Global Digital Freight Shipping Market Size (2023 – 2030)

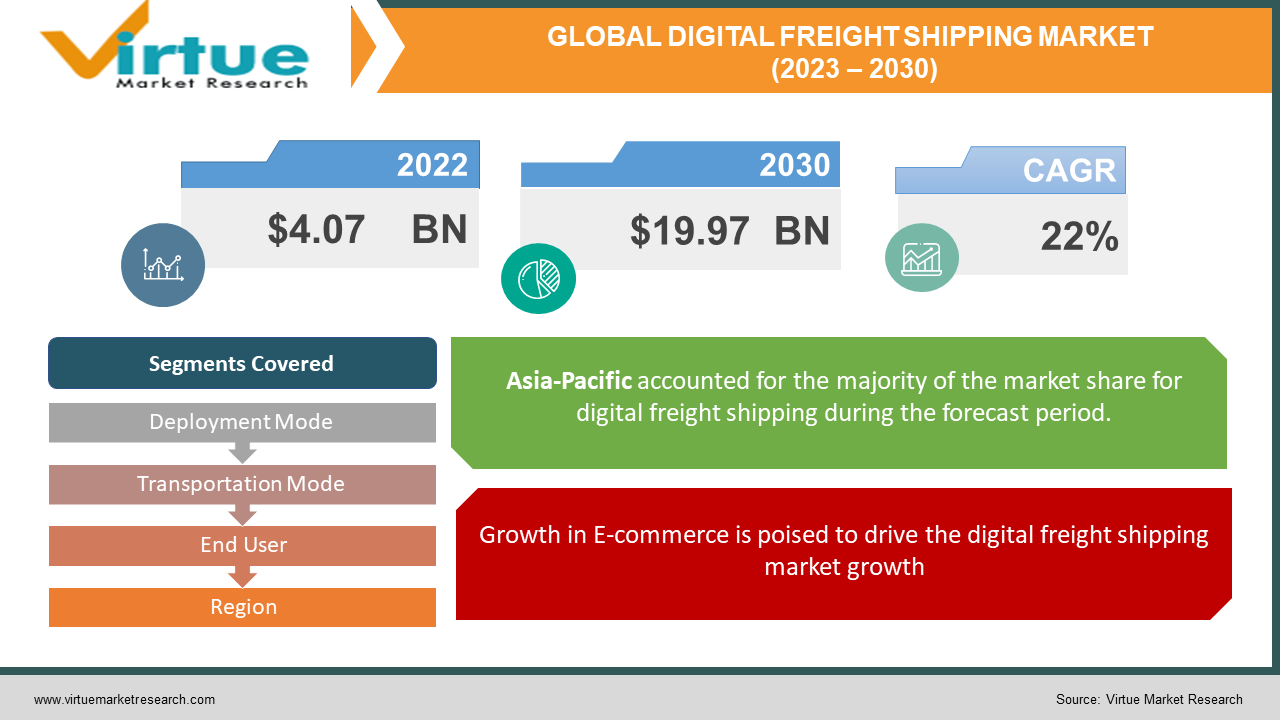

According to our research report, the global digital freight shipping market was valued at $4.07 Billion in 2022, and is projected to reach a market size of $19.97 Billion by 2030. The market is projected to grow with a CAGR of 22% per annum during the period of analysis (2023 - 2030).

Industry Overview

A digital freight forwarder employs digital tools to facilitate smooth communication and provide status updates on any shipment promptly. A digital freight forwarder uses a transparent system that compares several carriers to provide consumers with the best value. Its goal is to eliminate paperwork by creating, uploading, and sharing all documents on a web platform that all stakeholders can access easily. Factors such as the expansion of the e-commerce sector and the rise in free trade agreements are propelling the worldwide digital freight forwarding market ahead. The market's progress, however, is limited by a lack of infrastructure, higher logistical costs, and rigorous air freight regulations.

One of the primary drivers of the present economy's growth is digitization. Convoy, Uber Freight, and uShip are among the companies developing new platforms to fill in the holes in the logistics business. With digital freight forwarding, the manual process will be reduced. All freight forwarding quotes will be available on one platform, eliminating the need for hours of talk and paper trails. Instant quotations, clear pricing, rate and carrier comparisons, tracking, and easy paperwork are just a few of the advantages of digital freight forwarding. The logistics sector is evolving into a paperless, computerized industry, which is helping the market flourish.

