GLOBAL DIGITAL RECEIPTS MARKET SIZE (2023 - 2030)

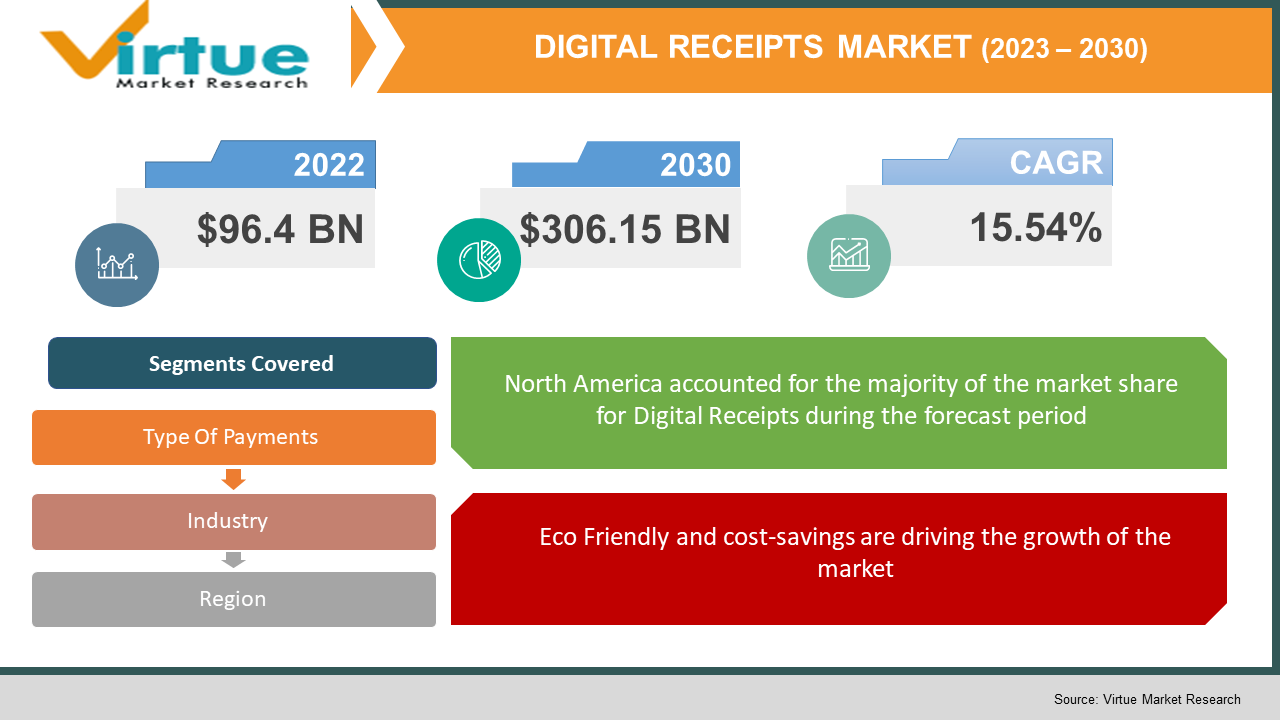

In 2022, the Global Digital Receipts Market was valued at $96.4 Billion and is projected to reach a market size of $306.15 Billion by 2030. Over the forecast period of 2023-2030 market is projected to grow at a CAGR of 15.54 %.

CLICK HERE TO REQUEST FREE SAMPLE PDF

Industry Overview:

Digital receipts are a structure of receipts issued with the aid of merchants, dispatched without delay to your telephone or email. You may additionally hear them referred to as digital receipts or e-receipts. Ultimately, they serve as proof of payment, besides the want for a bodily paper trail. Before now, outlets had to print receipts for their customers. These supposed greater expenses on paper and ink. To remedy this problem, technological know-how introduced us to digital receipts which anyone can have get entry to thanks to free admin templates for net applications.

Before we can talk about the execs and cons of digital receipts, we have to recognize what they are. Just as the identity implies, they are receipting that shops ship digitally. What this ability is that a purchaser receives their receipt in their e-mail after purchase. How did the thinking of digital receipts come about? It used to be an initiative pushed with the aid of the Apple Store alongside quite a few startups. The goal used to be to deal with the trouble of sustainability.

