Drone Detection Radar Market Size (2024 – 2030)

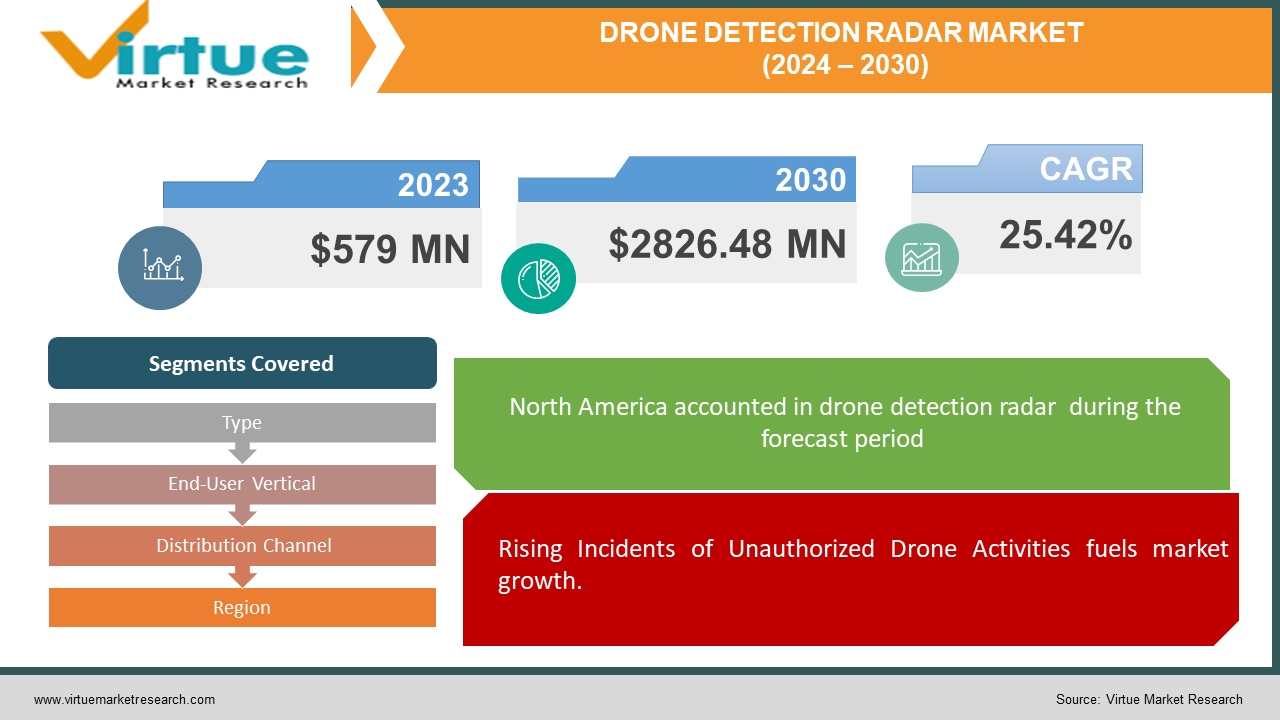

The Global Drone Detection Radar Market was valued at USD 579 million in 2023 and is projected to reach a market size of USD 2826.48 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 25.42%.

Drone detection radar is a system designed to detect, track, and monitor unmanned aerial vehicles (UAVs) in airspace. These radars enable rapid response to threats using radio frequency (RF) technology and advanced techniques to provide early warning of unauthorized drone activity. These systems, which first emerged from military needs in the mid-2000s, have been adapted to meet the needs of the public and have found use in various fields such as security, defense, police, civil aviation, and incident management.

Their popularity stems from their ability to effectively and reliably detect and track drones even in harsh environments, as well as their ability to operate independently and provide continuous monitoring without the need for human intervention. Integration with existing security systems, increased performance in different environments and the ability to meet specific needs, further contribute to their widespread adoption in safeguarding airspace integrity and enhancing security protocols in the face of evolving drone threats.

Key Market Insights:

Asia-Pacific region has the largest and had almost USD 200 million of total market share in 2023 and is expected to show a CAGR of 28.50%.CAGR exceeding 23%, indicating rapid market expansion thanks to its adoption across sectors such as defense, infrastructure protection, and commercial enterprises.Stakeholders collaborate to address market needs, driving innovation and standardization. Governments and security agencies invest in counter-drone technologies to mitigate emerging threats. Ongoing research and development efforts drive innovation and product enhancement in the drone detection radar market.

Drone Detection Radar Market Drivers:

Rising Incidents of Unauthorized Drone Activities fuels market growth.