Impact of Covid-19 on the Industry

The COVID-19 outbreak wreaked havoc on a range of industries, forcing governments throughout the world to impose stringent lockdowns and make social distance essential to stop the virus's spread, which interrupted supply chains and halted operations around the globe. As a result of the COVID-19 pandemic, nations were left with little choice but to temporarily suspend their transportation and logistical activities with one another, causing a substantial impact on commodity supply and, as a result, a supply chain disruption. Due to the relaxation of social distancing restrictions, an exponential increase in e-commerce, retail, and pharmaceutical sales, and automobile industry refurbishing activities, the digital freight sector saw a significant comeback in 2021.

In early 2020, the COVID-19 epidemic wreaked havoc on the country's maritime shipping and air freight services, resulting in delayed sailings and flights, port delays, and container shortages. For shipments from Northeast Asia to the United States, the disruptions were particularly severe. When paired with COVID-19-related swings in demand, the disruptions increased volatility in marine and air freight pricing across regions and caused significant delays in the delivery of US product imports. The effects of the COVID-19 pandemic on merchandise imports and marine trade interruptions may be divided into two groups. When compared to the same period in 2019, the volume of US marine container imports declined by 7.0 percent in the first half of 2020. Container imports, on the other hand, grew dramatically in the second half of 2020.

Market Drivers

Growth in E-commerce is poised to drive the digital freight shipping market growth

Online shopping is one of the most popular online activities in the world, and as a result, domestic and cross-border e-commerce is booming in developing countries like China, India, and Indonesia. This includes shipments of electronics, medicines, and consumer packaged products, as well as direct-to-consumer shopping. Even product producers are gradually transitioning from traditional freight forwarding to digital freight forwarding as internet availability grows. Instant quotations, clear pricing, rate and carrier comparisons, tracking, and easy paperwork are just a few of the advantages of digital freight forwarding.

The rising number of free trade agreements will improve the digital freight shipping market conditions

The expansion of the logistics business is fuelled by dynamic market circumstances and improvements in the global economy. Furthermore, as a result of rising globalization, numerous trade-related activities are increasing significantly. As a result, manufacturers and retailers are finding it increasingly difficult to maintain track of supply chain operations effectively. During the projected period, this factor is likely to boost the growth of the digital freight forwarding market.

Market Restraints

Poor infrastructure in the logistics industry will act as a market restraint for digital freight shipping

A successful logistics ecosystem necessitates advanced infrastructure, a well-organized supply chain, and rules that facilitate commerce. Without them, logistics companies would have to invest more in stock reserves and working capital, which will have a significant impact on national and regional competitiveness owing to high financial expenses. Furthermore, the absence of infrastructure development in certain countries impedes logistics, increasing costs and reducing supply chain reliability. Inefficiencies in transportation management systems, poor storage infrastructure, a complex tax structure, a low rate of technology adoption in the logistics sector, and a lack of proficiency among logistics professionals in using digitalization tools are all factors that slow down the pace and productivity of logistics firms. Latin America, for example, lacks basic infrastructure, according to research by the Economist, an international journal, with more than 60% of the region’s roads being unpaved. Another issue that parcels delivery teams in Latin American nations confront is inconsistencies in the address and postal systems. Shipping firms sometimes struggle to deliver items properly since many nations lack postal codes and rely on local landmarks for addresses.

DIGITAL FREIGHT SHIPPING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

22% |

|

Segments Covered |

By Deployment Mode, Transportation Mode, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Flexport, Twill, FreightHub, Fleet, InstaFreight Transporteca, Containersrs, KN Freight Net, Turvo, iContainers, DHL Group, Kuehne + Nagel International AG, Agility Logistics Pvt. Ltd. |

Global Digital Freight Shipping Market- By Deployment Mode

-

Cloud

-

On-Premises

The Cloud segment is projected to be the most lucrative segment. The cloud segment will be rising shortly as some of the major companies are promoting technological advancement in the freight management market.

Global Digital Freight Shipping Market- By Transportation Mode

-

Sea

-

Air

-

Land

According to the mode of transportation, Rail freight, road freight, ocean freight, and air freight are the four modes in which the digital freight forwarding business is split. Because the bulk of global trade takes place overseas and in oceans, the ocean freight category is predicted to have the highest share of the market. The fastest-growing sector, however, is air freight, which may be linked to a rise in demand for quick delivery as a result of rising worldwide e-commerce. The sea segment had the biggest market share in 2021, accounting for about half of the entire market share, and is expected to continue to dominate the market during the projected period. From 2023 - 2030, the category is projected to grow at the fastest rate of 23.7 percent. Land and air sectors are also included in the study.

