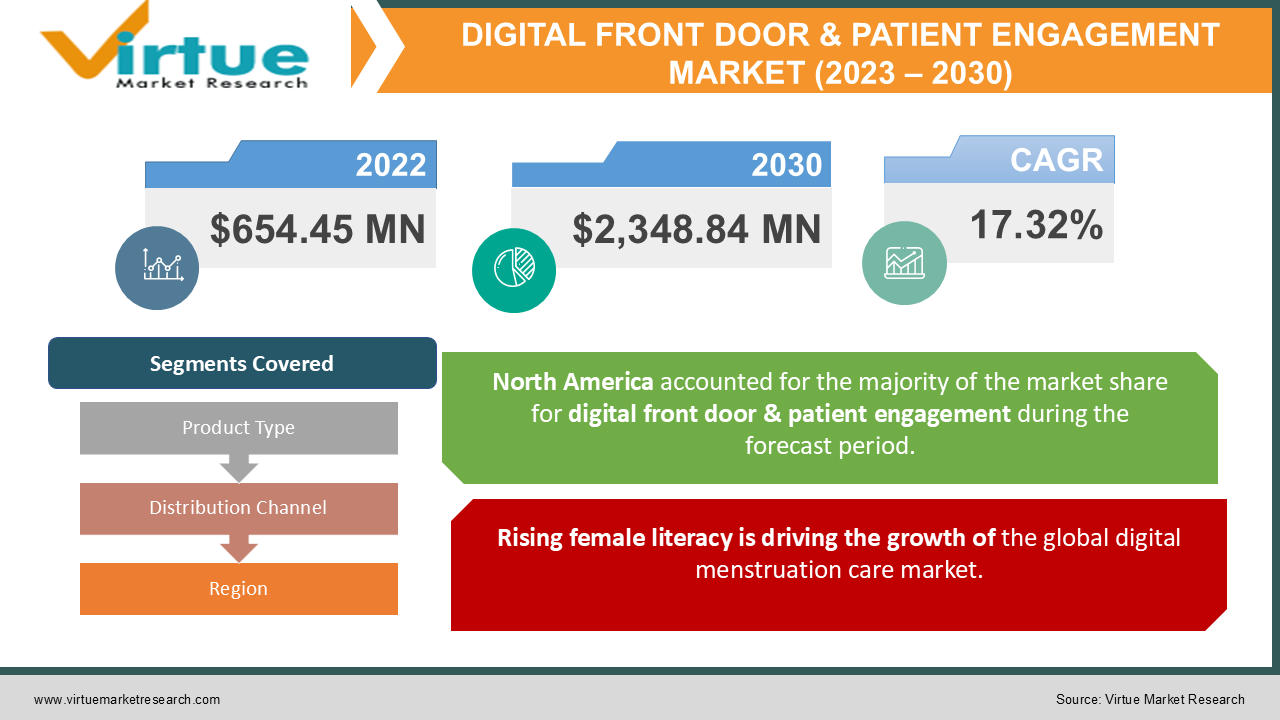

Global Digital Menstruation Care Market size (2023-2030)

The Global Digital Menstruation Care Market size was estimated to be worth USD 654.45 million in 2022 and is projected to grow to USD 2,348.84 million by 2030. This market is witnessing a healthy CAGR of 17.32% from 2023 - 2030. The increasing female population & rapid urbanization, rising female literacy and awareness of menstrual health & hygiene, rising disposable income of females, and women empowerment are majorly driving the growth of the industry.

Industry Overview:

Over the past few decades, a variety of digital tools for sharing and creating medical and health data have emerged. More recently, there have been mobile devices with constant Wi-Fi connectivity, social media platforms, mobile apps, and wearable self-monitoring devices that allow users to access information on the internet anywhere, at any time, and collect and share their health data and experiences with health care providers and medical groups. In recent years, digital solutions have emerged that can fill specific gaps in the women's healthcare system. The smart feminine care market overall is anticipated to be driven by the increase in fertility rate and pregnancy problems faced by women, as well as increasing awareness about extra hygiene products and advanced female intelligence. Therefore, the increasing adoption of mobile health apps for menstrual cycle tracking, fitness, and pregnancy is another factor influencing market trends. With the increase in the number of working women, there is a greater need for women to monitor their fertility. The industry continues to see an increase in demand due to the focus on technological innovations for feminine hygiene products.

MARKET DRIVERS:

Rising female literacy is driving the growth of the global digital menstruation care market.

Literacy is a fundamental right and a stepping stone to eradicating poverty and expanding the way we think about society. According to UNESCO, people in the United States with low literacy skills are three times more likely to have health problems than people with high literacy rates. This also applies to women's literacy, which is related to women's health and hygiene. Therefore, an increase in the literacy rate is directly proportional to societal development and thus, affects the women’s hygiene market as well as drives the sales of the digital menstruation care market.

