Digital Women’s healthcare And Diagnostics Market Size (2024 –2030)

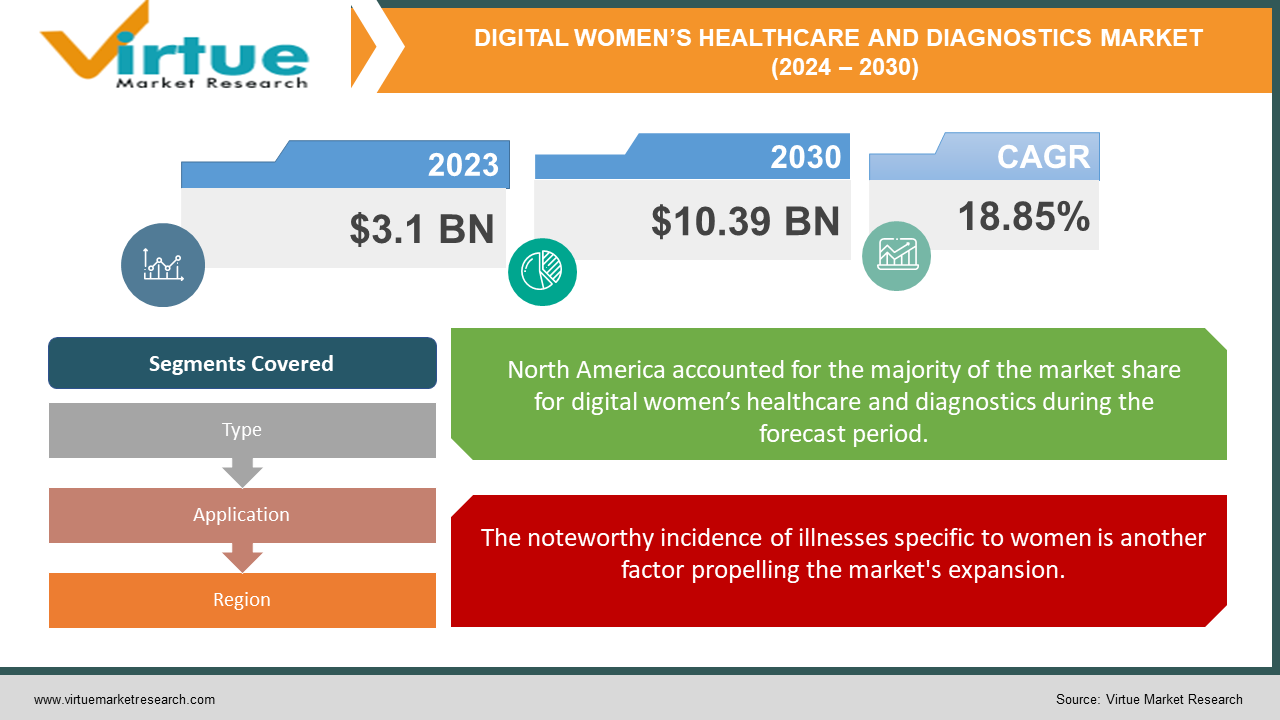

Global Digital Women’s healthcare and Diagnostics Market size was USD 3.1 billion in 2023 and is estimated to grow to USD 10.39 billion by 2030. This market is witnessing a healthy CAGR of 18.85% from 2024 - 2030.

The rise in smartphone penetration, adoption of preventive healthcare, favorable regulations, and rise in funding are majorly driving the growth of the industry. With four months left in the year, a digital health startup that focuses on women's healthcare has raised $1.3 billion through 26 transactions, almost doubling its funding from 2020. This is a significant accomplishment for the startup. This funding boom heralds a new wave of investment in women's digital health, moving beyond the conventional domains of menopause, chronic illness management, and primary care, to include areas such as pregnancy and fertility support. As per Rock Health, through August 2021, funding allocated to the women's health sector constituted 7% of all digital health funding, marking the second-highest share since the tracking started in 2011. Businesses are progressively including family planning, sexual health, and general health in all-inclusive offerings for women. Platforms like Rory (from Ro) that address issues like skin care, vitamin deficiencies, sexual well-being, and fertility are examples. There is a discernible trend of maturity among digital women's health startups as investment in this space increases. None of these companies received Series C funding or higher in 2017, with a median age of 4 years. In August 2021, 31 percent of women's digital health transactions were in Series C funding rounds or higher, indicating a maturing market. By the same month, the median age had risen to six years. Patients can now combine all of their healthcare requirements into one platform thanks to the growth of digital health solutions. For example, 10% of Nurx patients use their platform for more than one kind of treatment, according to CEO Varsha Rao of Nurx, illustrating the increasing integration of care in digital health services.

Key Market Insights:

Fertility tracking apps and devices account for approximately 35% of the digital women's healthcare market share, driven by increasing awareness of reproductive health and the trend towards family planning.

