DNS Security Market Size (2024-2030)

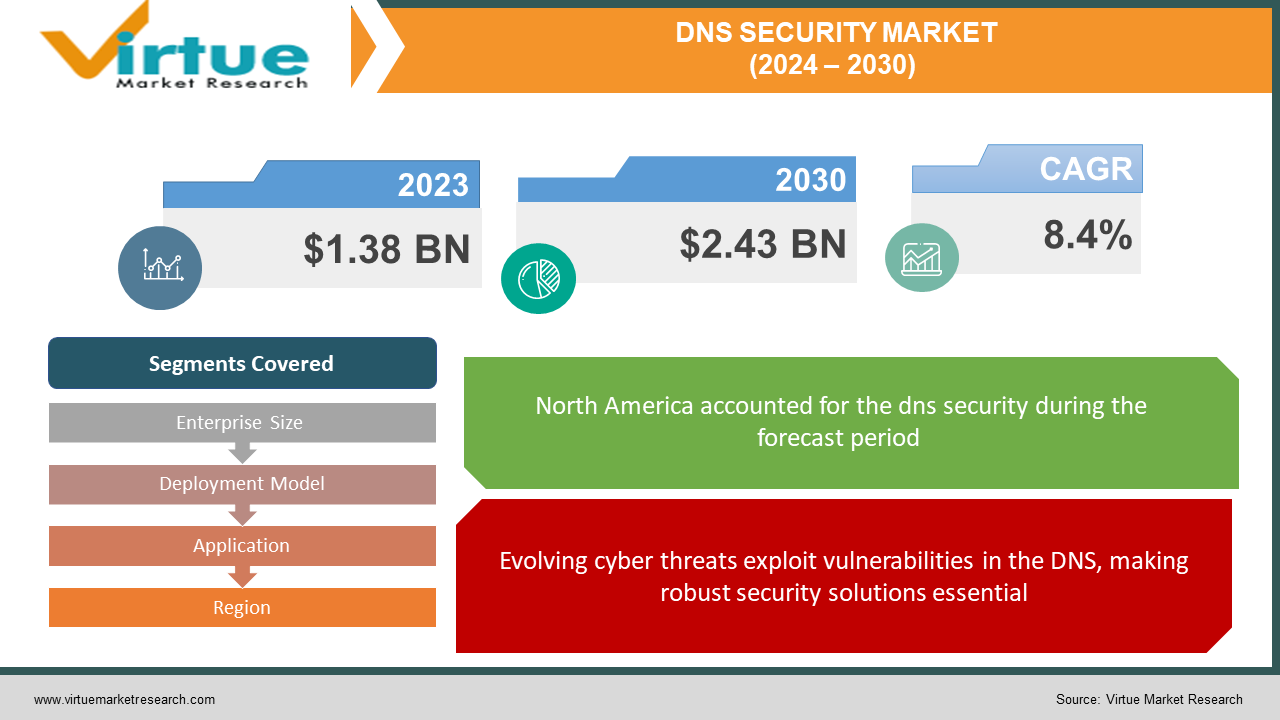

The DNS Security Market was valued at USD 1.38 billion in 2023 and is projected to reach a market size of USD 2.43 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 8.4%.

The DNS security market is thriving as cyber threats evolve and data security becomes a top priority. This growth is driven by the increasing use of cloud-based applications and the heightened awareness of online vulnerabilities. DNS security solutions combat various attacks, including those that redirect users to malicious websites or attempt to steal data. Common solutions include DNS filtering, which blocks malicious sites, DNSSEC, which verifies the authenticity of DNS data, and DNS redirection, which steers users away from harmful content. With the ever-present threat of cyberattacks, the DNS security market offers a promising future for companies that provide robust online protection.

Key Market Insights:

The DNS security market is experiencing a boom due to several converging forces. The constant evolution of cyber threats, particularly those that exploit weaknesses in the Domain Name System (DNS), has made robust defenses essential. Businesses and individuals alike rely on DNS security solutions to protect them from being redirected to malicious websites or having their data stolen. This need for protection is further amplified by the growing importance of cloud-based applications. As sensitive information migrates to the cloud, organizations require strong measures to safeguard it. DNS security solutions play a crucial role in securing this valuable data in the cloud environment.

Furthermore, there's a growing awareness of the importance of data security in general. Businesses are increasingly recognizing the risks associated with online vulnerabilities and are taking steps to mitigate them. This translates into increased investment in DNS security solutions. These solutions not only ensure online safety but also help organizations comply with data security regulations.

