Digital Diagnostics Market Size (2024 – 2030)

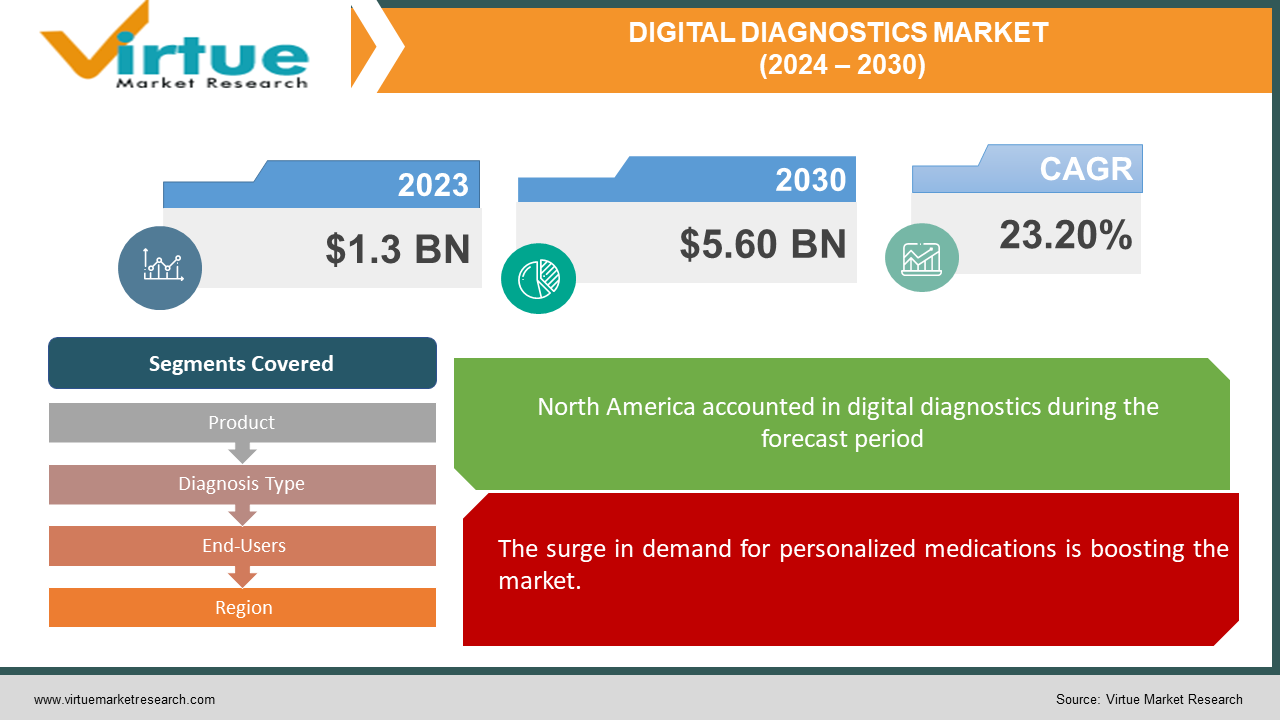

The digital diagnostics market was valued at USD 1.3 billion in 2023 and is projected to reach a market size of USD 5.60 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 23.20%.

Digital research is a type of research that uses AI and IoT technologies for research. It allows for automated health checks that can be done both electronically and virtually. Diagnostics help in the early detection of the disease and thus lead to better treatment and care. Common digital innovations include wearable devices, telehealth, and personalized medicine. The cost-effective nature of digital scanning and the growing demand for digital archives are some of the factors that have supported the long-term expansion of the digital scanning industry. Digital diagnostics has expanded to capture, coordinate, and record SARS-CoV-2 diagnostic data and the evolution of the coronavirus disease (COVID-19). Artificial intelligence (AI) makes it possible to analyze large amounts of data quickly. The growing trend of daily medical diagnostics, including digital radiology and digital pathology, will influence the digital diagnostics market. The increasing demand for patients to undergo digital examinations during laboratory or hospital visits is expected to boost the digital examination industry during the forecast period.

Key Market Insights:

According to Optum's survey of healthcare leaders, 56% stated that they are accelerating or extending their AI implementation in response to COVID-19, highlighting the importance of this business tool in the world. Magnetic resonance imaging (MRI) is a non-destructive imaging technology that produces detailed, three-dimensional images. MRI statistics in the US reveal that medical professionals perform approximately 30 million MRI scans each year. As per the February 2022 update from the World Health Organization, cancer is one of the primary causes of mortality globally, responsible for around 10 million deaths. Lung cancer (2.21 million cases), colon and rectum (1.93 million cases), prostate (1.41 million cases), skin (non-melanoma) (1.20 million cases), and year (1.09 million cases) are the most common cancer types recorded. The growing incidence of cancer makes early detection more important, which encourages digital cancer diagnostics.