The 25-40 age group constitutes around 55% of the demand for digital women's healthcare solutions, reflecting the tech-savvy nature of this demographic and their focus on both reproductive and general health management.

In terms of region, North America holds the largest market share of about 41% for digital women's healthcare and diagnostics, attributed to high smartphone penetration, advanced healthcare infrastructure, and greater adoption of digital health solutions.

The adoption of AI-powered diagnostic tools for women's health issues, such as breast cancer detection and menstrual disorder analysis, is growing at a rate of approximately 20% annually, driven by advancements in machine learning and the need for more accurate, accessible diagnostic options.

Global Digital Women’s healthcare And Diagnostics Market Drivers:

The market is expanding as a result of an increasing number of investment initiatives by well-established market players.

The introduction of multiple investment initiatives is one of the prominent trends in the women's healthcare device market, and it is expected to propel significant market expansion in the upcoming years. By expanding the availability of easier and more affordable solutions, these initiatives are advancing the field. It is anticipated that the healthcare industry will use these medical devices more frequently as a result of their accessibility.

The noteworthy incidence of illnesses specific to women is another factor propelling the market's expansion.

Health issues that women commonly deal with include menopause, osteoporosis, breast cancer, and anemia. These conditions can be dangerous and are common throughout the world. The need to give patients access to efficient treatments and support is growing as these conditions occur more frequently. As a result, there is an increasing need for medications and medical procedures to manage and treat these illnesses, which highlights the vital need for continuous improvements in healthcare solutions catered to the needs of women.

Digital Women’s healthcare And Diagnostics Market Challenges and Restraints:

Although women are more likely than men to suffer from some potentially fatal illnesses, there are a number of obstacles that prevent the field of women's health from growing. The detrimental effects of some medications on women's health are one important factor. Birth control pills, for example, may cause unpleasant side effects like headaches, nausea, breast tenderness, and irregular bleeding. Women may experience pain and distress as a result of these side effects, which emphasizes the need for more specialized care and drugs that reduce side effects and improve overall health outcomes.

Digital Women’s healthcare And Diagnostics Market Opportunities:

The digital healthcare and diagnostics market for women offers substantial prospects for expansion and novelty. The demand for customized health solutions that address the unique needs of women, such as menopause management, fertility tracking, and reproductive health, is growing as technology becomes more widely used. Businesses can use the Internet of Things (IoT), machine learning, and artificial intelligence (AI) to create smart devices and apps that improve women's access to and convenience with healthcare around the world. Expanding regulatory approvals for digital health applications and the possibility of M&A activity in the industry also present opportunities for product diversification and market expansion.

DIGITAL WOMEN’S HEALTHCARE AND DIAGNOSTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

18.85% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

HeraMD, ISONO Health, Clue By Biowink, Charo Technology Ltd., Natural Cycles, Ava Science, Inc., Glow, Lucina Health, mobileODt Ltd, Brater, Athena Feminine Technologie, Plackel Tech |

Digital Women’s healthcare and Diagnostics Market - By Type

-

Mobile Apps

-

Wearable Devices

-

Diagnostic Tools

-

Others

The women's health market was led by the mobile app segment in 2021, which also had the highest revenue share (65.9%). The growing popularity of smartphone apps for tracking fertility, managing menstrual cycles, and managing pregnancies is blamed for this dominance. Anticipating the future, the wearable device market is anticipated to grow at the quickest rate throughout the projection period due to rising demand for diagnostic tools and ongoing company innovations. These digital tools are becoming more widely accepted because they are easy to use and accessible, enabling women to effectively monitor their health. These resources are being improved by ongoing technological advancements in digital health, which offer useful information that helps make well-informed decisions regarding women's health.

Digital Women’s healthcare and Diagnostics Market - By Application

-

Reproductive Health

-

Pregnancy & Nursing Care

-

Pelvic Care

-

General Healthcare & Wellness

With a revenue share of 41.0% in 2021, the reproductive health segment led the women's healthcare market and saw a broad adoption of mobile applications for administrative needs. It is anticipated that the general health and wellness segment will expand at a rapid rate over the course of the forecast period. The market is growing to cover more general women's health concerns like managing pregnancies, caring for the pelvic floor, and chronic illnesses like breast and cervical cancer. Pregnancy monitoring platforms for self-monitoring health indicators, home screening for early cancer detection, and analytical platforms to identify women at risk of complications like preterm birth are examples of significant advancements. Through early intervention and individualized care options, these innovations are improving the healthcare experience for women.