The proliferation of drones has led to an increase in unauthorized and potential drone activity, including surveillance, theft, and illegal surveillance. These conditions pose a significant threat to many areas such as defense, critical infrastructure, and public safety. Therefore, the need for powerful drone detection radar systems that can instantly detect and identify drones is increasing. Radar technology can drive market growth by providing early warning and accurate tracking of drones, enabling preventive measures to be taken to prevent security breaches.

Technological Advancements in Radar Systems accelerates the market growth.

Continuous advances in radar technology, including improvements in detection range, accuracy, and signal processing capabilities, are driving innovation in the drone detection radar industry. Manufacturers are investing in research and development to improve the performance of radar systems, such as increasing the sensitivity of detecting small drones and reducing false alarms. Integration of radar systems with additional technologies such as photoelectric sensors and artificial intelligence algorithms can further improve detection capabilities and reduce response time. These technological advances have supported the growth of the business by attracting customers to find air protection solutions in the state.

Increasing Investments in Counter-Drone Technologies will drive the market forward.

Governments, military agencies, and private organizations are increasingly investing in drone technology in response to the ever-changing threat posed by drones. Drone detection radar systems play an important role in integrated security solutions by providing early detection and tracking capabilities. The increasing use of drone protection measures, including radar-based detection systems in critical areas, critical sites, and public places, is giving impetus to market expansion. In addition, collaborations between defense companies, technology companies, and government institutions to create the best solutions will help the sector grow by encouraging innovation and productivity.

Drone Detection Radar Market Restraints and Challenges:

Cost Constraints and Budgetary Limitations restrain the market growth.

The high initial cost associated with the procurement, installation, and maintenance of drone detection radar systems poses a significant challenge for potential buyers, especially in budget-constrained sectors such as civil aviation and public safety. Additionally, the total cost of ownership, which includes regular maintenance, training, and software updates, also increases the financial burden. Therefore, organizations, especially small businesses or regional businesses with limited budgets, may be reluctant to invest in drone detection radar solutions, limiting business growth.

Limited Detection Range and Performance Limitations prove to be a challenge in the Drone Detection Radar sector.

Despite advances in radar technology, some radar systems may have limitations in detection range, accuracy, and performance, especially when detecting small, low-flying drones or an environment with high clutter or electromagnetic interference. These operational limitations may result in false alarms, loss of visibility, or reduced effectiveness in detecting sensitive or fast-moving drones, thereby affecting the reliability of radar-based detection systems. Overcoming these challenges to improve detection capabilities and minimize vulnerabilities is critical to market acceptance and adoption.

Regulatory Hurdles and Legal Frameworks hinder the market growth.

Regulatory uncertainties and complex legal frameworks about drone operations and airspace management pose significant challenges to the deployment and operation of drone detection radar systems. Different regulations between regions and countries, combined with varying privacy concerns and data protection laws, can create compliance issues for organizations seeking to deploy drone detection radar solutions. Additionally, regulatory restrictions on the use of certain radar frequencies or restrictions on radar transmission in certain areas, such as airports or military installations, may impact business development and deployment opportunities.

Drone Detection Radar Market Opportunities:

Emerging Applications in Commercial and Industrial Sectors provide an opportunity for market players to establish their presence.

Drones are increasingly used in many industries and businesses, such as aerial photography, surveillance, agriculture, and infrastructure inspections, offering great opportunities for drone detection radar systems. As drones become more common in these areas, the need to protect critical infrastructure and assets, and secure airspace increases. Drone detection radar solutions provide an effective way to detect and mitigate unauthorized activities, providing opportunities for business expansion across different industries.

Integration with Counter-Drone Solutions – an opportunity to be more profitable in the market.

Integration of drone detection radar systems with complementary counter-drone technologies, such as jamming devices, drone capture nets, and kinetic mitigation systems, presents lucrative opportunities for market growth. By combining radar-based detection capabilities with countermeasures, organizations can develop comprehensive solutions that can effectively detect, track, and neutralize rogue UAVs effectively. The demand for integrated security solutions is expected to increase, especially in high-security areas such as airports, government facilities, and critical infrastructure sites.

Advancements in Sensor Fusion and Artificial Intelligence (AI) will provide limitless opportunities.

Ongoing advances in sensor fusion techniques and artificial intelligence (AI) algorithms provide opportunities to improve the capabilities of drone detection radar systems. By combining radar data with data from other sensors such as electro-optical cameras, acoustic sensors, and radio frequency detectors, organizations can increase detection accuracy, reduce false alarms, and improve situational awareness. AI-based algorithms can instantly analyze radar data to perform predictive analysis, pattern recognition, and anomaly detection, thereby increasing the effectiveness of drone detection and response.

