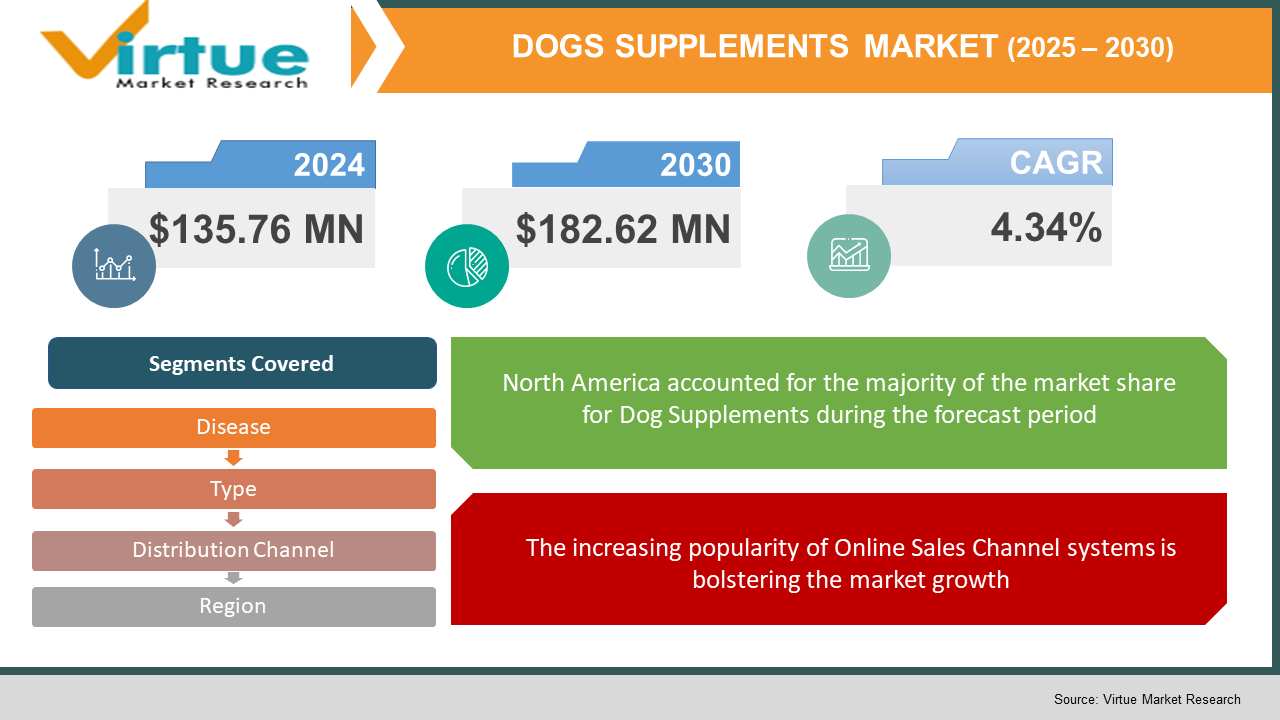

Dogs Supplements Market Size (2024 - 2030)

The Global Dog Supplements Market was valued at USD 135.76 million in 2023 and is projected to reach a market size of USD 182.62 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.34%.

Market Overview:

The rise in pet culture has led to people spending remarkably on their food, supplements, toys, accessories, and other pet-related products to keep them active, healthy, and happy. According to American Pet Products Association (APPA), in 2021, dog owners spent around USD 98.6 million on them in the U.S. These market trends are fuelling the demand for dog products and supplements. Additionally, the rising pet dog population and health concerns associated with it are likely to uplift the demand for dog supplements in the assessment period. Therefore, the elevating spending capacity on dog health products and a rise in their adoption are augmenting the dog supplements demand and expanding the market size.

COVID-19 Impact on the Dog Supplements Market:

The COVID-19 pandemic has dramatically changed the dog supplements market around the globe.

Almost all the services and stores for dogs or any other pets during the COVID-19 outbreak were closed or shut down due to stringent government rules associated with lockdowns or trips to the market. Due to this, a growing number of people began looking for food delivery alternatives for these animals. The origination of such innovative ideas is one of the few shining points in an otherwise devastating COVID-19 emergency. Online sales for food increased by 20% during the COVID-19 pandemic in the U.S., as per a report by the American Pet Products Association (APPA) in June 2021.

Market Drivers:

Increasing urbanization along with the disposable income among the middle-class population is bolstering the market growth:

With a rise in the population, rapidly increasing urbanization, improvement in standards of living, and growing disposable income among the middle-class population, the amount of household spending has also increased, driving the demand for high-quality pet products to keep up with the changing market dynamics. Therefore, the dog supplements market has also seen a rapid rise in demand owing to the rapid rise in pet culture along with the surplus disposable income among people.

The increasing popularity of Online Sales Channel systems is bolstering the market growth:

Businesses are now starting to explore untapped online opportunities to increase their sales efficiency, taking advantage of the market dynamics. A variety of pet products manufacturers have squeezed into various e-commerce channels such as Amazon, and others. In emerging economies, the growth has primarily come from the increased demand for low-cost products gathering popularity. The shift in business methodologies and strategies is opening new opportunities for several key players in the market to take over, contributing largely to the growth of the dogs supplements market.

The growing pet culture across the globe is boosting its demand in the market:

The increasing love for pets among people, especially the growing attraction of millennials towards dogs is the major driving force boosting the demand for the dog supplements market. Also, the escalating pet sentiment marketing has raised the revenue potential in the market.

