Digital living room Market Size (2025 – 2030)

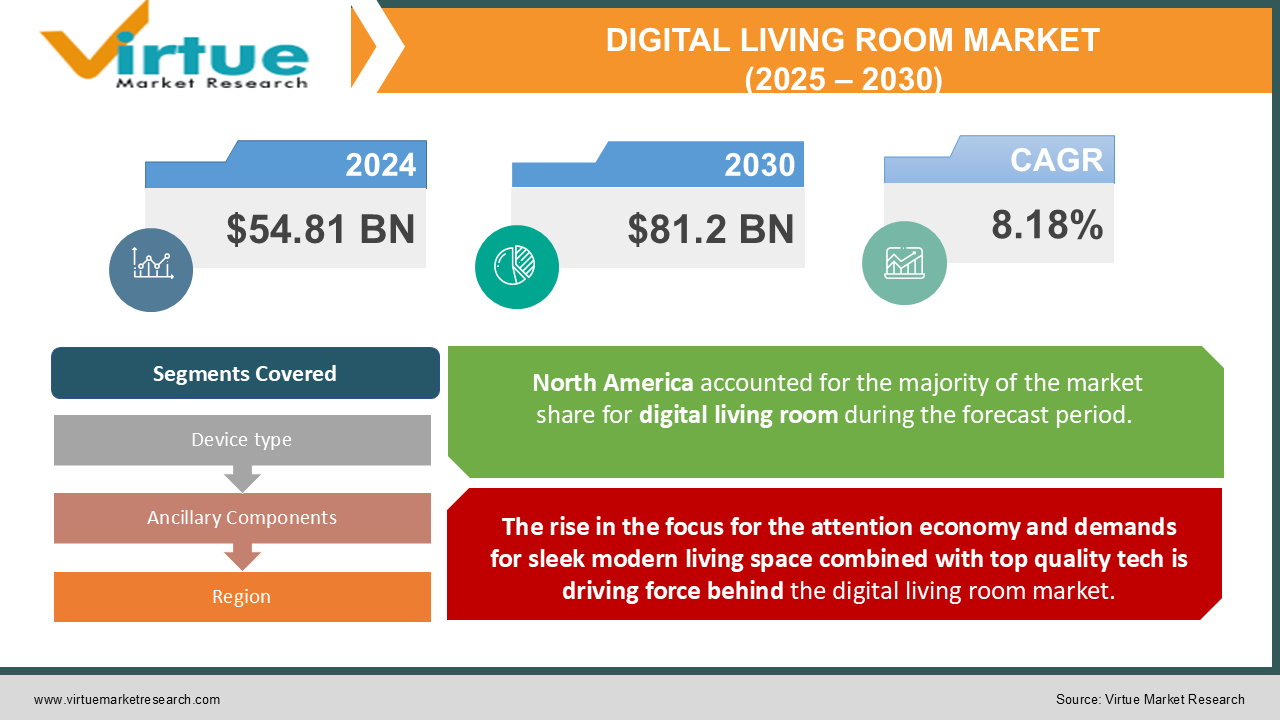

The Digital living room market was valued at USD 54.81 billion and is projected to reach a market size of USD 81.2 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.18%.

The Digital living room market refers to the various entertainment and convenience technologies that generally make up a modern home. The market is rather fragmented with various technologies being bought by consumers for a single room. A very early sign of this market gaining traction and becoming mainstream was the adoption of streaming services instead of the traditional cable. With global populations moving to urban centers with a projected increase from 55% to 68% the market is projected to grow rapidly as demand increases. With increased demand there is also a need to create more sustainable technologies and various innovations are taking place there as well.

Key Market Insights:

-

The shift from traditional cable to on demand streaming services started efforts to make the living room more interconnected through a centralized system for lights, TV etc. Products like Amazon Fire stick, Apple Tv have become more commonplace.

-

There is a security component to the digital living room which has made a market for products such as smart locks, monitors which you can operate from your smartphone etc.

-

Gaming is emerging as a central part of the digital living room, moving beyond dedicated consoles to cloud gaming services accessible through smart TVs and streaming devices. This is blurring the lines between gaming and traditional entertainment.

-

Voice control and AI assistants are becoming the preferred interface for controlling digital living room devices, driving changes in how products are designed and how people interact with their entertainment systems.

