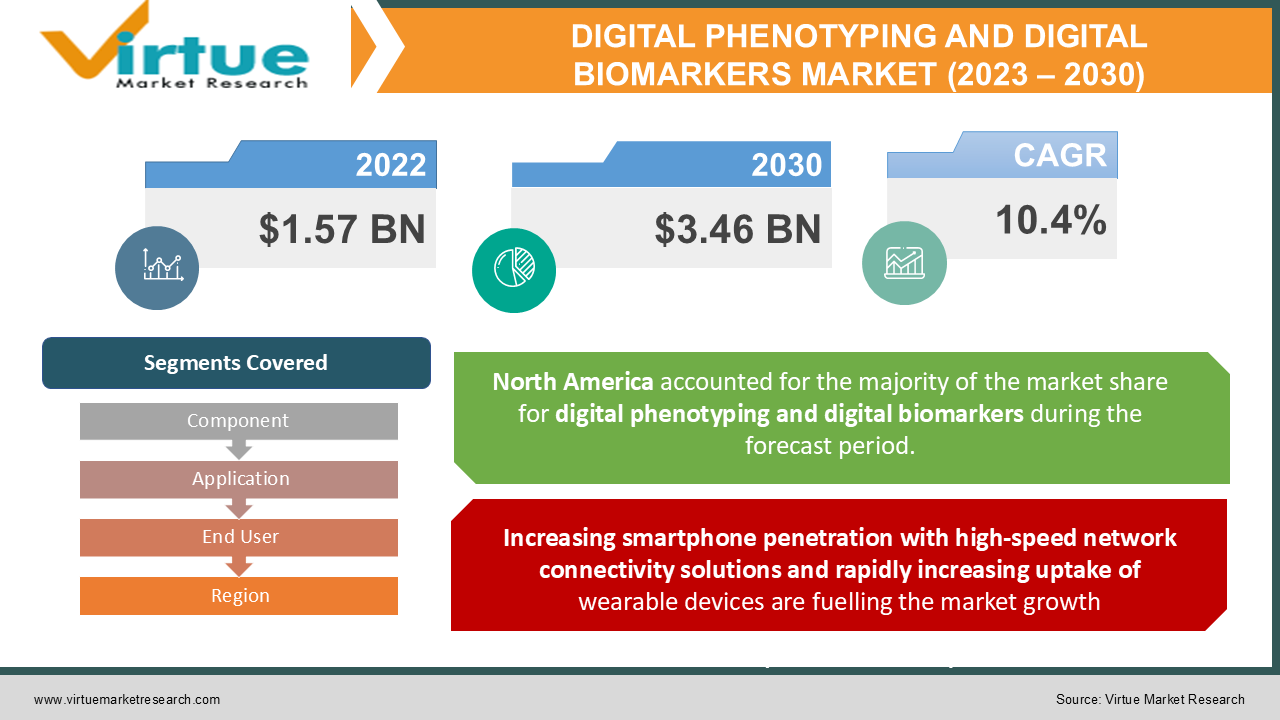

Global Digital Phenotyping and Digital Biomarkers Market Size (2023 – 2030)

In 2022, the Global Digital Phenotyping and Digital Biomarkers Market was valued at USD 1.57 Billion and is projected to reach a market size of USD 3.46 Billion by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 10.4%. Increasing smartphone penetration with high-speed network connectivity solutions, rapidly increasing uptake of wearable devices, increase in the prevalence of diseases and the growing geriatric population, significant product launches, and regulatory flexibility toward digital health solutions are majorly driving the growth of the market.