How do digital receipts work? After purchase, the purchaser chooses which kind of receipt they want. If they choose a digital receipt, they post their email. The receptionist enters the e-mail into the gadget and within seconds, they acquire the receipt electronically. The accurate issue about this is that the digital receipt gadget holds onto the e-mail address. This potential that outlets can use to attain out to their clients at some stage in advertising and marketing campaigns. With this out of the way, let’s take a speedy seem at the professionals and cons of digital receipts.

MARKET DRIVERS:

Eco Friendly and cost-savings are driving the growth of the market

There’s the price of producing paper then the price of shopping for it. After buying, you want ink to print on the paper and a printer as well. All of this takes its toll on special businesses. With digital receipts, no paper is involved. This ability that it eliminates any more costs. As such, money can be transferred to different elements of commercial enterprise operation.

Easy storage of E-Receipt is also driving the growth of the market

Paper receipts take up a lot of bodily actual property in the establishment. Customers additionally go through this and get to lose many receipts earlier than long. Even if the receipts don’t get lost, they quit fading. Digital receipts clear up all these troubles easily. They are less difficult to shop due to the fact they don’t take up bodily storage space. Many digital receipt structures permit you to shop copies in the cloud. Customers can additionally maintain their receipts in electronic mailboxes. This potential each client and outlet can constantly get entry to their receipts. As such, it improves report maintenance and accounting processes. Finally, they keep from fraudulent returns which have an effect on your commercial enterprise negatively.

MARKET RESTRAINTS:

General technical knowledge requirement is restraining the growth of the market

Digital receipts don’t want you to be a top-notch genius. However, each event (retailers and customers) needs to have some technical knowledge. Without this, there will be a hassle with the method and it won’t supply the preferred results. With technical knowledge, the retailer has to apprehend the receipt software. They should additionally be aware of how to manipulate it to ship the receipts to unique customers. After this, they need to comprehend how to use the analytics to their benefit. In the phase of the customer, they ought to have energetic emails. They should additionally recognize how to navigate to every email. While all this looks very simply, some humans will combat managing such tasks.

DIGITAL RECEIPTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

15.54% |

|

Segments Covered |

By Type Of Payments, Industry and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Square Inc, PayStand, Dashlane, Class Wallet, Finovera, Sensibill, Expensify, Flux Gini, App Card, Green Till, Togo Digital Ecrebo, Shoeboxed |

Market Segmentation Analysis

Digital Receipts Market - By Type of Payments:

-

-

Remote

-

Proximity

-

During the forecast period, the Proximity Payments phase is predicted to develop at a CAGR of 35.7%. Mobile telephones and POS gadgets are used to make proximity payments. A range of agencies presently provides purposes permitting proximity payments. It is similarly referred to as in-store repayments with recognition to price thru a product owner's POS terminal in the case of a retail keep or in-location payments. For quick distances and work, proximity repayments are especially enabled when each payer and the payee are current in an equal place. This charging device makes use of both barcodes and contactless interfaces to provoke cellular cash transactions. This is achieved via Near-field verbal exchange (NFC)-based technological know-how current on an NFC-enabled phone, which has completed important points about the cellular pockets positioned in the cloud or debit/credit card. This payee data is saved on the system in the POS terminal which is examined by using the corresponding NFC reader. Proximity repayments vary markedly from faraway payments, as it includes the presence of fee card small print from one's very own financial institution account and does no longer require any relation with a fee processor to facilitate the transaction. The growing adoption via brick- and mortar-based businesses of cellular price applied sciences similarly drives demand for proximity payments.

Digital Receipts Market - By Industry:

-

BFSI

-

Telecom and IT

-

Media and entertainment

-

Healthcare, Retail

-

Travel and hospitality

-

Transportation and logistics,

-

Energy and utilities

-

Others

Based on industry, banking and journey and hospitality are the fastest-growing utility section for the cellular repayments market, which are projected to develop at a CAGR of 30.2% and 34.8%. Companies like MakeMyTrip, Yatra, Ibibo, Cleartrip (for airways and hotels), and redBus (for buses) are examples of online tour reserving groups in India, which are fueling the cell repayments market, by using facilitating reserving solely thru online platforms. A learn by using the India Brand Equity Foundation (IBEF) located that 81% of present digital price customers in India favor the digital and cell mediums for banking over different non-cash price techniques such as demand drafts or cheques.

