Distributed Control Systems (DCS) Market Size (2024 – 2030)

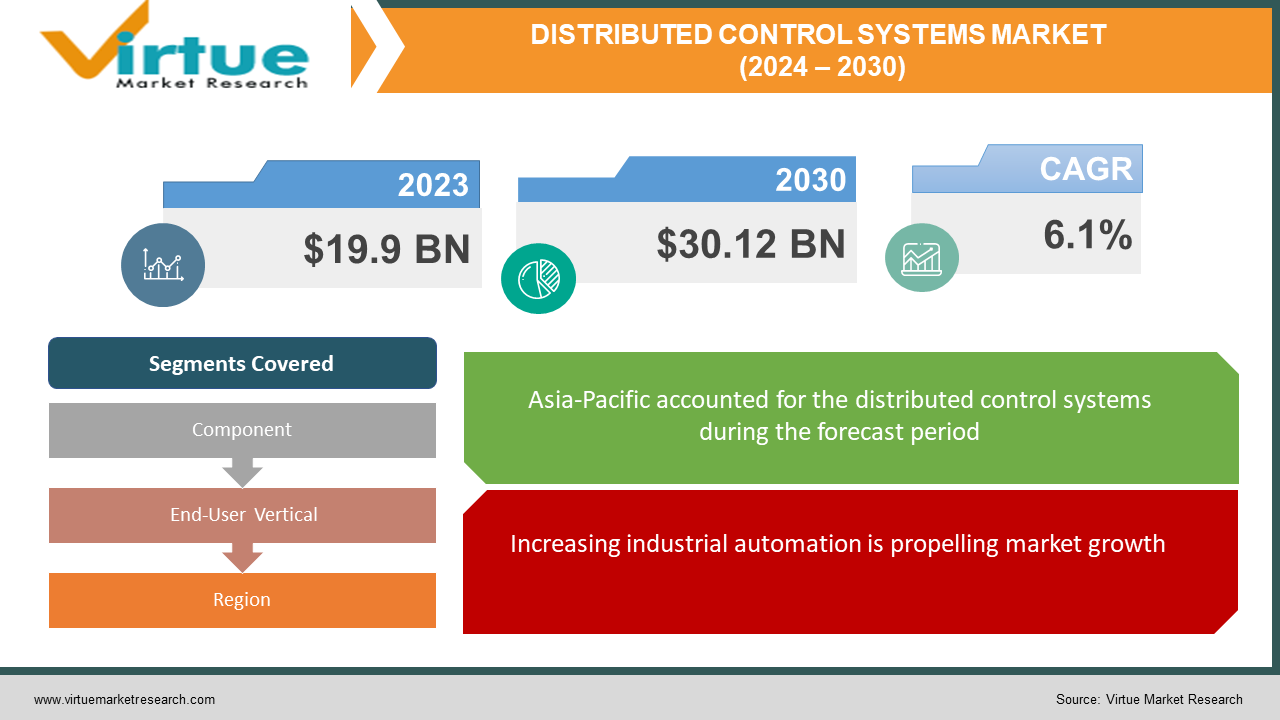

The global distributed control system market is valued at USD 19.9 billion in 2023 and is estimated to grow at 6.1% during 2024–2030, reaching a value of USD 30.12 billion in 2030.

A DCS is the brain and nervous system of an industrial plant. It's a network of interconnected computers and specialized software that monitors and controls various processes in real-time. It collects data from sensors scattered throughout the facility, analyzes it, and sends commands to actuators that adjust valves, pumps, and other equipment. This continuous feedback loop ensures optimal operation, maximizing efficiency, safety, and product quality. Across various industries, from power generation and oil and gas to chemicals and pharmaceuticals, DCS plays a critical role in ensuring smooth, efficient, and safe operations. They are very essential to maintaining harmony in industries.

