Direct Current Electric Drives Market Size (2024 – 2030)

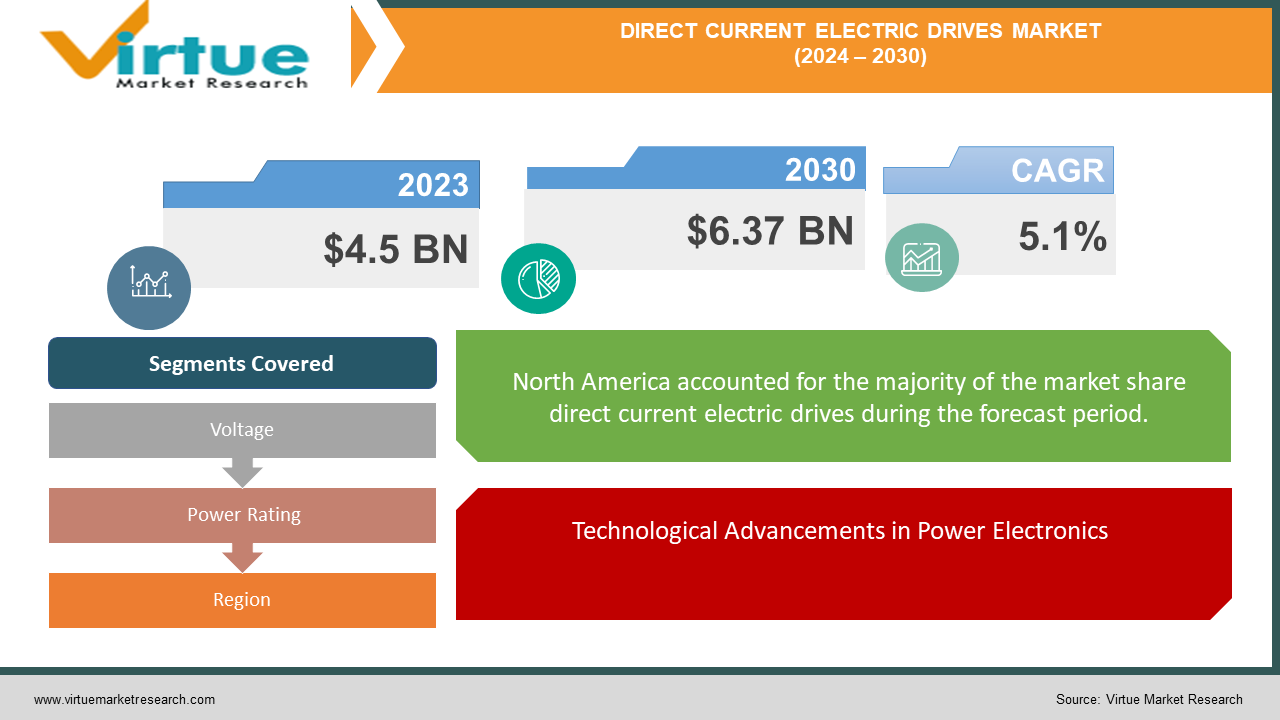

The Global Direct Current Electric Drives Market was valued at USD 4.5 billion in 2023 and is projected to reach a market size of USD 6.37 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 5.1% between 2024 and 2030.

The Global Direct Current (DC) Electric Drives Market is a pivotal segment within the industrial and automotive sectors, offering precise control and efficient operation of electric motors. DC electric drives are integral to applications requiring variable speed and torque control, such as in robotics, HVAC systems, and electric vehicles. Their ability to provide smooth and reliable performance under varying load conditions makes them indispensable in modern engineering and manufacturing.

The market is witnessing robust growth driven by technological advancements in power electronics, the increasing adoption of electric vehicles, and the demand for energy-efficient solutions.

Innovations such as digital controls and smart drive systems are enhancing the capabilities and versatility of DC drives, while ongoing trends in automation and renewable energy sources further propel market expansion.

However, the industry faces challenges including competition from alternative drive technologies and fluctuations in raw material costs. As industries continue to prioritize energy efficiency and advanced control systems, the DC electric drives market is poised for significant growth, with continuous developments expected to shape its future landscape.

Key Market Insights:

-

Energy efficiency improvements in DC drives are projected to increase by around 10% annually, driven by technological advancements.

-

The automotive sector is a major contributor, accounting for roughly 35% of the total demand for DC electric drives.

-

Industrial automation is expected to drive around 40% of the market growth, as industries seek more efficient and reliable drive systems.

