Digital Video Advertising Market Size (2025 – 2030)

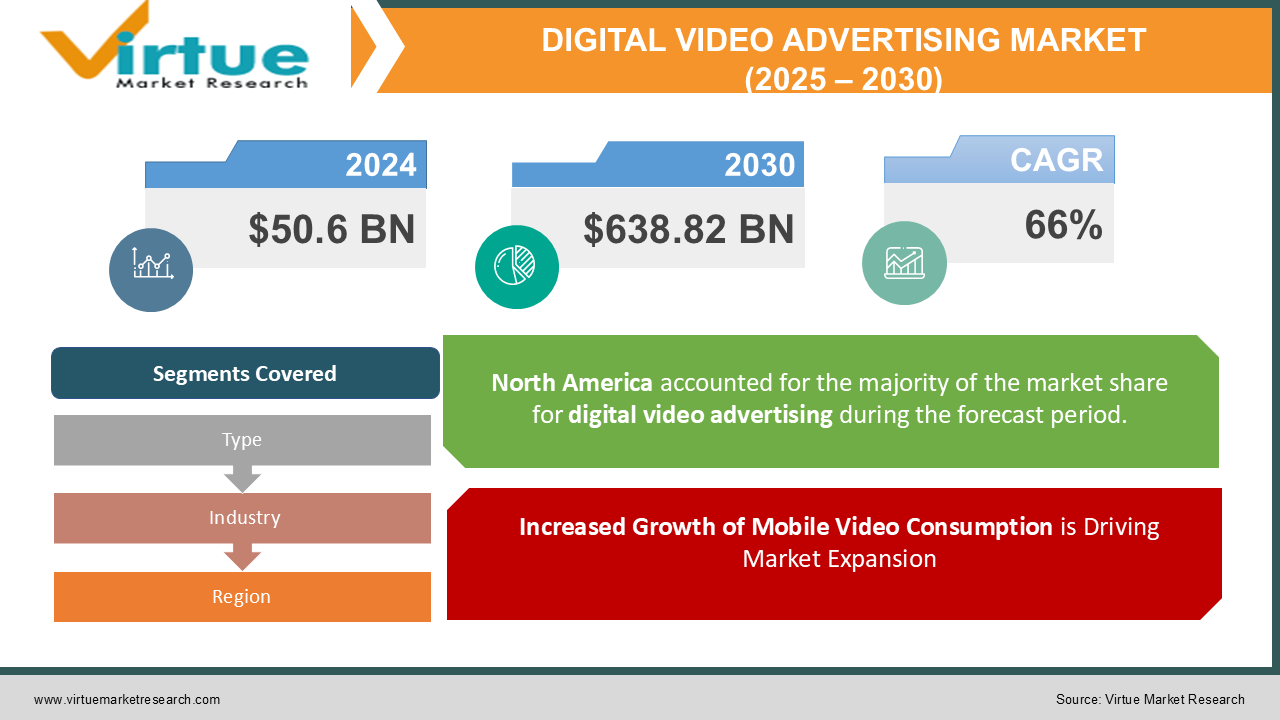

The Global Digital Video Advertising Market was valued at USD 50.6 billion in 2024 and is projected to reach a market size of USD 638.82 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 66%.

The digital video advertising market is witnessing rapid growth, driven by the increasing shift toward online content consumption, mobile video streaming, and the rise of social media platforms. With the expansion of high-speed internet and the dominating influence of AI-driven personalized ads, businesses are leveraging digital video ads to enhance audience engagement and conversion rates. The emergence of connected TV (CTV), programmatic advertising, and interactive video formats is further revolutionizing the market, making video ads a crucial component of modern marketing strategies. As brands prioritize video content for storytelling and brand awareness, the demand for innovative and immersive advertising solutions continues to rise globally.

Key Market Insights:

-

The digital video advertising market is experiencing a surge in adoption due to the widespread use of smartphones, social media platforms, and high-speed internet. Studies show that video ads have significantly higher engagement rates compared to traditional banner ads, with click-through rates (CTR) nearly doubling for video formats. Additionally, mobile video consumption continues to rise, with users spending an increasing amount of time watching short-form and interactive video content on social media, video streaming platforms, and mobile applications.

-

Interactive and shoppable video ads are influencing the way brands engage with audiences, allowing consumers to make direct purchases from video content. Research suggests that such ad formats significantly boost conversion rates, making them a preferred choice for e-commerce and direct-to-consumer (DTC) brands. Additionally, user-generated content (UGC) and influencer-driven video ads are proving highly effective in building consumer trust and brand credibility, further driving market growth.

Digital Video Advertising Market Drivers:

Increased Growth of Mobile Video Consumption is Driving Market Expansion

The expanding penetration of smartphones and high-speed internet has influenced the demand for mobile video advertising. Consumers spend more time streaming content on platforms like YouTube, TikTok, and Instagram, making mobile video ads an essential strategy for brands. With 5G networks improving video quality and reducing buffering times, advertisers are shifting budgets toward mobile-first campaigns. As engagement rates on mobile devices continue to outperform traditional media, brands are investing heavily in mobile-optimized video ads to capture audience attention.

