Distributed Generation Market Size (2024 – 2030)

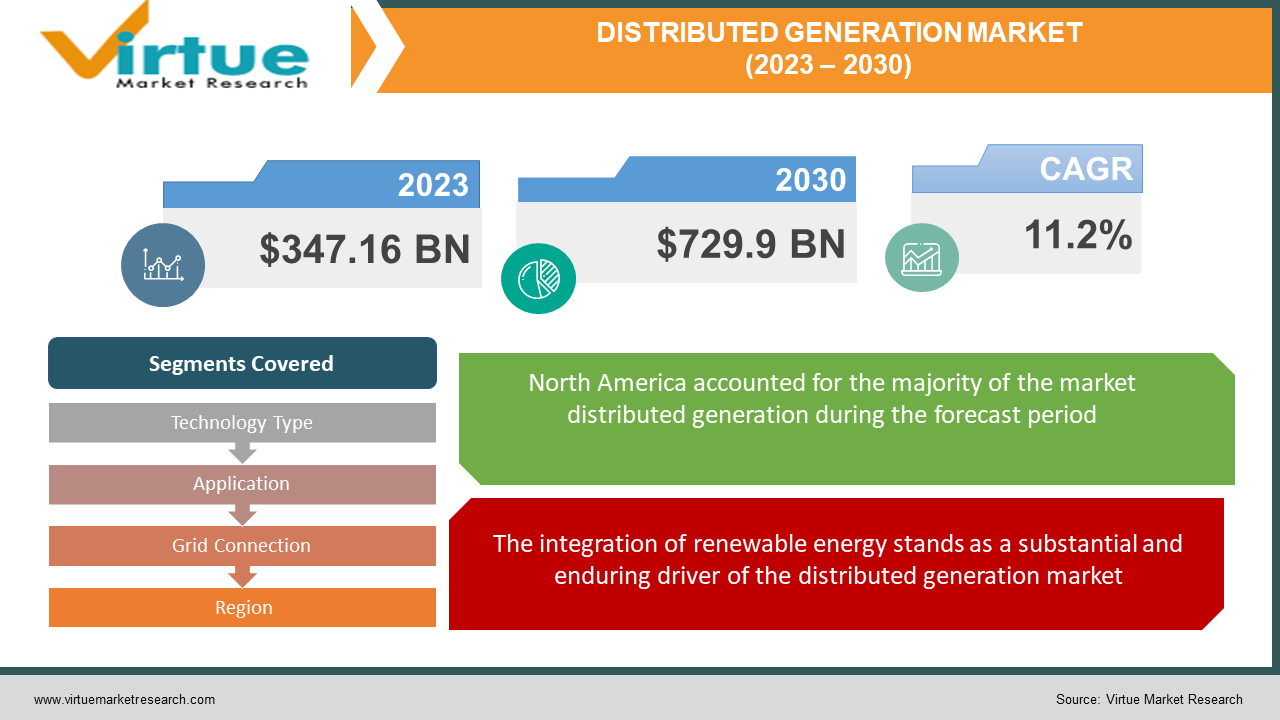

The Distributed Generation Market was valued at USD 347.16 Billion and is projected to reach a market size of USD 729.9 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11.2%.

Market Overview:

The distributed generation sector embodies a pivotal shift in the landscape of electricity generation and distribution. This transformative approach involves producing electricity on a smaller scale, often in proximity to consumption points, utilizing diverse technologies like solar panels, wind turbines, combined heat and power (CHP) systems, and microturbines. This strategy proffers multiple advantages, including bolstered grid resilience, minimized transmission losses, and the integration of renewable energy sources. As the world steers toward sustainable and decentralized energy solutions, distributed generation gains momentum, playing a pivotal role in modernizing power systems, fortifying energy security, and fostering an eco-friendly and efficient energy production and distribution paradigm that reshapes the future of the energy sector.

Key Market Insights:

The International Energy Agency (IEA) anticipates a staggering surge of over 250 percent in distributed solar PV capacity by 2024, projecting a reach of 530 GW—a substantial escalation from the preceding six years..