Key Market Insights:

The global Distributed Control Systems (DCS) market, valued at USD 19.9 billion in 2023, is poised for a steady climb, reaching an estimated USD 30.12 billion by 2030. This growth is fueled by industry demands for automation, safety, and efficiency. From power generation to pharmaceuticals, businesses are embracing DCS for real-time process control and optimization. Advancements like edge computing and cloud-based solutions are further empowering smarter and more flexible DCS implementations. With Asia Pacific leading the charge, regional opportunities abound, while established players like ABB and Rockwell Automation face challenges from niche specialists. As sustainability concerns rise, expect DCS to play a key role in optimizing energy consumption and reducing emissions. Overall, the DCS market promises exciting innovations and robust growth, offering immense potential for both established players and new entrants.

Distributed Control Systems Market Drivers:

Increasing industrial automation is propelling market growth.

A revolution is happening in many different industries, including chemicals, water treatment, oil and gas, and power generation. It is controlled by intelligent automation that is coordinated by distributed control systems (DCS). These intricate procedures, which were before just parts of an industrial machine, are now monitored closely by DCS, which maximizes production and optimizes each stage of the process. The power of DCS goes beyond efficiency. Chemical facilities protect complicated reactions, guaranteeing environmental compliance and worker safety. It stabilizes fragile systems in power generation, guaranteeing millions of people a steady supply of electricity. DCS guarantees that every drop of water is pure, safeguarding both valuable resources and public health.

Rising demand in emerging markets has been responsible for the success.

The DCS growth is being driven by emerging economies such as those in Latin America and Asia Pacific. This is because of rapid industrialization in industries such as manufacturing, electricity production, and water treatment, which need complex and efficient control systems. However, the adoption of these smart technologies is being accelerated by government initiatives to actively promote automation and digitalization, in addition to organic development. With Latin America emerging as a rapidly expanding competitor and Asia Pacific being an emerging market, enormous market opportunities are available in these areas.

The growing need for real-time monitoring and control is contributing to the expansion.

In dynamic industrial environments, fast and accurate process monitoring and control are crucial for safety, product quality, and optimal performance. DCS facilitates real-time data gathering and control decisions, ensuring tighter process management. Distributed Control Systems (DCS) are the safety net and the balancing pole, ensuring precision and stability through real-time monitoring and control.

The rising energy demand and focus on renewables have been accelerating the growth rate.

Growing global energy consumption, coupled with the shift towards renewable energy sources like wind and solar, necessitates advanced control systems for efficient power generation and grid management. This plays an important role in improving sustainability in power plants, industries, and factories by improving energy efficiency and encouraging the use of renewable resources. By maximizing process effectiveness and efficiency, DCS may also lower energy use, emissions, and waste and play a vital role in optimizing energy production and distribution.

Distributed Control System Market Challenges and Restraints:

A distributed control system requires a high initial investment, which can be a barrier.

Smaller companies or those with tight budgets might experience difficulties in arranging the associated costs. Hardware and software licenses alone can be hefty investments. Additionally, installation requires specialized technicians and training charges are applicable for new employees. Ongoing maintenance adds another layer of cost. This can create hurdles, demotivating the companies and thereby causing losses for the market.

Lack of skilled personnel is one of the challenging factors faced by the industry.

Operating and maintaining complex DCS systems requires skilled personnel with specific knowledge and experience. Finding and retaining such talent can be challenging, especially in smaller or remote locations.

Competition from alternative solutions can hinder DCS market growth.

Programmable Logic Controllers (PLCs) and other less complex automation solutions can be cheaper and easier to implement, posing competition to DCS in certain applications.

Regulations and compliance are creating hurdles for market expansion.

Strict rules, like environmental standards or safety protocols, add layers of complexity to the existing intricate DCS setup. Sensors, specialized software modules, and rigorous validation procedures pile up the complications and expenses. Stringent regulations demand specialized expertise to navigate the technology. Finding technicians fluent in both DCS technology and the specific regulations of a particular industry can be difficult, further inflating the costs.