Industry Overview:

Biomarkers are objective measures that capture anatomic, physiological, and pathological characteristics to understand the health of an individual and the warning signals being given by the body. Digital biomarkers are quantifiable behavioral and physiological data collected and measured by digital devices such as portables, wearables, and implantables. Digital biomarkers offer significant imaging capabilities with an enhanced spatial resolution. Digital phenotyping is the extraction of information from data streams and digital devices to create personalized real-time analysis, thereby helping to provide accurate data. Digital phenotyping can identify traits and patterns in the population by utilizing their active or passive data and devise the treatment strategies for mental disorders effectively. Neurological and Psychiatric diseases present with complex, fluctuant, atypical symptoms in disease progression and display high variableness between patients. Traditional diagnostic and efficacy evaluation methods often depend on in-clinic visits and subjective evaluation by caregivers, clinicians, and patients. In-clinic evaluation methods are often time-consuming, costly, and limited in their quality and quantity of observations. In addition, they are prone to high-inter and intra-rater variability. The traditional diagnosis methods have some drawbacks that can affect the diagnostic process in the early stage of a disease which has a lag between the onset of the pathological process and the onset of disease symptoms. Data related to health being collected by smartphones provide a promising complementary approach to in-clinic assessments and can enhance patient care and treatment outcomes. Digital biomarkers provide a frequent assessment of a larger target population over long periods. An increase in the use of smart wearables and connected devices helps in the measurement of a range of diagnostic parameters for diseases including diabetes, mental health, cardiovascular, and neurological diseases. The emergence of smartwatches and the rising usage of smartphones aid in tracking the physiological data related to health.

The rapid development of telecom and IT infrastructure is boosting market growth. Digital monitoring of patients in their everyday life using smart technologies is rapidly evolving and may help assist clinicians in facilitating early diagnosis and evaluation interventions. Smart sensor technology to monitor patients is emerging rapidly. Modern smartphones and smart wearables are equipped with various sensors including acceleration, GPS, gyroscope, barometer, temperature, and health sensors. Digital biomarkers are such health-related information being collected in clinical trials. They offer objective, invaluable, and ecologically valid information for a better understanding of specific diseases. The rising government investments in the digitalization of the healthcare sector and the development of smart hospitals are anticipated to spur the market demand for digital phenotyping and digital biomarkers. The market is highly influenced by various developmental strategies adopted by numerous market players.

COVID-19 impact on Digital Phenotyping and Digital Biomarkers Market

The COVID-19 pandemic has significantly impacted the Digital phenotyping and digital biomarkers market. The COVID-19 outbreak escalated the demand for digital phenotyping and digital biomarkers as it helps in screening and diagnosis. Digital phenotyping and digital biomarkers offer the real-time analysis of data and helped doctors to carry out the data collection process remotely during the pandemic. There was a sudden increase in the market demand. An increase in remote patient monitoring and growing health concern among people propelled the development and validation of digital phenotyping and digital biomarkers during the COVID-19 pandemic. They can help in identifying patients who are at risk of diseases, by continuously monitoring disease symptoms or progression using data collected from an individual’s smart device.

MARKET DRIVERS:

Increasing smartphone penetration with high-speed network connectivity solutions and rapidly increasing uptake of wearable devices are fuelling the market growth

The advent of connected devices such as smart wearables, portable devices, and biosensors has significantly enabled the measurement of various parameters for detecting novel biomarkers. Mobile health apps include various physiological parameters such as sleep, activity, heart rate, and others. Biochemical parameters include metabolites, electrolytes, proteins, and small molecules. This provides huge opportunities to revolutionize the process of data capture and collection during clinical trials. The increase in the usage of connected devices and health-related mobile applications aids in the diagnostic and prognostic measurements of diverse diseases which, in turn, is likely to boost the market growth of digital phenotyping and digital biomarkers. The growing use of mobile devices generates a vast amount of personalized data including location, physical movement, information about vital health signs, and social media habits that can be processed by data mining. According to Pew Research Center, smartphone ownership grew from 35% in 2011 to 85% in 2021 in the United States. Additionally, smartphone ownership amongst the United States citizens aged 65+ grew from 3% in 2013 to 12% in 2021. Technological advances in the ranges of mobiles and digitally connected devices are further fuelling the market growth.

