Digital Water Solutions Market Size (2024 – 2030)

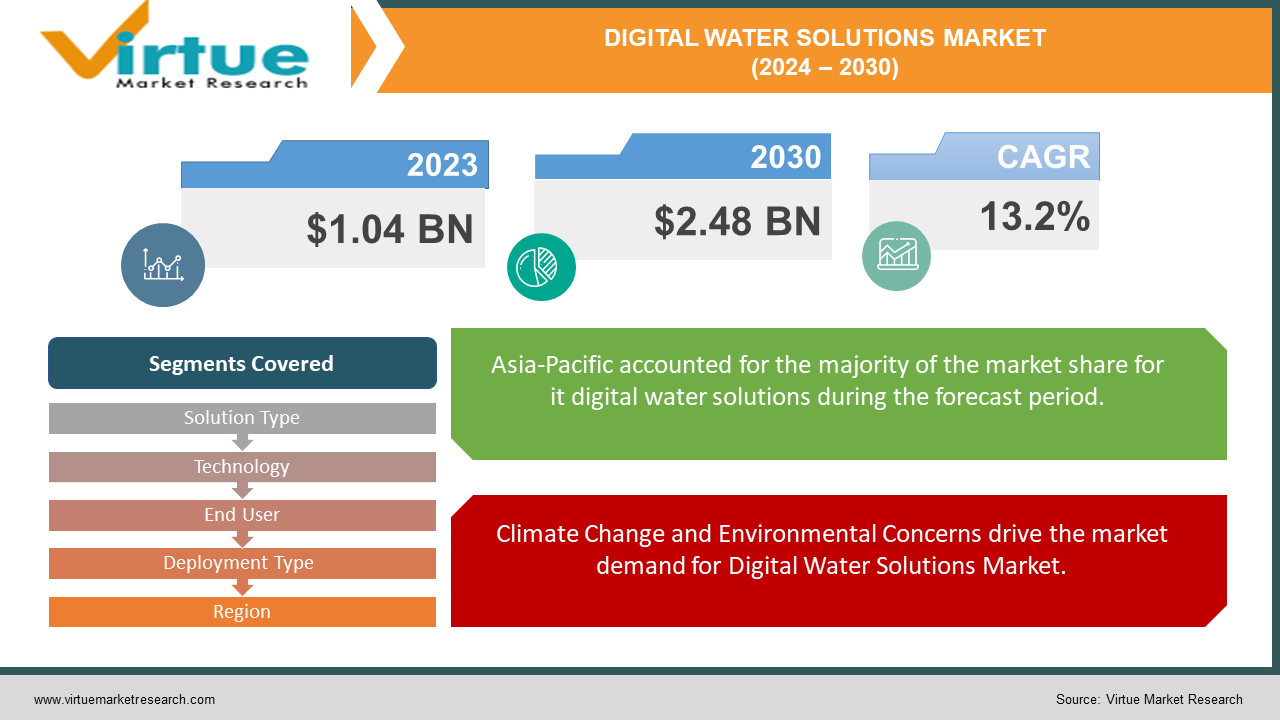

The Global Digital Water Solutions Market is valued at USD 1.04 Billion and is projected to reach a market size of USD 2.48 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 13.2%.

The digital water solutions market has been growing and changing a lot. One big reason for this is the need to manage water better over a long time. Climate change is a long-term market driver that is making it very important to use water more wisely. As temperatures go up and weather patterns change, there are more droughts and floods. These changes mean that managing water is getting harder. Digital water solutions, like smart meters and sensors, help cities and companies keep track of water use and find leaks quickly. This helps save water and makes sure everyone has enough to drink and use. An opportunity in the digital water solutions market is the chance to improve water quality. Many places have problems with dirty or polluted water. Digital tools can help monitor water quality in real time.

A trend observed in the digital water solutions industry is the rise of smart cities. Smart cities use technology to make life better for their residents. This includes using digital water solutions to manage water more effectively. In a smart city, everything from water use in homes to the water treatment plants is connected and monitored digitally. This makes it easier to spot problems and make the system more efficient. Smart cities are becoming more common, and as they do, the demand for digital water solutions is going up.

Key Market Insights:

The Digital Water Solutions Market is projected to expand at a compound annual growth rate of over 13.2% in the coming seven years, propelled by increasing urbanization and population growth in major cities worldwide.

