DLP Projectors Market Size (2024-2030)

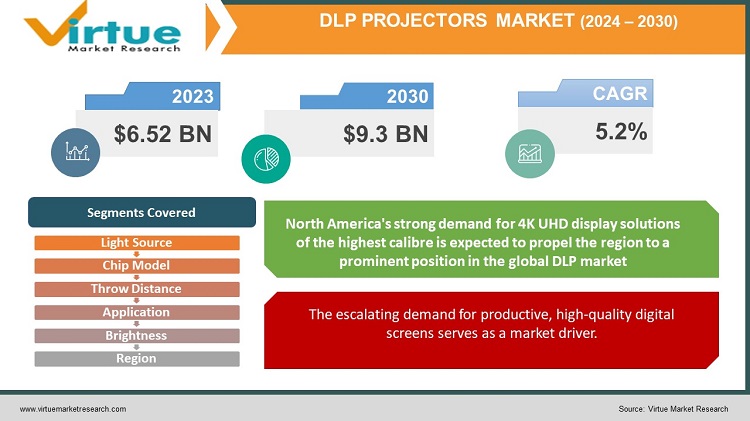

The Global DLP Projectors Market reached USD 6.52 Billion in 2023 and is projected to witness lucrative growth by reaching up to USD 9.3 Billion by 2030. The market is growing at a CAGR of 5.2% during the forecast period (2024-2030).

DLP, short for Digital Light Processing, constitutes a chipset founded on optical micro-electro-mechanical technology utilizing a digital micromirror device. In 1997, the inaugural DLP-based projector was developed by Digital Projection Ltd. The DLP projector emits light through a color wheel, a reflection mirror, and a lens, finding extensive application in display scenarios ranging from conventional static displays to interactive displays, and across medical, security, and industrial domains. DLP technology boasts features such as heightened pixel count for sharper imagery, a filter-free design necessitating minimal maintenance, the delivery of smooth, clear, and jitter-free images, a sealed chipset preventing dust accumulation, and the use of an environmentally friendly laser technology.

Key Market Insights:

The DLP projector, leveraging DLP technology, represents a data projection technology producing clear, readable images on illuminated screens. Functioning on an optical micro-electro-mechanical technology with digital micromirrors, DLP presents a revolutionary approach to displaying and projecting information. Its advantageous attributes, including durability, enhanced contrast, reliability, reduced pixilation, and portability, contribute significantly to the rising demand for DLP projectors. Furthermore, DLP projectors occupy less space compared to traditional counterparts and offer ease of relocation, making them a preferred choice. The benefits provided by DLP projectors vis-à-vis conventional LCD or LED projectors drive market growth.

DLP projectors extend their utility to business presentations such as sales, training, and marketing, while home theaters increasingly adopt them for viewing TV programs and movies on expansive screens. The growing prevalence of digital screens in the film industry augments the demand for DLP projectors. With lower repair costs and fewer components, DLP projectors prove cost-effective. Their sealed and filter-free chip design minimizes maintenance costs, further propelling market growth. Opportunities in spectroscopes, medical imaging, and holographic storage markets contribute to the expanding landscape for digital light processing projectors. The surge in 3-dimensional projection adoption and ongoing digitalization across sectors, including entertainment and education, continues to fuel demand for DLP projectors.

Global DLP Projectors Market Drivers:

The escalating demand for productive, high-quality digital screens serves as a market driver.

Cloud DVR adoption gains traction due to the pursuit of cost-effective, high-quality digital screens. Consumers, seeking immersive and engaging experiences, drive demand for various display technologies. The convenience and flexibility of cloud-based services propel the adoption of cloud DVR services, with DLP projectors emerging as a preferred choice for their capacity to deliver high-quality visuals and versatile projections.

In the education sector, the burgeoning demand for digitalization propels market growth.

The educational landscape's focus on integrating digital technology enhances the teaching and learning experience, incorporating multimedia content, e-learning platforms, collaborative tools, and more. As digitalization expands in education, the demand for DLP projectors grows, supported by their provision of engaging visual content, flexibility, supportive and interactive learning features, and cost-effectiveness.