Market Opportunities:

Integrating DCS with IoT sensors and AI-powered analytics can enable real-time data monitoring, predictive maintenance, and optimized process control. This can lead to increased efficiency, reduced downtime, and improved decision-making. Also, cloud-based solutions offer increased accessibility, scalability, and flexibility for managing and controlling distributed systems. This eliminates the need for on-premise infrastructure and provides cost-effective solutions for smaller companies. The growing demand for energy and focus on safety and efficiency present lucrative opportunities for DCS solutions in upstream and downstream oil and gas operations. Rapid industrialization and infrastructure development in regions like the Asia Pacific and Latin America are creating a massive demand for DCS solutions.

DISTRIBUTED CONTROL SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Component, End-User Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell, Emerson Electric, Siemens, Schneider Electric, Bentley Systems, Mitsubishi Motors Corporation, ABB, Yokogawa Electric Corporation, Rockwell Automation, General Electric (GE), Johnson Controls |

Distributed Control Systems Market Segmentation: By Component

-

Hardware

-

Software

-

Services

In the DCS market, the hardware segment is the largest growing, with a 42.5% share in 2023, fueled by Asia and Latin America's booming industries needing advanced controllers and networks. A significant component of DCS is hardware, which includes a variety of components such as input/output modules, controllers, communication devices, and sensors. The continued trend of industrial automation is one of the main factors propelling the expansion of the hardware industry. Businesses are spending a lot of money modernizing their control systems to increase production and efficiency. High-performance hardware components that can survive the rigors of industrial settings and provide continuous and dependable operation are therefore becoming more and more necessary. The services category is considered to be the fastest-growing segment, with a share of around 21.8%. This is because of the need to maintain, install, upgrade, and manage this equipment. Additionally, services regarding training and consultation are also provided. The software segment is driven by cloud, AI, and process control demands, with similar regional growth patterns.

Distributed Control Systems Market Segmentation: By End-User Vertical

-

Power Generation

-

Oil & Gas

-

Chemical

-

Refining

-

Mining and Metals

-

Others

In the global DCS market, oil and gas is the largest growing end-user, with an approximate share of 22.5% in 2023. To monitor and regulate a variety of activities, including drilling operations, production facilities, pipelines, and refineries, the oil and gas sector needs advanced DCS systems. It is fueled by safety needs and complex processes. Advancements in this are seen in Asia-Pacific and Latin America. Power generation, with a share of 19.4% in 2023, is the fastest-growing segment. This is driven by renewable energy and infrastructure growth, especially in the same fast-developing regions. DCS gives operators the capacity to keep an eye on and regulate the production, transmission, and distribution of power, guaranteeing peak efficiency, dependability, and security. The chemical industry also sees strong growth in these areas, demanding precise control and automation. While refining (14.2%) follows similar patterns, stricter regulations and environmental pressures slow it down. Mining & Metals (8.1%) is experiencing slower growth duto Fluctuations

Distributed Control Systems Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest and fastest-growing region, with a share of around 35.4% in 2023. Rapid industrialization in China, India, and Japan fuels their hunger for automation solutions like DCS. It is estimated that this region will have a projected growth rate of 5.5% by 2028. Europe takes a more measured approach, claiming 21.2% in 2023 of the market but growing at a slower pace of around 3.5%. North America, holding a share of 32.1% in 2023, is growing at a medium pace. Latin America, with 5.2%, is seeing significant developments, driven by investments in infrastructure and modernization. The Middle East and Africa hold 6%, primarily fueled by the oil and gas industry.

COVID-19 Impact Analysis on the Luxury Vehicle Market

The COVID-19 pandemic hurt the distributed control system (DCS) market. Initially, supply chain disruptions and project delays caused a temporary dip, particularly in regions like Asia and the Pacific heavily reliant on imported components. However, the long-term impact played out differently across sectors. While industries like hospitality and travel saw plummeting demand for DCS solutions, sectors like food and beverage and pharmaceuticals, experiencing heightened production needs, just accelerated their automation investments. Additionally, the pandemic triggered a surge in remote monitoring and data-driven decision-making, boosting the adoption of cloud-based DCS and analytics tools. Overall, the pandemic reshaped the landscape, accelerating existing trends towards digitalization and remote operations. While some segments faced temporary setbacks, the pandemic ultimately catalyzed innovation and adaptation, paving the way for a more future-proof and dynamic DCS market.

