Digital Out of Home (OOH) Advertising Produce Market Size (2024 – 2030)

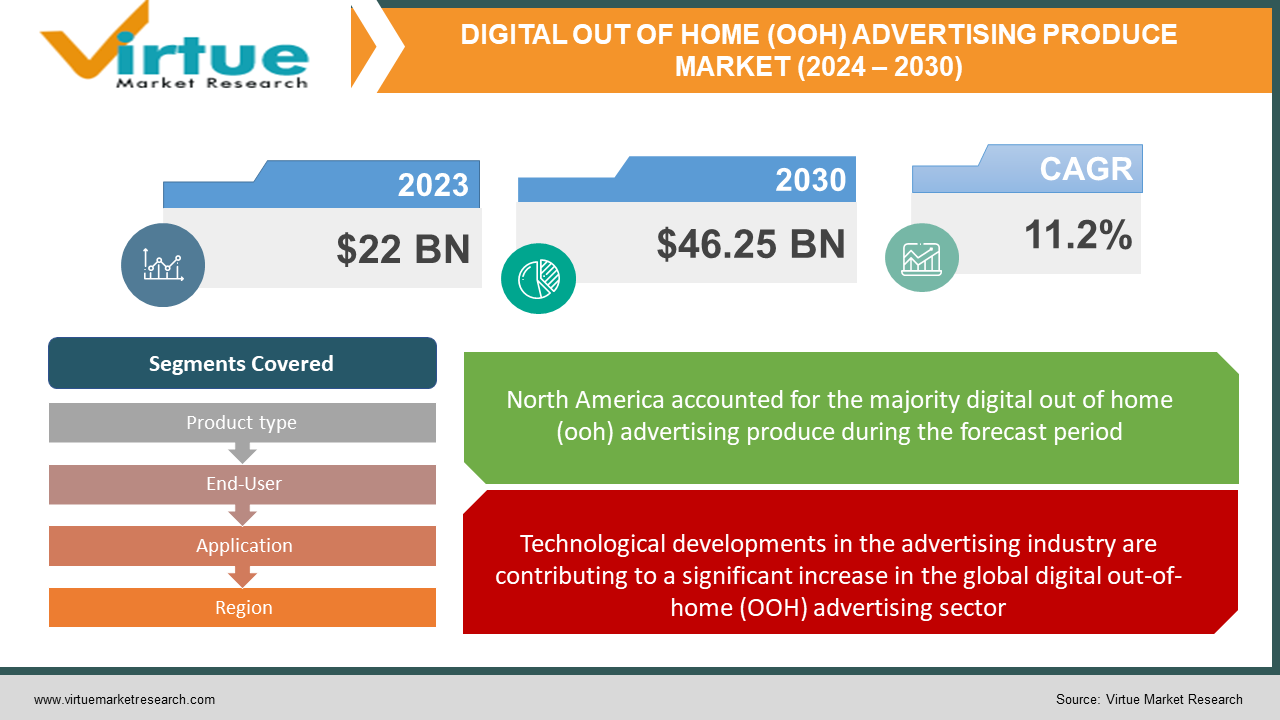

The global digital out-of-home (OOH) advertising market was valued at USD 22 billion and is projected to reach a market size of USD 46.25 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 11.2%.

Digital out-of-home (DOOH) advertising is a contemporary marketing strategy that uses digital displays like billboards and LED screens to convey dynamic and location-based advertising material. Busy public areas, transportation hubs, shopping malls, and other prime locations are used for these shows. In contrast to traditional static billboard displays, DOOH advertising allows many advertisements to be displayed consecutively, often in real time. Because it can engage viewers with visually attractive and contextually suitable material, this style of advertising is growing in popularity. Advertisers may easily adapt their messaging to fit changing target audiences or marketing objectives thanks to the remote management and updating capabilities of DOOH campaigns.

The growing use of digital media in advertising is driving a rapid expansion of the worldwide industry for digital out-of-home advertising. Furthermore, the product's extensive use due to its engaging and dynamic content delivery fosters an environment that is favorable to the growth of the sector. The sector is expanding as a result of the transition from traditional printing to digital formats, which provide marketers with the ability to target certain demographics and geographic areas, generate greater returns on investment (ROI), and spend advertising expenditures more effectively. Moreover, DOOH's ability to provide interactive experiences and real-time content updates raises brand exposure and audience engagement, both of which aid in market development. Furthermore, advances in display technology and the general availability of high-speed internet connections are driving business growth and enabling more dynamic and successful advertising campaigns. Additionally, advertisers are finding data-driven insights for campaign optimization increasingly appealing, which is propelling the market forward. These developments are made possible by the combination of automated marketing and data analytics in DOOH, which enables better evaluation of ad performance and the personalization of content.