Xylem Inc. – USA, SUEZ – France, and Veolia Water Technologies – France are some examples of Digital Water Solutions Market.

North America & Asia-Pacific accounts for approximately 75-80 % of the Digital Water Solutions Market, driven by Climate Change and Environmental Concerns, Aging Infrastructure and Need for Modernization, Regulatory Compliance, and Water Quality Standards & Technological Advancements, and IoT Integration.

Digital Water Solutions Market Drivers:

Climate Change and Environmental Concerns drive the market demand for Digital Water Solutions Market.

Climate change is a significant long-term driver for the digital water solutions market. As global temperatures rise and weather patterns become more erratic, water resources are increasingly under stress. Regions around the world are experiencing more frequent and severe droughts, floods, and other extreme weather events. These conditions make efficient water management critical. Digital water solutions, such as advanced monitoring systems and predictive analytics, help utilities and municipalities manage water resources more effectively. By providing real-time data and insights, these technologies enable proactive measures to conserve water, reduce waste, and ensure a reliable supply for communities and industries.

Aging Infrastructure and Need for Modernization drive the market demand for Digital Water Solutions Market.

Many water systems around the world are aging and in dire need of modernization. In developed and developing countries alike, old pipes, pumps, and treatment plants are prone to leaks, breaks, and inefficiencies. Maintaining and upgrading this infrastructure is costly and complex. Digital water solutions offer a way to extend the life of existing systems and improve their performance. For example, smart sensors can detect leaks and pinpoint their locations, allowing for targeted repairs. Automated control systems can optimize the operation of pumps and treatment processes, reducing energy use and maintenance costs. As utilities look for cost-effective ways to modernize their infrastructure, digital solutions are becoming an essential tool.

Regulatory Compliance and Water Quality Standards drive the market demand for Digital Water Solutions Market.

Stringent regulations and standards for water quality and safety are driving the adoption of digital water solutions. Governments and regulatory bodies are imposing stricter requirements to ensure that water supplies are safe and clean. Utilities must monitor water quality continuously and report their findings to regulatory agencies. Digital water solutions make it easier to comply with these regulations by providing accurate and timely data. Advanced analytics can identify potential issues before they become problems, allowing for quick corrective actions. This not only helps utilities avoid fines and penalties but also ensures the health and safety of their customers.

Technological Advancements and IoT Integration drive the market demand for the Digital Water Solutions Market.

Rapid advancements in technology, particularly in the Internet of Things (IoT), are a major driver for the digital water solutions market. IoT devices, such as smart meters and sensors, are becoming more affordable and accessible. These devices can collect vast amounts of data on water usage, quality, and system performance. When combined with cloud computing and artificial intelligence, this data can be analyzed to provide actionable insights. For example, predictive maintenance can identify when equipment is likely to fail, allowing for preemptive repairs. IoT integration enables more efficient and effective water management, reducing costs and improving service delivery. As technology continues to advance, the capabilities of digital water solutions will only expand, driving further adoption.

Digital Water Solutions Market Restraints and Challenges:

One of the primary restraints in the digital water solutions market is the high initial cost of implementing these advanced technologies. Upgrading existing infrastructure with smart sensors, meters, and data analytics platforms requires significant investment. Many utilities and municipalities, especially in developing regions, operate with tight budgets and limited financial resources. They often struggle to justify the upfront expenditure required for digital transformation, even though the long-term benefits are substantial. Additionally, smaller utilities may find it difficult to secure funding or loans for such projects. This financial constraint can delay or hinder the adoption of digital water solutions, as decision-makers weigh the immediate costs against future savings and efficiencies.

Digital Water Solutions Market Opportunities:

Water conservation is becoming increasingly critical as global water demand rises and water resources become scarcer. Digital water solutions offer a tremendous opportunity to enhance water conservation and efficiency. Technologies such as smart meters, leak detection systems, and real-time monitoring tools can help utilities and consumers better understand and manage their water use. Smart meters provide detailed insights into water consumption patterns, enabling users to identify wastage and implement conservation measures. Leak detection systems can quickly identify and locate leaks in the water distribution network, allowing for timely repairs and reducing water loss. Real-time monitoring tools provide data on water quality and system performance, ensuring that water resources are used efficiently and sustainably. By adopting these digital solutions, utilities and municipalities can significantly improve water conservation efforts, reduce operational costs, and ensure a more sustainable supply of water for future generations.

