Distributed Enterprise Market Size (2024 – 2030)

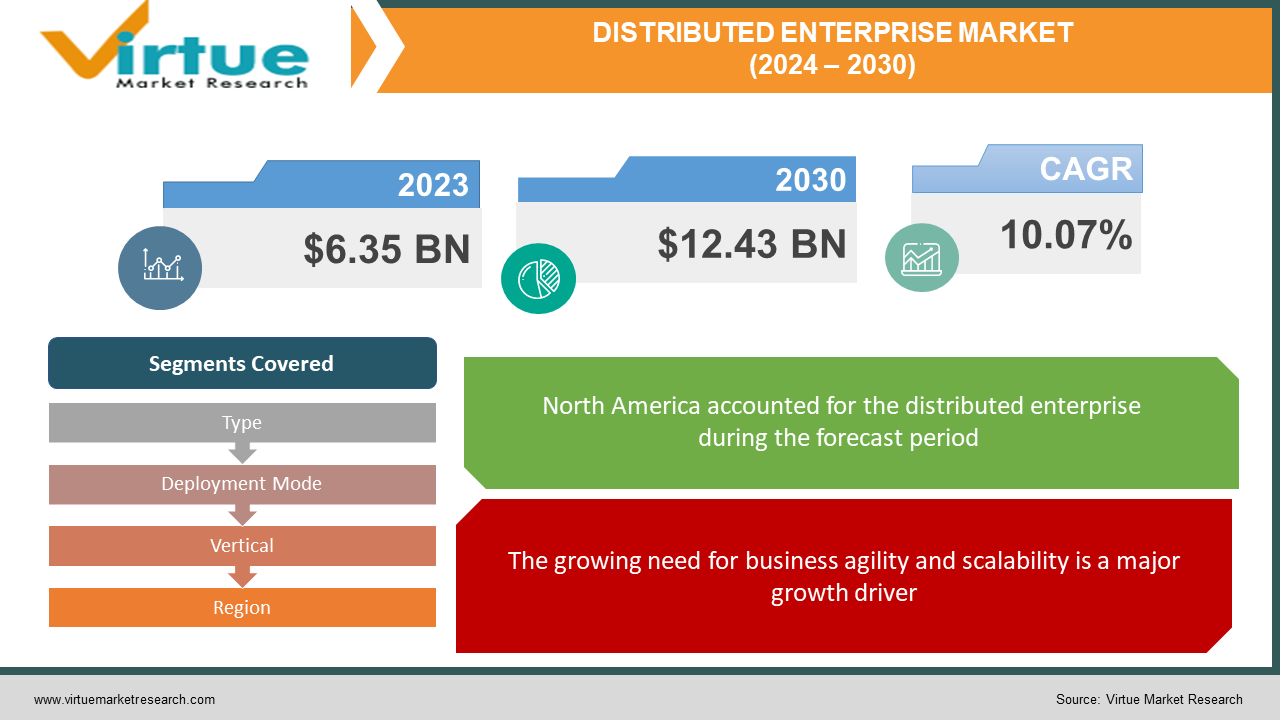

The global distributed enterprise market was valued at USD 6.35 billion in 2023 and is projected to reach a market size of USD 12.43 billion by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 10.07%.

A distributed enterprise is a type of company strategy in which several places serve as the labor, resources, and operations hub, as opposed to being centralized in one office or location. With this configuration, workers may operate remotely or from separate workplaces, staying connected and collaborating efficiently due to technology. Regardless of team members' geographical locations, distributed organizations frequently use digital tools and communication technology to maintain smooth workflows and effective collaboration. This methodology provides employees with freedom, lowers overhead expenses, and allows firms to access a wider talent pool while adjusting to evolving market conditions and customer preferences.

Key Market Insights:

The distributed nature of operations introduces new security challenges. Security solutions need to adapt to secure data across multiple locations, devices, and cloud environments. Zero-trust security models are gaining traction in this space. Effective communication and collaboration are paramount for geographically dispersed teams. The market is seeing a surge in demand for user-friendly and feature-rich collaboration tools that support real-time communication, document sharing, and project management.

Distributed Enterprise Market Drivers:

The growing need for business agility and scalability is a major growth driver.

Businesses today operate in a dynamic and competitive environment. Distributed enterprise models allow for greater agility and scalability. Companies can quickly adapt to changing market conditions by easily adding or removing resources from geographically dispersed locations. This flexibility is crucial for business growth and efficient resource allocation

Advancements in cloud computing and connectivity are also increasing demand for distributed enterprises.