Key Market Insights:

Digital out-of-home ads are an affordable way for advertisers to reach a broad audience; their usage is both high and growing, which will drive the market's growth throughout the projection period. Moreover, throughout the forecast period, it is projected that increased infrastructure development and urbanization worldwide will fuel market expansion. Additionally, the market is expanding more quickly thanks to the growing amount of money that different sectors are spending on outdoor marketing because it allows for the running of several ads on a single screen. For example, in June 2022, JCDecaux, an outdoor advertising company, announced the launch of its programmatic digital out-of-home (DOOH) product in Brazil in collaboration with VIOOH Limited. With the new platform, marketers can design quantifiable, adaptable, and effective digital out-of-home initiatives. In the realm of advertising, digital outdoor marketing is becoming more and more popular since it raises consumer awareness of a brand and supports other channels where the brand is being advertised, both of which are expected to spur market expansion. Additionally, since people spend more time outside of their homes and workplaces, out-of-home advertising enables brands to reach a large audience quickly and consistently, which is driving the market's rise throughout the projected period. Nonetheless, the fierce rivalry among out-of-home advertising vendors is impeding the market's expansion.

Global Digital Out-of-Home (OOH) Advertising Market Drivers:

Technological developments in the advertising industry are contributing to a significant increase in the global digital out-of-home (OOH) advertising sector.

The fast growth of digital technology is mostly to blame for the enormous rate at which the DOOH advertising industry is booming. Dynamic digital displays, including LED screens, interactive kiosks, and digital signs, are replacing static billboards in the marketplace. These digital formats allow advertisers to showcase visually appealing and intriguing content that captures the attention of passersby. Furthermore, remote control and real-time content updates are available due to the flexibility of digital displays. This enables marketers to quickly adapt their messaging in response to events, trends, or changing market conditions. As technology develops, DOOH becomes a more and more alluring option for marketers searching for novel ways to interact with their target audience.

Data-driven customization and targeting have contributed to a significant increase in the global digital out-of-home (OOH) advertising sector.

The potential of DOOH advertising to use data-driven targeting and customization is a key factor fueling its expansion. Through the integration of data analytics and programmatic advertising, marketers may gain deeper insights into the characteristics, inclinations, and actions of their intended audience. With this data, highly targeted and relevant advertising campaigns may be created. In addition, DOOH can display different content at different times depending on the weather, time of day, or proximity to specified locations. This level of personalization enhances the entire watching experience and increases the effectiveness of advertising, hence promoting the industry's growth. Additionally, because DOOH enables advertisers to tailor their campaigns for a higher return on investment, it is a popular choice for companies searching for measurable and efficient advertising solutions.

Increased interaction and a wider audience have a great impact on the growth of the global digital out-of-home (OOH) advertising sector.

The global reach and enhanced engagement potential of DOOH advertising significantly contribute to its growth. Smartly placed DOOH displays may be found in high-traffic areas, transportation hubs, shopping malls, and other notable locations. This ensures that advertisers may establish connections with a broad spectrum of individuals, encompassing both local and international clients. Furthermore, the dynamic nature of DOOH material, which blends interactivity, motion graphics, and video, draws viewers in and encourages them to interact with the commercial. As a result, interactive touchscreens, QR codes, and smartphone integrations enable viewers to react quickly by making purchases or obtaining more information. DOOH is an appealing option for marketers looking to make a lasting impact since it raises brand recognition and fosters intimate ties between clients and their target audience.

Global Digital Out-of-Home (OOH) Advertising Market Restraints and Challenges:

Data protection laws, like the General Data Protection Regulation (GDPR) in Europe, must be strictly followed because of the growing reliance on the gathering and use of customer data for targeted advertising. Privacy concerns have been brought up by this.

Global Digital Out-of-Home (OOH) Advertising Market Opportunities:

One new area in the advertising industry that could expand the use of DooH is targeted and relevant advertising. Through the use of data and analytics, OOH marketers could give customers highly customized and contextually relevant content. Tailored ads based on elements such as location where the DOOH needs to be placed, weather, time of day, and target population are more successful and engaging.

