial inspections. With increasingly favorable drone regulations, the short- and long-term growth prospects for the commercial drone payload market look strong.

Drone Payload Market Restraints and Challenges:

Regulatory and Safety Concerns

Though regulations for drones have been changing, regulatory compliance and issues of safety are still major challenges. Regulatory agencies such as the FAA and EASA have strict guidelines for drone operations, especially in urban settings or for beyond visual line of sight (BVLOS) flights. These constraints have the potential to hinder the maximum potential of drones, particularly in commercial use such as delivery services. This means that the demand for stronger regulatory frameworks and safety measures is holding back widespread adoption, particularly in some areas.

Short Battery Life and Payload Capacity

Perhaps the greatest challenge for the drone payload market is the short battery life and payload capacity. Existing drone technology also has limitations in terms of flight duration and payload capacity while still operating in an optimal state. Longer flight times and heavier payloads are necessary for cost-saving and effective operations for industries such as delivery and surveillance. This limitation will remain a hindrance to market growth, particularly in the case of long-range applications, until there are breakthroughs in battery technology or power management systems.

High Upfront Costs and Maintenance Costs

While drone technology is now more open to wider use, the price of advanced drones and specific payload systems still poses a major obstacle for most potential clients. For companies, the upfront cost of buying drone equipment, plus the expense of maintaining and updating payload systems, can be prohibitive. This hinders small and medium-sized companies from using drones commercially, restricting market penetration. As technology advances and economies of scale are realized, the costs can drop, but presently, affordability is a problem.

Drone Payload Market Opportunities:

The drone payload market presents a number of the most important opportunities in areas such as agriculture, logistics, and environmental monitoring. With increasingly powerful drones enabled by advanced payloads, prospects for precision agriculture are growing as drones can track crop health, optimize irrigation systems, and lower pesticide consumption, leading to increased yields and sustainability. In transportation, drones will transform delivery operations, particularly in remote locations, by lowering the cost and time of delivery, with Amazon and UPS already testing such services. Another expanding area is environmental monitoring, such as tracking wildlife and detecting pollution, where drones fitted with advanced sensors deliver real-time information in inaccessible areas. In addition, the growing use of autonomous drones, coupled with positive regulatory shifts, is creating new markets for surveillance and inspection services. As the technology continues to improve and become cheaper, these opportunities are likely to grow, driving market growth further.

DRONE PAYLOAD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

16.76% |

|

Segments Covered |

By payload type, application, drone type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DJI Innovations, Parrot SA, Northrop Grumman Corporation, Textron Inc., AeroVironment, Inc., Lockheed Martin Corporation, Delair, Insitu Inc. (A Boeing Company), Intel Corporation, Quantum Systems GmbH, etc. |

Drone Payload Market Segmentation:

Drone Payload Market Segmentation: by Payload Type

- Cameras and Imaging Systems

- Sensors

- Communication Equipment

- Others

UAVs with Cameras and Imaging Systems, such as optical, infrared, and multispectral sensors, are extensively utilized in use cases such as surveillance, agriculture, and infrastructure inspection. These payloads enable high-resolution data acquisition, which makes them ideal for applications that need detailed visual inspection. Sensors, like LIDAR, gas sensors, and temperature sensors, are important for observing environmental conditions, detecting danger, and acquiring scientific data. These sensors are becoming increasingly essential in agricultural, mining, and environmental monitoring industries. Communication Equipment payloads, such as relay systems and data transmitters, are mainly utilized in military and communications applications to enable real-time data transmission. Other payloads, such as those utilized for package delivery, agricultural spraying, or specialized industrial applications, extend the variety of drone applications, addressing unique requirements in industries like logistics and pest control. Market share for these segments is around 40% to 45% for Cameras and Imaging Systems, 25% to 30% for Sensors, 15% to 20% for Communication Equipment, and 10% to 15% for Others.

Drone Payload Market Segmentation: by Application

- Military and Defense

- Commercial

- Public Safety

- Industrial

In the Military and Defense segment, drones are fitted with sophisticated payloads for surveillance, reconnaissance, and tactical missions, with precision and reliability being paramount. This segment continues to be a major driver for high-performance payloads. The Commercial segment encompasses drones utilized in industries such as agriculture, logistics, film-making, and infrastructure inspection, with payloads engineered to cater to the specific demands of each industry. Drones within this category are gaining popularity, especially in agriculture for crop monitoring and precision agriculture. Public Safety missions, including search and rescue, law enforcement, and disaster response, use drones with thermal imaging, cameras, and communication systems to aid first responders in evaluating perilous situations better. Finally, Industrial missions include using drones for monitoring and inspection of infrastructure like pipelines, power lines, and mines, which reduces downtime and enhances safety. The market share of these segments is around 35% to 40% for Commercial, 25% to 30% for Military and Defense, 20% to 25% for Industrial, and 10% to 15% for Public Safety.

Drone Payload Market Segmentation: by Drone Type

- Fixed-wing Drones

- Rotary-wing Drones

- Hybrid Drones

Fixed-wing Drones are meant for long endurance and high-area coverage, thus best suited for surveying, mapping, and military reconnaissance, usually with heavier payloads and longer flight durations than other types. Rotary-wing Drones, such as quadcopters, are versatile with vertical takeoff and landing capabilities and are thus applicable in areas such as aerial photography, agricultural spraying, and short-range logistics. They can also hover in place, giving them precision for work that needs concentrated attention. Hybrid Drones incorporate the advantages of both fixed-wing and rotary-wing drones so that they can travel long distances but still have the capability to hover when needed. This makes hybrid drones perfect for sophisticated missions with both endurance and accuracy demands. The market share for these segments is around 60% to 65% for Rotary-wing Drones, 25% to 30% for Fixed-wing Drones, and 10% to 15% for Hybrid Drones.