-

Manufacturers are developing and incorporating distinctive features like voice control, seamless integration with other smart devices, and tailored content recommendations to enhance the user experience. Additionally, the growing demand for 4K and HDR content fuels the market for cutting-edge smart TV models with greater connectivity options.

-

Xbox gaming consoles from Microsoft are commonplace pieces of furniture in living rooms, acting as centers of entertainment for playing games, streaming media, and playing multimedia. Users may access a vast array of content thanks to the Xbox platform's integrations with other streaming services, including Netflix, Hulu, and Disney+. The gaming experience in the living room is further improved with the Xbox Game Pass membership program, which grants access to a library of titles.

Digital living room Market Drivers:

The rise in the focus for the attention economy and demands for sleek modern living space combined with top quality tech is driving force behind the digital living room market.

The increasing demand for continuous entertainment experiences, improvements in wireless connectivity, and the increased acceptance of smart home devices are the main factors propelling the digital living room market. The way people engage with their living spaces has changed as a result of the widespread use of smart TVs, gaming consoles, and AI-powered voice assistants like Google Assistant and Amazon Alexa. The demand for top-notch, networked entertainment systems is being further stimulated by the quick growth of streaming services like Netflix, Disney+, and Amazon Prime Video. Furthermore, improved automation and device compatibility made possible by IoT integration boost user experience and convenience. The emergence of 5G networks and Wi-Fi 6 has also helped the industry expand by facilitating quicker and more dependable connectivity, which guarantees seamless gaming and streaming experiences.

The urban population is the primary consumer of these products

The rising urban population is a significant driver of the digital living room market, as increasing urbanization leads to higher demand for smart home solutions and modern entertainment ecosystems. With more people living in densely populated cities, there is a growing emphasis on optimizing living spaces with technology that enhances convenience, efficiency, and entertainment. Urban dwellers, particularly younger demographics, are more inclined to adopt connected devices that integrate seamlessly into compact living environments. Furthermore, increasing disposable incomes, particularly in emerging economies, have led to higher spending on smart home ecosystems, driving sustained expansion in the digital living room market.

Digital living room restraints and challenges:

Cybersecurity, fragmented markets are a major concern along with no low-cost options

The market for digital living rooms is constrained by a number of factors, such as cybersecurity concerns, interoperability problems, and the expensive price of smart home technologies. Since many manufacturers produce smart devices, it is still difficult to ensure smooth interoperability and integration across many different technologies, which frequently results in fragmented user experiences. Concerns about cybersecurity and data privacy are also rising because of connected devices collecting enormous volumes of user data, making them vulnerable to hackers. Also, the problem with the market is that it does not cater to lower segments, making it much more restricted to the upper and the upper middle class.

DIGITAL LIVING ROOM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.18% |

|

Segments Covered |

By Device type, Ancillary Components, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amazon, Google, Samsung, Phillips, Sony, Roku Netflix, LG Electronics, Bose, Microsoft |

Digital living room market segmentation - By Device type

-

Smart TVs

-

Gaming Consoles

-

Smart Speakers

-

Lighting and security system

With integrated internet connectivity and streaming service access, retail TVs have taken centre stage in today's living rooms. The connected living room market was dominated by the Smart TVs sector in 2024, with over 40% of the market. Gaming consoles continue to be a significant component of the digital living room ecosystem, providing immersive entertainment experiences. The global gaming console market has seen substantial growth, with revenues reaching $45 billion by 2022, signalling its mainstream success.

Smart speakers, equipped with voice-activated assistants, have become increasingly prevalent in households. As of 2023, Amazon's Alexa, for instance, has sold over 40 million Echo devices in U.S. households. These devices not only play music but also control other smart home devices, enhancing the interconnectedness of the digital living room. Also the security system market is maturing in a lot of the western markets and slowly becoming more mainstream.

Digital living room market segmentation - By Ancillary Components

-

Cameras

-

Thermostats

-

Sensors

Because they provide real-time monitoring and features like motion detection and facial recognition, smart cameras have become an essential part of home security systems. They cameras made up 40% of total sales of cameras in 2024; this percentage is predicted to increase to 47% in 2025, indicating a growing demand from consumers for intelligent security solutions. Smart thermostats contribute to energy efficiency and personalized climate control within homes. The global smart thermostat market was valued at approximately USD 4.99 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 18.5% from 2025 to 2030.

Various sensors, including motion, temperature, and light sensors, enhance the interactivity and automation of the digital living room. These devices enable smart systems to respond dynamically to environmental changes, improving energy efficiency and user convenience.