Rising Popularity of Connected TV (CTV) and Over-the-Top (OTT) Platforms

With the deterioration of traditional cable TV, streaming services such as Netflix, Hulu, and Disney+ are reshaping the advertising landscape. Connected TV (CTV) and Over-the-Top (OTT) platforms offer targeted and data-driven advertising opportunities, making them attractive for marketers. Advanced targeting capabilities, such as programmatic ad placements and audience segmentation, ensure higher engagement rates. As more households cut the cord and shift to streaming CTV and OTT advertising are expected to dominate the digital video ad space.

AI-Powered Personalization is Enhancing Consumer Engagement

Artificial intelligence (AI) and machine learning have transformed digital video advertising by enhancing hyper-personalized and interactive ad experiences. AI-driven algorithms analyze consumer behavior, preferences, and viewing habits to deliver relevant ads in real time. Interactive and shoppable video ads powered by AI increase conversions by allowing viewers to engage directly with products. As AI technology continues to evolve, brands can optimize ad spend and improve customer retention through data-driven insights.

Social Media Platforms Fueling Short-Form Video Ad Boom

The explosive demand for platforms like TikTok, Instagram Reels, and YouTube Shorts has created new opportunities for short-form video ads. Brands are increasingly leveraging bite-sized, high-impact content to capture audience attention within seconds. These platforms also integrate native advertising formats that blend seamlessly with organic content, enhancing user engagement. With social media algorithms prioritizing video content, businesses are focusing on creating visually compelling, shareable ads to maximize reach and brand awareness.

Digital Video Advertising Market Restraints and Challenges:

Regulatory Concerns, Ad-Blocking, and Privacy Issues Pose Challenges for Digital Video Advertising Growth

Despite rapid growth, the digital video advertising market faces contests related to data privacy regulations, increasing use of ad-blockers, and consumer concerns over intrusive ads. Stringent laws such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) have restricted advertisers' ability to collect and use consumer data, limiting personalized targeting. Additionally, the growing popularity of ad-blocking software has slowly reduced ad visibility, forcing marketers to rethink their strategies. Consumers are also becoming increasingly resistant to disruptive ads, leading to lower engagement rates and prompting advertisers to find more innovative and user-friendly ad formats. Furthermore, the fragmentation of digital platforms complicates ad placements, making it challenging for brands to deliver consistent messaging across multiple channels. Advertisers must navigate these challenges by prioritizing transparent data usage, leveraging non-intrusive ad formats, and adapting to evolving consumer preferences.

Digital Video Advertising Market Opportunities:

The rise of artificial intelligence (AI) and machine learning in digital video advertising is fostering possibilities for hyper-personalized ad experiences, enhancing engagement and conversion rates. Connected TV (CTV) and over-the-top (OTT) platforms are witnessing exponential growth, providing advertisers with new avenues to reach audiences who are shifting away from traditional television. Additionally, emerging markets with increasing internet penetration and smartphone adoption present untapped potential for digital video advertising expansion. The integration of interactive and shoppable video ads is also revolutionizing consumer engagement, enabling brands to drive direct sales through engaging content. As advertisers leverage programmatic advertising and data-driven insights, the industry is poised for greater efficiency and effectiveness, making digital video advertising a critical component of modern marketing strategies.

DIGITAL VIDEO ADVERTISING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

66% |

|

Segments Covered |

By Type, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Google (YouTube Ads), Meta (Facebook & Instagram Ads), Amazon Advertising, TikTok for Business, Microsoft Advertising, Twitter Ads (X Ads), Snap Inc. (Snapchat Ads), Roku, Inc., The Trade Desk, Adobe Advertising Cloud |

Digital Video Advertising Market Segmentation: By Type

-

Desktop

-

Mobile

Mobile is the dominant and fastest-growing segment in the digital video advertising market, influenced by the rapid global adoption of smartphones and expanding mobile internet usage. With consumers spending more time streaming videos on mobile devices, advertisers are shifting their focus to mobile-first strategies. The rise of short-form video content on social media platforms like TikTok, Instagram Reels, and YouTube Shorts has further fueled mobile video ad consumption. Additionally, advancements in 5G technology and improved mobile internet speeds have enhanced video ad quality, making mobile an attractive platform for advertisers.

Meanwhile, desktop video advertising remains relevant, particularly for long-form content and professional audiences, but its growth is slower compared to mobile due to shifting consumer behavior towards mobile-first digital experiences.

Digital Video Advertising Market Segmentation: By Industry

-

Retail

-

Automotive

-

Financial Services

-

Telecom

-

Consumer Goods and Electronics

-

Media & Entertainment

-

Others

The Media & Entertainment industry dominates the digital video advertising market, as streaming platforms, social media, and content creators mostly rely on video ads for revenue. With the rise of over-the-top (OTT) platforms and video-sharing apps, advertisers are majorly investing in immersive and interactive video ads to engage audiences. The demand for premium ad placements on streaming services and social networks has further cemented this industry’s leadership.