Awareness of Menstrual health & hygiene along with smart technology integration is driving the Growth of the market.

Over the past decade, global organizations and organizations such as UNESCO have improved the literacy rate of young women in developing and developing countries as improving women's literacy has a positive impact on women's health care. Has been actively working on. UNICEF also sees menstrual health and hygiene as a fundamental right for women and girls, and therefore the Sustainable Development Goals (SDGs) for 2030 are central to the health care of all women. As a result, improved literacy rates for women are anticipated to drive the market for women's hygiene products. Additionally, with the integration of smart technologies in almost every sector more and more people are relying on them and adopting these smart technologies augmenting market growth.

MARKET RESTRAINTS:

The social stigma associated with menstruation and feminine hygiene products is restraining the growth of the market

The general perception and prejudice associated with menstruation is a major disadvantage for many women. According to the 2019 Essity Health & Hygiene Report, one in four women worldwide has a gestational age. Women who menstruate need not only a private space to wash and regulate the flow of menstruation but also women's hygiene products and a suitable disposal site. These needs are often overlooked in rural areas, and menstruation is a barrier to community participation, education, and employment. According to UNICEF, menstrual and hygiene needs have not been checked due to gender inequality, discriminatory social norms, cultural taboos, and poverty. The stigma associated with menstruation forces girls and women to adopt or abandon women's hygiene products. This social stigma surrounding women's menstruation serves as a significant restraint on the growth of the women's hygiene products market.

The Digital Menstruation Care Market's growth is being stifled by High Costs:

Digital Menstruation Care devices often come with a high price tag, making them less accessible to price-sensitive consumers. The cost of developing & manufacturing such smart devices, which incorporate advanced technologies such as sensors and Bluetooth, is significant. The high price point can hinder market growth, especially in developing economies where consumers may not have the disposable income to purchase such devices.

Digital Menstruation Care Market Report Coverage:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

17.32% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Johnson & Johnson (US), Procter & Gamble (US), Kimberly-Clark (US), Essity Aktiebolag (publ) (Sweden), Kao Corporation (Japan), Daio Paper Corporation (Japan), Unicharm Corporation (Japan), Premier FMCG (South Africa), Ontex (Belgium), Hengan International Group Company Ltd. (China), Drylock Technologies (Belgium), Natracare LLC (US), First Quality Enterprises, Inc. (US), and Bingbing Paper Co., Ltd. (China) |

This research report on the Digital Menstruation Care Market has been segmented based on Product Type, Distribution Channels, and Region.

Digital Menstruation Care Market – By Product Type

- Period Tracking Applications

- Wearable Devices

- Diagnostic Tools

- Others

Based on the Product Type, the digital menstruation care market is segmented into – Period Tracking Applications, Wearable Devices, Diagnostic Tools, and Others.

The period tracking application segment dominated the market and held the largest revenue share of 43.9% in 2022 due to the increasing adoption of mobile apps for the management of menstrual cycles, fertility cycles, and pregnancy. The wearable device segment is anticipated to observe the fastest growth over the forecast period and the diagnostics tools are also attracting attention gradually with new developments followed up by the companies.

The adoption of these digital tools is rapidly growing owing to the convenience and accessibility of the tools. The continuous technological advancements in the field of digital menstrual health allow women to be updated about their health status and make informed decisions based on insights.

Digital Menstruation Care Market – By Distribution Channel:

- Department Store

- Grocery Store

- Retail Pharmacy

- Supermarket

- Online Mode

- Others

Based on the distribution channel, the digital menstruation care market is segmented into – Department Stores, Grocery Stores, Retail Pharmacies, Supermarkets, Online Modes, and Others.

In 2022, the Retail Pharmacy segment accounted for the highest market share of the global digital menstruation care market. The ease and availability of these products with the convenience of physical buying majorly drive the segment’s growth. In addition, the Online Distribution Mode is anticipated to witness the fastest-growing CAGR during the forecast period, due to the growth of e-commerce websites and changes in consumer behaviours.

Digital Menstruation Care Market - By Region:

- North America

- Europe

- Asia-Pacific

- Rest of the World

Geographically, North America dominated the Digital Menstruation Care market in 2022. Regional growth is due to high smartphone usage, fertility tracking, pregnancy prediction, and increased awareness of advanced ovulation methods. The Asia-Pacific region will grow significantly during the forecast period due to the high prevalence of women's health problems such as PCOD, infertility, and psychological stress, and the growing awareness of smart menstrual pads/cups and menstrual tracking apps. It is anticipated to provide an opportunity for the Asia Pacific region to account for the fastest-growing region during the forecast period.

