Digital Womens Health Market Size (2024 – 2030)

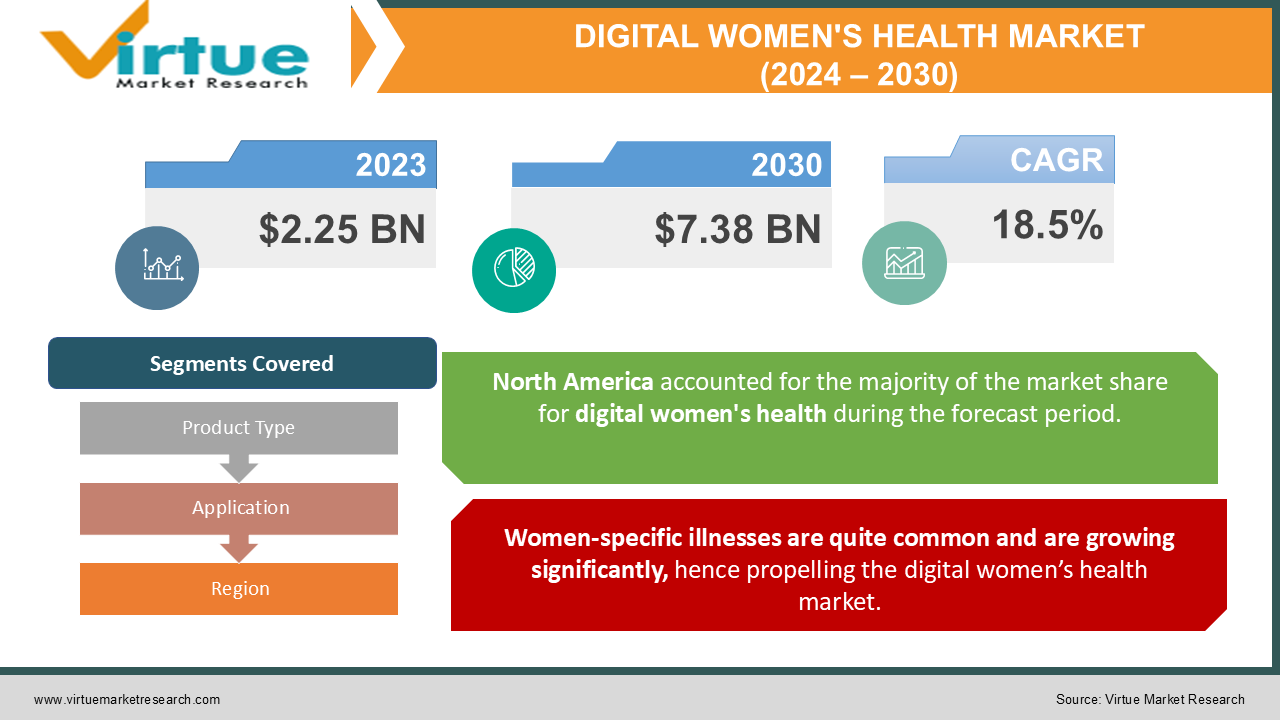

The global digital women’s health market was valued to be at USD 2.25 billion in 2023 and is projected to reach USD 7.38 billion by 2030. The market is anticipated to witness a compound annual growth rate (CAGR) of 18.5% over the forecast period of 2024 - 2030. The market is predicted to increase because of the favorable regulatory environment for digital solutions that address women's health concerns. Furthermore, as entrepreneurs become more interested in this industry, investment in women's health start-ups is increasing which is eventually propelling the market growth.

INDUSTRY OVERVIEW:

Digital health is a sort of communication technology that is utilised in the health care system for a variety of objectives, including detecting and treating women's overall health. Women can have a better understanding of their anatomy through healthcare technology.