The DNS security market itself is constantly innovating to address new threats. With a variety of solutions like DNS filtering, DNSSEC, and redirection, the market offers options to combat different attack vectors. However, a potential challenge exists in the form of a limited pool of skilled cybersecurity professionals. This highlights the need for user-friendly and easy-to-manage DNS security solutions that can be effectively implemented even with limited technical expertise.

The DNS Security Market Drivers:

Evolving cyber threats exploit vulnerabilities in the DNS, making robust security solutions essential.

Malicious actors are constantly innovating, devising new cyberattacks that exploit weaknesses in the Domain Name System (DNS). DNS spoofing and hijacking tactics aim to redirect users to fraudulent websites or steal sensitive data. Robust DNS security solutions act as a vital shield, mitigating these evolving threats and safeguarding businesses and individuals.

The cloud's growing presence necessitates strong DNS security to safeguard sensitive data.

The cloud's growing dominance in the business world raises security concerns. Sensitive data is increasingly migrating to cloud platforms, necessitating strong measures to protect it. DNS security solutions play a crucial role in securing this valuable information within the cloud environment, providing peace of mind for organizations that leverage cloud-based applications.

Heightened awareness of data breaches leads businesses to invest in DNS security for online safety and compliance.

Businesses are becoming acutely aware of the consequences of data breaches and online vulnerabilities. This heightened awareness translates into a proactive approach to data security. Organizations are investing heavily in DNS security solutions to ensure online safety and meet compliance regulations. Strong DNS security demonstrates a commitment to data protection, which is increasingly important for businesses of all sizes.

Advanced solutions like DNS filtering and redirection offer comprehensive defense against evolving cyber threats.

The DNS security market itself is constantly evolving to address emerging threats. A variety of sophisticated solutions like DNS filtering, DNSSEC (Domain Name System Security Extensions), and DNS redirection are readily available. These solutions cater to different attack vectors, offering a comprehensive defense against a wide range of cyber threats. This adaptability ensures that the DNS security market remains relevant and effective in the ever-changing cybersecurity landscape.

The DNS Security Market Restraints and Challenges:

Despite the positive outlook for the DNS security market, there are hurdles that could slow its unfettered growth. One major challenge is the cybersecurity industry's talent shortage. With a limited pool of skilled professionals, implementing and managing DNS security solutions can be difficult for some organizations. User-friendly and easy-to-manage solutions are crucial to overcome this obstacle. Additionally, integrating these solutions with existing IT infrastructure can be complex, requiring technical expertise and potentially causing disruptions. Streamlined integration processes and intuitive interfaces are essential for wider adoption.

The evolving nature of cyber threats presents another challenge. Malicious actors are constantly innovating, devising new methods to bypass security measures. DNS security solutions need to be equally innovative and adaptable to stay ahead of these ever-changing attack tactics. Finally, not all businesses, particularly smaller ones, are fully aware of the importance of DNS security. Educational initiatives that highlight the value proposition of these solutions and the potential consequences of neglecting them are necessary to bridge this awareness gap. By addressing these challenges, the DNS security market can ensure its continued growth and provide robust online protection to a wider range of organizations.

The DNS Security Market Opportunities:

The DNS security market offers a wealth of opportunities for continued growth and innovation. One key area lies in managed DNS security services. These services address the cybersecurity talent gap by providing comprehensive protection without requiring extensive in-house expertise. This makes them ideal for businesses with limited IT resources. Additionally, with cloud adoption on the rise, there's an opportunity to seamlessly integrate DNS security solutions with cloud-based security platforms. This would create a holistic approach to online protection for cloud-reliant organizations. Furthermore, emerging technologies like IoT and blockchain present new attack surfaces. DNS security solutions can be adapted to address these unique security challenges. The market can also benefit from a focus on user experience by developing intuitive and easy-to-manage solutions. This would broaden the target audience to include businesses with limited technical expertise. Finally, there's an opportunity to expand into new markets, such as small and medium-sized businesses recognizing the value of online security, and geographically untapped regions with growing internet usage. By capitalizing on these opportunities, the DNS security market can solidify its role as an essential component of any organization's cybersecurity strategy.

DNS SECURITY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.4% |

|

Segments Covered |

By Enterprise Size, Deployment Model, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cisco, Webroot, OpenText, Infoblox, EfficientIP Bluecat Networks, Akamai Technologies, Neustar, Comodo |

DNS Security Market Segmentation: By Enterprise Size

-

Large Enterprises

-

Small and Medium-sized Businesses (SMBs)

The DNS security market is segmented by enterprise size, with large enterprises currently holding the dominant share. These organizations have complex IT infrastructure and require robust security solutions. However, Small and Medium-sized Businesses (SMBs) are expected to be the fastest-growing segment. As SMBs become increasingly aware of cyber threats and their limited internal resources, user-friendly and cost-effective DNS security solutions become highly attractive.