Significant product launches and regulatory flexibility toward digital health solutions are contributing to the market growth

An increase in product launches and FDA approval also drive the market growth. FDA has simplified the entry process for companies operating in the digital phenotyping and digital biomarkers market by modifying its guidelines related to software-as-medical-device. The FDA launched the Pre-Cert model, which aimed to streamline the regulatory process and boost innovation of digital health technologies. This flexibility in regulations toward digital health solutions is anticipated to propel the market growth of Digital Phenotyping and Digital Biomarkers.

An increase in the prevalence of diseases and the growing geriatric population is fuelling the market demand

According to the United States Centers for Disease Control and Prevention (CDC), the leading causes of disability and death in the U.S. costs USD 3.8 trillion in annual healthcare costs of the country. The increasing prevalence of chronic diseases globally and the growing geriatric population is rising the demand for efficient treatment and technologies to reduce healthcare costs. Smart wearables and smartphones monitor the health status of users and provide detailed insights into inter-and intra-individual disease variability in daily life.

The increasing cost of drug development led to the need for other alternatives, of which digital phenotyping and digital biomarkers are significant.

The rising cost of research and development of drugs is resulting in the increased cost of drugs. In the recent past, the cost of drug development has increased by almost 145% and the rate of success of drug development has reduced to half. Presently, the approval rate for drugs that enter clinical development is less than 12%. The study of biomarkers may help target the pathway where research should be focused which can reduce the number of processes required for drug development and the overall cost can be reduced.

MARKET RESTRAINTS:

Challenges associated with test validation, and biases can hamper the digital biomarkers market growth

The clinical assessment of digital biomarkers and data platforms which includes apps and wearables is of utmost importance. The validation testing of the data collected from healthy individuals or the target population needs to be performed in a clinically relevant environment. The platform which assesses the data must be free from data bias as this can deteriorate the credibility of the data analysis and might even lead to failure in the process. It is necessary to remove such biases from the data or address them before analyzing the data.

Challenges associated with integration, usability, and cost can restrain the market growth

Interoperability and integration are the most important parameters to be considered while developing digital health services. It needs to be assured by the service providers that the data collected can be shared across hospitals, labs, clinics, pharmacies, and patients irrespective of the application vendor. Also, the cost versus benefit analysis of digital phenotyping and digital biomarkers solutions must be done appropriately considering the nascent stage of the market.

DIGITAL PHENOTYPING AND DIGITAL BIOMARKERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

10.4% |

|

Segments Covered |

By Component, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Akili Interactive Labs, ActiGraph, LLC., Fitbit, Inc., AliveCor, Inc., Novartis, Sanofi, Pfizer Inc., F. Hoffmann-La Roche Ltd, Takeda Pharmaceuticals, HumanAPI, GlaxoSmithKline Plc, Mindstrong Inc., Sharecare, Inc., Alphabet, Inc., Onnela lab, Verily Life Science LLC |

This research report on the global digital phenotyping and digital biomarkers market has been segmented and sub-segmented based on component, application, end-user, and region.

Digital Phenotyping and Digital Biomarkers Market – By Component

-

Data Collection Tools

-

Digital Platforms

-

Mobile Apps

-

Desktop-based Software

-

Wearables

-

Biosensors

-

Data Integration Systems

Based on Component, the Digital Phenotyping and Digital Biomarkers Market is segmented into Data Collection Tools and Data Integration Systems. The Data Collection Tools segment held a significant revenue share in the global market and is anticipated to sustain its dominance during the forecast period. This is attributed to the increased adoption of smartphones and wearables that significantly help in data collection. The internet and wireless connectivity are major tools that facilitate easy data collection and data transfer. Biosensors account for a major portion of the data collection tools. The Data Integration Systems segment is anticipated to grow with the highest CAGR of 42% during the forecast period.