DRONE DETECTION RADAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

25.42% |

|

Segments Covered |

By Type, End-User Vertical, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Robin Radar Systems, Dedrone , Terra Hexen , Thales Group, SpotterRF, Blighter, AxEnd , Boğaziçi Defense Technologies, Weibel Scientific A/S , Meteksan Savunma (Bilkent Holding) |

Drone Detection Radar Market Segmentation - by Type

-

Pulse-Doppler Radar Systems

-

Frequency-Modulated Continuous Wave (FMCW) Radar Systems

-

Other Radar Systems

In 2023, based on the Type, Pulse-Doppler Radar Systems holds the largest market share with over 60% of the market. Pulse Doppler radar systems have a proven track record in a variety of applications, including military and defense, border surveillance, and airborne surveillance, where long-range detection, tracking Speed , and the ability to distinguish between movement and parking are important. These radar systems are effective in complex environments such as urban areas and near airports and have the ability to track multiple targets at the same time. Pulse Doppler radar systems are mature and widely used in defense and security applications worldwide.

Although FMCW radar systems have the advantage of high resolution, accuracy, and sensitivity, especially in detecting small UAVs and distinguishing them from background clutter, they may not be as prevalent in certain sectors dominated by Pulse-Doppler radar systems. However, the adoption of FMCW radar systems is increasing in civilian applications such as airport security, critical infrastructure protection, and event management, where the need for precise drone detection is paramount.

Drone Detection Radar Market Segmentation - by End-User Vertical

-

Defense & Military

-

Critical Infrastructure Protection

-

Law Enforcement & Public Safety

-

Commercial Enterprises

-

Event Management

In 2023, based on the End-User Vertical, Defense and Military holds a significant portion of the market share and is expected to grow at a 27.80% CAGR during the forecast period. Defense and military sectors are significant end-user verticals for drone detection radar systems. Military installations, border patrols, and defense forces use radar systems to detect and track unauthorized drones that could pose a security threat. These radar systems are an important part of national security, providing early warning of potential intrusions and ensuring timely response to threats. Defense and military verticals are early adopters of advanced radar technologies and surveillance systems. These organizations invest in state-of-the-art radar solutions with capabilities such as long-range detection, high-resolution imaging, and multi-target tracking to address evolving security threats and operational requirements.

While Defense & Military Vertical dominated the Global Drone Detection Radar Market, the other end-user verticals like Critical Infrastructure Protection, Law Enforcement & Public Safety, Commercial Enterprises, and Event Management have their uses in relevant areas.

Drone Detection Radar Market Segmentation - by Distribution Channel

-

Direct Sales

-

Indirect Sales

-

OEM Partnerships and Alliances

-

Other Channels

In 2023, based on the Distribution Channel, Direct Sales holds the largest market share with over 65% of the market. Direct selling involves selling drone detection radar systems directly from manufacturers or authorized dealers to end users. Manufacturers are creating direct sales channels through sales teams, websites, and sales representatives to communicate directly with customers and provide personalized support. Direct sales are the first choice for large-scale exports, solutions, and profitable businesses, especially in sectors such as defense, critical construction, and government institutions.

Although Direct Sales dominate some industries, other distribution channels such as indirect sales, and partnerships with authorized dealers also play a role in expanding the business, entering niche markets, and meeting more customer needs.

Drone Detection Radar Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023 based on Region, North America has the largest market share, with over 31% market share. North America is the main market for drone detection radar systems, driven by the presence of key players, technological advancement, and the increasing adoption of drones across various fields. Regions include the United States and Canada, where defense, national security, critical infrastructure protection, and commercial markets are driving demand for drone detection radar systems. Strict regulations, security concerns, and investments in counter-drone technologies are driving the growth of the North American market.

In the Asia-Pacific region, the deployment of drone detection radars is rapidly increasing in countries such as China, India, and Japan, driven by increased use of drones, security concerns, and government measures. In Europe, strict regulations, security threats, and investments in counter-drone technologies have led to economic growth. In the Middle East and Africa, countries such as Saudi Arabia and the United Arab Emirates have invested in surveillance equipment to improve air security and protect critical infrastructure. Drone detection radar deployments continue to increase in South America due to security concerns and the expansion of commercial drone operations. Together, these areas contribute to the diversity and growth of the global economy, underlining the importance of drone detection radar systems in ensuring global security.

While North America leads the Global Drone Detection Radar market, other regions such as Asia-Pacific and Europe are experiencing rapid growth and present huge opportunities for Drone Detection Radar market vendors.

