Dispensing Systems Market Size (2024-2030)

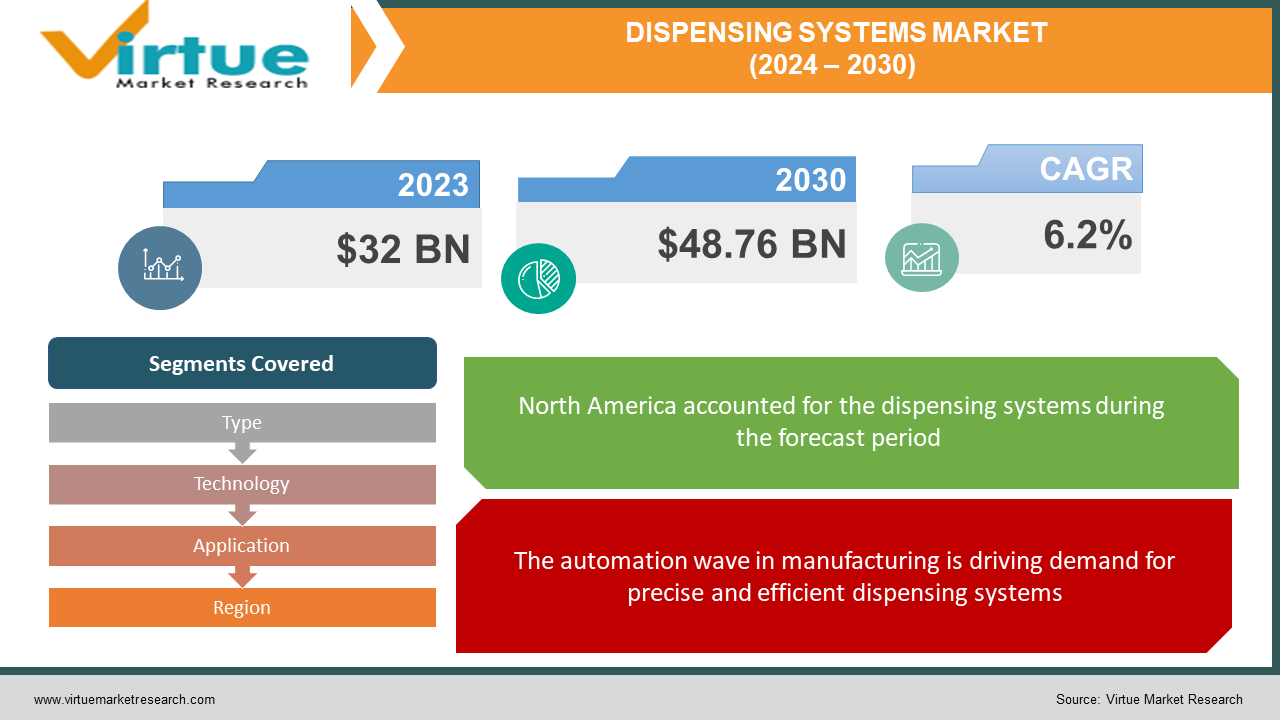

The Dispensing Systems Market was valued at USD 32 billion in 2023 and is projected to reach a market size of USD 48.76 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6.2%.

The dispensing systems market is thriving, fueled by automation and technological advancements. Manufacturers are increasingly relying on automated dispensing systems for their precision and efficiency, particularly in high-volume production. Integration of robotics and other cutting-edge technologies further enhances the accuracy and flexibility of these systems. Additionally, the growing demand for miniaturized and lightweight components across various industries necessitates precise material application, making dispensing systems an essential tool. The market offers a variety of dispensing systems categorized by their level of automation: automatic, semi-automatic, and manual. Each caters to different production needs.

Key Market Insights:

The dispensing systems market is thriving due to its role in modern manufacturing. Automation is a key driver, with manufacturers increasingly relying on automatic and semi-automatic dispensing systems. These systems offer unmatched precision and efficiency, particularly for high-volume production lines. Cutting-edge technologies like robotics are being integrated into these systems, further enhancing their accuracy and flexibility in material application. This trend is particularly relevant for the miniaturization trend across various industries. As components become smaller and lighter, precise material application becomes crucial.