Drone Payload Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In North America, the drone payload market is highly advanced, driven by strong demand in industries such as defence, agriculture, and logistics, with significant investments in drone technology and regulatory support. The region holds approximately 40% to 45% of the global market share due to its technological innovation and early adoption of commercial drone services.

In the Asia-Pacific region, countries like China and India are rapidly growing markets, fueled by increasing adoption in agriculture, infrastructure inspection, and e-commerce logistics, though regulatory challenges remain. This region holds around 25% to 30% of the global market share, with China leading the way in drone production and usage.

Europe is also seeing significant growth, particularly in commercial applications like agriculture and delivery services, with strong government initiatives to support drone technology and infrastructure. The market share for Europe stands at 15% to 20%, driven by adoption across both private and public sectors.

COVID-19 Impact Analysis on the Global Drone Payload Market:

The COVID-19 pandemic had a dual effect on the drone payload market, both positive and negative. On the one hand, the pandemic hastened the use of drones in sectors such as healthcare, logistics, and surveillance, as companies looked for contactless means of delivery, monitoring, and medical supplies. Drones with payloads for thermal scanning and disinfection were utilized in public health interventions, boosting demand for some types of payloads. Conversely, supply chain disruptions, labor shortages, and delays in regulation hindered the production and deployment of drones, affecting growth in certain industries. Overall, while the pandemic presented challenges, it also underscored the potential of drones, driving the market towards innovation and increasing the applications of drones for essential services as well as new uses.

Latest Trends/ Developments:

The market for drone payloads is seeing tremendous advancements in autonomous drone operations, with more use of AI and machine learning to make drones operate autonomously without human intervention. This is especially true in agriculture, where autonomous drones are employed for crop monitoring, pest management, and precision spraying, enhancing efficiency and sustainability. Another important advancement is the evolution of sensor technologies, including LIDAR and multispectral imaging, that improve data precision and allow drones to execute sophisticated missions such as environment monitoring and infrastructure inspection. Regulatory reforms are also influencing the market as governments across the globe implement more supportive policies for Beyond Visual Line of Sight (BVLOS) operations, unlocking new commercial prospects. Drones are being increasingly equipped with 5G connectivity, allowing for real-time, high-speed data transmission and improved remote operations for sectors such as logistics and public safety. Finally, the market is witnessing growth in the creation of hybrid drone designs, which merge the endurance of fixed-wing drones with the accuracy of rotary-wing drones, providing more versatility for intricate missions across different industries.

Key Players:

- DJI Innovations

- Parrot SA

- Northrop Grumman Corporation

- Textron Inc.

- AeroVironment, Inc.

- Lockheed Martin Corporation

- Delair

- Insitu Inc. (A Boeing Company)

- Intel Corporation

- Quantum Systems GmbH

Chapter 1. Drone Payload Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Drone Payload Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Drone Payload Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Application Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Drone Payload Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Drone Payload Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Drone Payload Market – By Payload Type

6.1 Introduction/Key Findings

6.2 Cameras and Imaging Systems

6.3 Sensors

6.4 Communication Equipment

6.5 Others Y-O-Y Growth trend Analysis By Deployment:

6.6 Absolute $ Opportunity Analysis By Deployment:, 2025-2030

Chapter 7. Drone Payload Market – By Application

7.1 Introduction/Key Findings

7.2 Military and Defense

7.3 Commercial

7.4 Public Safety

7.5 Industrial

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. Drone Payload Market – By Drone Type

8.1 Introduction/Key Findings

8.2 Fixed-wing Drones

8.3 Rotary-wing Drones

8.4 Hybrid Drones

8.5 Y-O-Y Growth trend Analysis Drone Type

8.6 Absolute $ Opportunity Analysis Drone Type , 2025-2030

Chapter 9. Drone Payload Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Application

9.1.3. By Drone Type

9.1.4. By Payload Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Application

9.2.3. By Drone Type

9.2.4. By Payload Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Application

9.3.3. By Drone Type

9.3.4. By Payload Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By DRONE TYPE

9.4.3. By Application

9.4.4. By Payload Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By DRONE TYPE

9.5.3. By Application

9.5.4. By Payload Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Drone Payload Market – Company Profiles – (Overview, Product Payload Type Type Portfolio, Financials, Strategies & Developments)

10.1 DJI Innovations

10.2 Parrot SA

10.3 Northrop Grumman Corporation

10.4 Textron Inc.

10.5 AeroVironment, Inc.

10.6 Lockheed Martin Corporation

10.7 Delair

10.8 Insitu Inc. (A Boeing Company)

10.9 Intel Corporation

10.10 Quantum Systems GmbH

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Drone Payload Market was valued at USD 16.28 billion and is projected to reach a market size of USD 35.33 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 16.76%.

Innovation in Drone payload technology, Increasing Need for Autonomous Drone Operations and Relaxation of Drone Rules and Business Applications, are some of the key market drivers in the Drone Payload Market.

Military and Defense, Commercial, Public Safety, and Industrial Use are the segments by Applications in the Drone Payload Market.

North America is the most dominant region in the global Drone Payload Market.

. DJI Innovations, Parrot SA, Northrop Grumman Corporation, Textron Inc., AeroVironment, Inc., Lockheed Martin Corporation, Delair, Insitu Inc. (A Boeing Company), Intel Corporation, Quantum Systems GmbH, etc.