DNS Security Market Segmentation: By Deployment Model

-

On-Premises

-

Cloud-Based

The dominant segment in the DNS security market by deployment model is currently on-premises solutions, favoured by large enterprises for their control and customization. However, cloud-based DNS security is expected to be the fastest-growing segment due to its scalability, easier management, and suitability for businesses of all sizes. This shift towards cloud-based solutions reflects the growing adoption of cloud applications and the increasing importance of user-friendliness.

DNS Security Market Segmentation: By Application

-

DNS Filtering

-

DNSSEC (Domain Name System Security Extensions)

-

DNS Redirection

The most dominant segment in the DNS Security Market by application is likely DNS Filtering, as it offers broad protection against malicious websites commonly encountered during web browsing. On the other hand, the fastest-growing segment is expected to be Emerging Technologies, driven by the rise of new attack surfaces associated with technologies like IoT and blockchain, creating a niche market for DNS security solutions specifically designed to address these evolving threats.

DNS Security Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America: North America currently reigns supreme in the DNS security market, holding the largest market share. This dominance can be attributed to several factors. Firstly, North American companies were early adopters of cybersecurity solutions in general, recognizing the importance of online protection. Secondly, the presence of major cybersecurity vendors with global reach is concentrated in this region. These vendors cater to a wide range of businesses and offer comprehensive DNS security solutions. Finally, stringent data security regulations in North America, like HIPAA and GDPR compliance, further drive market growth as organizations strive to meet these legal requirements.

Europe: Europe presents a significant market for DNS security solutions. The region boasts a growing awareness of cyber threats, with businesses and individuals becoming increasingly vigilant against online attacks. This heightened awareness is often coupled with government regulations mandating strong data protection measures. These regulations, similar to those in North America, incentivize organizations to invest in robust DNS security solutions to ensure compliance. As a result, the European DNS security market shows consistent growth with a promising future.

Asia-Pacific: The Asia-Pacific region is expected to be the fastest-growing market for DNS security solutions in the coming years. Several factors contribute to this projected surge. Firstly, internet penetration in the region is experiencing rapid growth, with a vast number of individuals coming online for the first time. This expanding user base creates a wider attack surface for malicious actors, necessitating robust DNS security solutions. Secondly, the increasing adoption of cloud-based applications across various industries in the region is driving the need for strong cloud security measures. DNS security solutions play a crucial role in this context. Finally, with growing economies and a rising focus on cybersecurity, businesses in the Asia-Pacific region are increasingly investing in DNS security to safeguard their online operations and protect sensitive data.

South America: The DNS security market in South America is still young compared to more established regions. However, there are promising signs of future growth. Internet usage is on the rise, creating a larger user base that requires online protection. As economies develop, businesses become more aware of cyber threats and the importance of data security, leading to increased investment in cybersecurity measures like DNS security solutions. Additionally, some South American countries are starting to implement data security regulations, further incentivizing businesses to adopt these solutions for compliance. Overall, the South American DNS security market presents an exciting opportunity with increasing internet usage, growing economies, and a rising focus on cybersecurity.

Middle East and Africa: Similar to South America, the Middle East and Africa (MEA) region's DNS security market is in its early stages but holds significant potential. Rapid internet expansion is creating a demand for robust DNS security solutions to protect users from cyber threats. As economies in the MEA region develop, businesses become more reliant on online platforms and cloud-based applications, necessitating strong cybersecurity measures like DNS security. Furthermore, some governments in the MEA region are recognizing the importance of cybersecurity and implementing initiatives to promote online safety, which could lead to increased adoption of DNS security solutions in the future. With a largely untapped market and evolving needs, the MEA region offers exciting opportunities for vendors who can develop user-friendly solutions and contribute to a more secure online environment.

COVID-19 Impact Analysis on the DNS Security Market:

The COVID-19 pandemic's impact on the DNS security market unfolded in two distinct phases. The initial stages, marked by global lockdowns and supply chain disruptions, presented some temporary challenges. Production and delivery of DNS security hardware and software experienced hiccups, and with businesses grappling with immediate financial concerns, some may have delayed or reduced investments in cybersecurity measures, including DNS security solutions.