Beyond these core functionalities, dispensing systems offer remarkable versatility. They find applications in diverse industries such as electronics, healthcare, and automotive. In electronics manufacturing, they ensure precise application of adhesives, sealants, and solder pastes during component assembly. Similarly, they play a vital role in applying fluids during the manufacturing of medical devices and pharmaceuticals. The automotive industry utilizes dispensing systems for adhesives, sealants, and lubricants in vehicle assembly.

Looking ahead, the future of dispensing systems is promising. As the focus on automation and technological innovation continues, the demand for these systems is expected to rise across a wider range of industries. Additionally, with growing concerns about sustainability, there's a potential focus on developing dispensing systems that minimize material waste and optimize resource utilization. This eco-conscious approach can further propel the dispensing systems market in the coming years.

The Dispensing Systems Market Drivers:

The automation wave in manufacturing is driving demand for precise and efficient dispensing systems.

The tide is turning towards automation in manufacturing, and dispensing systems are riding the wave. Automatic and semi-automatic systems deliver unmatched precision and efficiency, particularly for high-volume production lines. Consistency is key, and these systems minimize human error, ensuring repeatable results critical for quality control.

Integration of robotics with dispensing systems enhances control and accuracy of material application.

Advanced technologies like robotics are becoming seamlessly integrated with dispensing systems. This marriage of technology empowers these systems with enhanced capabilities. Imagine robots precisely controlling the dispensing arm, allowing for more controlled, flexible, and accurate material application. This becomes especially crucial for delicate tasks involving miniaturized components, a growing trend across industries.

The miniaturization trend necessitates precise material application, making dispensing systems essential.

Modern manufacturing thrives on smaller and lighter components. However, this miniaturization trend presents a challenge: applying materials with utmost precision on intricate designs. Dispensing systems come to the rescue, ensuring accurate material application during the manufacturing process of these miniaturized components.

Growing focus on sustainability compels development of dispensing systems that minimize waste and optimize resources.

As environmental concerns rise, manufacturers are increasingly seeking eco-conscious solutions. Dispensing systems can play a vital role here. By enabling precise material application, they can minimize material waste. Additionally, advancements in dispensing technology can lead to systems that optimize resource utilization, reducing overall environmental impact. This focus on sustainability presents a significant growth driver for the dispensing systems market.

The Dispensing Systems Market Restraints and Challenges:

The dispensing systems market isn't without its hurdles. Despite the clear advantages they offer, several factors can restrain their widespread adoption. A significant challenge lies in the upfront costs. Automatic and semi-automatic dispensing systems, while delivering superior performance, carry a hefty price tag. This initial investment can be a significant barrier for smaller manufacturers or those with limited budgets. Furthermore, integrating these complex systems into existing production lines isn't a simple task. Careful planning, technical expertise, and potential modifications to the production setup are all required. This adds to the overall cost and implementation time, creating a hurdle for manufacturers hesitant to disrupt their current workflows.

Another challenge lies in the workforce. Operating and maintaining these sophisticated systems requires a skilled workforce with a deep understanding of the technology and its intricacies. A lack of such skilled personnel can hinder the smooth operation and full potential of these systems. Manufacturers may need to invest in training programs or face limitations in utilizing the full capabilities of their dispensing systems.

Finally, ensuring compatibility with various materials can be a challenge. Dispensing systems need to work seamlessly with the specific materials used in the manufacturing process. This is especially true when dealing with new or unique materials, requiring additional research and testing to guarantee compatibility. Overcoming these compatibility hurdles can add complexity and potentially delay the adoption of dispensing systems.