In the forecast period of 2023 - 2030, the exponential growth in the variety of chronic and general illnesses is predicted to boost the growth of the women's digital health market. The favorable regulatory environment, a strong increase in investments and financing, as well as growing awareness and acceptance of digital health solutions among women, all bode well for women's digital health market. Furthermore, emerging technological developments and swift improvements in the medical sector will permit a variety of preventative care and provide tailored solutions to patients. The surge in smartphone usage, rise in preventative healthcare acceptance, favorable legislation and policies, and more financing are driving industry growth and awareness. In 2019, about one billion women have a mobile device capable of accessing modern-day digital technologies. The expanding incidence of chronic and general ailments, as well as infectious diseases, demonstrates the market potential for digital women's healthcare. The industry is being propelled forward by a favorable regulatory environment that allows for the approval of modern digital apps and gadgets that address traditional women's health concerns.

Women's healthcare has benefited from technical breakthroughs that have provided remedies to a variety of women's difficulties. Digital technologies make individualised and preventative treatment methods more accessible and affordable. Women may get personalized insights from artificial intelligence and data science, which track their health indicators and help them make informed decisions about their health. However, a lack of understanding regarding women's mental and physical health, as well as data security and privacy concerns, are projected to be key stumbling blocks for the women's digital health sector.

COVID-19 IMPACT ON THE DIGITAL WOMEN’S HEALTH MARKET:

The global crisis caused by the COVID-19 pandemic caused significant disruptions in most industries and the manufacturing industry was severely hit. The lockdown imposed due to the pandemic caused the major manufacturing sectors to suspend their operations. The restriction created a supply chain crisis during the pandemic as there was a shortage of labor, and raw materials, and the localized shutdown of a few production plants decelerated the overall market growth.The pandemic has significantly affected the digital women’s health market in terms of growth. In early 2020, the COVID-19 disease started to spread worldwide, millions of people worldwide have been infected with the COVID-19 infection, and major countries across the world shifted their focus in curbing the widespread of the disease, which resulted in the delay of prevention, detection, and treatment of other chronic conditions. Moreover, during the outbreak, some governments declared reproductive healthcare non-essential. As a result, digital fitness solutions like smartphone applications and wearable monitoring devices are likely to see substantial growth in 2020. The closing of the factory, however, substantially hampered the production of products related to women's digital health.

MARKET DRIVERS:

Women-specific illnesses are quite common and are growing significantly, hence propelling the digital women’s health market.

Anaemia, osteoporosis, breast cancer, and menopause are just a handful of the most prevalent ailments that women throughout the world are being diagnosed with. These disorders are not only frequent, but they may also be quite dangerous for the victim. Because these diseases are growing more common, it is now necessary to give these patients effective procurements. The need for drugs to treat these diseases is always increasing which in turn is fueling the digital women’s health market growth.

An increasing number of investment initiatives by established market players drives the market growth.

The implementation of a range of investment projects is one of the most apparent trends in the women's health devices market, and it is likely to contribute substantially to the industry's growth throughout the forecast period. This rapid speed of investment initiatives has several benefits. One of the benefits of these activities is the growing availability of more simple and cost-effective solutions, which leads to more usage of these medical services.

The rise in the smartphone penetration is fueling the wide adoption of digital healthcare solutions eventually driving the market.

The global smartphone users and internet subscriptions have grown substantially in the past few years.1366.14 million smartphones were shipped in 2020 and it is expected to reach 1,556.67 million units by 2030. The technology sector is trying to exploit the health care sector by developing more services and devices that help people manage and monitor their personal and family health. There are many health-related applications available now. These applications are acting as a virtual assistance service to the common people. People's engagement channel in the medical industry is also evolving due to the rise of digital apparatus available due to the rise of internet and smartphone users. Many activities like doctor’s consultations, storage of medical records etc can easily be done on these platforms.