Digital living room market segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The North American digital living room market leads globally, holding over 35.4% of the market share in 2023, driven by high consumer spending, widespread smart home adoption, and the presence of major tech companies. Meanwhile, Europe follows closely, with strong demand for energy-efficient smart home devices in countries like Germany, the UK, and France. Regulatory policies promoting sustainability and data privacy further shape market growth in the region.

Asia-Pacific is the fastest-growing market, fuelled by rapid urbanization, rising disposable incomes, and expanding internet infrastructure. Countries like China, India, and South Korea are key players, with increasing adoption of smart TVs, gaming consoles, and connected devices. South America is an emerging market, with Brazil and Argentina showing growth potential due to rising internet penetration and economic development, though challenges like economic volatility persist.

Covid-19 Impact analysis on the Digital living room market:

Covid-19 forced majority of the white-collar population inside for a prolonged period of time, this meant that streaming services benefitted greatly from this change in behaviour as record profits soared during the covid times. Moreover, the shift toward remote work and virtual socializing boosted the adoption of smart speakers, webcams, and other home office-related devices. The increased reliance on digital platforms for work, education, and leisure catalysed the integration of smart home technologies, as consumers sought ways to enhance their home environments. While the pandemic disrupted global supply chains, it also encouraged innovation in the digital living room market, with companies focusing on remote technologies, AI-driven solutions, and better integration across devices.

Trends/Developments

Samsung has introduced its Tizen OS to enable a seamless user interface, while LG focuses on OLED technology for superior picture quality and energy efficiency. These innovations aim to deliver a more immersive and user-friendly experience.

Major players such as Amazon and Google are enhancing the functionality of digital living room devices through AI and voice-activated technologies. Amazon’s Alexa and Google’s Assistant are embedded in numerous smart speakers, smart TVs, and other connected devices, allowing users to control entertainment, lighting, temperature, and security systems using voice commands.

Companies like Samsung and Philips are also emphasizing sustainability in their product offerings. The digital living room market is seeing innovations focused on energy-efficient devices, with many companies launching eco-friendly products such as energy-saving smart bulbs, solar-powered devices, and products built from recyclable materials. This trend is aligned with the growing consumer demand for environmentally conscious technology.

Key Players:

-

Amazon

-

Google

-

Samsung

-

Phillips

-

Sony

-

Roku

-

Netflix

-

LG Electronics

-

Bose

-

Microsoft

Chapter 1. Digital living room Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Digital living room Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Digital living room Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Digital living room Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Digital living room Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Digital living room Market – By Device type

6.1 Introduction/Key Findings

6.2 Smart TVs

6.3 Gaming Consoles

6.4 Smart Speakers

6.5 Lighting and security system

6.6 Y-O-Y Growth trend Analysis By Device type

6.7 Absolute $ Opportunity Analysis By Device type, 2025-2030

Chapter 7. Digital living room Market – By Ancillary Components

7.1 Introduction/Key Findings

7.2 Cameras

7.3 Thermostats

7.4 Sensors

7.5 Y-O-Y Growth trend Analysis By Ancillary Components

7.6 Absolute $ Opportunity Analysis By Ancillary Components, 2025-2030

Chapter 8. Digital living room Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Device type

8.1.3 By Ancillary Components

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Device type

8.2.3 By Ancillary Components

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Device type

8.3.3 By Ancillary Components

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Device type

8.4.3 By Ancillary Components

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Device type

8.5.3 By Ancillary Components

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Digital living room Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Amazon

9.2 Google

9.3 Samsung

9.4 Phillips

9.5 Sony

9.6 Roku

9.7 Netflix

9.8 LG Electronics

9.9 Bose

9.10 Microsoft

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Ans. The market is projected to reach USD 81.2 billion by 2030, growing at a CAGR of 8.18% from 2025-2030.

Ans. North America leads the global market with a 35.4% market share (as of 2023), driven by high consumer spending, widespread smart home adoption, and the presence of major tech companies.

Ans. Key challenges include cybersecurity concerns, interoperability issues between different manufacturers' devices, fragmented user experiences, and limited accessibility to lower-income segments due to high costs.

Ans. COVID-19 positively impacted the market as people spent more time at home, leading to increased adoption of streaming services, smart speakers, and home office devices. While it disrupted supply chains, it also drove innovation in remote technologies and AI-driven solutions.