Digital Menstruation Care Market Share by Company

- Johnson & Johnson (US)

- Procter & Gamble (US)

- Kimberly-Clark (US)

- Essity Aktiebolag (publ) (Sweden)

- Kao Corporation (Japan)

- Daio Paper Corporation (Japan)

- Unicharm Corporation (Japan)

- Premier FMCG (South Africa)

- Ontex (Belgium)

- Hengan International Group Company Ltd. (China)

- Drylock Technologies (Belgium)

- Natracare LLC (US)

- First Quality Enterprises, Inc. (US)

- Bingbing Paper Co., Ltd. (China)

NOTABLE HAPPENINGS IN THE DIGITAL MENSTRUATION CARE MARKET IN THE RECENT PAST:

- Product Launch - In April 2022, Fairhaven Health launched the OvaCue Wireless Fertility Monitor. OvaCue uses two wireless sensors to provide detailed information and is suitable for those who have irregular cycles.

- Collaboration - In April 2021, Flo, the leading female health and wellbeing app, and Phenomenal, the female-led lifestyle brand committed to bringing awareness to global causes and cultural issues, have teamed up to launch merchandise

- Product Launch - In September 2021, Bellabeat launched Ivy, a smart Bracelet for Women. With patented app algorithms, Ivy is designed specifically for the female body, taking into account anatomical, mental, and physiological factors. The device keeps track of crucial health data, lifestyle habits, and cycles, as well as offers advice to help women better understand their bodies and achieve optimal wellness.

COVID-19 impact on Digital Menstruation Care Market

During the COVID-19 pandemic, the government imposed a global blockade, which led to higher unemployment rates around the world. The rise in the unemployment rate led to a decline in the purchasing power of customers, and demand for women's products drastically declined. According to Scroll, only 15% of Indian girls have access to sanitary napkins in similar situations, and women in Fiji, the United States, the United Kingdom, and others reported shortages and price increases due to supply chain and contract manufacturing disruptions in 2020. However, secondary effects are those indirectly caused by a pandemic, either by the effects of fear on the population or by measures to contain and manage it. The COVID-19 pandemic is anticipated to have a major secondary impact on the women's hygiene product market. Impacts may vary from country to country and are capable of responding through social protection and medical infrastructure. The most affected consumers are likely to be the poorest and most vulnerable to economic and social shocks.

According to a study by the Menstrual Health Alliance India, the COVID-19 pandemic had a serious impact on access to women's hygiene products. According to a survey, more than 82% of women's hygiene product manufacturers had to suspend operations in India due to social distance norms and blockades. Due to limited production, the availability of these products, including disposable and reusable menstrual napkins, increased at the local level. Consumers who had access to the product in the local market could not access it due to the closed public transport and no travel restrictions. However, there was another trend in the United States. Low-income consumers faced the consequences of hoarding and prices soared during the blockade. Women who rely on free women's hygiene products from schools, social service centers, government health centers, and medical facilities also faced a shortage due to the COVID-19 pandemic.

Chapter 1. DIGITAL MENSTRUATION CARE MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. DIGITAL MENSTRUATION CARE MARKET– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-16 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. DIGITAL MENSTRUATION CARE MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. DIGITAL MENSTRUATION CARE MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5.DIGITAL MENSTRUATION CARE MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. DIGITAL MENSTRUATION CARE MARKET– Product Type

6.1. Period Tracking Applications

6.2. Wearable Devices

6.3. Diagnostic Tools

6.4. Others

Chapter 7. DIGITAL MENSTRUATION CARE MARKET– Distribution Channel

7.1. Department Store

7.2. Grocery Store

7.3. Retail Pharmacy

7.4. Supermarket

7.5. Online Mode

7.6. Others

Chapter 8. DIGITAL MENSTRUATION CARE MARKET– By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. DIGITAL MENSTRUATION CARE MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Johnson & Johnson (US)

9.2. Procter & Gamble (US)

9.3. Kimberly-Clark (US)

9.4. Essity Aktiebolag (publ) (Sweden)

9.5. Kao Corporation (Japan),

9.6. Daio Paper Corporation (Japan)

9.7. Unicharm Corporation (Japan),

9.8. Premier FMCG (South Africa)

9.9. Ontex (Belgium)

9.10. Hengan International Group Company Ltd. (China)

9.11. Drylock Technologies (Belgium)

9.12. Natracare LLC (US)

9.13. First Quality Enterprises, Inc. (US)

9.14. Bingbing Paper Co., Ltd. (China)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Digital menstruation care devices are mobile devices with constant Wi-Fi connectivity, social media platforms, mobile apps, and wearable self-monitoring devices that allow users to access their personal menstruation information on the internet anywhere, at any time, and collect and share their health data and experiences with health care providers and medical groups

The factors driving the digital menstruation care market are the rise in literacy rates in women and the increase in the purchasing power of the population.

The global Digital Menstruation Care Market size was estimated to be worth USD 654.45 million in 2022 and is projected to grow to USD 2,348.84 million by 2030

The key players operating in the global market are: Kimberly-Clark, Essity Aktiebolag (publ), Kao Corporation, Daio Paper Corporation, Unicharm Corporation, and Premier FMCG.

North American region is dominating the global digital menstruation care market.