The Retail sector is the fastest-growing industry in digital video advertising, influenced by the surge in e-commerce and online shopping behavior. Retailers leverage video ads for product showcases, personalized recommendations, and influencer-driven marketing on platforms like YouTube, Instagram, and TikTok. The integration of shoppable video ads and AI-driven targeting has made video advertising an essential tool for boosting sales and brand engagement, fueling rapid growth in this segment.

Digital Video Advertising Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America leads the digital video advertising market, holding the largest share because of the strong presence of major advertisers, advanced digital infrastructure, and high internet penetration. The U.S. accounts for a significant portion of ad spending, driven by increased investments from industries such as retail, entertainment, and financial services. The region benefits from mature advertising ecosystems, widespread mobile usage, and the dominance of streaming platforms, social media, and connected TV advertising.

Asia-Pacific is the fastest-growing market for digital video advertising, driven by rapid smartphone adoption, increasing internet users, and the rising demand for social media and e-commerce platforms. Countries like China, India, and Southeast Asian nations are witnessing exponential growth as brands shift towards digital campaigns to target younger demographics. The expansion of short-video platforms like TikTok, Instagram Reels, and local streaming services further accelerates the region’s advertising growth, making it a key market for future investments.

COVID-19 Impact Analysis on the Global Digital Video Advertising Market:

The COVID-19 pandemic highly accelerated the growth of digital video advertising as businesses inclined from traditional marketing to online channels. With lockdowns and restrictions limiting physical interactions, brands increased their digital ad spending to engage consumers spending more time on streaming platforms, social media, and video-sharing apps. The surge in OTT (Over-The-Top) content consumption, live streaming, and e-commerce integration with video ads reshaped advertising strategies globally.

However, the initial phase of the pandemic saw budget cuts in certain industries like travel and hospitality, resulting in a temporary decline in ad revenues. In contrast, sectors such as e-commerce, gaming, and healthcare rapidly increased their video ad investments, fueling the overall market recovery. As remote work and digital entertainment habits became permanent trends, advertisers continued prioritizing video-based content, making digital video advertising a dominant force in post-pandemic marketing strategies.

Latest Trends/ Developments:

The digital video advertising landscape is rapidly evolving with AI-powered personalization and automation resulting in the transformation. Brands are leveraging AI-driven ad targeting, dynamic content optimization, and predictive analytics to enhance engagement and improve conversion rates. Interactive and shoppable video ads have gained traction, allowing viewers to make purchases directly from video content, bridging the gap between entertainment and e-commerce. Additionally, programmatic advertising continues to expand, enabling real-time bidding and efficient ad placements across multiple platforms.

Another major development is the rise of connected TV (CTV) and Over-The-Top (OTT) advertising. As consumers majorly shift from traditional cable TV to streaming services, advertisers are focusing on premium ad placements within these digital environments. Short-form video content on platforms like TikTok, Instagram Reels, and YouTube Shorts is also witnessing explosive growth, pushing brands to create engaging, mobile-friendly ad formats. Furthermore, privacy regulations and the decline of third-party cookies are driving the adoption of contextual targeting and first-party data strategies to ensure effective yet compliant advertising campaigns.

Key Players:

-

Google (YouTube Ads)

-

Meta (Facebook & Instagram Ads)

-

Amazon Advertising

-

TikTok for Business

-

Microsoft Advertising

-

Twitter Ads (X Ads)

-

Snap Inc. (Snapchat Ads)

-

Roku, Inc.

-

The Trade Desk

-

Adobe Advertising Cloud

Chapter 1. Digital Video Advertising Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Digital Video Advertising Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Digital Video Advertising Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Digital Video Advertising Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Digital Video Advertising Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Digital Video Advertising Market – By Type

6.1 Introduction/Key Findings

6.2 Desktop

6.3 Mobile

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Digital Video Advertising Market – By Industry

7.1 Introduction/Key Findings

7.2 Retail

7.3 Automotive

7.4 Financial Services

7.5 Telecom

7.6 Consumer Goods and Electronics

7.7 Media & Entertainment

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Industry

7.10 Absolute $ Opportunity Analysis By Industry, 2025-2030

Chapter 8. Digital Video Advertising Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Digital Video Advertising Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Google (YouTube Ads)

9.2 Meta (Facebook & Instagram Ads)

9.3 Amazon Advertising

9.4 TikTok for Business

9.5 Microsoft Advertising

9.6 Twitter Ads (X Ads)

9.7 Snap Inc. (Snapchat Ads)

9.8 Roku, Inc.

9.9 The Trade Desk

9.10 Adobe Advertising Cloud

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Digital Video Advertising Market was valued at USD 50.6 billion in 2024 and is projected to reach a market size of USD 638.82 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 66%.

Rising mobile video consumption, AI-driven ad personalization, and growing programmatic advertising adoption.

Based on Type, the Global Digital Video Advertising Market is segmented into Desktop and Mobile.

North America is the most dominant region for the Global Digital Video Advertising Market.

Google (YouTube Ads), Meta (Facebook & Instagram Ads), Amazon Advertising, and TikTok for Business are key players in the Global Digital Video Advertising Market.