Digital Diagnostics Market Drivers:

The surge in demand for personalized medications is boosting the market.

Digital diagnostics play a critical role in extracting large amounts of patient data, such as genetic information, lifestyle characteristics, and environmental exposures. This data can be processed and interpreted to provide personalized treatment options using modern algorithms and cognitive processes. Digital research allows doctors to collect detailed information about patients, thus creating accurate diagnoses, treatment options, and monitoring.

The increasing number of chronic diseases is driving the market growth.

Cancer, diabetes, and heart disease are chronic diseases that cause great concern in the global health system. Digital diagnostics offer many advantages in the treatment of chronic diseases. They can help with early detection through internal monitoring, portable devices, and home testing, allowing for early intervention and reducing the burden of disease. In addition, computerized diagnostics provide continuous monitoring of patient health data, enabling customized medication changes and better disease management. The need to improve patient outcomes drives market growth.

Demand for better outcomes is fueling the growth.

They want accurate and fast diagnosis, effective treatment methods, and better health. Digital analytics support improved patient outcomes by helping healthcare professionals make better decisions. For example, human intelligence algorithms and predictive analytics can help with early detection, risk assessment, and treatment optimization. This results in better patient outcomes, such as higher survival rates.

Digital Diagnostics Market Restraints and Challenges:

Lack of awareness is a major barrier.

Lack of awareness of digital diagnostics among health professionals and patients is a major problem. Many healthcare providers may not be aware of the opportunities and benefits of digital diagnostic technology, which may hinder their adoption. Similarly, patients may not be aware of the availability and benefits of the equipment. This lack of awareness can affect the adoption of digital analytics and hinder the expansion of the industry.

Management challenges the digital analytics sector operating in a complex and ever-changing environment.

Regulatory agencies develop clear rules and regulations to ensure safety, integrity, and reliability. These barriers can be detrimental to companies that are trying to develop and market digital diagnostic tools. Security and privacy

The collection, transmission, and protection of sensitive and confidential patient data is part of digital discovery.

The privacy and confidentiality of this data are critical to maintaining patient trust and meeting regulatory requirements. However, there are concerns about data breaches, illegal access, and the misuse of patient information. Addressing these security and privacy issues is essential to increasing patient and provider confidence in digital diagnostics.

Digital Diagnostics Market Opportunities:

The development of new digital detection technologies provides many possibilities.

Advances in artificial intelligence, machine learning, genomics, and nanotechnology are driving the development of new digital diagnostic solutions. These technologies can increase the accuracy of research, understanding, specificity, and ease of use, thus strengthening the power of diagnosis and expanding the horizons of medical professionals.

Integrating digital analytics with other health technologies is beneficial.

Digital diagnostics can be easily integrated with other health technologies to form a comprehensive and integrated health system. Electronic health records (EHR) ensure that patient data is quickly exchanged between researchers and healthcare providers, resulting in a more complete picture of a patient's health. This combination can provide accuracy in diagnosis and performance and provide management coordination. In addition, the integration of digital diagnostics and telemedicine enables remote monitoring, better diagnostics, and the provision of diagnostic services in underserved areas, thus improving the availability and quality of patients.

DIGITAL DIAGNOSTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

23.20% |

|

Segments Covered |

By Product, Diagnosis Type, End-Users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Hoffmann-La Roche Ltd., GE Healthcare, Digital Diagnostics, Inc., Siemens Healthcare GmbH, Riverain Technologies, ThermoFisher Scientific Inc., Cerora, Laboratory Corporation of America Holdings |

Digital Diagnostics Market Segmentation: By Product

-

Hardware

-

Software

-

Services

Software has the highest market share by product type. This plays an important role in shaping modern society, affecting everything from communication to marketing. Its importance in the digital age is profound, and various factors contribute to its growth. Technological advances, such as artificial intelligence, machine learning, and the cloud, make the evolution of software more efficient, creating better processes and new solutions. In addition, the growing demand for automation in all areas leads to the development of special software designed for specific needs. In the global digital analytics market, software serves as the backbone, enabling seamless data management, analysis, and interpretation of analytics information. This integrated software improves diagnostics, speeds up procedures, and improves patient outcomes. In addition, digital diagnostic solutions are rapidly enabling remote healthcare delivery, expanding access to healthcare services worldwide. As software continues to advance, its impact on the digital diagnostic market is likely to increase, changing the delivery of healthcare and research worldwide. Services are the fastest-growing category. This can include a variety of services, including digital pathology, remote monitoring, and telehealth consultations. These services, which give healthcare practitioners continuous maintenance, technical support, and training, are essential to the adoption and use of digital diagnostic equipment.