The dispersed enterprise market is being driven primarily by the growing adoption of cloud-based solutions and improvements in high-speed internet access, such as 5G. Cloud computing offers secure and reliable access to applications, data storage, and collaboration tools from anywhere, enabling remote teams to function effectively. 5G provides the bandwidth and low latency needed to support real-time communication and data transfer across distributed locations.

Market Restraints and Challenges:

Ensuring data security and compliance is a major challenge for manufacturers.

Distributed enterprises face a complex challenge in securing their data across geographically dispersed locations and multiple devices. Compliance with data privacy regulations like GDPR and CCPA adds another layer of complexity. Companies need robust cybersecurity solutions and data governance strategies to mitigate risks and maintain compliance.

Maintaining effective communication and collaboration is very challenging for the market.

Effective communication and collaboration are crucial for the success of any organization, but they become even more critical in a distributed work environment. Challenges include time zone differences, cultural barriers, and maintaining a strong company culture across geographically dispersed teams. Distributed enterprises need to invest in collaboration tools and communication strategies to foster a sense of connection and teamwork.

Standardization and visibility across operations pose a challenge to the distributed enterprise market.

Managing a distributed workforce and geographically dispersed operations presents challenges in maintaining consistent standards and visibility across the organization. Distributed enterprises need to invest in centralized platforms and processes to ensure smooth workflow, efficient resource allocation, and consistent quality of service or product delivery.

Market Opportunities:

Edge computing and decentralized applications (dApps) are major opportunities for the market.

The rise of distributed enterprises creates a need for processing power and data storage closer to where data is generated, at the edge of the network. This fuels the market opportunity for edge computing solutions that can handle real-time data processing, analytics, and decision-making at geographically dispersed locations. Additionally, the integration of dApps, which operate on a decentralized blockchain network, can further enhance security, transparency, and collaboration within distributed workforces.

AI-powered workforce management and talent acquisition are opening new opportunities for manufacturers.

Distributed enterprises require efficient tools to manage a geographically dispersed workforce and source talent from a global pool. Artificial intelligence (AI) can play a significant role in this area. AI-powered platforms can automate tasks like scheduling, performance management, and skills gap analysis, streamlining workforce management. Additionally, AI can assist in talent acquisition by identifying top candidates regardless of location, fostering a more inclusive and diverse talent pool.

DISTRIBUTED ENTERPRISE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.07% |

|

Segments Covered |

By Type, Deployment Mode, Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cisco Systems, Inc., VMware, Inc., Citrix Systems, Inc., Hewlett-Packard Enterprise Company, Microsoft Corporation, Dell Technologies Inc., Fortinet, Inc., Palo Alto Networks, Inc., Juniper Networks, Inc., Aruba Networks |

Distributed Enterprise Market Segmentation: By Type

-

Branch Offices

-

Retail Chains

-

Franchise Businesses

-

Manufacturing Facilities

-

Remote Workforce

-

Global Enterprises

-

Cloud-based Infrastructure

-

Service Providers

The market for cloud-based infrastructure is regarded as the largest growing. The need for cloud-based infrastructure services is still growing as more companies use cloud computing solutions to centralize IT processes, increase scalability, and improve flexibility. This market sector gives dispersed businesses the power to effectively manage their data, apps, and resources across many locations, all while cutting expenses and boosting overall operational effectiveness. The remote workforce segment is anticipated to witness the fastest growth. Global occurrences like the COVID-19 pandemic have sped up the emergence of remote work, which has fueled the expansion of distributed businesses that assist remote teams. The growth of this market sector is being driven by businesses investing in technology and solutions that facilitate remote collaboration, communication, and productivity.

Distributed Enterprise Market Segmentation: By Deployment Mode

-

Cloud

-

On-Premises

The distributed enterprise market caters to businesses with varying preferences regarding deployment mode. Cloud solutions currently hold the dominant position. This dominance is driven by the numerous advantages the cloud offers, including scalability, cost-efficiency, and simplified management. Cloud-based solutions provide instant access to applications and data from anywhere, making them ideal for geographically dispersed teams and operations like branch offices, remote workforces, and global enterprises. Additionally, cloud providers handle infrastructure maintenance and upgrades, freeing up internal IT resources for core business activities. However, on-premises solutions are the fastest-growing segment, expected to witness significant growth at a CAGR of 12.8% during the forecast period. Certain industries, like manufacturing and finance, might prioritize on-premises deployments due to concerns around data security and regulatory compliance. Additionally, organizations with substantial existing infrastructure investments might opt for a hybrid approach, combining on-premises solutions with cloud services for a customized solution that meets their specific needs. This trend highlights the evolving nature of the market, where flexibility and a mix-and-match approach are becoming increasingly important for distributed enterprises.