Global DLP Projectors Market Restraints and Challenges:

The impediments to the DLP projectors market's expansion on a global scale include elevated costs and a lack of knowledge, acting as constraints that hinder overall market growth. Additionally, concerns such as leakage issues and the occurrence of the rainbow effect pose challenges for DLP projectors. Leakage problems involve the unintended escape of light from the projector's optical system, leading to diminished contrast and a consequent impact on image quality. The rainbow effect manifests in high-contrast scenes or during rapid eye movement, causing momentary flashes of rainbow colors for viewers. Over time, these challenges are expected to limit the adoption of DLP projectors among potential customers.

Global DLP Projectors Market Opportunities:

The prospects for the expansion of the DLP projectors market are closely tied to its distinctive features, including high contrast, reduced pixilation, durability, portability, and reliability. Significant market expansion opportunities exist across various sectors such as education, entertainment, and corporate domains. The educational sector presents noteworthy opportunities for high revenue growth due to increased adoption, driven by the advantageous features and customization options of DLP projectors. In the entertainment sector, the cost-effectiveness and scalable solutions for large-screen displays contribute to the demand for DLP projectors. The market experiences growth through increased adoption in theaters, event venues, and theme parks. Opportunities to enhance functionality and connectivity options in corporate settings further drive adoption. Continuous advancements in innovative and high-performance DLP projectors continually open avenues for high market growth rates.

DLP PROJECTORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Light Source, Chip Model, Throw Distance, Application, Brightness, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BenQ Corporation, Sony Corporation, NEC Display Solutions, Panasonic Corporation, LG Electronics Inc. |

Global DLP Projectors Market Segmentation:

Global DLP Projectors Market Segmentation: By Light Source:

- Lamp

- LED

- Laser

In this market, lamp-based DLP projectors are the market leader in 2023. This dominance can be ascribed to their cost-effectiveness, broad availability, and long history of lamp technology in projection systems. But as we look to the future, it appears that the fastest-growing subsegments will be LED and laser projectors. These technologies are becoming more and more popular due to their longer lifespan, lower energy usage, and increased demand for environmentally responsible and higher-quality projection solutions.

Global DLP Projectors Market Segmentation: By Chip Model:

- One Chip

- Three Chip

The biggest market in this category is made up of single-chip DLP projectors in 2023. Their success is a result of their cost and portability, which make them ideal for a variety of uses, including business presentations and home theatres. It's interesting to see that this market is expanding the fastest. This pattern reflects the ongoing advancements in one-chip DLP technology, which increase colour accuracy and image quality and make these projectors more and more user-friendly.

Global DLP Projectors Market Segmentation: By Throw Distance:

- Normal Throw

- Short Throw

- Ultra-Short Throw

Short Throw projectors are currently the clear winners in this area. They're very popular because they don't require a lot of area to display a large, clear image. This makes them ideal for smaller spaces, such as a classroom or a cosy home theatre. But guess what? The Ultra-Short Throw projectors are on the rise! These projectors are incredible because they can be put very close to the screen (even only a few inches away!) and still provide a large, clear image. They're growing more popular, especially in settings where space is at a premium, such as small conference rooms or tiny residences.

Global DLP Projectors Market Segmentation: By Application:

- Home Entertainment & Cinema

- Business, Education & Government

- Large Venues, and Others

Home Entertainment & Cinema is the largest market sector in this case. Yes, a lot of people enjoy utilising projectors at home to play video games or view films on a large screen. It's like to having a home theatre. Due to the fact that projectors are becoming extremely valuable instruments in these fields. They are utilised in meetings and presentations in businesses. Teachers in schools use them to project instructive slideshows or films. Additionally, they facilitate the exchange of crucial information during lengthy discussions in government contexts. An increasing number of educational institutions, businesses, and government agencies are realising the benefits of these projectors as technology advances.

Global DLP Projectors Market Segmentation: By Brightness:

- Less than 2,999 Lumens

- 3,000 to 5,999 Lumens

- 6,000 Lumens & Above

Projectors under 2,999 lumens, projectors between 3,000 and 5,999 lumens, and projectors over 6,000 lumens are included in the market segments. Currently, the market share that is largest belongs to the category of projectors that have 6,000 lumens or more. The expanding need for high-brightness projectors in large events and outdoor locations is the main driver of this segment's popularity. It's noteworthy that this is also the segment with the greatest rate of growth, demonstrating a growing inclination towards high-brightness projectors in a variety of professional and educational contexts where the ambient light demands more potent projection solutions.