Digital Diagnostics Market Segmentation: By Diagnosis Type

-

Cardiology

-

Oncology

-

Neurology

-

Radiology

-

Pathology

-

Others

Cardiology, the branch of medicine that deals with the study and treatment of problems of the heart and blood vessels, is the largest category in 2023. New technological innovations, such as digital diagnostics, have changed the field, enabling better diagnosis and more personalized treatment plans. Factors driving the growth of heart disease include an aging population, poor lifestyle choices leading to an increase in heart disease, and an increase in early detection and prevention. These factors have boosted the demand for advanced heart disease applications and treatments. In addition, the integration of artificial intelligence and machine learning algorithms into digital analysis has improved the efficiency of heart analysis. This evolution in cardiology has had a significant impact on the global digital diagnostic market, which has grown exponentially as healthcare providers and patients adopt digital solutions for cardiac care, thus improving patient outcomes and reducing healthcare costs. Radiology is the fastest-growing segment. It is a medical specialty focused on the diagnosis and treatment of disease using medical imaging techniques and has seen significant progress in recent years. Factors contributing to its growth include technological innovations such as digital radiography, computerized tomography (CT), magnetic resonance imaging (MRI), and ultrasound. These technologies have not only improved the accuracy of diagnosis but also improved patient outcomes through early diagnosis and correct treatment planning.

Digital Diagnostics Market Segmentation: By End-Users

-

Hospitals & Clinics

-

Clinical Laboratories

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

Others

Hospitals and clinics are the largest end-users. They serve as the cornerstone of healthcare systems worldwide, offering vital medical services and treatments to communities. With advancements in technology and healthcare practices, these institutions are continuously evolving to meet the growing demands of patients and medical standards. Factors such as population growth, aging demographics, and the prevalence of chronic diseases contribute to the expansion of healthcare facilities. Additionally, the increasing adoption of digital health solutions within hospitals and clinics has revolutionized diagnostics and patient care. Through the integration of digital diagnostic tools like telemedicine, remote monitoring devices, and AI-powered diagnostic systems, healthcare providers can enhance the efficiency, accuracy, and accessibility of medical services. This evolution not only improves patient outcomes but also significantly impacts the global digital diagnostics market, driving its growth and innovation. As hospitals and clinics continue to embrace digital transformation, the synergy between healthcare institutions and digital diagnostics technology is poised to reshape the landscape of healthcare delivery on a global scale.

Digital Diagnostics Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America has the largest market share of around 40% in 2023, with its diverse economy, technological advancements, and strong healthcare infrastructure. The region's digital diagnostics market is experiencing rapid growth, fueled by factors such as increased investment in healthcare IT, the rise of advanced diagnostic technologies, and a growing emphasis on precision medicine. A thriving pharmaceutical and biotechnology sector in North America, along with government-backed initiatives and favorable reimbursement policies, is driving market expansion. In addition, the region benefits from the strong presence of market leaders and research firms that are driving innovation in the digital research sector. As North America continues to lead healthcare innovation, its impact on the global digital analytics market remains profound. The region's progress is not only improving health outcomes in the country but also having a significant impact on the evolution of the global digital diagnostic market, setting benchmarks for efficiency, accuracy, and availability worldwide. The Asia-Pacific region is the fastest-growing market. With rapidly changing economies such as China, India, Japan, and South Korea, the region has become a center for various industries, including healthcare. Factors such as increasing disposable income, expanding the middle class, and advancements in medical equipment are driving significant growth in the healthcare sector, especially in the area of digital analytics. The adoption of digital diagnostic technologies, including telemedicine, eye monitoring, and AI-based diagnostics, is increasing in the Asia-Pacific region. This adoption is driven by factors such as access to better healthcare services, the need for effective and cost-effective diagnostic solutions, and the increase in chronic diseases.

COVID-19 Impact Analysis on the Digital Diagnostics Market:

The COVID-19 pandemic has had a significant impact on the digital discovery market. The need for medical services, including mobile diagnostics and monitoring of patients, has increased during this pandemic. Digital diagnostic solutions have played an important role in helping healthcare providers identify and monitor COVID-19 patients, thereby reducing the risk of transmission. This pandemic has led to the adoption of digital health technologies, including digital analytics, and demonstrated their importance in managing health crises effectively.