Global Digital Freight Shipping Market- By End User

-

Retail and E-Commerce

-

Manufacturing

-

Healthcare

-

Automotive

-

Others

E-commerce is a type of online business where products and services are offered without the need for physical premises. Logistics services are used by the e-commerce sector to handle and control e-commerce enterprises' supply chains, allowing them to focus on marketing and other company activities. E-commerce is a popular medium for purchasing a wide range of things due to its easy accessibility, pleasant shopping experiences, and substantial savings and offers. These reasons have all led to the expansion of the e-commerce services sector. According to the latest projections from the United Nations Conference on Trade and Development (UNCTAD), online retail sales as a percentage of total retail sales increased by 3% points in 2020, based on data obtained by national statistics agencies in many countries (from 16 percent in 2019 to 19 percent in 2020). Online sales accounted for 25.9% of total sales in South Korea, 24.9 percent in China, and 23.3 percent in the United Kingdom.

International trading now necessitates more complicated contact between several persons and organizations. Shipment supply networks now span many nations and regions, and trading has evolved into a 24-hour operation. Improved connection along the sea, rail, and roads is required for high performance in logistics, but it also extends to other sectors such as information processing, financial markets, and telecommunications. Furthermore, due to several benefits given by logistics to e-commerce enterprises, such as efficient track systems, cost-effective shipments, and a faster-quoting process, the use of digital freight forwarding services is on the rise. During the projected period, such advancements are likely to propel the worldwide digital freight forwarding market's growth.

Global Digital Freight Shipping Market- By Geography & Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

The freight transportation industry in the United States, which was first ravaged by COVID-19, is resurfacing with a renewed sense of purpose and optimism that digitalization will be the pandemic's legacy. In early 2020, the COVID-19 epidemic wreaked havoc on the country's maritime shipping and air freight services, resulting in delayed sailings and flights, port delays, and container shortages. For shipments from Northeast Asia to the United States, the disruptions were particularly severe. When paired with COVID-19-related swings in demand, the disruptions increased volatility in marine and air freight pricing across regions and caused significant delays in the delivery of US product imports. One of the main drivers of the American economy's development is digitization. Convoy, Uber Freight, and uShip are among the companies developing new platforms to fill in the holes in the logistics business. The manual process will be minimalized with digital freight forwarding. All freight forwarding quotes will be available on one platform, eliminating the need for hours of talk and paper trails. Instant quotations, clear pricing, rate and carrier comparisons, tracking, and easy paperwork are just a few of the advantages of digital freight forwarding. The logistics sector is evolving into a paperless, computerized industry, which is assisting the market's growth.

Global Digital Freight Shipping Market- By Companies

-

Flexport

-

Twill

-

FreightHub

-

Fleet

-

InstaFreight

-

Transporteca

-

Containersrs

-

KN Freight Net

-

Turvo

-

iContainers

-

DHL Group

-

Kuehne + Nagel International AG

-

Agility Logistics Pvt. Ltd.

NOTABLE HAPPENINGS IN THE GLOBAL DIGITAL FREIGHT SHIPPING MARKET IN THE RECENT PAST:

-

Business Partnership: - In June 2021, Convoy, the country's most efficient digital freight network, and Flexport, the world's largest logistics platform, have announced a long-term strategic partnership to enable end-to-end shipment automation.

-

Business Partnership: - In June 2021, Cargo.one, a platform for scheduling and marketing air freight capacity, announced a collaboration with American Airlines. European freight forwarders will get real-time cargo capacity information from the US and will be able to book with instant confirmation.

Chapter 1. Global Digital Freight Shipping Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Digital Freight Shipping Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Global Digital Freight Shipping Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Global Digital Freight Shipping Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Digital Freight Shipping Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Digital Freight Shipping Market – By Deployment Mode

6.1. Cloud

6.2. On-Premises

Chapter 7. Global Digital Freight Shipping Market – By Transportation Mode

7.1. Sea

7.2. Air

7.3. Land

Chapter 8. Global Digital Freight Shipping Market – By End User

8.1. Retail and E-Commerce

8.2. Manufacturing

8.3. Healthcare

8.4. Automotive

8.5. Others

Chapter 9. Global Digital Freight Shipping Market- By Region

9.1. North America

9.2. Europe

9.3. Asia-Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. Global Digital Freight Shipping Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. Company 1

10.2. Company 2

10.3. Company 3

10.4. Company 4

10.5 Company 5

10.6. Company 6

10.7. Company 7

10.8. Company 8

10.9. Company 9

10.10. Company 10

Download Sample

Choose License Type

2500

4250

5250

6900