Per the World Bank report, China, accounting for 16% of global GDP and 24% of worldwide energy demand, stands as the sole major economy experiencing an upsurge in electricity demand, contributing to 28% of global electricity generation this year.

Furthermore, heightened focus on advancing solar power technology through research and development is poised to propel market growth. Distributed energy generation systems, presenting a cost-effective alternative to traditional methods, drive the demand for clean energy solutions, thereby stimulating market expansion.

Distributed Generation Market Drivers:

The integration of renewable energy stands as a substantial and enduring driver of the distributed generation market.

The accentuated focus on clean energy sources such as solar and wind power has been instrumental. Technologies like solar panels and small wind turbines enable the seamless integration of renewable energy into the grid at or near consumption points. Incentives, subsidies, and favorable regulations for renewable energy projects have further accelerated the adoption of distributed generation, empowering end-users to generate clean electricity and curtail reliance on fossil fuels.

Heightened concerns regarding the resilience and reliability of centralized power grids, especially in the face of extreme weather, natural calamities, and cybersecurity threats, have spurred the adoption of distributed generation.

Dispersing power generation across multiple locations mitigates single points of failure in the grid. Microgrids, a form of distributed generation, function independently or in tandem with the main grid, offering backup power during grid outages. This fortifies grid stability, ensuring uninterrupted power supply, making distributed generation an appealing choice for businesses, communities, and critical infrastructure.

Distributed Generation Market Restraints and Challenges:

Interconnecting and integrating decentralized sources into existing electricity grids pose a primary challenge.

The intermittent and varying scale of electricity production from distributed generation systems challenges grid stability and reliability. Establishing robust interconnection standards, modernizing grids, and devising effective energy management and storage solutions are imperative to optimize the use of these resources.

Regulatory and policy barriers present hurdles to the adoption and growth of distributed generation.

Inconsistent or convoluted regulations, such as permitting requirements and net metering policies, can deter potential investors and project developers. Issues regarding grid access, tariff structures, and utility compensation affect the economic viability of distributed generation projects. Addressing these regulatory and policy challenges is pivotal to unlocking the full potential of distributed generation.

Distributed Generation Market Opportunities:

Amidst increasing demand for reliable and sustainable energy solutions, the distributed generation market presents promising prospects. These systems, encompassing solar, wind, and microgrids, offer opportunities for bolstered energy security, reduced transmission losses, and enhanced resilience during grid disruptions. Growing interest in renewable energy sources, coupled with advancements in technology and energy storage, fosters a conducive environment for market expansion. Moreover, the potential to extend electricity access to off-grid and remote communities further broadens the market's scope. As distributed generation evolves, it stands poised to meet the evolving energy needs of today's world.

DISTRIBUTED GENERATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.2% |

|

Segments Covered |

By Technology Type, Application, Grid Connection, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Siemens AG, General Electric Company, Schneider Electric SE, ABB Group, E.ON SE, Enel X, Cummins Inc., Bloom Energy Corporation, Caterpillar Inc., Vestas Wind Systems A/S |

Distributed Generation Market Segmentation: By Technology Type

-

Solar Photovoltaic

-

Wind Turbines

-

Gas/Diesel Generators

-

Microturbines

-

Fuel Cells

-

Combined Heat and Power (CHP) System

-

Energy Storage Systems

The most extensive segment within the distributed generation market, concerning technology type, encompasses solar photovoltaic systems, holding an approximate share of 57%. This dominance primarily stems from the substantial progress witnessed in solar PV technology, rendering it increasingly cost-efficient and proficient. Solar PV systems exhibit remarkable versatility, proving suitable for residential, commercial, and utility-scale applications, while their significant environmental appeal propels widespread adoption. Government incentives and policies further bolster the prominence of solar PV as the market's leading technology segment, aligned with the growing emphasis on sustainability and renewable energy sources. Notably, solar photovoltaic stands as the fastest-growing segment, anticipated to expand rapidly with a CAGR of 27.2%. This surge finds support in several factors, including the continual decline in solar panel costs, heightened environmental consciousness, and governmental initiatives promoting renewable energy. The adaptability and scalability of solar PV systems across various applications, from residential rooftops to expansive solar farms, position them prominently as a clean and accessible distributed generation technology, fostering their status as the market's fastest-growing segment.