-

The Asia-Pacific region holds a significant share of the market, representing about 40% of global revenue, due to rapid industrialization and growth in electric vehicle adoption.

-

North America follows with approximately 30% of the market share, supported by technological innovations and strong industrial infrastructure.

-

The adoption of DC drives in renewable energy applications, such as solar power systems, is expected to grow by 15% annually, reflecting a shift towards sustainable energy solutions.

Global Direct Current Electric Drives Market Drivers:

Technological Advancements in Power Electronics

Technological advancements in power electronics are a major driver for the growth of the Global Direct Current (DC) Electric Drives Market. Innovations in semiconductor technologies, such as the development of high-efficiency transistors and integrated circuits, have significantly enhanced the performance of DC drives. These advancements enable more precise control, improved efficiency, and better integration with digital systems. Enhanced power converters and control algorithms contribute to reduced energy consumption and increased operational reliability, making DC drives more attractive for various applications. The continuous evolution of power electronics supports the development of smart drive systems, which offer real-time diagnostics and remote monitoring capabilities, further expanding the potential applications of DC electric drives in industries like automotive, manufacturing, and renewable energy.

Rising Adoption of Electric Vehicles

The rising adoption of electric vehicles (EVs) is another key driver for the Global Direct Current Electric Drives Market. As the automotive industry shifts towards electrification to meet environmental regulations and consumer demand for sustainable transportation, the need for efficient and reliable DC drives has surged. DC electric drives play a crucial role in powering EVs, providing smooth acceleration, regenerative braking, and precise speed control. The growth of the EV market is spurring investments in DC drive technology, leading to innovations that enhance the performance and efficiency of electric propulsion systems. This trend is expected to continue as governments and automotive manufacturers focus on reducing carbon emissions and promoting electric mobility.

Global Direct Current Electric Drives Market Restraints and Challenges:

The Global Direct Current (DC) Electric Drives Market faces several restraints and challenges that could impact its growth trajectory. One significant restraint is the intense competition from alternative drive technologies, such as alternating current (AC) drives, and emerging technologies like piezoelectric and linear drives, which offer different advantages in various applications. These alternatives can sometimes provide better performance or lower costs, potentially limiting the market share of DC drives. Additionally, the fluctuating prices of raw materials used in DC drive components, such as rare earth metals and semiconductors, pose a challenge to manufacturers by increasing production costs and affecting profitability. Economic uncertainties and supply chain disruptions can further exacerbate these issues. Another challenge is the need for ongoing technological innovation to keep pace with advancements in automation and energy efficiency demands. DC drives must continually evolve to meet the increasing performance expectations of modern applications, which requires significant research and development investment. Lastly, the complexity of integrating DC drives with existing systems and infrastructure can pose implementation hurdles, particularly in industries with legacy equipment. Addressing these restraints and challenges is crucial for sustaining growth and maintaining competitive advantage in the rapidly evolving market.

Global Direct Current Electric Drives Market Opportunities:

The Global Direct Current (DC) Electric Drives Market presents numerous opportunities driven by emerging trends and evolving industry needs. One of the most promising opportunities lies in the expanding electric vehicle (EV) sector, which requires advanced DC drives for efficient power management and enhanced performance. As governments and industries push for greener transportation solutions, the demand for high-performance DC drives in EVs is expected to rise, fostering growth in this segment. Additionally, the growing emphasis on renewable energy sources, such as solar and wind power, presents opportunities for DC drives in applications like solar tracking systems and wind turbine control. Technological advancements, including the development of smart and connected drive systems, also offer opportunities by enabling real-time monitoring, predictive maintenance, and improved energy efficiency. The rise of Industry 4.0 and automation in manufacturing processes further creates demand for DC drives with advanced control and integration capabilities. Moreover, emerging markets in Asia-Pacific and Latin America, with their increasing industrialization and infrastructure development, offer new growth avenues. By leveraging these opportunities and investing in innovative technologies, companies can position themselves strategically to capitalize on the evolving demands of the DC electric drives market.