Global DLP Projectors Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America's strong demand for 4K UHD display solutions of the highest calibre is expected to propel the region to a prominent position in the global DLP market. The increasing demand for sophisticated digital light processing projectors is being driven by these superior display options. Digital light processing (DLP) projector adoption is largely being driven by the established education and corporate sectors. The market expansion for DLP projectors in North America will be propelled by the rising acceptance of 3D projection technology and its associated applications. The ultra-short throw DLP projector market is also seeing substantial acceptance in North America and Europe. Furthermore, low-cost DLP projectors have an opportunity for home theatre applications due to the growing demand for gaming and home theatre projectors.

Over the course of the forecast period, the DLP projector market is anticipated to benefit greatly from the Asia-Pacific region's contributions. Growing investments in consumer electronics devices is one of the main reasons for the growth of the DLP market. Further bolstering the market's expansion is the healthcare, education, and automotive sectors' robust demand for DLP projectors. The Asia-Pacific entertainment market is expanding and is in need of cutting-edge technologies, which presents a growth potential for the DLP projector market. The increased use of high-quality film screens and the expanding distribution of 3D films are expected to fuel market expansion throughout Asia-Pacific. Prominent market participants are present throughout the region, which is fostering the DLP industry's expansion.

COVID-19 Impact Analysis on the Global DLP Projectors Market:

COVID-19 had a significant effect on the market for DLP projectors. The sudden lockdown, remote learning, limited outside entertainment, and work from home policies increased the need for DLP projectors in homes as a business, entertainment, and educational tool, which in turn drove the industry. Conversely, adverse effects on the market are observed, including but not limited to supply chain disruption, trade relations issues, temporary operational breakdowns, and others.

Latest Trends/Developments:

- In 2023, Optoma unveiled the GT2160HDR, a cutting-edge gaming and cinema projector. This device boasts a 4K UHD DLP chipset and is enhanced with features such as HDR tone, color mapping technology, and a rapid-switching display. It also includes a feature that automatically transitions to HDR display mode.

- In 2022, Barco Technology struck a deal worth USD 18.2 million with a Korean design firm to supply projectors. As part of this agreement, BARCO Technologies committed to delivering G-series DLP projectors and the UDM hardware for fleet management purposes.

- In September 2022, Barco Technology Company finalized a contract valued at GBP 15 million (approximately USD 18.2 million) with a Korean design company for the supply of projectors. Under this agreement, BARCO agreed to supply G-series DLP projectors and UDM hardware. Additionally, the deal included access to BARCO's Insights Management Suite for efficient fleet management.

Key Players:

- BenQ Corporation

- Sony Corporation

- NEC Display Solutions

- Panasonic Corporation

- LG Electronics Inc.

Chapter 1. Global DLP Projectors Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global DLP Projectors Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global DLP Projectors Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global DLP Projectors Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global DLP Projectors Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global DLP Projectors Market– By Light Source