Distributed Generation Market Segmentation: By Application

-

Residential

-

Commercial & Industrial

-

Utilities

-

Remote & Off-Grid Areas

The most substantial segment concerning application lies within the Commercial & Industrial sector, boasting a revenue share of 74.9%. This predominance arises from the significant energy requisites of commercial and industrial establishments, often necessitating reliable and cost-effective power sources to sustain operations. Distributed generation technologies, such as solar panels and combined heat and power (CHP) systems, present businesses with opportunities to curtail energy expenses, ensure stable power supplies, and achieve sustainability objectives. Increasingly, the commercial and industrial sector embraces these systems to fortify energy security and resilience, particularly in regions prone to grid disruptions or where energy costs significantly impact operations. Simultaneously, the fastest-growing segment in the distributed generation market remains the Commercial and Industrial sector, primarily propelled by the escalating demand among businesses and industrial facilities for cleaner and more dependable energy sources. Embracing distributed generation technologies like solar PV and CHP systems empowers users to generate their electricity, diminish grid reliance, and potentially vend surplus power back to the grid, leading to substantial cost savings and environmental advantages.

Distributed Generation Market Segmentation: By Grid Connection

-

Grid-Tied (On-Grid)

-

Off-Grid (Islanded)

The foremost segment within the distributed generation market concerning grid connection is Grid-Tied distributed generation, claiming an 87% share. This dominance emanates from the inherent advantages of grid-tied systems, seamlessly integrating distributed generation sources with the central electrical grid. These systems facilitate surplus electricity exportation to the grid, enabling net metering and compensation, thereby presenting economic incentives for consumers. Additionally, grid-tied systems fortify energy reliability by allowing the utilization of grid power when local generation falls short. These advantages fuel widespread adoption, as grid-tied distributed generation offers both economic incentives and augmented energy security for end-users. Moreover, Grid-Tied stands as the fastest-growing segment, as these systems strike a balance between energy self-sufficiency and grid connectivity. Empowering consumers to generate their electricity while potentially exporting excess energy to the grid via net metering arrangements fosters financial incentives. This approach diminishes reliance on traditional energy sources, reduces energy expenses, and contributes to both grid stability and clean energy objectives, aligning with the broader shift towards sustainable energy sources while ensuring grid reliability and interaction.

Distributed Generation Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America represents the most substantial region within the distributed generation market, securing a market share of 37%. This prominence is attributable to several factors, including the widespread adoption of solar and wind energy technologies, supportive governmental policies and incentives, and a robust commercial and industrial sector. Microgrid adoption and energy storage solutions further bolster the role of distributed generation in ensuring energy resilience within North America. The region's diverse energy landscape, coupled with a focus on sustainability and grid reliability, underpins its significance in the distributed generation market. Meanwhile, the Asia-Pacific region emerges as the fastest-growing region in the distributed generation market, poised to grow with a CAGR of 23.5%. This surge finds impetus in escalating electricity demands, burgeoning urbanization, and governmental initiatives aimed at expanding electricity access in rural and remote areas. Commitment to reducing carbon emissions, transitioning towards cleaner energy sources, and rapid adoption of solar and wind technologies contribute substantially to the robust expansion of distributed generation in the Asia-Pacific region.

COVID-19 Impact Analysis on the Global Distributed Generation Market:

The global Distributed Generation market encountered a mix of impacts due to the COVID-19 pandemic. While the initial outbreak disrupted supply chains and momentarily slowed down installation and maintenance activities, the market showcased resilience owing to the persistent need for reliable moisture control in electrical equipment. The surge in remote monitoring and maintenance solutions during the pandemic, alongside an increased emphasis on fortifying the reliability of critical infrastructure, propelled the interest in smart Distributed Generations. As economies recover and infrastructure projects resume, the market is expected to regain momentum, fueled by a combination of deferred maintenance and the incorporation of advanced technologies, positioning it for growth in the post-pandemic era.

