GLOBAL DITCHER MARKET (2024 - 2030)

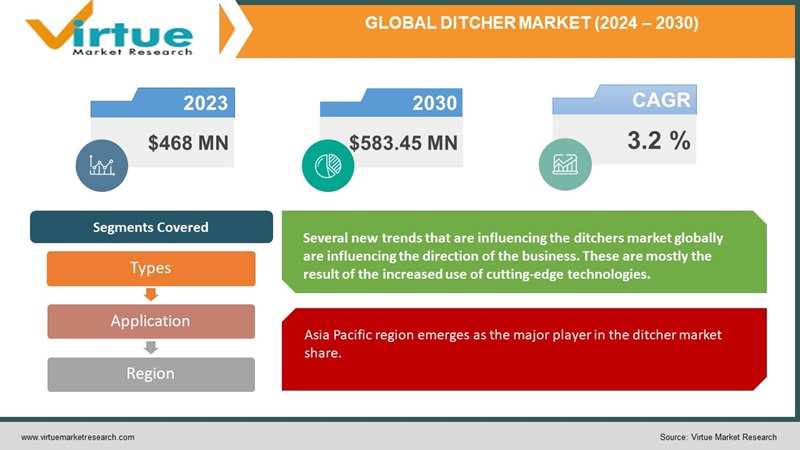

The Ditcher Market was valued at USD 468 Million in 2023 and is projected to reach a market size of USD 583.45 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.2% .

Ditchers are large pieces of heavy machinery that are used in excavation and duties associated with them, like canal, ditch, and trench construction. Construction, agriculture, and infrastructure development projects depend heavily on these machines because of their revolving drum or bucket, which effectively removes soil and other waste from the ground. The Ditchers Market has a promising future and is predicted to grow significantly over the next several years. The need for effective and time-saving excavation equipment is growing, as are global construction and infrastructure development activities. Additionally, technological improvements have increased ditcher performance and capacities, contributing to this rise.

Key Market Insights:

Crucial variables are driving the market's significant rise. The market is expanding because of the growing need for effective earthmoving machinery in agriculture and construction. In order to create a drainage system and prepare land for different uses, ditchers are essential to improving project efficiency and safety. In order to meet the changing needs of the construction and agricultural industries, industry participants are committed to enhancing the precision, adaptability, and effectiveness of ditching equipment. The market's upward trend is supported by this match with the need for dependable earthmoving solutions. The ditcher market is changing as a result of technical advancements. Developments in automation, precision control systems, and designs are propelling expansion. Professionals in construction and agriculture are looking for ditching solutions that will maximise their operations and be quicker, more precise, and easier to use. The importance of accurate ditching instruments increases as these industries become more automated and mechanised. This compatibility with the advancements in earthmoving technology and the dedication to supporting effective land preparation solutions the expansion of the industry.

In the upcoming years, the ditcher market is probably going to rise steadily because of the growing emphasis on water management, agricultural production, and infrastructure development.

Ditcher Market Drivers:

Several new trends that are influencing the ditchers market globally are influencing the direction of the business. These are mostly the result of the increased use of cutting-edge technologies.

The use of cutting-edge technology like GPS, laser control systems, and telematics is spreading and changing the ditcher industry, increasing task precision and efficiency. Advanced ditchers with features like data analytics, remote monitoring, and autonomous operation are becoming more and more in demand. An increasing number of environmentally conscious and energy-efficient ditchers have been developed in response to concerns about environmental sustainability. To improve manoeuvrability and versatility, ditchers that are lightweight and compact are becoming more and more popular. All things considered, the worldwide ditchers market is expanding and innovating due to these factors.

The continued development of agriculture and the expansion of international infrastructure projects are two factors propelling the ditcher market.

Growing global infrastructure initiatives and continuous improvements in agriculture are two factors propelling the ditcher market. The necessity for effective drainage and soil preparation techniques is rising as farming methods become more sophisticated and automated. Ditchers are essential for establishing ideal field conditions that lead to increased crop yields and better land utilisation. The need for accurate and adaptable drilling equipment is being driven by the growing use of contemporary farming methods and the pursuit of greater agricultural efficiency. There is an increased need for earthmoving equipment as nations invest in infrastructure development, particularly road construction and land drainage projects. These devices are essential for designing drainage systems and upkeep of landscapes for a range of applications. Building and engineering companies are looking for dependable ditching equipment to effectively meet project requirements, which is driving the infrastructure sector's expansion, which is fueled by urbanisation and economic growth.

Ditcher Market Restraints:

Economic uncertainty is a prominent restraint on the ditcher market.

Uncertainty in the economy is a significant barrier to the ditcher market. Recessions, shifts in the economy, and unstable markets can discourage investments in building and agricultural projects, which might affect the demand for ditching. In uncertain economic times, industries often put off or cut back initiatives, which lowers demand. To mitigate this constraint and preserve market growth, it is imperative to overcome the problems caused by oscillations in the economy and maintain market stability.