Digital Phenotyping and Digital Biomarkers Market – By Application

-

Sleep and Movement

-

Mood and Behavior

-

Neurodegenerative Disorders

-

Cardiological Diseases

-

Diabetes

-

Chronic pain

-

Respiratory Conditions

-

Gastrointestinal Diseases

-

Others

Based on Application, the Digital Phenotyping and Digital Biomarkers Market is segmented into Sleep and Movement, Mood and Behavior, Neurodegenerative Disorders, Cardiological Diseases, Diabetes, Chronic pain, Respiratory Conditions, Gastrointestinal Diseases, and Others. The Cardiovascular diseases segment dominates the global market in terms of revenue and is anticipated to sustain its dominance during the forecast period. This is attributed to the increased prevalence of cardiovascular diseases globally. According to WHO, cardiovascular diseases account for 32% of global deaths.

The Respiratory Conditions segment is estimated to be the fastest-growing segment during the forecast period owing to the rising prevalence of respiratory diseases like chronic obstructive pulmonary disease and asthma. The Neurodegenerative Disorders segment is estimated to have significant growth during the forecast period owing to an increase in the prevalence of neurological disorders and the rising adoption of digital phenotyping technology for mental health.

Digital Phenotyping and Digital Biomarkers Market – By End User

-

Biopharmaceutical Companies & labs

-

Insurance Payers

-

Healthcare Providers

Based on End-User, the Digital Phenotyping and Digital Biomarkers Market is segmented into Biopharmaceutical Companies & labs, Insurance Payers, and Healthcare Providers. The Biopharmaceutical Companies & labs segment dominates the market share and is anticipated to hold the largest revenue during the forecast period. The Insurance Payers segment is estimated to grow at the highest rate, around 43% during the forecast period.

Digital Phenotyping and Digital Biomarkers Market - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East

-

Africa

Geographically, the North American Digital Phenotyping and Digital Biomarkers Market holds the largest market share and is anticipated to account for a significant revenue share in the global market during the forecast period. The key factors contributing to this growth are the huge geriatric population, significant product launches, higher adoption rate of digital technologies, increase in investments in research & development, increased healthcare expenditure, growing approval of smart devices in this region, and the strong presence of key market players.

The European Digital Phenotyping and Digital Biomarkers Market held the second-largest share in the global market and is poised to expand at a significant growth rate during the forecast period owing to the rising demand for mobile health apps, and increased adoption of smartphones and wearable technology in healthcare.

The Digital Phenotyping and Digital Biomarkers Market in the Asia Pacific accounted for a major market share and is anticipated to witness a higher CAGR during the forecast period owing to the surge in the usage of smart devices, the proliferation of the digital technologies, increase in the patient pool, rising focus on enhancing healthcare facilities by the government, and growing focus of market players to leverage growth opportunities in this region. In addition, the growing geriatric population in this region is anticipated to exponentially augment the demand for digital phenotyping and digital biomarkers.

The Digital Phenotyping and Digital Biomarkers Market in Latin America, the Middle East, and Africa is anticipated to grow during the forecast period owing to increasing cases of chronic diseases, the growing need to manage healthcare costs and the increasing use of smartphones and the internet.

Major Key Players in the Market

Companies like

- Akili Interactive Labs

- ActiGraph, LLC.

- Fitbit, Inc.

- AliveCor, Inc.

- Novartis

- Sanofi

- Pfizer Inc.

- F. Hoffmann-La Roche Ltd

- Takeda Pharmaceuticals

- HumanAPI

- GlaxoSmithKline Plc

- Mindstrong Inc.

- Sharecare, Inc.

- Alphabet, Inc.

- Onnela lab

- Verily Life Science LLC

The global digital phenotyping and digital biomarkers market is dominated by plenty of digital health companies that can be categorized as developers of sensors and tools that collect and integrate patient-level data. Prominent players in the digital phenotyping and digital biomarkers market are engaged in synergistic activities, innovative product launches, acquisitions, collaborations with research and medical institutions, business expansion, and funding activities to expand the digital phenotyping and digital biomarker space.