Market Restraints:

Lack of knowledge and awareness regarding dog supplements is hampering the market growth:

The lack of awareness regarding dog supplements across the globe is one of the major factors hindering the growth of the market for dog supplements. Various pet owners are of the opinion that their pets do not require any supplements if they are in good health and that "complete and balanced" pet diets fulfil all of their pets' requirements. This common misconception accounts for one of the major challenges confronted by the dog supplement business.

DOGS SUPPLEMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.34% |

|

Segments Covered |

By Disease, Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bayer AG, PetHonesty, Honest Paws, Zenwise, Dechra Pharmaceuticals Plc, Only Natural Pets, Virbac, NOW Foods, Garmon Corporation, Nestle Purina Petcare, Food Science Corporation, Ark Naturals, Kemin Industries Inc., Novotech Nutraceuticals, Zoetis Inc. and many others. |

This research report on the Dog Supplements Market has been segmented and sub-segmented based on the Diseases, Distribution Channel, Type, Region, and Companies.

Dog Supplements Market – By Diseases.

- Diabetes

- Oral Care

- Digestive Sensitivity

- Weight loss

- Other diseases

Based on the disease, Dog Supplement Market has been segmented into 5 categories – Diabetes, Oral Care, Digestive Sensitivity, Weight Loss, and Others.

Dog Supplements Market – By Distribution Channel.

- Online stores

- Offline stores

- Hypermarket/Supermarket

- Retail stores

- Other stores

Based on the distribution channel, Dog Supplement Market has been segmented into 2 categories – Online Stores and Offline Stores.

The online distribution channel is estimated to register the highest CAGR of around 8.5% in the market from 2023 - 2030. Sites such as Chewy; Petco Animal Supplies, Inc.; BestVetCare.com; and Amazon are major key online suppliers of supplements for animals.

Dog Supplements Market – By Type.

-

Powder

- Pills

- Liquid

- Chewable Tablet

- Others

Based on the type, Dog Supplement Market has been segmented into 5 categories – Powder, Pills, Liquid, Chewable Tablet, and Others.

Approximately 70% of global sales in 2021 derived from chewable tablets segment, making it the most popular supplement types across the globe.

From 2023 - 2030, the powder segment is anticipated to grow at a CAGR of 6.59%. Powdered form is more quickly absorbed, easier to intake, and can be incorporated into a mixture of foods and beverages than pills or tablets. Powder-based products are estimated to grow popular among pet owners as a result of such factors.

Dog Supplements Market – By Region.

- North America

- Europe

- Asia-Pacific

- South America

- Middle-East and Africa

Based on the region, Dog Supplements Market has been segmented into 5 major regions – North America, Europe, Asia-Pacific, South America, Middle-East, and Africa.

US is one of the major markets for dog’s supplements across the globe. US supplements market is to witness a notable growth rate during the forecast period.

Europe is anticipated to grow at the highest CAGR during the forecasted years, 2023 - 2030. As per a report, the total pet adoption of dogs has reached to 68% in Europe which is anticipated to be a major reason for the rising demand for the dogs' supplement in the region.

Dog Supplements Market – By Companies.

- Bayer AG

- PetHonesty

- Honest Paws

- Zenwise

- Dechra Pharmaceuticals Plc

- Only Natural Pets

- Virbac

- NOW Foods

- Garmon Corporation

- Nestle Purina Petcare

- Food Science Corporation

- Ark Naturals

- Kemin Industries Inc.

- Novotech Nutraceuticals

- Zoetis Inc. and many others.

Numerous strategies are adopted by major players to maximize their market share. Also, a rise in product awareness can be seen and different innovative ideas and products are being manufactured. Due to this, a huge customer base can be created in the coming few years.

Recent Industry Developments:

- On January 31, 2022, Cranswick, U.K. based food producer brand, marked its way into the pet food industry with its acquisition of Lincolnshire-based Grove Pet Foods. The company manufactures Vitalin and Alpha Feeds dry dog food brands and co-manufactures for different other brands.

- On April 9, 2022, Real Pet Food announced the acquisition of People for Pets, owner of the brand Nectar of the Dogs.

Chapter 1.DOG SUPPLEMENTS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Dog Supplements Market MARKET – Executive Summary

2.1. Market Size & Forecast – (2022 – 2026) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-16 Impact Analysis

2.3.1. Impact during 2022 - 2026

2.3.2. Impact on Supply – Demand

Chapter 3 Dog Supplements Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Dog Supplements Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. DOG SUPPLEMENTS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6 Dog Supplements Market – By Diseases.

6.1. Diabetes

6. Oral Care

6. Digestive Sensitivity

6. Weight loss

6. Other diseases

Chapter 7.Dog Supplements Market – By Distribution Channel.

7.1. Online stores

7.2. Offline stores

7.2.1. Hypermarket/Supermarket

7.2.1.1. Retail stores

7.2.1.2. Other stores

Chapter 7.Dog Supplements Market – By By Type.

7.1.Powder

7.2. Pills

7.3.Liquid

7.4.Chewable Tablet

7.5. Others

Chapter 8. Dog Supplements Market Share- By Regional

8.1. North America

8.2. Europe

8.3. Asia Pacific

8.4. Latin America

8.5. Middle East & Africa

Chapter 9. Co2 Indicator Labels marketShare- by Company

9.1. Bayer AG

9.2. PetHonesty

9.3. Honest Paws

9.4. Zenwise

9.5. Dechra Pharmaceuticals Plc

9.6. Only Natural Pets

9.7. Virbac

9.8. NOW Foods

9.9. Garmon Corporation

9.10. Nestle Purina Petcare

9.11. Food Science Corporation

9.12. Ark Naturals

9.13. Kemin Industries Inc.

9.14. Novotech Nutraceuticals

9.15. Zoetis Inc. and many others.

Download Sample

Choose License Type

2500

4250

5250

6900