DITCHER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

3.2 % |

|

Segments Covered |

By Types, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ditch Witch, Vermeer, Case Construction, Inter-Drain, Port Industries, Tesmec, Guntert & Zimmerman, Hurricane Ditcher Company, BRON, Land Pride |

Ditcher Market Segmentation: By type

-

Power Ditcher

-

Dynamic Ditcher

Chain and wheel ditchers are two categories of ditchers. Farm drainage, sewer and water pipeline installation, telecommunication network building, energy cable and fibre optic laying, oil and gas pipeline installation, and agricultural trenching are the primary uses for ditchers. Huge manufacturers primarily distribute in Europe and America internationally. Similar to Ditch Witch, Vermeer, and Case Construction, American and European brands have a lengthy history and an unwavering reputation in this field. Ditchers are agricultural implements that are utilised to excavate or construct ditches in diverse topographies. Dynamic Ditchers are adaptable and flexible devices that have simple depth and width adjustments. Large-scale projects benefit greatly from the special heavy-duty jobs that Power Ditchers are made for. Cyclone ditch sweepers effectively remove dirt and debris from ditches thanks to their revolving blades. These three sorts of markets serve distinct purposes and give farmers a variety of options to select from according to the kind and extent of ditching that is needed.

Ditcher Market Segmentation: By Applications

-

Agricultural

-

Construction

When installing, maintaining, or inspecting pipes or cables, construction work entails backfilling the trench after digging down to expose the pipe or cable and replace or repair it. Tressers, or ditchers, are the name of the construction tools best suited for this use.

This machine smashes rock and penetrates the earth, much like excavators do. A form of earthmoving machinery called a trencher uses a steel-toothed metal chain to cut through the ground like a chainsaw. A ditcher, like an excavator, removes dirt and roots to make room for a trench. It can take several hours to dig a trench by hand. Trespassers can get the job done faster and with fewer personnel by using a ditcher. Considering that they are necessary for every building site due to their fundamental function Ditchers Market Application is a flexible digital platform intended for use in a variety of markets, such as construction, drainage pipes, subways, and agriculture. It helps farmers manage their livestock, crops, and equipment in the agriculture industry. It simplifies contractor communication, the supply chain, and project management for the construction sector. Planning, observing, and maintaining subterranean transit networks are aided by it in the construction of subways. Additionally, it aids in inventory management, production tracking, and timely delivery in the drainage pipe industry. Last, but not least, it serves a variety of additional markets by providing individualised solutions for their unique requirements.

Ditcher Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

South-America

-

Middle East and Africa

Due to its rapid economic expansion and increased infrastructure development, the Asia Pacific region emerges as the major player in the ditcher market share. With its developing economies, the area is undergoing massive construction and agricultural development. The need for earthmoving equipment is growing to support the efficiency of these initiatives. Asia Pacific is leading the market due to its booming agriculture sector and dedication to infrastructure development. Asia Pacific's market dominance is further cemented by this alignment with strong economic growth and infrastructure investment, as the building and agricultural sectors continuously look for practical ditching solutions to meet their changing needs.

Ditcher Market COVID-19 Impact Analysis:

COVID-19 had a primarily negative effect on the market. The epidemic caused delays and disruptions because it interfered with supply chains, hindered construction projects, and created a workforce shortage. Furthermore, the demand was adversely affected by lower infrastructural investments and economic uncertainties throughout the epidemic period. It's crucial to remember that some regions witnessed a slight increase in demand because of maintenance projects, even if the construction and agricultural sectors—which are the main uses of ditchers—had setbacks. However, the overall effects of COVID-19 were unfavourable and marked by difficulties and interruptions.

Latest Trends/ Developments:

The growing focus on sustainability is a common trend in the ditcher industry. This trend is a result of earthmoving machinery and environmental concerns. The development of ditchers with features like efficient fuel use and lower emissions, which would lessen their influence on the environment, is not a priority for manufacturers. This trend is changing the industry by providing eco-friendly solutions that meet changing environmental requirements and client requests for green machinery, as sustainability becomes a crucial factor in the construction and agricultural industries.

Key Players:

A well-known brand in the cutthroat ditching industry is Ditch Witch. The company was founded in the 1940s and brought the first compact ditching machine, which completely changed the industry. As a result of its constant product range expansion and capacity for innovation, Ditch Witch has emerged as an industry leader. The business has grown steadily and is well-known throughout the world. They provide a large selection of goods to meet different needs related to trenching, drilling, and digging.

In the cutthroat ditchers market, Vermeer is yet another well-known player. Vermeer was founded in 1948 and first specialised in agricultural machines before branching out into infrastructure and construction equipment. Their ditchers are well known for their effectiveness and robustness. Thanks to its dedication to quality and technological innovation, Vermeer has experienced steady growth and has amassed a sizeable market share. They have a global network of distributors and dealers and are constantly growing their product line.

-

Ditch Witch

-

Vermeer

-

Case Construction

-

Inter-Drain

-

Port Industries

-

Tesmec

-

Guntert & Zimmerman

-

Hurricane Ditcher Company

-

BRON

-

Land Pride

Chapter 1. DITCHER MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. DITCHER MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. DITCHER MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. DITCHER MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. DITCHER MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. DITCHER MARKET – By Type

6.1 Introduction/Key Findings

6.2 Dynamic Ditchers

6.3 Power Ditcher

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. DITCHER MARKET – By Application

7.1 Introduction/Key Findings

7.2 Agriculture

7.3 Construction

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. DITCHER MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. DITCHER MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Ditch Witch

9.2 Vermeer

9.3 Case Construction

9.4 Inter-Drain

9.5 Port Industries

9.6 Tesmec

9.7 Guntert & Zimmerman

9.8 Hurricane Ditcher Company

9.9 BRON

9.10 Land Pride

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Ditcher Market was valued at USD 468 Million in 2023

Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.2 %.

Increased use of cutting-edge technologies, the continued development of agriculture, and the expansion of international infrastructure projects are the driving factors.

Economic uncertainty is a prominent restraint on the ditcher market.

Power ditcher, Cyclone Ditcher, and Dynamic ditcher.