Digital Fabric Printing Machines Market Size (2025 – 2030)

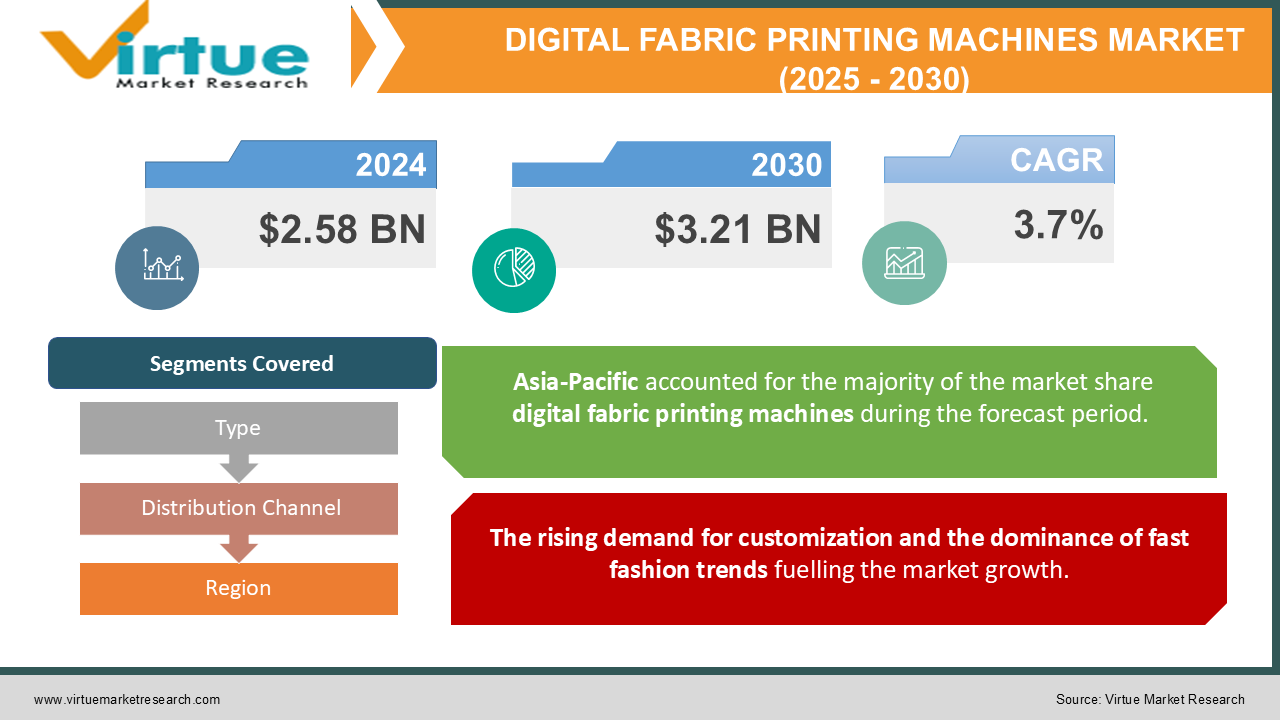

The Digital Fabric Printing Machines Market was valued at USD 2.58 Billion in 2024 and is projected to reach a market size of USD 3.21 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 3.7%.

Digital fabric printing machines have revolutionized the textile and fashion industries, enabling vibrant and intricate designs with speed and efficiency. The transition from traditional analogy methods to digital processes is reshaping production paradigms, offering scalability and customization at competitive costs. The market is flourishing due to the increasing demand for sustainable and on-demand printing solutions, as consumers seek environmentally friendly products while businesses strive for operational flexibility. The technology leverages advanced inkjet printing mechanisms, sophisticated colour management systems, and specialized textile-compatible inks to create complex, high-resolution designs directly onto various fabric substrates.

Key Market Insights:

-

Nearly 65% of global textile printing was dedicated to apparel and fashion-related applications.

-

Around 45% of businesses investing in digital fabric printers in 2023 were small and medium-sized enterprises (SMEs).

-

Over 30% of digital fabric printing machines sold in 2023 featured eco-solvent ink technology.

-

The market for sublimation printers accounted for 40% of total machine sales in 2023.

-

95% of surveyed manufacturers acknowledged reduced material wastage with digital printing compared to traditional methods.

-

Textile manufacturers reported an average of 25% reduction in production lead times after adopting digital printing technologies.

-

Digital printers capable of printing on natural fibers such as cotton grew in demand by 20% in 2023.

-

More than 1 million square meters of fabric were digitally printed daily across the globe.

Digital Fabric Printing Machines Market Drivers:

The pressing need for sustainable practices in the textile industry is one of the most pivotal drivers of the digital fabric printing machines market.