Digital Women’s healthcare and Diagnostics Market - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East

-

Africa

With the biggest revenue share of 41.1% in the women's health market in 2023, North America dominated the market. This is explained by the population's increased disposable income, strong diagnostic and therapeutic capabilities, access to cutting-edge equipment, and sophisticated technological infrastructure. Asia-Pacific is expected to grow at the fastest rate between 2023 and 2030. Strong economic growth is being experienced by emerging economies like China, India, and Singapore, which is being aided by government initiatives and advantageous regulatory frameworks. The region's digital women's health market is growing as a result of these factors. In these nations, efforts are also being made to overcome sociocultural obstacles that affect women's healthcare and diagnostics, which should spur market expansion even more.

COVID-19 Impact on the global Digital Women’s healthcare And Diagnostics Market:

Since its outbreak in Wuhan, China, the COVID-19 pandemic has caused widespread disruption and destroyed many industries worldwide. Strict lockdowns imposed by governments in response had a disastrous effect on international supply chains, production, product sales, and delivery schedules. Assisted reproductive technology was deemed unnecessary in many countries during the pandemic, which resulted in a shift in the healthcare sector toward digital fitness solutions like wearable tracking devices and smartphone apps, which saw significant growth in 2020. But during this time, the manufacturing of products linked to women's digital health has been severely impeded by the closure of industries.

Latest Trend/Development:

With its focus on devices, software, diagnostics, services, and products specific to women's reproductive health, fertility, and sexuality, women's digital health has become a very competitive market. Many service providers are creating cutting-edge digital health apps for women by utilizing machine learning, artificial intelligence, and the Internet of Things. The market is expanding steadily, with about 200 companies actively working in this field. Since women make up roughly half of the world's population, there are still plenty of opportunities for both new and established businesses to grow and satisfy consumer demand. NC Birth Control, created by Natural Cycles, is an example of innovation in this field. It was the first FDA-approved application for contraception in the United States in 2018, providing menstrual cycle tracking in addition to contraceptive functionality. This industry's suppliers are making significant investments in R&D to develop technologically advanced systems that give them a competitive advantage and boost industry revenues. In order to gain market share and diversify their product offerings, companies are strategically positioning themselves for future mergers and acquisitions as the market matures.

Key Players:

-

HeraMD

-

ISONO Health

-

Clue By Biowink

-

Charo Technology Ltd.

-

Natural Cycles

-

Ava Science, Inc.

-

Glow

-

Lucina Health

-

mobileODt Ltd

-

Brater

-

Athena Feminine Technologie

-

Plackel Tech

Market News:

-

The telehealth company Hims & Hers added a women's health division called hers to its portfolio in April 2021. In addition to their current line of prescription and over-the-counter medications and personal care products, this division focuses on offering birth control options, products for sexual health, and skincare and haircare solutions.

-

Elvie revealed the creation of a new NHS biofeedback therapy supply chain in 2017 at the International Continence Society Conference. This invention uses Bluetooth technology to provide women all over the world with cutting-edge biofeedback therapy that addresses problems with pelvic health and managing continence.

Chapter 1. Digital Women’s healthcare And Diagnostics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Digital Women’s healthcare And Diagnostics Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Digital Women’s healthcare And Diagnostics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Digital Women’s healthcare And Diagnostics Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Digital Women’s healthcare And Diagnostics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Digital Women’s healthcare And Diagnostics Market – By Application

6.1 Introduction/Key Findings

6.2 Reproductive Health

6.3 Pregnancy & Nursing Care

6.4 Pelvic Care

6.5 General Healthcare & Wellness

6.6 Y-O-Y Growth trend Analysis By Application

6.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Digital Women’s healthcare And Diagnostics Market – By Type

7.1 Introduction/Key Findings

7.2 Mobile Apps

7.3 Wearable Devices

7.4 Diagnostic Tools

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Type

7.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Digital Women’s healthcare And Diagnostics Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Digital Women’s healthcare And Diagnostics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 HeraMD

9.2 ISONO Health

9.3 Clue By Biowink

9.4 Charo Technology Ltd.

9.5 Natural Cycles

9.6 Ava Science, Inc.

9.7 Glow

9.8 Lucina Health

9.9 mobileODt Ltd

9.10 Brater

9.11 Athena Feminine Technologie

9.12 Plackel Tech

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Digital Women’s healthcare and Diagnostics Market size was USD 3.1 billion in 2023 and is estimated to grow to USD 10.39 billion by 2030.

Reproductive Health, Pregnancy & Nursing Care, Pelvic Care, General Healthcare & Wellness

The market is expanding as a result of an increasing number of investment initiatives by well-established market players and The noteworthy incidence of illnesses specific to women is another factor propelling the market's expansion.

North-America is the most dominating region in the Digital Women’s healthcare and Diagnostic Market.

HeraMD, ISONO Health, Clue By Biowink, Charo Technology Ltd.¸Natural Cycles, Ava Science, Inc., Glow, Lucina Health, mobileODt Ltd, Brater.