MARKET RESTRAINTS:

The availability of certain women's healthcare products that have negative side effects and creates cynicism in the consumer which is hampering the market growth:

Duplicate products may risk people's health and safety, as well as cost them a lot of money. Even though women have a greater incidence of life-threatening diseases than men, the growth of the women's healthcare industry is hampered by several problems. The harmful effects of certain drugs on women's health are one such aspect. Spotting or bleeding between periods, painful breasts, nausea, headaches, and other unpleasant side effects may result from using contraceptive medications. For them, these side effects might be extremely painful and unpleasant. The impact of high doses of medicine may be extremely harmful to one's health and, in rare circumstances, fatal. As a result, will limit future market growth and development.

Concerns regarding the privacy and security related issues are a major factor inhibiting the growth of the digital women’s health market:

Some people are hesitant in sharing their details on such platforms as they fear privacy violations. The increase in usage of digital platforms poses security and privacy issues. The high risk of hackers accessing the system data and unauthorized access to data can be exploited for carrying out malicious or criminal activities and can act as a threat. Breach of sensitive data such as patient addresses, vital health parameters etc. can potentially harm the patient thus creating a trust deficit. Due to this, regulations are constantly evolving to cater for the changing needs. The increasing data breaches and cyber-attacks, and rising data security concerns act as a hindrance to the growth of the market.

DIGITAL WOMENS HEALTH MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

18.5% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

HeraMED, iSono Health, Clue by Biowink, Chiaro Technology Ltd., Natural Cycles, Ava Science, Inc, NURX Inc., Prima-Temp, Inc., Glow, Lucina Health, MobileODT Ltd., Braster SA, Athena Feminine Technologies, Plackal Tech |

This research report on the digital women’s health market has been segmented and sub-segmented based on Product Type, By Application, and By Region.

DIGITAL WOMEN’S HEALTH MARKET - BY PRODUCT TYPE

-

Mobile Apps

-

Wearable Devices

-

Diagnostic Tools

-

Others

Based on product type, the digital women’s health market is segmented into Mobile Apps, Wearable Devices and Diagnostic Tools among others. Among these, the Mobile app segment contributed significantly to the market growth and is projected to continue with this trend over the forecast period. Because of the increased usage of mobile applications for monitoring menstrual cycles, fertility cycles, and conception, the mobile apps category accounted for the largest market and held the biggest revenue share of 68.9% in 2021. Besides this, the wearable devices segment is also poised to expand significantly over the forecast period and the diagnostic tools are also attracting the eyeballs of patients and medical professionals as innovations and developments are launched by the companies. Because of the accessibility and affordability of these digital technologies, their use is fast increasing. Women may stay informed about their health conditions and make conscious choices based on actionable information thanks to ongoing technology breakthroughs in the field of digital health. Thus, the aforementioned reason is likely to have a positive influence on the digital women’s health market growth.

DIGITAL WOMEN’S HEALTH MARKET - BY APPLICATION

-

Reproductive Health

-

Pregnancy & Nursing Care

-

Pelvic Care

-

General Healthcare & Wellness

Based on application, the digital women’s health market is segmented into Reproductive Health, Pregnancy & Nursing Care, Pelvic Care and General Healthcare & Wellness. Among these, the reproductive health segment dominated the market when compared to other segments. The reproductive health category accounted for over 45% of the market share in terms of revenue in 2021. The market dominance is driven by the surge in the adoption of mobile applications catering to women’s health care management. The general healthcare and wellness area, on the other hand, is projected to increase at the quickest rate throughout the projected period. More women's concerns, such as pelvic care, prenatal care, and chronic illnesses including breast cancer and cervical cancer, are gradually being addressed in the sector. At-home diagnostics aid in the early diagnosis of cancer; pregnancy tracking platforms aid in the self-monitoring of essential key metrics; and analytics platforms aid in the identification of women at risk of preterm delivery or other issues. The wide range of benefits of digital health services is visible to the consumer and medical practitioner which is encouraging them to adopt these services in turn driving the market expansion.