Conventional textile printing methods, such as screen printing, are notoriously resource-intensive, consuming vast amounts of water, energy, and chemicals. As global awareness of environmental issues intensifies, industries are under immense pressure to adopt eco-friendly alternatives, with digital fabric printing emerging as a transformative solution. The use of water-based and eco-solvent inks in digital printing further aligns with sustainability goals. These inks produce fewer volatile organic compounds (VOCs) and are often biodegradable, reducing the overall environmental footprint. By incorporating such sustainable practices, companies are not only complying with environmental regulations but also enhancing their corporate image among eco-conscious consumers. Energy consumption is another area where digital fabric printing outshines traditional methods. Screen printing, for example, requires extensive setups, including plate preparation and drying processes, which consume significant energy. Digital printing eliminates many of these steps, resulting in a streamlined, energy-efficient process. Studies have shown that digital printers can reduce energy usage by up to 60%, translating to substantial cost savings for manufacturers while supporting global energy conservation efforts. Governments worldwide are tightening regulations to curb pollution and encourage sustainable practices. The European Union’s REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulation and similar policies in other regions compel manufacturers to adopt cleaner technologies. Digital fabric printing machines allow companies to meet these stringent standards effortlessly, thus driving their adoption.

The rising demand for customization and the dominance of fast fashion trends fuelling the market growth.

Today’s consumers are seeking unique, personalized products that reflect their individuality, a trend that has disrupted traditional textile production processes. In an era of individual expression, consumers are moving away from mass-produced designs, favouring items tailored to their preferences. Digital fabric printing enables manufacturers to cater to this demand by producing custom designs with unmatched precision and efficiency. Unlike traditional methods, which require costly setups for each design, digital printing can seamlessly transition between multiple patterns, making it ideal for personalized, small-batch production. For example, consumers can order custom-printed t-shirts, bags, or curtains featuring personal images or one-of-a-kind patterns. This ability to offer tailor-made products has opened up vast opportunities for businesses, especially in the e-commerce space, where on-demand printing has become a lucrative model. The fast fashion industry thrives on rapidly changing trends and the ability to deliver new designs to the market within weeks. Traditional printing methods struggle to keep up with this pace due to their lengthy setup and production processes. Digital fabric printing machines, however, are designed for agility.

Digital Fabric Printing Machines Market Restraints and Challenges:

Digital fabric printing machines represent a significant capital investment, which can deter small- and medium-sized enterprises (SMEs) from entering the market. Advanced printers with cutting-edge capabilities often come with hefty price tags, ranging from $20,000 to over $500,000, depending on the machine's features and production capacity. Financing options for acquiring these machines are not always readily available, particularly in developing economies. High-interest rates on loans and stringent borrowing requirements further compound the issue. As a result, the market growth potential in certain regions remains untapped. The advanced technology underpinning digital fabric printing machines introduces a layer of technical complexity that can be challenging for operators unfamiliar with the equipment. Unlike traditional printing methods, which rely on well-established processes, digital printing requires operators to be proficient in managing software, colour calibration, and machine maintenance. This learning curve can slow the adoption rate, especially in regions with limited access to skilled technicians. Digital fabric printing machines demand regular maintenance to ensure optimal performance. The use of sophisticated components, such as precision nozzles and advanced ink delivery systems, increases the likelihood of breakdowns, particularly in high-output settings. Manufacturers face the dual challenge of ensuring operational efficiency while minimizing downtime, which can disrupt production schedules and inflate costs. Ink is a critical component of digital fabric printing, and its cost is significantly higher compared to conventional printing methods. Specialized inks, such as pigment, reactive, and sublimation inks, are designed for specific fabric types and applications. The price of digital printing inks can account for up to 50% of the total operational cost. This high expenditure limits the technology's cost-effectiveness, particularly for low-margin businesses. Furthermore, fluctuations in raw material prices, such as pigments and solvents, contribute to the volatility of ink costs.

Digital Fabric Printing Machines Market Opportunities:

In the automotive sector, digitally printed fabrics are being used for car interiors, seat covers, and decorative panels. The ability to customize designs with precision and durability makes digital printing an attractive option Demand for personalized home décor products, such as curtains, upholstery, and wallpaper, is on the rise. Digital fabric printing enables intricate designs that cater to niche customer preferences, opening up lucrative avenues for growth. In healthcare, digital printing is being used for medical garments, such as scrubs and patient gowns, offering both functional and aesthetic advantages. Meanwhile, in sportswear, the technology supports the creation of lightweight, durable, and highly customizable fabrics, meeting the growing demand for performance-oriented apparel. Digital fabric printing significantly reduces water and chemical usage compared to traditional methods. This makes it a preferred choice among environmentally conscious brands and manufacturers. Companies are exploring ways to integrate digital printing into circular economy models, where fabrics can be recycled or repurposed without compromising on print quality.