The Dispensing Systems Market Opportunities:

The future of dispensing systems is brimming with exciting opportunities. One key area of growth lies in venturing beyond traditional applications. Dispensing systems have the potential to revolutionize new and emerging fields like 3D printing, bioprinting, and even nanotechnology, where precise material deposition is paramount. Manufacturers can gain a competitive edge by prioritizing user experience. This means developing user-friendly interfaces, offering comprehensive training programs for operators, and designing modular systems that are easier to integrate and maintain. Technological advancements can lead to dispensing systems capable of handling a wider range of materials, from low-viscosity fluids to complex pastes. This expanded material compatibility would open doors for dispensing systems in a greater number of manufacturing processes. Furthermore, the rise of Industry 4.0 presents an opportunity to integrate dispensing systems with industrial networks. This allows for real-time monitoring, data analysis, and predictive maintenance, optimizing performance, minimizing downtime, and driving overall efficiency. Finally, with the growing focus on sustainability, manufacturers that develop eco-friendly dispensing systems with capabilities like waste minimization and resource optimization will likely be well-positioned to thrive in a market increasingly concerned about environmental responsibility.

DISPENSING SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Type, Technology, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nordson EFD, Asymtek, PVA TePla AG, Musashi Engineering Inc., Techcon Systems Ltd., Graco Inc., Fisnar Inc., Dymax Corporation |

Dispensing Systems Market Segmentation: By Type

-

Automatic Dispensing Systems

-

Semi-automatic Dispensing Systems

-

Manual Dispensing Systems

By type, automatic dispensing systems dominate the market due to their unmatched precision and efficiency, perfect for high-volume production. However, the fastest-growing segment is likely semi-automatic systems. These offer a cost-effective balance for medium-volume production while still providing flexibility compared to fully automatic options. This makes them attractive for a wider range of manufacturers.

Dispensing Systems Market Segmentation: By Technology

-

Jet Dispensing

-

Valve Dispensing

-

Screw Dispensing

While definitive data can vary depending on the source, valve dispensing is likely the most dominant segment within the dispensing systems market by technology. Its versatility allows it to handle a wide range of fluids and viscosities, making it suitable for various applications. On the other hand, jet dispensing is expected to be the fastest-growing segment. This is due to its precision in applying low-viscosity fluids, which is becoming increasingly important in sectors like electronics manufacturing with miniaturized components.

Dispensing Systems Market Segmentation: By Application

-

Electronics

-

Healthcare & Pharmaceuticals

-

Automotive

The electronics and automotive sectors currently dominate the dispensing systems market by application, accounting for a significant share due to their high reliance on precise material deposition for components and assembly. However, the Asia Pacific region is expected to be the fastest-growing segment due to its expanding manufacturing base across various industries, including electronics and automotive, which will further drive the demand for dispensing systems.

Dispensing Systems Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America: North America boasts a well-established market with strong industry players and infrastructure. However, its growth is expected to be more stable compared to emerging regions. Here, manufacturers are already familiar with the technology, and significant growth might come from advancements and adoption of even more sophisticated dispensing systems.

Europe: Europe presents a mature market with a focus on cutting-edge technologies. High-quality standards and emphasis on automation are hallmarks of European manufacturing. Growth here is likely driven by the adoption of these advanced dispensing systems that deliver superior efficiency and precision.

Asia-Pacific: The Asia Pacific region is poised for the most significant growth. This is primarily fueled by its rapidly expanding manufacturing base, particularly in electronics and automotive sectors. As these industries experience a boom, the demand for dispensing systems to ensure consistent and high-quality production will soar.

South America: South America's dispensing systems market is still in its development stage, but moderate growth is anticipated. This is driven by increasing automation adoption and a rising demand for consumer electronics, prompting manufacturers to invest in these systems for improved production efficiency.

Middle East and Africa: Finally, the Middle East and Africa represent emerging markets with the potential for future growth. As these regions experience industrial development and infrastructure advancements, the demand for dispensing systems is expected to rise in the coming years, offering exciting opportunities for market expansion.

COVID-19 Impact Analysis on the Dispensing Systems Market:

The COVID-19 pandemic undeniably impacted the dispensing systems market, bringing both temporary setbacks and potential long-term opportunities. In the short-term, the market grappled with supply chain disruptions due to lockdowns and travel restrictions. This led to critical component shortages, stalling production and hindering growth. Additionally, production slowdowns and shutdowns, particularly in Asia Pacific, significantly reduced demand for dispensing systems used in those manufacturing lines. Furthermore, with the pandemic prioritizing essential medical supplies, resources shifted away from other industries, potentially causing a temporary decline in demand for dispensing systems in non-essential sectors.