DIGITAL WATER SOLUTIONS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.2% |

|

Segments Covered |

By Solution Type, Technology, End User, Deployment Type and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Xylem Inc. - USA, SUEZ - France, Veolia Water Technologies - France, Schneider Electric - France, Siemens AG - Germany, ABB Ltd. - Switzerland, Itron Inc. - USA, Badger Meter, Inc. - USA, Honeywell International Inc. - USA, IBM Corporation - USA |

Digital Water Solutions Market Segmentation: By Solution Type

-

Smart Water Meters

-

Water Quality Monitoring

-

Leak Detection Systems

-

Advanced Analytics and Data Management

-

Network Management

-

Others

Smart water meters are currently the largest segment within the digital water solutions market. These devices enable accurate measurement of water usage, providing real-time data to both utilities and consumers. They help reduce water wastage, lower operational costs, and enhance billing accuracy. The widespread adoption of smart water meters by utilities to improve water management and customer service has solidified their dominance in the market.

The fastest-growing segment is advanced analytics and data management. This category includes tools and platforms that analyze vast amounts of data from various digital water solutions. The increasing focus on data-driven decision-making and predictive analytics to optimize water management, detect anomalies, and prevent system failures is driving rapid growth in this segment. Utilities and municipalities are increasingly adopting these solutions to improve efficiency and ensure sustainable water management.

Digital Water Solutions Market Segmentation: By Technology

-

Internet of Things

-

Cloud Computing

-

Artificial Intelligence

-

Big Data Analytics

-

Blockchain

-

Machine Learning

IoT is the largest technology segment in the digital water solutions market. IoT technology connects various devices and sensors within the water infrastructure, allowing for seamless data collection and remote monitoring. The proliferation of IoT devices in water management systems enables real-time monitoring, enhances operational efficiency, and supports proactive maintenance strategies.

Artificial Intelligence (AI) is the fastest-growing technology segment. AI algorithms and machine learning models are being increasingly applied to analyze data, predict maintenance needs, and optimize water distribution networks. The ability of AI to provide actionable insights and automate complex processes is driving its rapid adoption across the water management sector.

Digital Water Solutions Market Segmentation: By End User

-

Residential

-

Commercial

-

Industrial

-

Agricultural

-

Utilities and Municipalities

Utilities and municipalities represent the largest end-user segment. These entities are responsible for managing public water systems and ensuring reliable water supply and quality. The adoption of digital water solutions by utilities and municipalities helps in achieving operational efficiency, regulatory compliance, and improved customer service, making this segment the largest in the market.

The industrial sector is the fastest-growing end-user segment. Industries require substantial water resources for their operations, and efficient water management is critical to their sustainability efforts. The adoption of digital water solutions in the industrial sector is driven by the need to optimize water usage, reduce costs, and comply with stringent environmental regulations. Industries such as manufacturing, power generation, and food and beverage are increasingly implementing these technologies to enhance their water management practices.

Digital Water Solutions Market Segmentation: By Deployment Type

-

On-Premises

-

Cloud-Based

On-premises deployment is currently the largest segment. Many utilities and industries prefer on-premises solutions due to concerns about data security, control, and compliance with regulatory requirements. On-premises systems allow organizations to manage their digital water solutions internally, ensuring that sensitive data remains within their control.

Cloud-based deployment is the fastest-growing segment. The scalability, flexibility, and cost-effectiveness of cloud-based solutions are driving their rapid adoption. Cloud-based platforms enable remote access to data, seamless integration with other systems, and real-time updates, making them attractive to utilities and industries looking to modernize their water management infrastructure.

Digital Water Solutions Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America is the largest regional market for digital water solutions. The region's advanced infrastructure, high adoption of technology, and strong focus on sustainability and regulatory compliance contribute to its leading position. The presence of major market players and substantial investment in water management technologies also support the dominance of North America.

The Asia-Pacific region is the fastest-growing market for digital water solutions. Rapid urbanization, increasing population, and growing industrial activities are putting significant pressure on water resources in this region. Governments and utilities in Asia-Pacific are increasingly adopting digital water solutions to address water scarcity, improve infrastructure, and ensure sustainable water management. The region's economic growth and focus on technological advancements further drive the expansion of the digital water solutions market.