DIGITAL WOMEN’S HEALTH MARKET - BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East

-

Africa

Based on region, the digital women’s health market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East, and Africa. North America emerged as the largest regional market for the digital women’s health market and is expected to continue the trend during the forecast period. The North American region accounted for over 41% of the market share in 2021. The increased awareness regarding women’s health is propelling the industry forward in this area. The North American region, is home to key businesses that provide a tailored solution which is contributing to market expansion. Moreover, rising chronic illnesses such as Breast cancer are also propelling the market growth. Furthermore, when customers' incomes improve in the region, their purchasing power rises, encouraging them to choose better medical facilities which is a prominent factor driving the market expansion in the region.

The Asia Pacific, on the other hand, is predicted to develop at the quickest rate from 2023 - 2030. China, India, and Singapore, among other emerging economies in the area, are seeing rapid economic expansion.

In these nations, government policy measures and a favorable regulatory system are accelerating the growth of the digital women's healthcare industry. In addition to initiatives to eliminate the socio-cultural barrier to women's healthcare are also influencing the market growth in the region.

DIGITAL WOMEN’S HEALTH MARKET - BY COMPANIES

Some of the prominent players operating in the digital women’s health market are

- HeraMED

- iSono Health

- Clue by Biowink

- Chiaro Technology Ltd.

- Natural Cycles

- Ava Science, Inc.

- NURX Inc.

- Prima-Temp, Inc.

- Glow

- Lucina Health

- MobileODT Ltd.

- Braster SA

- Athena Feminine Technologies

- Plackal Tech

Women's digital health is a very small niche sector that offers products, solutions, gadgets, diagnostics, and software geared at female requirements such as reproductive health, ovulation, and sexuality. To develop women's digital health apps, several vendors are investigating artificial intelligence, machine learning, and the internet of things. These enterprises are always working to develop technologically enhanced apps and technologies that address women's healthcare needs in a tailored and effective manner. The market is rapidly increasing, with 200 businesses operating in this area. With a target market of about 50.0 per cent of the global population, there is plenty of opportunity for new entrants and established enterprises to expand to meet the demand.

NOTABLE HAPPENING IN THE DIGITAL WOMEN’S HEALTH MARKET

- PRODUCT LAUNCH- In October 2021, OvaCue Wireless, the highly awaited next-generation upgrade to the renowned OvaCue cycle monitoring monitor, was launched by Fairhaven Health. The new OvaCue Wireless improves on the previous OvaCue's proven technology and patented algorithm.

- COLLABORATION- Fertility Focus teamed up with ExSeed Health, a home-based fertility testing firm, in February 2021. Both organisations would work together to give options to couples planning pregnancy as part of this agreement.

- PRODUCT LAUNCH- In April 2019, Elvie and Chiaro Technology Ltd introduce the world's first noiseless wearable breast pump, which is both convenient and technologically advanced.

- PRODUCT APPROVAL- In August 2018, NaturalCycles Nordic AB received FDA clearance for NATURAL CYCLES, the first and only contraceptive app that includes a basal thermometer and a mobile app to avoid pregnancy.

Chapter 1. Digital women’s health market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Digital women’s health market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Digital women’s health market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Digital women’s health market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Digital women’s health market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Digital women’s health market – By Product Type

6.1. Mobile Apps

6.2. Wearable Devices

6.3. Diagnostic Tools

6.4. Others

Chapter 7. Digital women’s health market – By Application

7.1. Reproductive Health

7.2. Pregnancy & Nursing Care

7.3. Pelvic Care

7.4. General Healthcare & Wellness

Chapter 8. Digital women’s health market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Digital women’s health market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1 HeraMED

9.2 iSono Health

9.3 Clue by Biowink

9.4 Chiaro Technology Ltd.

9.5 Natural Cycles

9.6 Ava Science, Inc.

9.7 NURX Inc.

9.8 Prima-Temp, Inc.

9.9 Glow

9.10 Lucina Health

9.11 MobileODT Ltd.

9.12 Braster SA

9.13 Athena Feminine Technologies

9.14 Plackal Tech

Download Sample

Choose License Type

2500

4250

5250

6900