However, the long-term effects of the pandemic have been a boon for the market. The massive shift to remote work triggered by COVID-19 significantly increased reliance on cloud-based applications and internet usage. This expanded digital footprint created a larger attack surface for malicious actors, highlighting the critical need for robust DNS security solutions. The pandemic served as a stark reminder of the vulnerability of organizations to cyberattacks, leading to a heightened awareness of online threats. This translated into a greater focus on cybersecurity investments, with DNS security solutions playing a crucial role in protecting remote employees and the sensitive data they access.

Furthermore, the pandemic underscored the importance of business continuity for organizations. Ensuring uninterrupted operations became a top priority, and DNS security emerged as a vital component of safeguarding online infrastructure. By mitigating the risks associated with DNS spoofing and other cyberattacks, DNS security solutions helped organizations maintain smooth operations during a time of unprecedented disruption.

In conclusion, while the initial stages of the COVID-19 pandemic presented temporary challenges for the DNS security market, the long-term effects have been overwhelmingly positive. The increased reliance on the internet, heightened security awareness, and focus on business continuity have all contributed to the sustained growth and importance of the DNS security market in today's digital landscape.

Latest Trends/ Developments:

The DNS security market is constantly innovating to combat evolving threats and capitalize on new opportunities. One key trend is the integration of Artificial Intelligence (AI) and Machine Learning (ML) into security solutions. These technologies can analyze vast amounts of data to identify and block malicious activity in real-time, providing a more proactive defense. Another trend is the need to keep pace with the ever-changing threat landscape. DNS security solutions are incorporating advanced threat intelligence and zero-trust security models to stay ahead of new attack tactics employed by cybercriminals. With cloud adoption on the rise, there's a growing focus on integrating DNS security solutions seamlessly with cloud-based security platforms, offering a holistic approach to protecting organizations that rely heavily on cloud infrastructure. Additionally, user-friendliness is becoming a priority. There's a trend towards developing intuitive and easy-to-manage solutions, alongside increased automation to streamline tasks and reduce the burden on IT security teams. Finally, data privacy regulations are prompting a focus on privacy-preserving DNS security solutions that ensure robust protection without compromising user privacy or violating data compliance regulations. By staying ahead of these trends, DNS security vendors can deliver increasingly sophisticated and user-friendly solutions that effectively address the ever-changing needs of organizations in a dynamic online threat landscape.

Key Players:

-

Cisco

-

Webroot

-

OpenText

-

Infoblox

-

EfficientIP

-

Bluecat Networks

-

Akamai Technologies

-

Neustar

-

Comodo

Chapter 1. DNS Security Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. DNS Security Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. DNS Security Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. DNS Security Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. DNS Security Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. DNS Security Market – By Enterprise Size

6.1 Introduction/Key Findings

6.2 Large Enterprises

6.3 Small and Medium-sized Businesses (SMBs)

6.4 Y-O-Y Growth trend Analysis By Enterprise Size

6.5 Absolute $ Opportunity Analysis By Enterprise Size, 2024-2030

Chapter 7. DNS Security Market – By Deployment Model

7.1 Introduction/Key Findings

7.2 On-Premises

7.3 Cloud-Based

7.4 Y-O-Y Growth trend Analysis By Deployment Model

7.5 Absolute $ Opportunity Analysis By Deployment Model, 2024-2030

Chapter 8. DNS Security Market – By Application

8.1 Introduction/Key Findings

8.2 DNS Filtering

8.3 DNSSEC (Domain Name System Security Extensions)

8.4 DNS Redirection

8.5 Y-O-Y Growth trend Analysis By Application

8.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. DNS Security Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Enterprise Size

9.1.3 By Deployment Model

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Enterprise Size

9.2.3 By Deployment Model

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Enterprise Size

9.3.3 By Deployment Model

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Enterprise Size

9.4.3 By Deployment Model

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Enterprise Size

9.5.3 By Deployment Model

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. DNS Security Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cisco

10.2 Webroot

10.3 OpenText

10.4 Infoblox

10.5 EfficientIP

10.6 Bluecat Networks

10.7 Akamai Technologies

10.8 Neustar

10.9 Comodo

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The DNS Security Market was valued at USD 1.38 billion in 2023 and is projected to reach a market size of USD 2.43 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 8.4%.

Escalating Cyber Threats, Cloud Adoption and Security Concerns, Heightened Data Security Awareness, Evolving Threat Landscape and Advanced Solutions.

DNS Filtering, DNSSEC (Domain Name System Security Extensions), DNS Redirection.

North America holds the strongest position in the DNS Security Market due to early adoption of security solutions and the presence of major cybersecurity vendors.

Cisco, Webroot, OpenText, Infoblox, EfficientIP, Bluecat Networks, Akamai Technologies, Neustar, Comodo.