DIRECT CURRENT ELECTRIC DRIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By Voltage, Power Rating, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Siemens AG, ABB Ltd., Schneider Electric SE, Mitsubishi Electric Corporation, Rockwell Automation Inc., Danfoss Group, Honeywell International Inc., Emerson Electric Co., Nidec Corporation, GE Power Conversion, Textron Inc. |

Global Direct Current Electric Drives Market Segmentation: By Voltage

-

Low Voltage

-

Medium Voltage

The Global Direct Current Electric Drives Market by Voltage, Low Voltage market share last year and is poised to maintain its dominance throughout the forecast period. Low-voltage DC drives are widely used due to their versatility, cost-effectiveness, and established technology, making them suitable for a broad range of applications from small-scale industrial processes to consumer products. Their popularity stems from their ability to deliver reliable performance at a lower cost compared to high-voltage counterparts, and their mature technology ensures their widespread availability. However, several challenges could impact their continued dominance in the market. The rise of AC drives, particularly variable frequency drives (VFDs), presents a competitive threat as these drives offer superior efficiency and versatility, which is increasingly sought after in various applications. Additionally, industries are placing a growing emphasis on energy efficiency, which can favor AC drives in applications where energy consumption is a critical factor. Technological advancements in power electronics and motor control technologies also have the potential to reshape the market landscape, introducing new solutions that could challenge the current prominence of low-voltage DC drives. In conclusion, while low-voltage DC drives remain a significant segment of the market, their future dominance will be influenced by the growing adoption of AC drives, advancements in technology, and evolving industry requirements, which may shift preferences towards solutions that offer greater efficiency and precision.

Global Direct Current Electric Drives Market Segmentation: By Power Rating

-

Low Power

-

Medium Power

-

High Power

The Global Direct Current Electric Drives Market by Power Rating had a low Power market share last year and is poised to maintain its dominance throughout the forecast period. Low-power DC drives are widely utilized across various sectors, from household appliances to small industrial equipment, due to their versatility, cost-effectiveness, and mature technology. These drives are generally more affordable compared to higher-power alternatives, making them a popular choice for numerous applications. However, their continued dominance faces several challenges. The rising adoption of AC drives, which offer increased efficiency and versatility, particularly in low-power applications, presents a growing competitive threat. Additionally, the global focus on energy efficiency is steering industries toward more efficient drive systems, which could favor AC drives over DC drives in certain scenarios. Technological advancements in power electronics and motor control are also disrupting the market landscape, potentially introducing new solutions that challenge the current prominence of low-power DC drives. As a result, while low-power DC drives remain a key segment of the market, their future dominance will likely be influenced by the increasing adoption of AC drives, evolving energy efficiency standards, and ongoing technological innovations. The market's trajectory will depend on how these factors interplay with the specific requirements and cost considerations of different applications.

The Global Direct Current Electric Drives Market by End-User Industry, Oil & Gas market share last year and is poised to maintain its dominance throughout the forecast period. The oil and gas industry has traditionally been a significant consumer of DC electric drives due to their robustness in handling large-scale machinery and pumping operations. DC drives have long been favored for their reliable motor control in these demanding applications. However, several factors are likely to impact their future dominance. The shift towards AC drives, particularly variable frequency drives (VFDs), is gaining momentum due to their increased efficiency and versatility, encroaching upon traditional DC drive applications. Additionally, the industry’s focus on enhancing energy efficiency to meet environmental standards is pushing for more advanced and efficient drive systems, often favoring AC drives. Furthermore, fluctuations in oil prices and a global shift towards renewable energy sources are leading to reduced investment in the oil and gas sector, which could adversely affect demand for DC drives. As a result, while DC electric drives continue to play a crucial role in the oil and gas industry, their market dominance is expected to wane over time. This shift is driven by technological advancements, evolving energy efficiency requirements, and broader industry trends that are reshaping the drive systems landscape.

Global Direct Current Electric Drives Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Global Direct Current Electric Drives Market by Region, North America market share last year and is poised to maintain its dominance throughout the forecast period. North America has historically been a dominant force in the DC electric drives market, benefiting from its early industrialization, strong manufacturing base, and technological advancements. The region’s long-standing industrial capabilities in sectors such as automotive, aerospace, and manufacturing have driven significant demand for electric drives, contributing to its market leadership. However, this dominance is facing challenges as the global manufacturing landscape evolves. The rapid industrialization and growth in Asia, particularly China, are increasing competition in the electric drives market, as these regions expand their manufacturing capacities and demand for drive systems. Additionally, global supply chain shifts, with many production facilities relocating to Asia for cost advantages, are impacting North America's market share. The focus on cost reduction in various industries further pressures North America, as lower manufacturing costs in other regions become more attractive. In conclusion, while North America remains a key player in the DC electric drives market, its future dominance is uncertain due to rising competition from Asia and the shift towards more cost-effective production regions. The market dynamics are shifting, and North America will need to adapt to these evolving global trends to maintain its position.