DIGITAL OUT OF HOME (OOH) ADVERTISING PRODUCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.2% |

|

Segments Covered |

By Product type, End-User, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Clear Channel Outdoor Holdings, Inc., Lamar Advertising Company, JCDecaux, Outfront Media, Inc., Global Media, Stroer, OOH Media Limited, APGISGA |

Global Digital Out of Home (OOH) Advertising Market Segmentation: By Product Type

-

Digital Billboards

-

Street Furniture

-

Place-Based Media

-

Transit and Transportation

-

Ambient Advertising

-

Video Advertising and Others

Based on product type, digital billboards hold the largest market share of 67.2% in 2023. Digital outdoor billboards may now communicate with their target audience thanks to the expanding smart advertisement trend, which is anticipated to quicken industry expansion. Furthermore, the market is growing because of technical developments like virtual reality and augmented reality, which make outdoor promotions more visceral and engaging. For example, Maxam Ventures Private Limited, a gaming platform offering gamified solutions, stated in February 2023 that it is partnering with Lemma Technologies to introduce its metaverse billboards for digital out-of-home clients in the real world. Through virtual billboards in the metaverse, the partnership aims to help global businesses leave a lasting impact on underserved populations.

Throughout the projected period, the place-based media segment is the fastest-growing segment. Place-based media targets certain audiences with tailored advertising campaigns. Place-based media allows advertisers to interact with their target audience in areas where they are likely to spend their time.

Global Digital Out of Home (OOH) Advertising Market Segmentation: By End-User

-

Banking

-

Transportation

-

Education

-

Retail

-

Recreation and Others

Retail is both the largest and fastest-growing segment in this market. The ability of DOOH advertising to improve in-store customer experiences is the main factor driving the growing demand for it in the retail industry. When used in retail settings, DOOH displays provide dynamic, eye-catching material that may be customized to highlight certain goods, deals, or seasonal marketing initiatives. Additionally, the interactive nature of DOOH may draw customers in with touchscreens, QR codes, and smartphone interfaces, giving them immediate access to more product details or the ability to make purchases right away, supporting the market's expansion. Furthermore, the flexibility of DOOH content in real-time makes it easier to promote last-minute sales or inventory adjustments. Furthermore, the instantaneous flexibility of DOOH content makes it easier to advertise last-minute specials or inventory upgrades. This guarantees that shops can react quickly to changes in the market and consumer preferences, which in turn promotes brand engagement and increases sales. The retail industry's adoption of DOOH is being driven by its ability to turn physical places into immersive, rich-information shopping experiences.

Global Digital Out of Home (OOH) Advertising Market Segmentation: By Application

-

Indoor

-

Outdoor

Outdoor holds the largest market share of around 72% in 2023. Outdoor digital out-of-home kits are more expensive than indoor versions. The rising use of digital technologies like interactive displays, projection mapping, and LED displays is one of the main factors propelling the growth of this market. With the use of these technologies, marketers can produce more dynamic and captivating advertising campaigns that draw customers outside. The development of data-driven advertising solutions also helps the outdoor market expand. Advertisers can increase the success of their outdoor campaigns by using data on consumer behavior, demographics, and preferences to target and deliver more relevant advertising messages to customers.

The industry's fastest-growing segment is the indoor category, which includes media and advertising displays found inside public spaces, including malls, airports, theatres, and other indoor venues. This indoor category is expected to develop as more shopping centers and commercial buildings are constructed. Indoor DOOH advertising initiatives are becoming increasingly evaluated for success using data analytics. Advertisers may learn which ad types work best and modify their campaigns by monitoring KPIs like engagement rates, rates of clicks, and conversion rates.

Global Digital Out of Home (OOH) Advertising Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America holds the largest market share of roughly 38% in 2023. Rapid urbanization in the region's rising nations, such as the United States and Canada, and the increasing use of digital out-of-home advertising in commercial verticals are credited with the market's expansion. The region's market's continued expansion fuels both the spread of smart cities and the acceleration of technological breakthroughs. For instance, prominent U.S. retailers began offering programmatic digital out-of-home advertising at airports in February last year through VIOOH Limited and JCDecaux, an outdoor advertising services provider. The service will be available at airports in Massachusetts, Pennsylvania, Texas, and California.

Throughout the projection period, Asia-Pacific is expected to grow at the fastest rate. Due to their large consumer bases, growing nations like China, India, and Japan have been spending more on digital out-of-home advertising. Furthermore, throughout the forecast period, it is anticipated that the digital out-of-home advertising market will grow due to the growing acceptability and popularity of out-of-home advertising among the various industry verticals. Furthermore, over the past few years, market expansion has been fueled by the increasing technological development in emerging markets like China and India. For example, in February 2023, Times Innovative Media Limited, a supplier of comprehensive and customized out-of-home (OOH) solutions, collaborated with Closeup, an American toothpaste brand owned by Unilever, to introduce a new digital billboard campaign in Ahmedabad. The youth audience was the campaign's objective.