Latest Trends/ Developments:

Oncology is the branch of medicine that deals with the prevention, diagnosis, and treatment of cancer. This includes medical oncology, radiation oncology, and surgical oncology. Factors driving the oncology segment and digital diagnostic market are the increasing cancer burden globally, the increasing introduction of digital diagnostic platforms for cancer diagnosis, technological innovations, and the adoption of key strategies by market players. In addition, the introduction of new products and services in this sector will help contribute to the significant growth of the market. Also, the growing research activities and studies on the integration of technology and diagnostic systems, which increase the efficiency of cancer diagnosis, will drive the market.

Key Players:

-

Hoffmann-La Roche Ltd.

-

GE Healthcare

-

Digital Diagnostics, Inc.

-

Siemens Healthcare GmbH

-

Riverain Technologies

-

ThermoFisher Scientific Inc.

-

Cerora

-

Laboratory Corporation of America Holdings

-

In June 2022, Roche officially announced the CE introduction of the next-generation VENTANA DP 600 slide scanner (CE-IVD-marked). This scanner produces superior image quality of stained histology slides from patient tissue samples. It offers ease of use and workflow flexibility to the pathology lab.

-

In May 2022, TestCard, a MedTech startup, raised funds of about USD 10 million in its most recent investment round. The money will be utilized largely to expand its current product line and provide new solutions, such as diabetes, pregnancy, chronic kidney disease (CKD), and flu testing. This funding will permit TestCard to strengthen its commercialization efforts and empower customers with easy-to-use diagnostic solutions.

-

In March 2022, Ibex Medical Analytics and Hartford HealthCare launched a clinical trial involving Ibex's Galen Breast, an AI solution that helps doctors provide advanced diagnosis and better treatment to patients with breast cancer. Good research results will facilitate the adoption of technology in cancer research, thus advancing the sector.

-

In February 2022, Labcorp launched "Labcorp OnDemand," an online platform that allows customers to order tests and optionally gather specimens at home. This user-friendly website eases access to leading diagnostic tests, allowing patients to obtain these critical services via digital methods readily.

-

In January 2022, Roche announced the launch of the "Cobas®" pulse system in selected countries receiving the CE Mark. The Cobas® pulse system records Roche Diagnostics' most novel production of networked point-of-care solutions for professional blood glucose management. Glucose is among the most important biomarkers to evaluate patient health.

Chapter 1. Digital Diagnostics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Digital Diagnostics Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Digital Diagnostics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Digital Diagnostics Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Digital Diagnostics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Digital Diagnostics Market – By Product

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Services

6.5 Y-O-Y Growth trend Analysis By Product

6.6 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Digital Diagnostics Market – By Diagnosis Type

7.1 Introduction/Key Findings

7.2 Cardiology

7.3 Oncology

7.4 Neurology

7.5 Radiology

7.6 Pathology

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Diagnosis Type

7.9 Absolute $ Opportunity Analysis By Diagnosis Type, 2024-2030

Chapter 8. Digital Diagnostics Market – By End User

8.1 Introduction/Key Findings

8.2 Hospitals & Clinics

8.3 Clinical Laboratories

8.4 Pharmaceutical & Biotechnology Companies

8.5 Academic & Research Institutes

8.6 Others

8.7 Y-O-Y Growth trend Analysis By End User

8.8 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. Digital Diagnostics Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Diagnosis Type

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Diagnosis Type

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Diagnosis Type

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Diagnosis Type

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Diagnosis Type

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Digital Diagnostics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Hoffmann-La Roche Ltd.

10.2 GE Healthcare

10.3 Digital Diagnostics, Inc.

10.4 Siemens Healthcare GmbH

10.5 Riverain Technologies

10.6 ThermoFisher Scientific Inc.

10.7 Cerora

10.8 Laboratory Corporation of America Holdings

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The digital diagnostics market was valued at USD 1.30 billion and is projected to reach a market size of USD 5.60 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 23.20%.

The surge for personalized medicine, the increasing number of chronic diseases, and the demand for better outcomes are driving the digital diagnostics market.

Based on product, the digital diagnostics market is segmented into hardware, software, and services.

North America is the most dominant region for the digital diagnostics market.

Hoffmann-La Roche Ltd., GE Healthcare, Digital Diagnostics Inc., Siemens Healthcare GmbH, Riverain Technologies, ThermoFisher Scientific Inc., Cerora, and Laboratory Corporation of America Holdings are some of the major players in the digital diagnostics market.