Notable happenings in the Global Digital Phenotyping and Digital Biomarkers Market in the recent past:

-

Partnership- In March 2021, Human API partnered with CLEAR to empower the safe re-opening of businesses using secure COVID tests and vaccine data. Health Pass is a mobile application that makes it easier and safer for people to connect members' identities to COVID-related information.

-

Partnership- In March 2021, Wellstar Health System, one of Georgia's largest and most integrated healthcare systems, announced a strategic partnership with Sharecare, the digital health company that helps people manage all their health in one place. The partnership would offer market-leading innovations in personalized care delivery, population health, and consumer engagement.

-

Partnership- In April 2021, Winterlight Labs partnered with the Digital Medicine Society (DiMe) to drive the adoption of digital health resources.

-

Partnership- In March 2020, Vivoryon Therapeutics AG partnered with Winterlight Labs for the upcoming Phase 2b trial of PQ912 in Alzheimer’s clinical trial. Vivoryon Therapeutics will use the Winterlight speech-based biomarker and enhance novel therapy for Alzheimer’s disease.

-

Partnership- In September 2020, Jetstream APS partnered with Human API to enable life insurance applicants to digitally share access to their electronic health records (EHR).

-

Acquisition- In October 2020, Medidata, a Dassault Systemes company, the global leader in creating end-to-end solutions to support the clinical development process, announced the acquisition of the digital biomarker business of MC10. This will help Medidata to enhance remote biometric data capture capabilities in hybrid and virtual clinical trials.

-

Collaboration- In October 2019, MC10, Inc., collaborated with the University of Rochester for the application of the FDA-approved BioStamp nPoint system for the collection of movement-related data to quantitatively access the progression of diseases such as Parkinson’s and Huntington’s disease.

Chapter 1. Digital Phenotyping and Digital Biomarkers Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Digital Phenotyping and Digital Biomarkers Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Digital Phenotyping and Digital Biomarkers Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Digital Phenotyping and Digital Biomarkers Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Digital Phenotyping and Digital Biomarkers Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Digital Phenotyping and Digital Biomarkers Market – By Component

6.1. Data Collection Tools

6.1.1. Digital Platforms

6.1.2. Mobile Apps

6.1.3. Desktop-based Software

6.1.4. Wearables

6.1.5. Biosensors

6.2. Data Integration Systems

Chapter 7. Digital Phenotyping and Digital Biomarkers Market – By End User

7.1. Biopharmaceutical Companies & labs

7.2. Insurance Payers

7.3. Healthcare Providers

Chapter 8. Digital Phenotyping and Digital Biomarkers Market – By Application

8.1. Sleep and Movement

8.2. Mood and Behavior

8.3. Neurodegenerative Disorders

8.4. Cardiological Diseases

8.5. Diabetes

8.6. Chronic pain

8.7. Respiratory Conditions

8.8. Gastrointestinal Diseases

8.9. Others

Chapter 9. Digital Phenotyping and Digital Biomarkers Market - By Region

9.1. North America

9.2. Europe

9.3. Asia-Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. Digital Phenotyping and Digital Biomarkers Market – key players

10.1 Akili Interactive Labs

10.2 ActiGraph, LLC.

10.3 Fitbit, Inc.

10.4 AliveCor, Inc.

10.5 Novartis

10.6 Sanofi

10.7 Pfizer Inc.

10.8 F. Hoffmann-La Roche Ltd

10.9 Takeda Pharmaceuticals

10.10 HumanAPI

10.11 GlaxoSmithKline Plc

10.12 Mindstrong Inc.

10.13 Sharecare, Inc.

10.14 Alphabet, Inc.

10.15 Onnela lab

10.16 Verily Life Science LLC

Download Sample

Choose License Type

2500

4250

5250

6900