COVID-19 Impact Analysis on the Global Digital Out-of-Home (OOH) Advertising Market:

The COVID-19 epidemic has accelerated the shift toward digital advertising as businesses search for more measurable and cost-effective advertising choices. Digital out-of-home advertising has several advantages over traditional advertising, including real-time tracking and targeting, which makes it a more appealing option for advertisers. The business is expected to grow as public-private partnerships multiply and smart cities gain traction. For example, in October 2022, StackAdapt Inc., a provider of online advertising services, and Vistar Media, Inc., a business that offers location-based ad technology, together introduced a new digital out-of-home (DOOH) channel internationally. StackAdapt wants to increase its ability to offer scalability and a future-proof, one-of-a-kind solution with this service.

Latest Trends/ Developments:

The dynamic nature of the sector is reflected in the intense competition in the worldwide digital OOH advertising market, which is characterized by a mix of well-established players and creative startups. Leading digital signage firms, advertising agencies, and technology suppliers are important participants in this sector. Large advertising agencies are well-represented in the industry due to their vast networks of digital displays in strategic places across the globe. These businesses provide marketers with wide coverage and well-placed advertisements by utilizing their experience and worldwide reach. Tech-focused companies offer content management systems and programmatic solutions at the same time, letting advertisers effectively manage and maximize their DOOH campaigns. Creative firms with a focus on data analytics allow marketers to improve campaign efficacy and target audiences more precisely. In addition, corporations are increasingly engaging in partnerships and acquisitions to broaden their product offerings and market penetration.

Key Players:

-

Clear Channel Outdoor Holdings, Inc.

-

Lamar Advertising Company

-

JCDecaux

-

Outfront Media, Inc.

-

Global Media

-

Stroer

-

OOH Media Limited

-

APGISGA

In July 2023, OH Media unveiled an enhanced data package designed for audience-led advertising strategy and attribution. They established a long-term out-of-home partnership with Unpacked by Flybuys, demonstrating the growing confluence of advertising and technology. This relationship leverages transactional data from a large pool of 9 million Flybuys consumers and gains insights from 2 billion Westpac card transactions, representing a deliberate move towards data-driven decision-making in the realm of outdoor advertising.

In May 2023, JCDecaux SE said that it had bought Clear Channel Outdoor Investments, Inc. to bolster its presence in Italy and Spain and to better position itself in the evolving sector of digital outdoor advertising.

In April 2023, Outfront Media Inc. announced that it would be collaborating with RCC Media Inc. and its subsidiary, Outfront Media Canada LP. As a consequence of this partnership, the firm installed eight large-format digital bulletins and 39 digital bridge flyover screens around the Greater Toronto Area, demonstrating its commitment to building a network of digital outdoor advertising.

Chapter 1. Digital Out of Home (OOH) Advertising Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Digital Out of Home (OOH) Advertising Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Digital Out of Home (OOH) Advertising Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Digital Out of Home (OOH) Advertising Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Digital Out of Home (OOH) Advertising Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Digital Out of Home (OOH) Advertising Market – Product Type

6.1 Introduction/Key Findings

6.2 Digital Billboards

6.3 Street Furniture

6.4 Place-Based Media

6.5 Transit and Transportation

6.6 Ambient Advertising

6.7 Video Advertising and Others

6.8 Y-O-Y Growth trend Analysis Product Type

6.9 Absolute $ Opportunity Analysis Product Type, 2024-2030

Chapter 7. Digital Out of Home (OOH) Advertising Market – By Application

7.1 Introduction/Key Findings

7.2 Indoor

7.3 Outdoor

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Digital Out of Home (OOH) Advertising Market – By End-User

8.1 Introduction/Key Findings

8.2 Banking

8.3 Transportation

8.4 Education

8.5 Retail

8.6 Recreation and Others

8.7 Y-O-Y Growth trend Analysis By End-User

8.8 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Digital Out of Home (OOH) Advertising Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 Product Type

9.1.3 By Application

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 Product Type

9.2.3 By Application

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 Product Type

9.3.3 By Application

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 Product Type

9.4.3 By Application

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 Product Type

9.5.3 By Application

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Digital Out of Home (OOH) Advertising Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

10.1 Clear Channel Outdoor Holdings, Inc.

10.2 Lamar Advertising Company

10.3 JCDecaux

10.4 Outfront Media, Inc.

10.5 Global Media

10.6 Stroer

10.7 OOH Media Limited

10.8 APGISGA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global digital out-of-home (OOH) advertising plays an important role in the advertising business, as the demand for it has increased in recent years and will grow at a CAGR of 11.2%.

The Asia-Pacific Region is continuously emerging in the field of global digital out-of-home (OOH) advertising.

North America has the largest market for global digital out-of-home (OOH) advertising.

The market for global digital out-of-home (OOH) advertising is expanding at an impressive rate, propelled by customers' rising awareness of customized ads using digital and modern techniques.

Global digital out-of-home (OOH) advertising is used in the retail sector the most. The maximum business comes from this sector.