COVID-19 Impact Analysis on the Global Drone Detection Radar Market:

The COVID-19 pandemic has had a significant impact on the global drone detection radar market. Initially, there were disruptions in the supply chain, production, and project implementation due to market closures, travel restrictions, and labor shortages. Therefore, some plans and acquisitions were postponed or canceled, affecting short-term business. However, the pandemic has also highlighted the importance of air security and the need for strong surveillance systems to mitigate emerging threats, including illegal drone operations. This recognition encourages investment in drone detection radar technology by governments, defense agencies, large employers, and commercial enterprises worldwide. In addition, drones are increasingly used in many applications such as delivery services, monitoring, and surveillance, as well as the need for drone detection radar systems and commercial vehicle rescue, and are becoming widespread in the post-pandemic period.

Latest Trends/ Developments:

The Global Drone Detection Radar Market is seeing many important trends and developments shaping its course. One of the most important of these is the integration of advanced technologies such as artificial intelligence (AI), machine learning, and data analysis into drone detection radar systems. These technologies increase detection accuracy, reduce vulnerability, and enable threat mitigation strategies. In addition, there is a growing trend towards multi-sensor fusion, which combines radar data with data from other sensors such as electro-optical cameras, acoustic sensors, and radio frequency detectors to provide information about events. Another important trend is the emergence of portable and mobile drone detection radar solutions that meet the needs of flexible, fast-moving systems in the operational environment. Additionally, growing concerns around compatibility, privacy issues, and design are driving innovation and collaboration among industry participants to accommodate changes and ensure drone safety and accountability.

Key Players:

-

Robin Radar Systems

-

Dedrone

-

Terra Hexen

-

Thales Group

-

SpotterRF

-

Blighter

-

AxEnd

-

Boğaziçi Defense Technologies

-

Weibel Scientific A/S

-

Meteksan Savunma (Bilkent Holding)

-

In November 2022 – Dedrone has announced a strategic collaboration with Johnson Controls, to address the security threats posed by unauthorized drone activity.

-

In April 2022, Thales and CS GROUP started working with their partners in France and Europe on a program capable of providing permanent deployable protection for critical infrastructure from drone threats.

Chapter 1. Drone Detection Radar Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Drone Detection Radar Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Drone Detection Radar Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Drone Detection Radar Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Drone Detection Radar Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Drone Detection Radar Market – By Type

6.1 Introduction/Key Findings

6.2 Pulse-Doppler Radar Systems

6.3 Frequency-Modulated Continuous Wave (FMCW) Radar Systems

6.4 Other Radar Systems

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Drone Detection Radar Market – By End-User Vertical

7.1 Introduction/Key Findings

7.2 Defense & Military

7.3 Critical Infrastructure Protection

7.4 Law Enforcement & Public Safety

7.5 Commercial Enterprises

7.6 Event Management

7.7 Y-O-Y Growth trend Analysis By End-User Vertical

7.8 Absolute $ Opportunity Analysis By End-User Vertical, 2024-2030

Chapter 8. Drone Detection Radar Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Indirect Sales

8.4 OEM Partnerships and Alliances

8.5 Other Channels

8.6 Y-O-Y Growth trend Analysis By Distribution Channel

8.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Drone Detection Radar Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By End-User Vertical

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By End-User Vertical

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By End-User Vertical

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By End-User Vertical

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By End-User Vertical

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Drone Detection Radar Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Robin Radar Systems

10.2 Dedrone

10.3 Terra Hexen

10.4 Thales Group

10.5 SpotterRF

10.6 Blighter

10.7 AxEnd

10.8 Boğaziçi Defense Technologies

10.9 Weibel Scientific A/S

10.10 Meteksan Savunma (Bilkent Holding)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Drone Detection Radar Market was valued at USD 579 million in 2023 and is projected to reach a market size of USD 2826.48 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 25.42%.

The segments under the Global Drone Detection Radar Market by Type are Pulse-Doppler Radar Systems, Frequency-Modulated Continuous Wave (FMCW) Radar Systems, and Other Radar Systems.

North America is the dominant region in the Global Drone Detection Radar Market.

Robin Radar Systems, Miltronix, Terra Hexen, Thales Group, SpotterRF, etc.

The COVID-19 pandemic has had a significant impact on the global drone detection radar market. Initially, there were disruptions in the supply chain, production, and project implementation due to market closures, travel restrictions, and labor shortages. Therefore, some plans and acquisitions were postponed or canceled, affecting short-term business. However, the pandemic has also highlighted the importance of air security and the need for strong surveillance systems to mitigate emerging threats, including illegal drone operations.