Digital Receipts Market - By Region:

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East

-

Africa

Geographically, North America, which has displayed affinity over the years in adopting more modern technologies, is the most money-making place for the cell repayments market, producing an international demand share of 34.3% in 2021. With quite a few revolutionary key market gamers positioned in North America such as PayPal Holdings, Inc. and Microsoft Corporation, this location is main the modern front with the improvement of novel applied sciences such as contactless payments and near-field communication. An excessive fee of net penetration, increase in e-commerce, and micropayment picks have contributed to the recognition of the cell repayments market in North America.

Banks in Europe are making efforts to launch a European charge initiative aimed at developing a unified repayments answer for retailers and buyers throughout the region. Such initiatives are anticipated to create new increase possibilities for the market over the forecast period. Moreover, the digital marketing campaign launched via the Italian authorities to extend digital repayments in us of a is additionally propelling the regional market growth.

Digital Receipts Market Share by Company

-

Square Inc

-

PayStand

-

Dashlane

-

Class Wallet

-

Finovera

-

Sensibill

-

Expensify

-

Flux

-

Gini

-

App Card

-

Green Till

-

Togo Digital

-

Ecrebo

-

Shoeboxed

Celerant Technology offers an omnichannel solution with POS, e-commerce, CRM, inventory management, fulfillment processing, marketing automation, and analytics.

Star Micronics Cloud is a cloud-based Internet of Things company that offers a portfolio of products and services to help retailers build customer relationships, including digitized receipts for retailers who own Star Micronics POS printers.

The market is characterized by way of the presence of each multinational and regional player that is engaged in the designing, manufacturing, distribution, and setup of a broad variety of products. Major groups have invested closely in R&D initiatives. They are moreover focusing on integrating superior applied sciences to increase extra high-quality and environment-friendly solutions, which can be utilized in the market

NOTABLE HAPPENINGS IN THE GLOBAL DIGITAL RECEIPT MARKET IN THE RECENT PAST:

-

Product Launch- In November 2021, Fiserv launched EnteractSM, a new, cloud-based customer relationship management (CRM) platform for financial institutions

-

Agreement - In September 2021, Global Payments Inc and Virgin Money signed an agreement to leverage Global Payments’ unique two-sided network to empower Virgin Money customers with market-leading digital payment experiences globally.

COVID-19 impact on the Digital Receipts Market

The outbreak of COVID-19 has extensively impacted operations in a few key sectors, such as manufacturing, logistics, hospitality, transportation, healthcare, and retail, and somewhat impacted a few sectors that encompass IT and telecom, power and utilities, government, education, and BFSI. The pandemic has accelerated the adoption of contactless and pocket payments. eWallets are witnessing multiplied traction for Peer to Peer (P2P) transfers, consignment payments, and Customer to Business (C2B) repayments for critical offerings owing to the lockdown and aversion to the change of cash. However, some pocket vendors have expanded their charges for retailers and consumers, main to retailers no longer accepting their wallets for transactions.

The COVID-19 pandemic has had a sizable impact on the cell cash market, as shoppers and companies are pressured to alternate their shopping habits. There has been a superb spike in the adoption of cellular wallets, as contactless repayments have grown to be essential for purchases. Avoiding money and card transactions to maintain COVID-19 from spreading has precipitated many subscribers to strive out cell wallets. Since the COVID-19 disaster complicates each and every day, customers turn out to be accustomed to digital payments, making cellular cash necessary for every transaction.

Chapter 1. DIGITAL RECEIPTS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. DIGITAL RECEIPTS MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. DIGITAL RECEIPTS MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. DIGITAL RECEIPTS MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. DIGITAL RECEIPTS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. DIGITAL RECEIPTS MARKET – By Type Of Payments

6.1. Remote

6.2. Proximity

Chapter 7. DIGITAL RECEIPTS MARKET – By Industry

7.1. BFSI

7.2. Telecom and IT

7.3. Media and Entertainment

7.4. Healthcare, Retail

7.5. Travel and Hospitality

7.6. Transpotation and logististics

7.7. Energy and Utlites’

7.8. Others

Chapter 8. DIGITAL RECEIPTS MARKET – By Region

8.1. North America

8.2. Europe

8.3. Asia-P2acific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. DIGITAL RECEIPTS MARKET – By Manufactures

9.1. Square Inc

9.2. PayStand Dashlane

9.3. Class Wallet

9.4. Finovera Sensibill

9.5. Expensify

9.6. Flux

9.7. Gini

9.8. App Card

9.9. Green Till

9.10. Togo Digital

9.11. Ecrebo Shoeboxed

Download Sample

Choose License Type

2500

4250

5250

6900