Latest trends/Developments

The DCS industry has been involved in a lot of innovations. Cloud-based solutions are being emphasized, offering scalability, remote access, and cost savings. IIoT and AI are emerging fields, providing real-time data and smart automation, while cybersecurity is being advanced to handle increased connectivity. User-friendly interfaces and modular designs are making life easier for operators, and sustainability is high on the agenda with DCS managing renewables and optimizing energy use. Manufacturers are prioritizing customization that tailors the needs of each industry with specialized solutions and safety-critical options for high-stakes players. Digital twins, edge computing, and blockchain promise a future of secure, efficient, and intelligent control systems.

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Companies are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

Key Players:

-

Honeywell

-

Emerson Electric

-

Siemens

-

Schneider Electric

-

Bentley Systems

-

Mitsubishi Motors Corporation

-

ABB

-

Yokogawa Electric Corporation

-

Rockwell Automation

-

General Electric (GE)

-

Johnson Controls

-

In September 2023, with the introduction of DeltaV Version 15 Feature Pack 1, the world leader in software and technology, Emerson, expanded on cutting-edge technologies and solutions through the DeltaVTM distributed control system (DCS). The new technologies and improvements to existing capabilities included in this feature pack release serve to enable more sustainable, efficient operations while also improving situational awareness and the performance of the control system.

-

In February 2023, ABB introduced the AbilityTM Symphony® Plus, the company's most recent distributed control system (DCS) update. The system integrates, optimizes, and automates the whole plant to maximize plant dependability and efficiency.

-

In May 2022, the Nexus OnCoreTM Compact Control System was introduced by Nexus Controls to enhance smaller industrial facilities. Smaller industrial locations that are typically handled by less complex programmable logic controllers (PLCs) can now have advanced, integrated controls due to the new compact distributed control system (DCS).

Chapter 1. Distributed Control Systems (DCS) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Distributed Control Systems (DCS) Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Distributed Control Systems (DCS) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Distributed Control Systems (DCS) Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Distributed Control Systems (DCS) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Distributed Control Systems (DCS) Market – By Component

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Services

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Distributed Control Systems (DCS) Market – By End-User Vertical

7.1 Introduction/Key Findings

7.2 Power Generation

7.3 Oil & Gas

7.4 Chemical

7.5 Refining

7.6 Mining and Metals

7.7 Others

7.8 Y-O-Y Growth trend Analysis By End-User Vertical

7.9 Absolute $ Opportunity Analysis By End-User Vertical , 2024-2030

Chapter 8. Distributed Control Systems (DCS) Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By Component

8.1.3 By End-User Vertical

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By Component

8.2.3 By End-User Vertical

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By Component

8.3.3 By End-User Vertical

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By Component

8.4.3 By End-User Vertical

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By By Component

8.5.3 By End-User Vertical

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Distributed Control Systems (DCS) Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Honeywell

9.2 Emerson Electric

9.3 Siemens

9.4 Schneider Electric

9.5 Bentley Systems

9.6 Mitsubishi Motors Corporation

9.7 ABB

9.8 Yokogawa Electric Corporation

9.9 Rockwell Automation

9.10 General Electric (GE)

9.11 Johnson Controls

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global distributed control system market is valued at USD 19.9 billion in 2023 and is estimated to grow at 6.1% during 2024–2030, reaching a value of USD 30.12 billion in 2030.

Increasing industrial automation, demand in emerging markets, the growing need for real-time monitoring and control, and the rising energy demand and focus on renewables are the factors that are driving market growth.

Based on component type, the market is divided into hardware, software, and services.

Asia-Pacific is the most dominant region for the distributed control system market.

Honeywell, Emerson Electric, Siemens, Schneider Electric, and Bentley Systems are the prominent companies in this market.