6.1. Introduction/Key Findings

6.2. Lamp

6.3. LED

6.4. Laser

6.5. Y-O-Y Growth trend Analysis By Light Source

6.6. Absolute $ Opportunity Analysis By Light Source , 2024-2030

Chapter 7. Global DLP Projectors Market– By Chip Model

7.1. Introduction/Key Findings

7.2. One Chip

7.3. Three Chip

7.4. Y-O-Y Growth trend Analysis By Chip Model

7.6. Absolute $ Opportunity Analysis By Chip Model , 2024-2030

Chapter 8. Global DLP Projectors Market– By Throw Distance

8.1. Introduction/Key Findings

8.2. Normal Throw

8.3. Short Throw

8.4. Ultra-Short Throw

8.5. Y-O-Y Growth trend Analysis Throw Distance

8.6. Absolute $ Opportunity Analysis Throw Distance , 2024-2030

Chapter 9. Global DLP Projectors Market– By Application

9.1. Introduction/Key Findings

9.2. Home Entertainment & Cinema

9.3. Business, Education & Government

9.4. Large Venues, and Others

9.5. Y-O-Y Growth trend Analysis Application

9.6. Absolute $ Opportunity Analysis Application , 2023-2030

Chapter 10. Global DLP Projectors Market– By Brightness

10.1. Introduction/Key Findings

10.2. Less than 2,999 Lumens

10.3. 3,000 to 5,999 Lumens

10.4. 6,000 Lumens & Above

10.5. Y-O-Y Growth trend Analysis Brightness

10.6 . Absolute $ Opportunity Analysis Brightness , 2023-2030

Chapter 11. Global DLP Projectors Market, By Geography – Market Size, Forecast, Trends & Insights

11.1. North America

11.1.1. By Country

11.1.1.1. U.S.A.

11.1.1.2. Canada

11.1.1.3. Mexico

11.1.2. By Light Source

11.1.3. By Chip Model

11.1.4. By Application

11.1.5. Throw Distance

11.1.6. Brightness

11.1.7. Countries & Segments - Market Attractiveness Analysis

11.2. Europe

11.2.1. By Country

11.2.1.1. U.K.

11.2.1.2. Germany

11.2.1.3. France

11.2.1.4. Italy

11.2.1.5. Spain

11.2.1.6. Rest of Europe

11.2.2. By Light Source

11.2.3. By Chip Model

11.2.4. By Application

11.2.5. Throw Distance

11.2.6. Brightness

11.2.7. Countries & Segments - Market Attractiveness Analysis

11.3. Asia Pacific

11.3.2. By Country

11.3.2.2. China

11.3.2.2. Japan

11.3.2.3. South Korea

11.3.2.4. India

11.3.2.5. Australia & New Zealand

11.3.2.6. Rest of Asia-Pacific

11.3.2. By Light Source

11.3.3. By Chip Model

11.3.4. By Application

11.3.5. Throw Distance

11.3.6. Brightness

11.3.7. Countries & Segments - Market Attractiveness Analysis

11.4. South America

11.4.3. By Country

11.4.3.3. Brazil

11.4.3.2. Argentina

11.4.3.3. Colombia

11.4.3.4. Chile

11.4.3.5. Rest of South America

11.4.2. By Light Source

11.4.3. By Chip Model

11.4.4. By Application

11.4.5. Throw Distance

11.4.6. Brightness

11.4.7. Countries & Segments - Market Attractiveness Analysis

11.5. Middle East & Africa

11.5.4. By Country

11.5.4.4. United Arab Emirates (UAE)

11.5.4.2. Saudi Arabia

11.5.4.3. Qatar

11.5.4.4. Israel

11.5.4.5. South Africa

11.5.4.6. Nigeria

11.5.4.7. Kenya

11.5.4.11. Egypt

11.5.4.11. Rest of MEA

11.5.2. By Light Source

11.5.3. By Chip Model

11.5.4. By Application

11.6.5. Throw Distance

11.5.6. Brightness

11.5.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12. Global DLP Projectors Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 BenQ Corporation

12.2. Sony Corporation

12.3. NEC Display Solutions

12.4. Panasonic Corporation

12.5. LG Electronics Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global DLP Projectors Market reached USD 6.52 Billion in 2023

The worldwide Global DLP Projectors Market growth is estimated to be 5.2% from 2024 to 2030.

The Global DLP Projectors Market is segmented by Light Source (Lamp, LED, and Laser), by Chip Model (One Chip and Three Chip), by Brightness (Less than 2,999 Lumens, 3,000 to 5,999 Lumens, and 6,000 Lumens & Above), by Throw Distance (Normal Throw, Short Throw, and Ultra-Short Throw), and by Application (Home Entertainment & Cinema, Business, Education & Government, Large Venues, and Others).

The development of digital light processing technology, growing demand from the business and education sectors, and the growing acceptance of home theatre systems are all factors contributing to the growth of the global DLP projector market.

The COVID-19 epidemic had a major effect on the global market for DLP projectors, disrupting demand, supply networks, and manufacturing. Demand for projectors surged as remote work and online education became more common, but market participants faced difficulties due to production issues and unpredictable economic conditions.