COVID-19 Impact Analysis on the Global Direct Current Electric Drives Market.

The COVID-19 pandemic had a notable impact on the Global Direct Current (DC) Electric Drives Market, influencing both supply and demand dynamics. Initially, the pandemic caused significant disruptions in supply chains, affecting the production and distribution of DC electric drives. Lockdowns and social distancing measures led to reduced manufacturing capabilities and delays in the delivery of components, which hindered market growth. Concurrently, the slowdown in industrial activities and economic uncertainties led to decreased demand from key sectors such as automotive and industrial machinery. However, the pandemic also accelerated the adoption of automation and energy-efficient technologies as industries sought to enhance operational resilience and reduce reliance on manual labor. This shift increased interest in DC electric drives, which are known for their efficiency and adaptability in various applications. Additionally, the focus on sustainable practices and green energy solutions gained momentum during the pandemic, further boosting the demand for DC electric drives. As industries recover and adapt to the new normal, the market for DC electric drives is expected to rebound with renewed emphasis on technological advancements and energy efficiency, positioning itself strongly for future growth.

Latest trends / Developments:

The Global Direct Current (DC) Electric Drives Market is experiencing several notable trends and developments driven by advancements in technology and evolving industry demands. One key trend is the increasing integration of smart technologies, such as IoT and AI, which enhances the performance and efficiency of DC electric drives through real-time monitoring and predictive maintenance. This integration supports more reliable and efficient operations across various applications, from automotive to industrial machinery. Another significant development is the growing emphasis on energy efficiency and sustainability, as industries seek to reduce their carbon footprint and operational costs. This shift is leading to the adoption of advanced DC electric drives with improved energy management capabilities and lower environmental impact. Additionally, there is a rising demand for miniaturized and high-performance DC electric drives, driven by the expansion of electric vehicles and consumer electronics. The development of new materials and technologies is enabling smaller, lighter, and more efficient drives, catering to the needs of these growing sectors. Furthermore, advancements in power electronics are enhancing the capabilities of DC electric drives, allowing for better control and integration into complex systems. These trends collectively highlight a dynamic market poised for continued innovation and growth.

Key Players:

-

Siemens AG

-

ABB Ltd.

-

Schneider Electric SE

-

Mitsubishi Electric Corporation

-

Rockwell Automation Inc.

-

Danfoss Group

-

Honeywell International Inc.

-

Emerson Electric Co.

-

Nidec Corporation

-

GE Power Conversion

-

Textron Inc.

Chapter 1. Direct Current Electric Drives Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Direct Current Electric Drives Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Direct Current Electric Drives Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Direct Current Electric Drives Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Direct Current Electric Drives Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Direct Current Electric Drives Market – By Voltage

6.1 Introduction/Key Findings

6.2 Low Voltage

6.3 Medium Voltage

6.4 Y-O-Y Growth trend Analysis By Voltage

6.5 Absolute $ Opportunity Analysis By Voltage, 2024-2030

Chapter 7. Direct Current Electric Drives Market – By Power Rating

7.1 Introduction/Key Findings

7.2 Low Power

7.3 Medium Power

7.4 High Power

7.5 Y-O-Y Growth trend Analysis By Power Rating

7.6 Absolute $ Opportunity Analysis By Power Rating, 2024-2030

Chapter 8. Direct Current Electric Drives Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Voltage

8.1.3 By Power Rating

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Voltage

8.2.3 By Power Rating

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Voltage

8.3.3 By Power Rating

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Voltage

8.4.3 By Power Rating

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Voltage

8.5.3 By Power Rating

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Direct Current Electric Drives Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Siemens AG

9.2 ABB Ltd.

9.3 Schneider Electric SE

9.4 Mitsubishi Electric Corporation

9.5 Rockwell Automation Inc.

9.6 Danfoss Group

9.7 Honeywell International Inc.

9.8 Emerson Electric Co.

9.9 Nidec Corporation

9.10 GE Power Conversion

9.11 Textron Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Direct Current Electric Drives Market is expected to be valued at USD 4.5 billion.

Through 2030, the Global Direct Current Electric Drives Market is expected to grow at a CAGR of 5.1 %.

By 2030, the Global Direct Current Electric Drives Market is expected to grow to a value of USD 6.37 billion.

North America is predicted to lead the Global Direct Current Electric Drives Market.

The Global Direct Current Electric Drives Market has segments By Voltage, End-User, Power Rating, and Region.