Distributed Enterprise Market Segmentation: By Vertical

-

BFSI

-

IT & Telecom

-

Retail & E-Commerce

-

Healthcare

-

Media & Entertainment

-

Others

The distributed enterprise market caters to a diverse range of industries, each with its own specific needs and growth potential. As of 2023, the IT & telecom sector holds the largest market share of around 31%. This dominance is driven by the ever-increasing volume of data generated and processed in this sector. Distributed cloud solutions offer IT & telecom companies the scalability and agility needed to manage this data effectively, enabling advancements in areas like big data analytics, cloud-based telephony, and the Internet of Things (IoT). Looking ahead, the retail & e-commerce segments are expected to witness the fastest growth. The rise of online shopping and omnichannel retail experiences necessitates geographically dispersed operations, such as fulfillment centers and customer service teams. Cloud-based solutions for inventory management, supply chain optimization, and secure online transactions are crucial for success in this space. Additionally, the healthcare sector is increasingly adopting distributed cloud solutions for remote patient monitoring, telehealth consultations, and secure storage of electronic health records. This trend highlights the broad applicability of distributed enterprise solutions across various industries, with each vertical presenting unique growth opportunities.

Distributed Enterprise Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The global distributed enterprise market exhibits significant regional variation in terms of adoption and growth potential. North America is the largest growing market. This growth is driven by the high concentration of established enterprises, a mature IT infrastructure, and a strong focus on innovation and digital transformation. Asia Pacific is the fastest-growing market. This dominance is fueled by factors like rapid economic growth, government initiatives promoting digital adoption, and a large pool of tech-savvy talent. This region presents a particularly attractive market for cloud-based solutions and tools that cater to geographically dispersed operations, common in sectors like manufacturing and retail with widespread supply chains. Europe represents another significant market, with a growing demand for distributed solutions that comply with strict data privacy regulations like GDPR. Looking beyond these established regions, South America, the Middle East, and Africa (MEA) showcase promising growth potential. These regions are experiencing rapid urbanization, increasing internet penetration, and a growing awareness of the benefits of distributed enterprise solutions. This trend suggests a future market landscape with a more balanced distribution of growth across various geographical regions.

COVID-19 Impact Analysis on the Global Distributed Enterprise Market:

The COVID-19 pandemic acted as a significant accelerant for the global distributed enterprise market. Before the pandemic, many businesses operated with a centralized workforce model. However, lockdowns and social distancing mandates forced companies to rapidly adopt remote work arrangements. This created a surge in demand for cloud-based collaboration tools, secure access solutions, and video conferencing platforms to facilitate communication and productivity across geographically dispersed teams. The pandemic's impact went beyond immediate needs. It exposed the limitations of traditional, centralized business models and highlighted the advantages of distributed work environments. Businesses increasingly recognize the benefits of flexibility, scalability, and access to a global talent pool that distributed enterprises offer. This newfound appreciation, coupled with advancements in cloud computing and communication technologies, is expected to have a lasting impact on the market. The distributed enterprise model is likely to become the norm for many organizations, driving sustained growth in the market in the years to come.

Latest Trends/Developments:

Convergence of edge computing and distributed cloud: As distributed enterprises continue to expand geographically, the need for real-time data processing and decision-making at the edge of the network becomes crucial. This trend is driving the convergence of edge computing and distributed cloud solutions. By combining these technologies, enterprises can leverage the scalability and flexibility of the cloud with the low latency and processing power of edge computing. This convergence allows for near-real-time data analysis and automated actions closer to where the data is generated, enhancing operational efficiency and responsiveness.

The rise of secure access service edge (SASE): The distributed nature of workforces and geographically dispersed operations introduces complex security challenges for distributed enterprises. Traditional security solutions often struggle to adapt to this dynamic environment. Secure Access Service Edge (SASE) is emerging as a key trend, offering a cloud-based, integrated approach to security. SASE combines various security functions like Zero Trust Network Access (ZTNA), Cloud Access Security Broker (CASB), and Secure Web Gateway (SWG) into a single, unified platform. This simplifies security management for distributed enterprises and provides consistent and comprehensive protection across all access points, devices, and locations.