Latest Trends/Developments:

An eminent trend in the Distributed Generation market revolves around the integration of smart technologies into these devices. Smart Distributed Generations incorporate sensors and communication capabilities to provide real-time monitoring and data-driven insights into electrical equipment condition and breather performance. These devices can detect moisture levels, particle contamination, and other critical parameters, transmitting this data for analysis to predict maintenance needs and optimize equipment performance. This aligns with the broader shift towards Industry 4.0 and the Internet of Things (IoT) in industrial applications, facilitating proactive maintenance and improved reliability. Consequently, smart Distributed Generations assist organizations in reducing downtime, enhancing the lifespan of electrical assets, and streamlining maintenance operations.

A noteworthy development in the Distributed Generation market is the escalating emphasis on sustainability and environmentally responsible practices. Manufacturers and end-users are actively exploring alternatives to traditional desiccant materials, considering their potential as hazardous waste. Efforts are underway to develop eco-friendly desiccants and materials with reduced environmental impact. Additionally, there's a growing focus on implementing recycling programs for breather components to minimize waste and decrease the ecological footprint of these products. As environmental regulations become stringent and corporate sustainability goals gain prominence, these initiatives for sustainable materials and recycling programs are emerging as key developments in the Distributed Generation market, catering to the demand for greener solutions while maintaining effective moisture control.

Key Players:

-

Siemens AG

-

General Electric Company

-

Schneider Electric SE

-

ABB Group

-

E.ON SE

-

Enel X

-

Cummins Inc.

-

Bloom Energy Corporation

-

Caterpillar Inc.

-

Vestas Wind Systems A/S

Chapter 1. Distributed Generation Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Distributed Generation Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Distributed Generation Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Distributed Generation Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Distributed Generation Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Distributed Generation Market – By Technology Type

6.1 Introduction/Key Findings

6.2 Solar Photovoltaic

6.3 Wind Turbines

6.4 Gas/Diesel Generators

6.5 Microturbines

6.6 Fuel Cells

6.7 Combined Heat and Power (CHP) Systems

6.8 Energy Storage Systems

6.9 Y-O-Y Growth trend Analysis By Technology Type

6.10 Absolute $ Opportunity Analysis By Technology Type, 2024-2030

Chapter 7. Distributed Generation Market – By Application

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial & Industrial

7.4 Utilities

7.5 Remote & Off-Grid Areas

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Distributed Generation Market – By Grid Connection

8.1 Introduction/Key Findings

8.2 Grid-Tied (On-Grid)

8.3 Off-Grid (Islanded)

8.4 Y-O-Y Growth trend Analysis By Grid Connection

8.5 Absolute $ Opportunity Analysis By Grid Connection, 2024-2030

Chapter 9. Distributed Generation Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Grid Connection

9.1.4 By Technology Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Grid Connection

9.2.4 By Technology Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Grid Connection

9.3.4 By Technology Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Grid Connection

9.4.4 By Technology Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Grid Connection

9.5.4 By Technology Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Distributed Generation Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Siemens AG

10.2 General Electric Company

10.3 Schneider Electric SE

10.4 ABB Group

10.5 E.ON SE

10.6 Enel X

10.7 Cummins Inc.

10.8 Bloom Energy Corporation

10.9 Caterpillar Inc.

10.10 Vestas Wind Systems A/S

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

AThe Distributed Generation Market was valued at USD 347.16 Billion in 20223and is projected to reach a market size of USD 729.91 Billion by the end of 2030 growing at a rapid CAGR of 11.2%.

Renewable energy integration along with Grid Resilience and Reliability are drivers of the Distributed Generation market.

Based on grid connection, the Distributed Generation Market is segmented into Grid-Tied (On-Grid) and Off-Grid (Islanded).

North America is the most dominant region for the Distributed Generation Market.

Siemens AG, General Electric Company, Schneider Electric SE, and ABB Group are a few of the key players operating in the Distributed Generation Market.