DIGITAL FABRIC PRINTING MACHINES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.7% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kornit Digital, Mimaki Engineering, EFI Reggiani, Durst Group, Roland DG Corporation, Epson Corporation, Mutoh Europe, Ricoh Company, Atexco, Brother Industries |

Digital Fabric Printing Machines Market Segmentation: By Type

-

Direct-to-Garment Printers (DTG)

-

Sublimation Printers

-

UV-Based Printers

-

Hybrid Printers

-

Single-Pass Printers

Single-pass printers are experiencing the fastest growth due to their high-speed capabilities, making them ideal for industrial-scale applications. Their ability to print directly onto fabrics without requiring pre-treatment significantly reduces production time.

DTG printers remain the most dominant due to their versatility in printing intricate designs directly onto finished garments. Their ease of use and ability to produce high-quality prints make them a preferred choice for small and medium-sized businesses.

Digital Fabric Printing Machines Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors

-

E-Commerce Platforms

-

Retail Stores

E-commerce platforms are gaining traction as the fastest-growing distribution channel, driven by the convenience of online purchasing and the growing popularity of digital marketplaces.

Direct sales remain dominant, as manufacturers prefer to maintain control over the sales process and establish direct relationships with customers for better service and support.

Digital Fabric Printing Machines Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

North America leads the market, driven by advanced textile industries and widespread adoption of innovative technologies.

Asia-Pacific is the fastest-growing region, fueled by rapid industrialization, increasing consumer spending, and the expansion of textile manufacturing hubs.

COVID-19 Impact Analysis on Digital Fabric Printing Machines Market:

The COVID-19 pandemic significantly disrupted the global digital fabric printing machines market, presenting both challenges and opportunities. In the early stages, widespread lockdowns and restrictions led to the closure of manufacturing facilities, disrupting production schedules and supply chains. Shortages of raw materials and logistical challenges added to the industry's struggles, as international trade faced severe bottlenecks. Demand from key sectors such as fashion, retail, and home décor plummeted due to reduced consumer spending and a shift in priorities toward essential goods. Many small and medium-sized textile businesses, which constitute a significant portion of the market's customer base, faced financial constraints, leading to a temporary slowdown in equipment purchases. However, as the pandemic progressed, the market witnessed a shift in dynamics. The rise of remote working and increased time spent at home spurred demand for home furnishings, personalized décor, and comfortable leisurewear, all of which rely heavily on digital fabric printing for customization.

Latest Trends and Developments:

The digital fabric printing machines market is witnessing a wave of transformative trends and technological developments that are reshaping the industry. One of the most significant trends is the increasing adoption of eco-friendly practices, driven by the global shift toward sustainability. Manufacturers are introducing biodegradable and water-based inks to reduce environmental impact while simultaneously exploring energy-efficient printing technologies to align with green manufacturing goals. The rise of single-pass printing technology represents another major development, allowing for faster production speeds and enhanced efficiency, making digital fabric printing more viable for large-scale industrial use. The integration of artificial intelligence (AI) and the Internet of Things (IoT) is further revolutionizing the market, enabling real-time monitoring of machine performance, predictive maintenance, and automated quality control, all of which enhance productivity and minimize downtime.

Key Players:

-

Kornit Digital

-

Mimaki Engineering

-

EFI Reggiani

-

Durst Group

-

Roland DG Corporation

-

Epson Corporation

-

Mutoh Europe

-

Ricoh Company

-

Atexco

-

Brother Industries

Chapter 1. Digital Fabric Printing Machines Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Digital Fabric Printing Machines Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Digital Fabric Printing Machines Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Digital Fabric Printing Machines Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Digital Fabric Printing Machines Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Digital Fabric Printing Machines Market – By Type

6.1 Introduction/Key Findings

6.2 Direct-to-Garment Printers (DTG)

6.3 Sublimation Printers

6.4 UV-Based Printers

6.5 Hybrid Printers

6.6 Single-Pass Printers

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Digital Fabric Printing Machines Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors

7.4 E-Commerce Platforms

7.5 Retail Stores

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Digital Fabric Printing Machines Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Digital Fabric Printing Machines Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Kornit Digital

9.2 Mimaki Engineering

9.3 EFI Reggiani

9.4 Durst Group

9.5 Roland DG Corporation

9.6 Epson Corporation

9.7 Mutoh Europe

9.8 Ricoh Company

9.9 Atexco

9.10 Brother Industries

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Consumers increasingly desire personalized and customized products, which has led to a surge in demand for digital fabric printing.

One of the primary concerns for businesses considering the adoption of digital fabric printing technology is the high upfront capital investment required for purchasing digital fabric printing machines.

Kornit Digital, Mimaki Engineering, EFI Reggiani, Durst Group, Roland DG Corporation.

North America currently holds the largest market share, estimated at around 35%.

Asia Pacific has shown significant room for growth in specific segments.