Integration of AI and machine learning (ML) for distributed work management: Distributed enterprises face challenges in managing a geographically dispersed workforce. Artificial intelligence (AI) and machine learning (ML) are offering innovative solutions to address these challenges. AI-powered platforms can automate tasks like scheduling, performance management, and skills gap analysis, streamlining workforce management. Additionally, ML algorithms can analyze data from various sources to predict potential issues, recommend training programs, and identify top talent regardless of location. This integration of AI and ML fosters a more efficient, data-driven approach to managing a distributed workforce.

Key Players:

-

Cisco Systems, Inc.

-

VMware, Inc.

-

Citrix Systems, Inc.

-

Hewlett-Packard Enterprise Company

-

Microsoft Corporation

-

Dell Technologies Inc.

-

Fortinet, Inc.

-

Palo Alto Networks, Inc.

-

Juniper Networks, Inc.

-

Aruba Networks

-

In May 2023, Cisco Systems Inc. made a major investment in India's manufacturing industry when it announced plans to establish core manufacturing capabilities in the nation. These capabilities would include testing, development, logistics, and increasing in-house repair operations.

-

In May 2023, to further 5G technology, Apple Inc. and Broadcom Inc. announced a significant agreement. The alliance's goal is to concentrate on the research and manufacturing of essential 5G radio frequency components in the US.

-

In May 2023, Project Helix, a collaborative effort between Dell Technologies Inc. and NVIDIA, was unveiled to streamline the on-premises generative AI model adoption process for enterprises.

Chapter 1. Distributed Enterprise Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Distributed Enterprise Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Distributed Enterprise Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Distributed Enterprise Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Distributed Enterprise Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Distributed Enterprise Market – By Type

6.1 Introduction/Key Findings

6.2 Branch Offices

6.3 Retail Chains

6.4 Franchise Businesses

6.5 Manufacturing Facilities

6.6 Remote Workforce

6.7 Global Enterprises

6.8 Cloud-based Infrastructure

6.9 Service Providers

6.10 Y-O-Y Growth trend Analysis By Type

6.11 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Distributed Enterprise Market – By Deployment Mode

7.1 Introduction/Key Findings

7.2 Cloud

7.3 On-Premises

7.4 Y-O-Y Growth trend Analysis By Deployment Mode

7.5 Absolute $ Opportunity Analysis By Deployment Mode, 2024-2030

Chapter 8. Distributed Enterprise Market – By Vertical

8.1 Introduction/Key Findings

8.2 BFSI

8.3 IT & Telecom

8.4 Retail & E-Commerce

8.5 Healthcare

8.6 Media & Entertainment

8.7 Others

8.8 Y-O-Y Growth trend Analysis By Vertical

8.9 Absolute $ Opportunity Analysis By Vertical, 2024-2030

Chapter 9. Distributed Enterprise Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Deployment Mode

9.1.4 By Vertical

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Deployment Mode

9.2.4 By Vertical

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Deployment Mode

9.3.4 By Vertical

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Deployment Mode

9.4.4 By Vertical

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Deployment Mode

9.5.4 By Vertical

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Distributed Enterprise Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cisco Systems, Inc.

10.2 VMware, Inc.

10.3 Citrix Systems, Inc.

10.4 Hewlett-Packard Enterprise Company

10.5 Microsoft Corporation

10.6 Dell Technologies Inc.

10.7 Fortinet, Inc.

10.8 Palo Alto Networks, Inc.

10.9 Juniper Networks, Inc.

10.10 Aruba Networks

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global distributed enterprise market was valued at USD 6.35 billion in 2023 and is projected to reach a market size of USD 12.43 billion by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 10.07%.

Key drivers include the growing need for business agility and scalability and advancements in cloud computing and connectivity.

BFSI, IT & telecom, retail & e-commerce, healthcare, media & entertainment, and others are verticals of the distributed enterprise market.

North America dominates the market with a significant share of over 30%.

Cisco Systems, Inc., VMware, Inc., Citrix Systems, Inc., Hewlett Packard Enterprise Company, Microsoft Corporation, Dell Technologies, Inc., Fortinet, Inc., Palo Alto Networks, Inc., Juniper Networks, Inc., and Aruba Networks are some of the leading players in the global distributed enterprise market.