COVID-19 Impact Analysis on Digital Water Solutions Market:

One of the most significant impacts of COVID-19 on the digital water solutions market was the accelerated adoption of digital technologies. As lockdowns and social distancing measures were implemented globally, utilities and water management companies faced operational challenges. Traditional, manual methods of managing water systems became impractical due to restricted movement and the need to minimize human contact. In response, there was a surge in the deployment of remote monitoring and automated systems. Digital water solutions, such as smart meters and IoT-enabled sensors, allowed for continuous monitoring and management of water infrastructure without the need for physical presence, ensuring uninterrupted service delivery during the pandemic.

Latest Trends/ Developments:

One of the most prominent trends in the digital water solutions market is the integration of advanced analytics and artificial intelligence (AI). Utilities and water management companies are increasingly leveraging AI and machine learning algorithms to analyze vast amounts of data collected from smart meters, sensors, and other monitoring devices. These technologies enable predictive maintenance, anomaly detection, and optimization of water distribution networks. For example, AI can predict pipe failures before they occur, allowing for proactive maintenance and reducing downtime. The use of advanced analytics also helps in better demand forecasting, efficient resource allocation, and enhanced decision-making processes, making water management more intelligent and responsive.

Key Players:

-

Xylem Inc. - USA

-

SUEZ - France

-

Veolia Water Technologies - France

-

Schneider Electric - France

-

Siemens AG - Germany

-

ABB Ltd. - Switzerland

-

Itron Inc. - USA

-

Badger Meter, Inc. - USA

-

Honeywell International Inc. - USA

-

IBM Corporation - USA

Chapter 1. Digital Water Solutions Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Digital Water Solutions Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Digital Water Solutions Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Digital Water Solutions Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Digital Water Solutions Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Digital Water Solutions Market – By Solution Type

6.1 Introduction/Key Findings

6.2 Smart Water Meters

6.3 Water Quality Monitoring

6.4 Leak Detection Systems

6.5 Advanced Analytics and Data Management

6.6 Network Management

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Solution Type

6.9 Absolute $ Opportunity Analysis By Solution Type, 2024-2030

Chapter 7. Digital Water Solutions Market – By Technology

7.1 Introduction/Key Findings

7.2 Internet of Things

7.3 Cloud Computing

7.4 Artificial Intelligence

7.5 Big Data Analytics

7.6 Blockchain

7.7 Machine Learning

7.8 Y-O-Y Growth trend Analysis By Technology

7.9 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Digital Water Solutions Market – By Deployment Type

8.1 Introduction/Key Findings

8.2 On-Premises

8.3 Cloud-Based

8.4 Y-O-Y Growth trend Analysis By Deployment Type

8.5 Absolute $ Opportunity Analysis By Deployment Type, 2024-2030

Chapter 9. Digital Water Solutions Market – By End-User

9.1 Introduction/Key Findings

9.2 Residential

9.3 Commercial

9.4 Industrial

9.5 Agricultural

9.6 Utilities and Municipalities

9.7 Y-O-Y Growth trend Analysis End-User

9.8 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Digital Water Solutions Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Solution Type

10.1.2.1 By Technology

10.1.3 By Deployment Type

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Solution Type

10.2.3 By Technology

10.2.4 By Deployment Type

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Solution Type

10.3.3 By Technology

10.3.4 By Deployment Type

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Solution Type

10.4.3 By Technology

10.4.4 By Deployment Type

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Solution Type

10.5.3 By Technology

10.5.4 By Deployment Type

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Digital Water Solutions Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Xylem Inc. - USA

11.2 SUEZ - France

11.3 Veolia Water Technologies - France

11.4 Schneider Electric - France

11.5 Siemens AG - Germany

11.6 ABB Ltd. - Switzerland

11.7 Itron Inc. - USA

11.8 Badger Meter, Inc. - USA

11.9 Honeywell International Inc. - USA

11.10 IBM Corporation - USA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Digital Water Solutions Market is valued at USD 1.04 Billion and is projected to reach a market size of USD 2.48 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 13.2%.

Climate Change and Environmental Concerns, Aging Infrastructure and the Need for Modernization, Regulatory Compliance and Water Quality Standards & Technological Advancements, and IoT Integration are the major drivers of the Digital Water Solutions Market.

On-premises & Cloud-Based are the segments under the Digital Water Solutions Market by deployment type.

North America is the most dominant region for the Digital Water Solutions Market.

Asia-Pacific is the fastest-growing region in the Digital Water Solutions Market.