However, the pandemic also brought forth long-term opportunities. The heightened focus on automation and production flexibility has the potential to drive a lasting increase in demand for automatic and semi-automatic dispensing systems. These systems offer greater efficiency and a reduced reliance on human labor, factors that gained importance during the pandemic. The surge in demand for medical devices and pharmaceuticals during this time could also create a lasting positive impact on the dispensing systems market used in their production. Finally, the increased focus on hygiene and safety post-pandemic may lead to a rise in demand for dispensing systems used in the production of personal protective equipment (PPE) and sanitizing products. In conclusion, while the COVID-19 pandemic brought its share of challenges, the long-term outlook for the dispensing systems market appears promising, driven by factors like automation, growth in healthcare applications, and the need for hygiene solutions.

Latest Trends/ Developments:

The dispensing systems market is abuzz with exciting developments. One key trend is the integration with Industry 4.0. This marriage of technology allows for real-time monitoring, data analysis, and predictive maintenance of dispensing systems, leading to optimized performance and reduced waste. Sustainability is also a major focus, with manufacturers developing eco-friendly dispensing systems that minimize material waste, optimize energy use, and even utilize bio-based or recyclable materials. For intricate and delicate manufacturing processes, the rise of microfluidic dispensing systems is a boon. These systems handle extremely small fluid volumes with high accuracy, perfect for miniaturization needs in electronics and bioprinting. The future also holds "smart" dispensing systems that leverage Artificial Intelligence. These systems can learn and adjust dispensing parameters in real-time for consistent, optimal results, further enhancing quality control. Finally, manufacturers are prioritizing user experience by developing intuitive interfaces, comprehensive training programs, and modular systems for easier integration and maintenance. This focus on user-friendliness improves operator productivity and reduces training times. Overall, the dispensing systems market thrives on continuous innovation, driven by the ever-present need for efficiency, precision, sustainability, and user-friendliness in modern manufacturing.

Key Players:

-

Nordson EFD

-

Asymtek

-

PVA TePla AG

-

Musashi Engineering Inc.

-

Techcon Systems Ltd.

-

Graco Inc.

-

Fisnar Inc.

-

Dymax Corporation

Chapter 1. Dispensing Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Dispensing Systems Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Dispensing Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Dispensing Systems Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Dispensing Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Dispensing Systems Market – By Type

6.1 Introduction/Key Findings

6.2 Automatic Dispensing Systems

6.3 Semi-automatic Dispensing Systems

6.4 Manual Dispensing Systems

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Dispensing Systems Market – By Technology

7.1 Introduction/Key Findings

7.2 Jet Dispensing

7.3 Valve Dispensing

7.4 Screw Dispensing

7.5 Y-O-Y Growth trend Analysis By Technology

7.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Dispensing Systems Market – By Application

8.1 Introduction/Key Findings

8.2 Electronics

8.3 Healthcare & Pharmaceuticals

8.4 Automotive

8.5 Y-O-Y Growth trend Analysis By Application

8.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Dispensing Systems Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Technology

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Technology

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Technology

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Technology

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Technology

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Dispensing Systems Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nordson EFD

10.2 Asymtek

10.3 PVA TePla AG

10.4 Musashi Engineering Inc.

10.5 Techcon Systems Ltd.

10.6 Graco Inc.

10.7 Fisnar Inc.

10.8 Dymax Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Dispensing Systems Market was valued at USD 32 billion in 2023 and is projected to reach a market size of USD 48.76 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6.2%.

Automation Wave, Cutting-Edge Technologies, the Need for Miniaturization, Sustainability Focus.

Automatic Dispensing Systems, Semi-automatic Dispensing Systems, Manual Dispensing Systems.

The Asia Pacific region is currently the most dominant market for dispensing systems due to its rapidly expanding manufacturing base, particularly in electronics and automotive industries.

Nordson EFD, Asymtek, PVA TePla AG, Musashi Engineering Inc., Techcon Systems Ltd., Graco Inc., Fisnar Inc., Dymax Corporation.